Internal GOP Resistance Could Halt Trump's Tax Bill

Table of Contents

Moderate Republicans' Concerns Over Tax Cuts for the Wealthy

Moderate Republicans are expressing deep concerns about the proposed tax cuts, particularly those benefiting the wealthy. Their apprehension stems from two primary areas: the potential impact on the national debt and the rushed legislative process.

Impact on the National Debt

The projected increase in the national debt due to the proposed tax cuts is a major point of contention. Fiscally conservative Republicans, known for their adherence to balanced budgets, are sounding the alarm.

- The Committee for a Responsible Federal Budget estimates a trillion-dollar increase in the national debt over the next decade as a result of the tax plan.

- Representative [insert name of a fiscally conservative Republican], a long-time advocate for fiscal responsibility, has publicly voiced concerns about the plan's long-term fiscal sustainability.

- [Insert name of another fiscally conservative Republican] has echoed these concerns, stating that the tax cuts are "fiscally irresponsible" and will jeopardize future economic growth.

- Data from the Congressional Budget Office (CBO) shows a significant rise in the deficit under the proposed tax plan. [Link to CBO report]

Lack of Transparency and Hasty Legislative Process

The speed at which the bill is being pushed through Congress has also raised concerns among moderate Republicans. Many feel the process lacks transparency and sufficient public debate.

- Critics argue that the bill was drafted behind closed doors, limiting opportunities for input from various stakeholders.

- Republican Senator [insert name] expressed concern over the lack of thorough vetting, stating, "[insert quote expressing concern about the speed and lack of transparency]". [Link to news article quoting the Senator]

- The limited time allotted for public comment and analysis has fueled concerns about unintended consequences.

Conservative Republicans' Concerns Over Spending

While some Republicans support the tax cuts, a significant faction within the conservative wing harbors concerns about spending. Their primary worries are the bill's failure to address entitlement spending and its potential negative impact on the economy.

Failure to Address Entitlement Spending

Conservative Republicans argue that the proposed tax cuts are fiscally irresponsible without simultaneous efforts to curtail entitlement spending. They see a disconnect between cutting taxes and maintaining current levels of government spending.

- The bill's lack of significant entitlement reforms is viewed by many as a missed opportunity to address long-term fiscal challenges.

- Representative [insert name of a conservative Republican] has publicly stated that "[insert quote emphasizing the need for spending cuts to balance the tax cuts]". [Link to news article or official statement]

- Concerns exist that the tax cuts will exacerbate the national debt without addressing underlying spending issues.

Potential Impact on the Economy

Some conservative Republicans question whether the tax cuts will actually stimulate the economy as claimed. They argue that the potential negative economic consequences outweigh the benefits.

- Several conservative economists have voiced skepticism about the efficacy of the proposed tax cuts in boosting economic growth. [Link to research or expert opinion]

- Concerns have been raised regarding the potential for increased inflation and a widening trade deficit.

- Some argue that the tax cuts disproportionately benefit corporations and the wealthy, failing to trickle down to the rest of the economy.

The Role of the Freedom Caucus

The House Freedom Caucus, a group of conservative and libertarian Republicans, holds significant sway in the legislative process. Their demands and negotiation tactics will play a crucial role in determining the bill’s fate.

Key Demands and Negotiation Tactics

The Freedom Caucus has made several key demands for changes to the bill, including [insert specific demands, e.g., further reductions in corporate taxes, stricter spending caps].

- Their negotiation tactics often involve threatening to withhold their support unless their demands are met.

- Key members of the Freedom Caucus, such as [insert names], have publicly stated their reservations and outlined their conditions for supporting the bill. [Link to statements from Freedom Caucus members]

- Their ability to influence the outcome is substantial, given the narrow Republican majority in Congress.

Potential Outcomes and the Path Forward

Several scenarios could unfold regarding the future of Trump's tax bill.

Scenarios for Success, Failure, and Compromise

- Passage with Amendments: The bill could pass after significant amendments are negotiated to address concerns raised by moderate and conservative Republicans. This is the most likely scenario.

- Passage without Amendments: A swift passage without significant changes is less likely given the level of internal resistance.

- Significant Delay: The bill could be delayed considerably as negotiations continue, potentially impacting its passage before the end of the year.

- Complete Failure: The bill could fail to pass Congress altogether if sufficient compromises cannot be reached.

Conclusion

The future of Trump's tax bill remains highly uncertain. Internal GOP resistance, fueled by concerns about the national debt, the economic impact, and the legislative process itself, presents a formidable obstacle. The outcome will likely depend on further negotiations and compromises between different factions within the Republican party. Moderate and conservative Republicans, along with the Freedom Caucus, will continue to exert significant influence over the final shape—or demise—of this controversial legislation. Stay informed about this developing situation and the potential impacts of internal GOP resistance on Trump’s tax bill. Understanding the dynamics of this internal struggle is crucial to predicting the ultimate fate of this significant piece of legislation.

Featured Posts

-

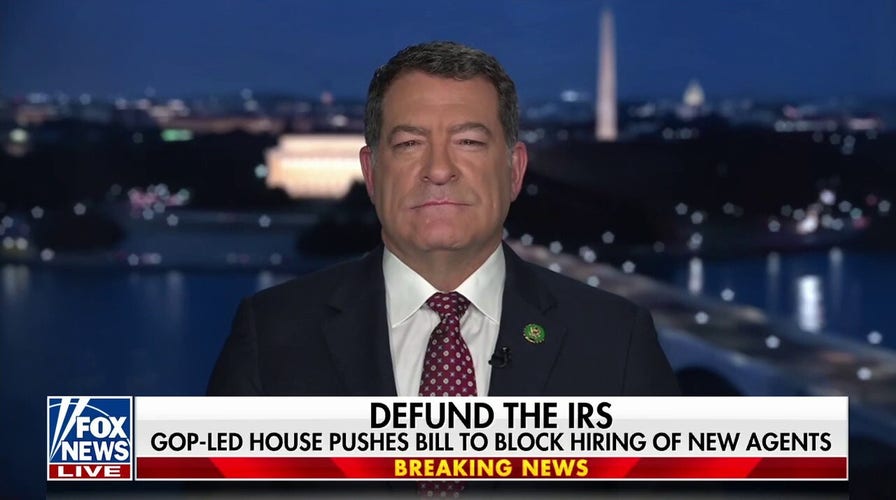

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025

The Impact Of Tariff Uncertainty On U S Company Spending

Apr 29, 2025 -

Ftc Probes Open Ais Chat Gpt Implications For Ai Development

Apr 29, 2025

Ftc Probes Open Ais Chat Gpt Implications For Ai Development

Apr 29, 2025 -

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

Apr 29, 2025

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

Apr 29, 2025 -

Us Pressure Fails To Sway Hungary On China Economic Relations

Apr 29, 2025

Us Pressure Fails To Sway Hungary On China Economic Relations

Apr 29, 2025 -

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Latest Posts

-

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025

Oh What A Beautiful World A Review Of Willie Nelsons New Album

Apr 29, 2025 -

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025

Country Legend Willie Nelson Releases Oh What A Beautiful World

Apr 29, 2025 -

New Music Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025

New Music Willie Nelson Releases 77th Solo Album At 91

Apr 29, 2025 -

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025 -

Oh What A Beautiful World Willie Nelsons Latest Album Details

Apr 29, 2025

Oh What A Beautiful World Willie Nelsons Latest Album Details

Apr 29, 2025