The Impact Of Tariff Uncertainty On U.S. Company Spending

Table of Contents

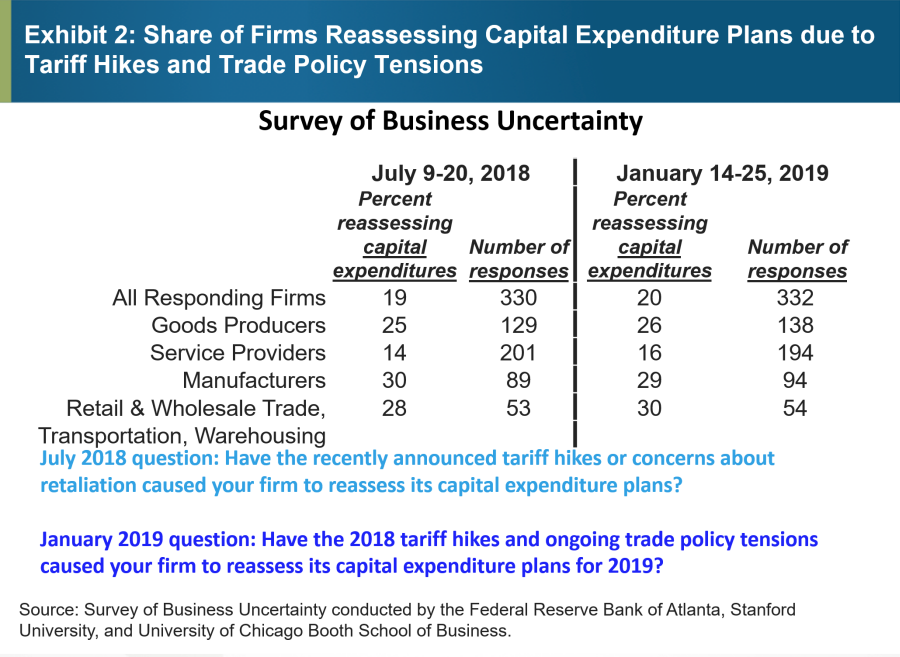

Reduced Capital Expenditures

Tariff uncertainty forces businesses to delay or postpone major capital investments, creating a ripple effect throughout the economy. The risk of unforeseen tariff increases makes it difficult to accurately predict the return on investment (ROI), leading to a wait-and-see approach that stifles growth and innovation.

Delayed Investment Decisions

Tariff uncertainty significantly impacts investment decisions. The unpredictable nature of trade policies makes long-term planning extremely difficult. Businesses hesitate to commit significant resources when faced with the possibility of sudden tariff hikes that could drastically alter projected costs and profits.

- Difficulty in forecasting future costs: Fluctuating tariffs make it nearly impossible to accurately predict future input costs, hindering effective budgeting and financial planning.

- Hesitation to commit to long-term contracts: Businesses are less likely to enter into long-term contracts for equipment, materials, or services due to the fear of unexpected tariff increases rendering those contracts unprofitable.

- Increased risk aversion among investors: The increased uncertainty discourages investment, as investors become more risk-averse and seek more stable investment opportunities.

- Shifting investment to more stable markets: Companies may redirect investment to countries with more predictable and stable trade policies, further harming the U.S. economy.

Impact on Innovation and Productivity

Delayed capital expenditures directly impede innovation and productivity growth. Businesses unable to upgrade equipment or implement new technologies become less competitive, impacting overall economic performance. This lag in technological advancement weakens the U.S.'s position in the global marketplace.

- Lower adoption rates of new technologies: The lack of investment in new technologies reduces efficiency and competitiveness.

- Reduced efficiency and competitiveness: Outdated equipment and processes lead to higher production costs and lower output, making U.S. businesses less competitive globally.

- Slower overall economic growth: Reduced investment in innovation and productivity translates to slower overall economic growth for the nation.

- Increased susceptibility to foreign competition: Companies unable to modernize are more vulnerable to competition from businesses in countries with more stable trade environments.

Impact on Hiring and Employment

Uncertainty surrounding tariffs can significantly impact hiring and employment levels, leading to job losses and decreased consumer spending. Businesses, facing unpredictable costs, often resort to cost-cutting measures, directly impacting their workforce.

Hiring Freezes and Layoffs

In response to tariff uncertainty, many businesses implement hiring freezes or even resort to layoffs to mitigate potential losses. This reduction in workforce directly impacts consumer spending and overall economic health.

- Reduced demand for labor: Uncertainty leads to decreased production and a subsequent reduction in the demand for labor.

- Increased unemployment rates: Layoffs and hiring freezes contribute to higher unemployment rates, straining social safety nets and reducing consumer confidence.

- Decreased consumer spending: Job losses and fear of further job insecurity lead to decreased consumer spending, further hindering economic growth.

- Negative ripple effect throughout the economy: The reduced consumer spending creates a negative ripple effect, impacting businesses across various sectors.

Impact on Wage Growth

The reduced demand for labor caused by tariff uncertainty can suppress wage growth, negatively impacting workers' incomes and overall consumer confidence. This contributes to economic inequality and slows overall economic expansion.

- Stagnant wage growth: The reduced demand for labor can lead to stagnant or even declining wage growth, particularly impacting low-income workers.

- Reduced consumer purchasing power: Stagnant wages reduce consumer purchasing power, hindering economic growth and exacerbating economic inequality.

- Lower economic growth: Lower consumer spending due to reduced purchasing power further dampens economic growth.

- Increased economic inequality: Stagnant wages for many while others maintain or increase their income further widens the gap in economic inequality.

Supply Chain Disruptions and Restructuring

Tariff uncertainty forces businesses to reassess and potentially restructure their supply chains, leading to increased costs and reduced competitiveness. This often involves expensive and time-consuming adjustments.

Shifting Supply Chains

Businesses may react to tariff uncertainty by reshoring production or shifting their supply chains to other countries to mitigate the impact of tariffs. This can be a costly and complex undertaking.

- Increased transportation costs: Shifting supply chains often involves longer transportation distances, leading to significantly higher transportation costs.

- Higher production costs: Relocating production facilities or finding new suppliers can significantly increase overall production costs.

- Difficulty finding reliable suppliers: Establishing relationships with new suppliers in different countries takes time and may result in less reliable supply chains.

- Loss of expertise and relationships with long-term suppliers: Disrupting long-standing supplier relationships can lead to a loss of valuable expertise and experience.

Increased Costs and Reduced Competitiveness

The costs associated with restructuring supply chains, coupled with the potential for higher input costs due to tariffs, can reduce the competitiveness of U.S. companies in the global marketplace. This impacts pricing, market share, and employment.

- Higher prices for consumers: Increased production costs due to tariffs and supply chain disruptions are often passed on to consumers in the form of higher prices.

- Decreased market share: Higher prices and reduced efficiency can lead to a decrease in market share, as businesses lose out to more competitive companies.

- Loss of jobs in specific sectors: Restructuring supply chains and relocating production can lead to job losses in specific sectors.

- Reduced export opportunities: Higher production costs make U.S. goods less competitive in the global export market.

Conclusion

Tariff uncertainty presents a significant challenge to U.S. company spending, impacting capital expenditures, hiring practices, and supply chain stability. The resulting economic consequences can be far-reaching, affecting everything from innovation and productivity to employment and wage growth. Businesses need clear and predictable trade policies to make informed decisions and invest in future growth. Understanding the complexities of tariff uncertainty is crucial for navigating the current global trade environment and making sound business decisions. By mitigating the risks associated with tariff uncertainty, U.S. companies can better position themselves for sustained growth and competitiveness in the long term. Therefore, advocating for policies that reduce tariff uncertainty is essential for the overall health of the U.S. economy.

Featured Posts

-

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025 -

Quinoas New Rival The Next Generation Of Superfoods

Apr 29, 2025

Quinoas New Rival The Next Generation Of Superfoods

Apr 29, 2025 -

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 29, 2025

The Countrys Emerging Business Hubs A Geographic Analysis

Apr 29, 2025 -

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 29, 2025

Minnesota Faces Pressure Attorney Generals Transgender Athlete Ban Directive

Apr 29, 2025 -

Lynas Texas Refinery Us Aid Request As Costs Escalate

Apr 29, 2025

Lynas Texas Refinery Us Aid Request As Costs Escalate

Apr 29, 2025

Latest Posts

-

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025 -

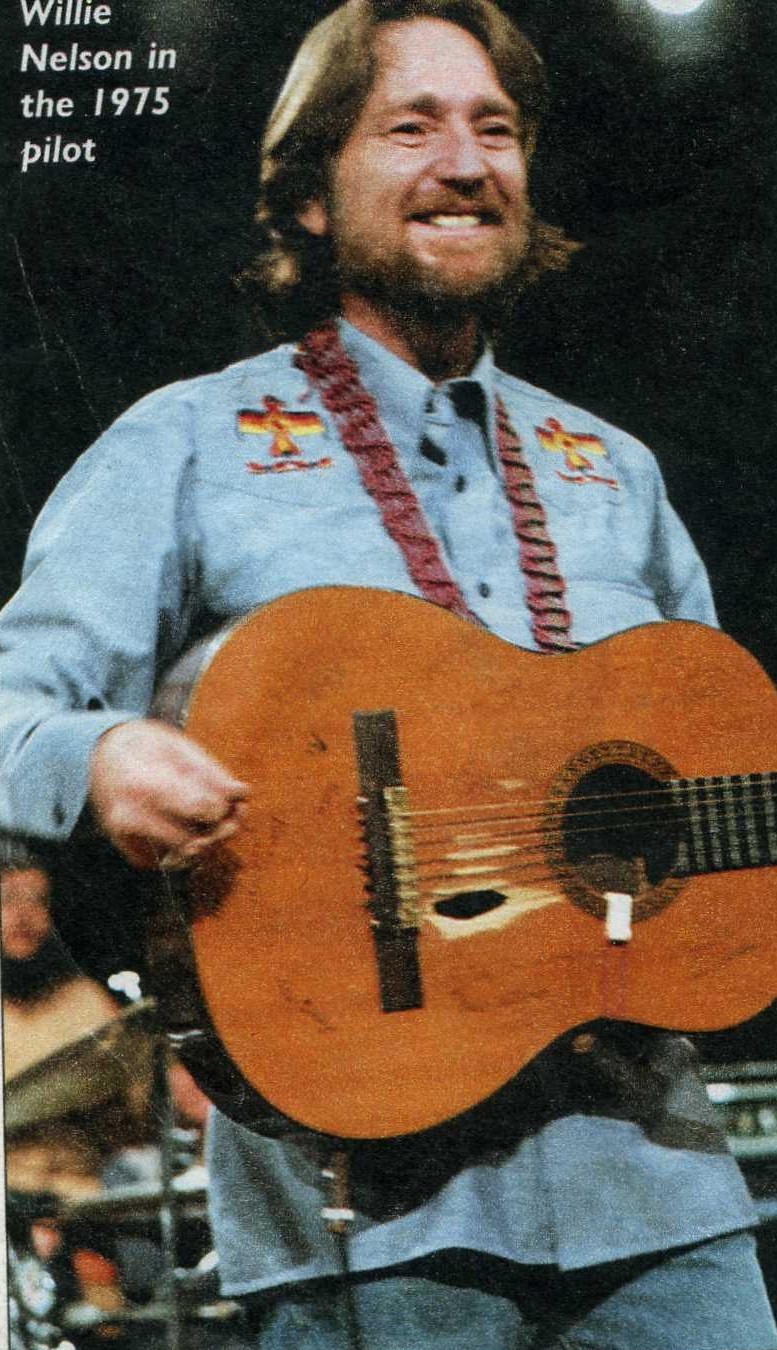

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025

Austin City Limits Celebrating Willie Nelson And Familys Legacy

Apr 29, 2025 -

Extreme Price Hike For V Mware At And Ts Concerns Over Broadcoms Proposal

Apr 29, 2025

Extreme Price Hike For V Mware At And Ts Concerns Over Broadcoms Proposal

Apr 29, 2025 -

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025

Rosenberg Accuses Bank Of Canada Of Monetary Policy Mistake

Apr 29, 2025 -

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025

Willie Nelson And Family An Austin City Limits Concert Retrospective

Apr 29, 2025