Intercontinental Exchange (ICE) Q1 Earnings: NYSE Trading Volume Fuels Profit Beat

Table of Contents

NYSE Trading Volume Surges, Driving Revenue Growth

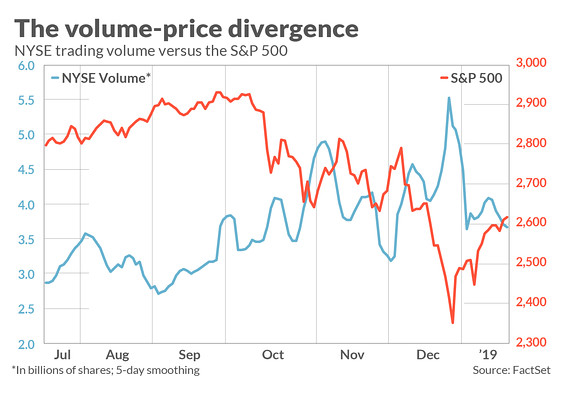

The remarkable performance of ICE in Q1 2024 is largely attributable to a significant surge in NYSE trading volume. This increase surpassed both the previous quarter's figures and expectations for the same period last year.

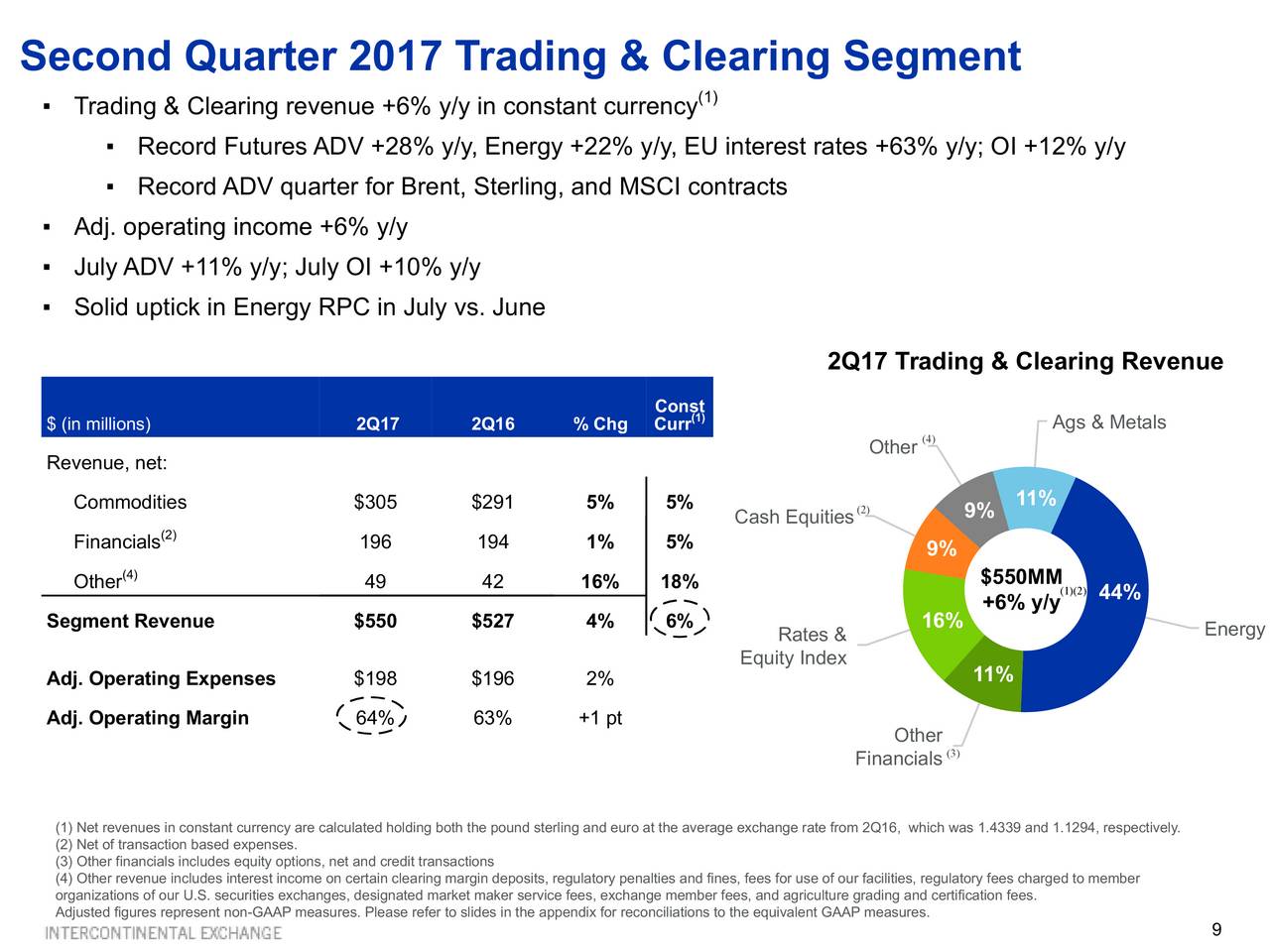

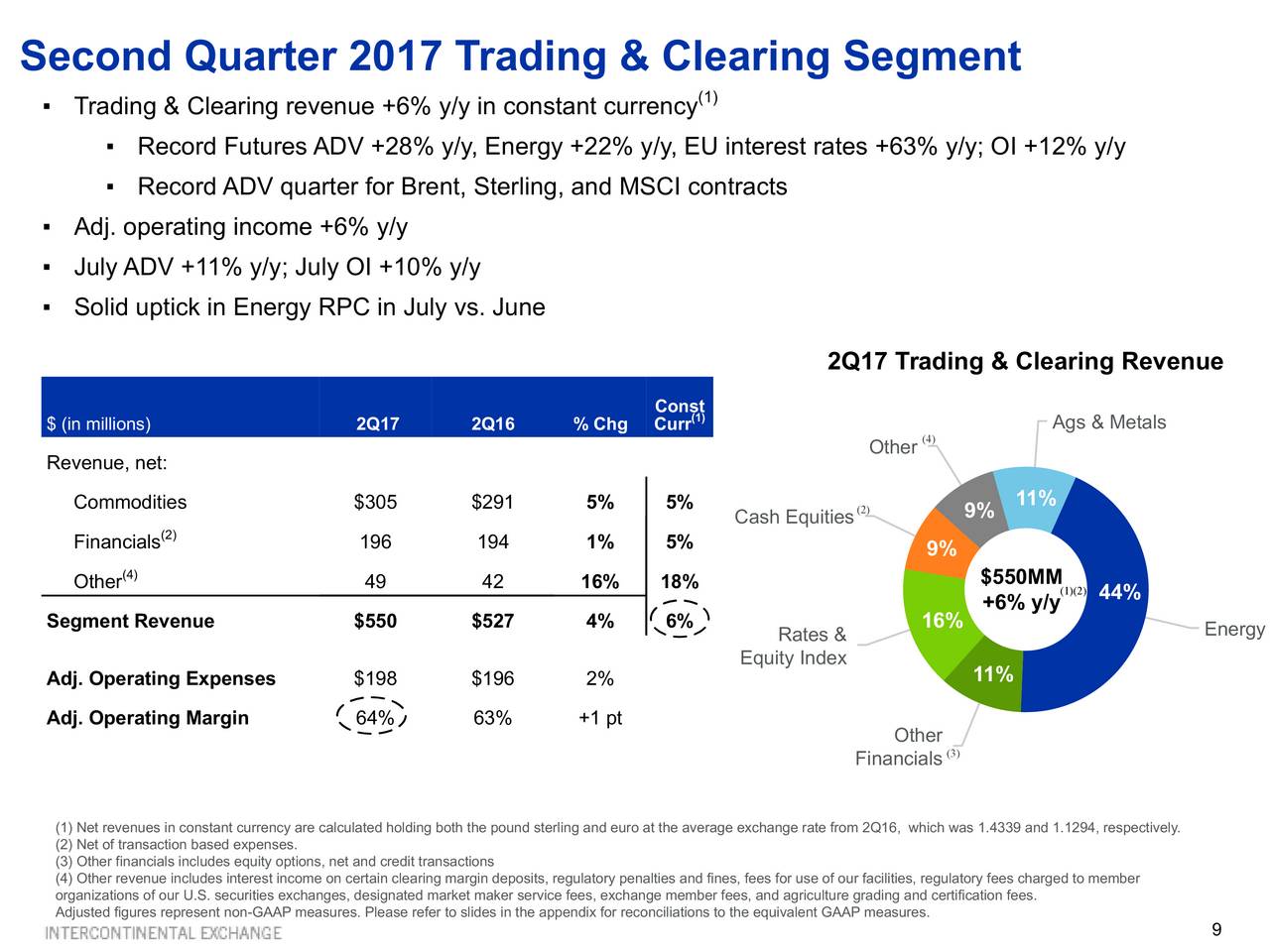

Record-Breaking Trading Activity

NYSE trading volume experienced a substantial uplift, exceeding [Insert Specific Percentage]% compared to Q1 2023 and [Insert Specific Percentage]% compared to Q4 2023. This translates to [Insert Specific Number] shares traded, a record-breaking figure for the exchange.

- Equities Trading: Equities trading contributed significantly to the overall volume increase, with a [Insert Specific Percentage]% rise compared to the previous year. This robust performance reflects strong investor activity and market confidence.

- Derivatives Trading: Derivatives trading also experienced growth, with a [Insert Specific Percentage]% increase year-over-year. This growth may be attributed to [mention specific market events or factors, e.g., increased volatility, hedging activities].

- (Optional) Include a chart or graph visually representing the increase in NYSE trading volume across different asset classes and compared to previous periods.

This exceptional NYSE trading activity directly translated into substantial revenue growth for ICE, laying the foundation for the overall profit beat.

Exceeding Profit Expectations: A Deep Dive into ICE's Q1 Financials

ICE's Q1 2024 financial results significantly exceeded analyst expectations across key performance indicators (KPIs). This strong performance underscores the effectiveness of ICE's business model and its ability to capitalize on market opportunities.

Key Performance Indicators (KPIs)

- Earnings Per Share (EPS): ICE reported an EPS of [Insert Specific Figure], exceeding the consensus analyst estimate of [Insert Specific Figure] by [Insert Specific Percentage]%.

- Revenue: Total revenue reached [Insert Specific Figure], surpassing the anticipated [Insert Specific Figure] and representing a [Insert Specific Percentage]% year-over-year increase.

- Net Income: Net income came in at [Insert Specific Figure], a substantial increase compared to [Insert Specific Figure] in Q1 2023.

These figures showcase ICE's ability to generate strong profitability even in a dynamic market environment. The positive deviation from analyst expectations reflects a better-than-anticipated performance across multiple business segments.

Analyzing the Contributing Factors Beyond NYSE Trading Volume

While the NYSE trading volume played a pivotal role, other ICE business segments also contributed to the strong Q1 results. A balanced performance across various sectors cemented ICE's overall success.

Performance of Other ICE Businesses

- Energy Trading: The energy segment showed [Insert Description of Performance, e.g., stable performance, slight growth, etc.], reflecting [mention specific market conditions or factors].

- Fixed Income: Fixed income markets demonstrated [Insert Description of Performance, e.g., robust growth driven by increased volatility, etc.], contributing positively to overall revenue.

- Data Services: ICE's data services arm experienced [Insert Description of Performance, e.g., continued growth due to increased demand, etc.], showcasing the value of its data analytics offerings.

The diversified nature of ICE's business proved advantageous, mitigating potential risks associated with reliance on a single segment and contributing to the overall strong performance.

Future Outlook and Investor Implications

ICE's Q1 results provide a positive outlook for the remainder of 2024, though challenges remain within the broader macroeconomic environment.

ICE's Guidance for Q2 and Beyond

ICE management provided guidance for Q2 and the full year, expressing confidence in continued growth, though acknowledging potential headwinds from [mention potential challenges, e.g., geopolitical uncertainty, interest rate hikes, etc.]. The company anticipates [Insert Summary of Guidance, e.g., continued revenue growth, maintaining profitability, etc.].

- Macroeconomic Factors: Global economic conditions will continue to play a role in influencing trading activity and overall performance. ICE's ability to adapt to fluctuating market conditions will be crucial.

- Strategic Initiatives: ICE's ongoing investments in technology and data analytics are expected to support future growth and enhance its competitive position.

Conclusion:

Intercontinental Exchange (ICE)'s Q1 2024 earnings demonstrated exceptional strength, driven largely by record-breaking NYSE trading volume. The company exceeded expectations across key financial metrics, showcasing a resilient and profitable business model. While future performance will depend on market conditions and macroeconomic factors, ICE's diversified portfolio and strategic initiatives position it for continued growth. To stay informed about future Intercontinental Exchange (ICE) financial results and the ongoing impact of NYSE trading volume, subscribe to ICE's investor relations materials or follow reputable financial news outlets for updates on ICE earnings reports and market analysis.

Featured Posts

-

Eurojackpotin 40 000 E Voitto Suomeen Onnellinen Voittaja Kertoo Tarinansa

May 14, 2025

Eurojackpotin 40 000 E Voitto Suomeen Onnellinen Voittaja Kertoo Tarinansa

May 14, 2025 -

Oqtf La Riposte Humoristique De Saint Pierre Et Miquelon

May 14, 2025

Oqtf La Riposte Humoristique De Saint Pierre Et Miquelon

May 14, 2025 -

Liverpool Transfers Reds Tracking Bournemouths Dean Huijsen

May 14, 2025

Liverpool Transfers Reds Tracking Bournemouths Dean Huijsen

May 14, 2025 -

Robust Trading Volume Boosts Ices Q1 Earnings Exceeding Nyse Profit Estimates

May 14, 2025

Robust Trading Volume Boosts Ices Q1 Earnings Exceeding Nyse Profit Estimates

May 14, 2025 -

Pokemon Ash Gray Full Game Walkthrough And Trainer Guide

May 14, 2025

Pokemon Ash Gray Full Game Walkthrough And Trainer Guide

May 14, 2025