Positive Disney Profit Revision: Thanks To Theme Parks And Streaming

Table of Contents

Theme Park Performance Fuels Disney's Positive Profit Revision

The resurgence of Disney theme park attendance post-pandemic has been a major driver of the positive Disney profit revision. Factors contributing to this success include increased spending per guest, the successful introduction of new attractions, and strong international park performance. Disney World revenue and Disneyland attendance have both reached record-breaking levels, exceeding even pre-pandemic figures.

- Record-breaking attendance: Both domestic (Disney World and Disneyland) and international Disney parks have seen record-breaking attendance figures, demonstrating high demand for the immersive experiences they offer.

- High demand for park tickets and resort accommodations: The strong demand for park tickets and resort accommodations has led to increased revenue streams for the company. High occupancy rates and premium pricing strategies have contributed significantly to overall profitability.

- Successful new rides and attractions: The introduction of new and exciting rides and attractions, like Rise of the Resistance and Guardians of the Galaxy: Cosmic Rewind, has boosted guest engagement and encouraged repeat visits.

- Strong merchandise sales: Disney's merchandise sales continue to be a significant contributor to overall revenue, with guests eager to purchase souvenirs and themed items to commemorate their visit.

- Effective pricing strategies: Disney has implemented effective pricing strategies, maximizing profit margins while still maintaining high demand. This includes tiered pricing, seasonal adjustments, and various park hopper options.

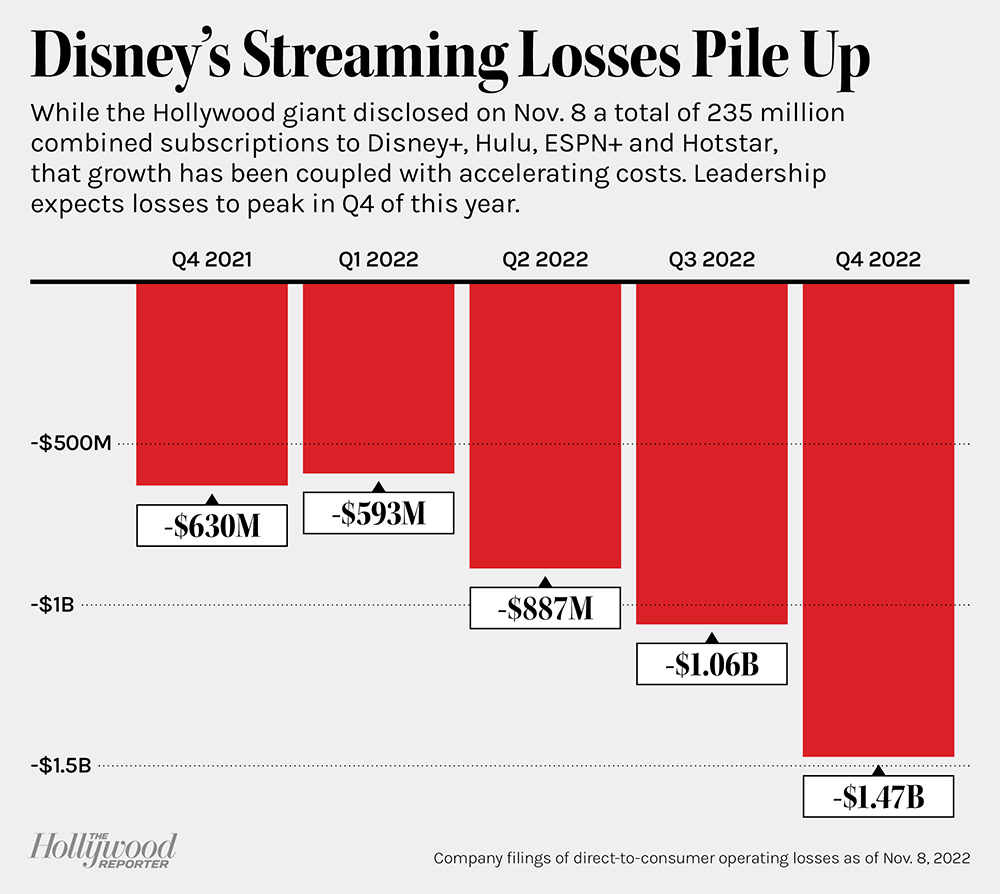

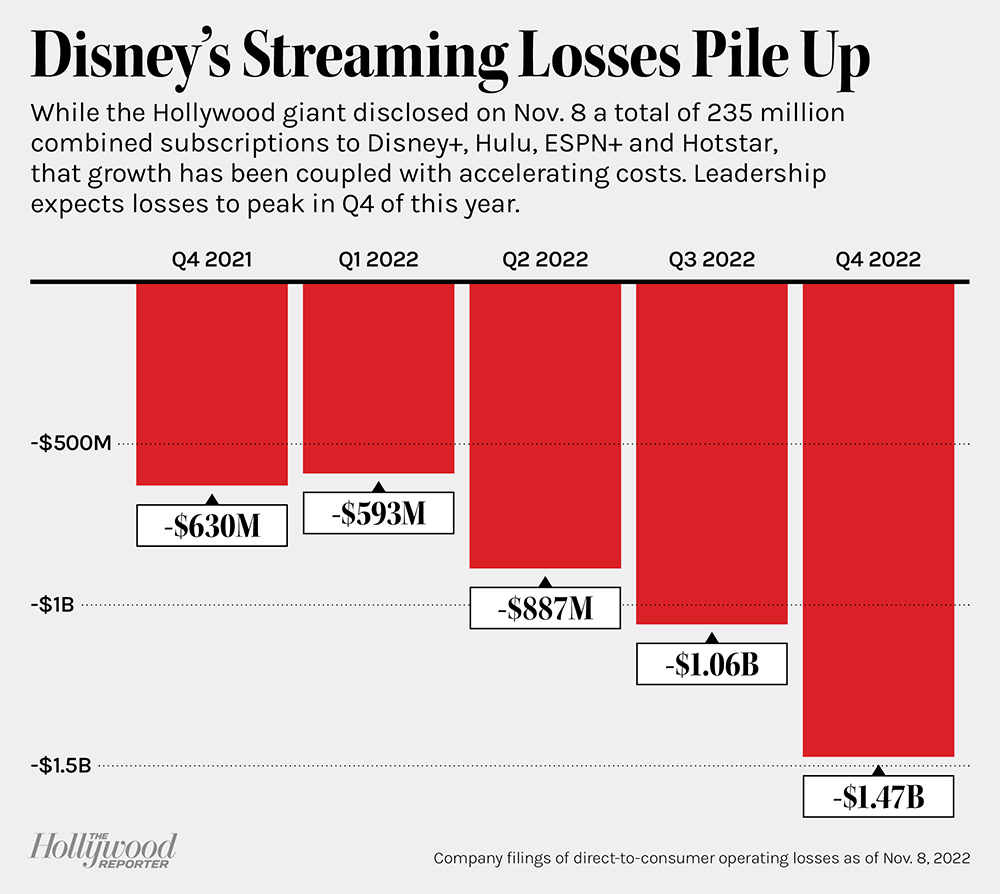

Disney Streaming's Contribution to the Positive Profit Revision

Disney's streaming services, including Disney+, Hulu, and ESPN+, have also played a crucial role in the positive Disney profit revision. The growth in Disney+ subscribers, exceeding initial projections, is a key indicator of success. Furthermore, a strong content strategy, incorporating popular franchises and original programming, has attracted and retained subscribers.

- Increased Disney+ subscriber base: Disney+ has experienced significant subscriber growth, exceeding projections and demonstrating the strong appeal of its content library.

- Successful content strategy: Disney's content strategy, leveraging popular franchises like Marvel and Star Wars alongside engaging original programming, has been highly effective in attracting and retaining subscribers.

- Growth in Hulu and ESPN+ subscriber numbers: The growth in subscribers for Hulu and ESPN+ has also contributed significantly to the overall streaming revenue, diversifying Disney's streaming portfolio.

- Effective pricing strategies: Disney has managed to balance subscriber acquisition with profitability through strategic pricing, including bundled offers and premium tiers.

- Improved profitability through cost-cutting measures: Efficient content production and cost-cutting measures have also improved the profitability of Disney's streaming services.

Addressing Challenges in Disney's Streaming Business

While Disney's streaming strategy has been largely successful, challenges remain. Increased competition from other streaming platforms, such as Netflix and HBO Max, necessitates continuous innovation and strategic adjustments. Furthermore, managing subscriber churn and the high cost of producing original content are ongoing concerns.

- Increased competition from other streaming platforms: The streaming landscape is highly competitive, requiring Disney to continuously innovate and deliver high-quality content to retain its subscriber base.

- Strategies to reduce subscriber churn: Disney is implementing strategies to reduce subscriber churn, including improving the user experience, enhancing content offerings, and introducing new features.

- Management of content production costs: Disney is actively managing its content production costs to ensure profitability, balancing quality with budgetary constraints.

Overall Financial Impact of the Positive Disney Profit Revision

The positive Disney profit revision has had a significant impact on Disney's stock price and overall market capitalization. Investor confidence in the company's future prospects has been significantly boosted, leading to a positive outlook for future revenue growth.

- Positive impact on Disney's stock price: The positive profit revision has resulted in a significant increase in Disney's stock price, reflecting investor confidence in the company's future performance.

- Increased investor confidence: The strong financial results have significantly increased investor confidence in Disney's ability to navigate the evolving entertainment landscape and achieve long-term growth.

- Positive outlook for future revenue growth: Based on the current strong performance, the outlook for future revenue growth is positive, driven by continued growth in both theme parks and streaming services.

- Potential for further investment: The improved financial position allows for further investment in content creation, theme park expansion, and technological advancements.

Conclusion

The positive Disney profit revision underscores the company's strategic success in its theme parks and streaming divisions. The strong performance of both sectors has driven this unexpected financial upturn, highlighting the power of a diversified entertainment strategy. While challenges remain in the competitive streaming market and managing costs, Disney is well-positioned for continued growth.

Call to Action: Stay informed about the latest developments in Disney's financial performance and the strategies driving this remarkable positive Disney profit revision by following our blog and subscribing to our newsletter. Learn more about the factors contributing to Disney's success and how this positive Disney profit revision impacts the future of the entertainment industry.

Featured Posts

-

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025

Psg Brise La Serie De Dijon En Arkema Premiere Ligue

May 09, 2025 -

Les Ecologistes Et Les Municipales 2026 A Dijon

May 09, 2025

Les Ecologistes Et Les Municipales 2026 A Dijon

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Nepogoda V Yaroslavskoy Oblasti Gotovnost K Snegopadam

May 09, 2025

Nepogoda V Yaroslavskoy Oblasti Gotovnost K Snegopadam

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th

May 09, 2025

Latest Posts

-

Oboronnoe Soglashenie Frantsiya Polsha Posledstviya Dlya Evropeyskoy Bezopasnosti

May 09, 2025

Oboronnoe Soglashenie Frantsiya Polsha Posledstviya Dlya Evropeyskoy Bezopasnosti

May 09, 2025 -

Zelenskiy Tramp Vatikan Makron Oglasil Itogi Vstrechi

May 09, 2025

Zelenskiy Tramp Vatikan Makron Oglasil Itogi Vstrechi

May 09, 2025 -

Soyuz Frantsii I Polshi Oboronnoe Soglashenie I Ego Geopoliticheskoe Znachenie

May 09, 2025

Soyuz Frantsii I Polshi Oboronnoe Soglashenie I Ego Geopoliticheskoe Znachenie

May 09, 2025 -

France And Poland Strengthen Ties Friendship Treaty Signing Planned

May 09, 2025

France And Poland Strengthen Ties Friendship Treaty Signing Planned

May 09, 2025 -

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty Po Slovam Makrona

May 09, 2025

Vstrecha Zelenskogo I Trampa V Vatikane Rezultaty Po Slovam Makrona

May 09, 2025