Investing In Cryptocurrency: A Case Study Of XRP (Ripple)

Table of Contents

Understanding XRP and its Technology

XRP, unlike Bitcoin or Ethereum, isn't solely a decentralized cryptocurrency. It's designed to facilitate fast and low-cost cross-border payments through RippleNet, Ripple's global payment network. This network leverages the XRP Ledger, a distributed ledger technology that offers significantly faster transaction speeds and lower fees than many other blockchain networks. This focus on efficiency and institutional partnerships distinguishes XRP from its competitors.

- Speed of Transactions: XRP transactions are significantly faster than those on Bitcoin or Ethereum, often completing in a matter of seconds.

- Low Transaction Costs: The cost of sending XRP is considerably lower than many other cryptocurrencies, making it a more attractive option for high-volume transactions.

- Institutional Adoption: RippleNet boasts a growing number of partnerships with major financial institutions, indicating a potential for broader adoption of XRP in the future. This institutional backing is a key differentiator for XRP in the crypto space.

Analyzing the XRP Market and Price History

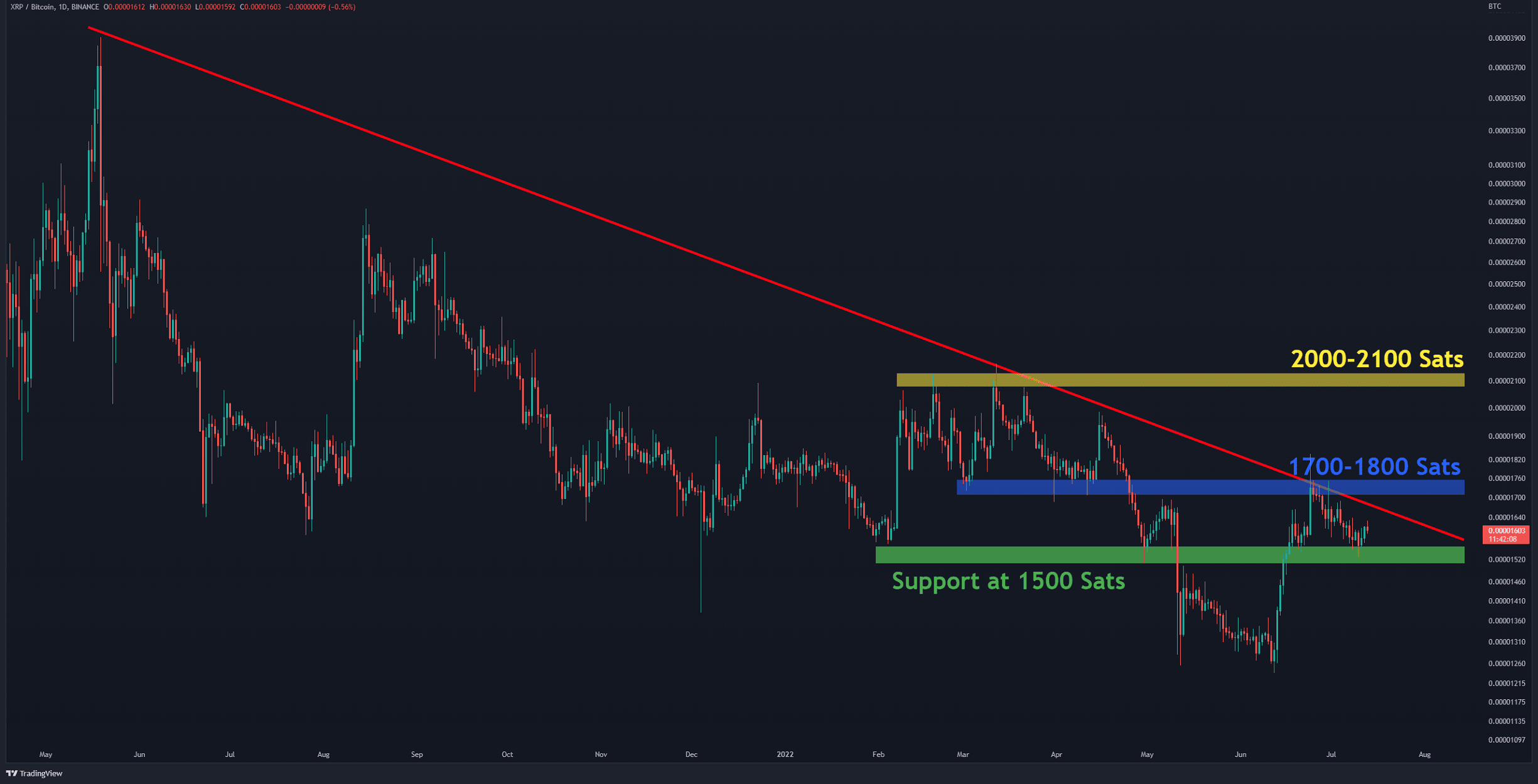

XRP's price history is characterized by significant volatility, mirroring the overall cryptocurrency market. However, its price movements are often influenced by specific factors, including:

- Regulatory Changes: Regulatory scrutiny and legal battles have historically impacted XRP's price.

- Market Sentiment: Like all cryptocurrencies, XRP's price is susceptible to shifts in overall market sentiment. Positive news or partnerships can drive prices up, while negative news can trigger price drops.

- Partnerships and Adoption: Announcements of new partnerships and integrations with RippleNet often correlate with price increases.

Analyzing key price milestones and major events reveals a pattern of sharp price swings, highlighting the importance of careful risk assessment before investing.

- All-Time High: Understanding the all-time high allows for perspective on potential future growth.

- Major Price Fluctuations: Studying past price drops and rallies provides insights into potential market reactions to news and events.

- Correlation with Bitcoin: XRP's price often shows correlation with Bitcoin's price movements, though the strength of this correlation can vary.

The Risks and Rewards of Investing in XRP

Investing in XRP, or any cryptocurrency, involves substantial risk. The cryptocurrency market is highly volatile, and regulatory uncertainty remains a significant concern.

- Regulatory Risks: Changes in regulatory frameworks can significantly impact the price and usability of XRP.

- Market Volatility: The inherent volatility of the cryptocurrency market makes significant price swings a constant possibility.

However, the potential rewards can be substantial. The growing adoption of XRP by financial institutions suggests a potential for significant price appreciation.

- High Growth Potential: XRP's focus on institutional adoption offers the potential for substantial returns if adoption continues to grow.

- Diversification: Investing in XRP as part of a diversified investment portfolio can help to mitigate overall risk.

Careful risk management is crucial, including thorough research and diversification across different asset classes.

Comparing XRP to Other Cryptocurrencies

Compared to other leading cryptocurrencies like Bitcoin and Ethereum, XRP distinguishes itself through its focus on speed, low transaction fees, and institutional partnerships.

- Transaction Speed: XRP offers significantly faster transaction speeds compared to Bitcoin and Ethereum.

- Transaction Fees: XRP transactions are much cheaper than those on Bitcoin or Ethereum.

- Market Capitalization: XRP's market capitalization positions it differently from Bitcoin and Ethereum.

A comparison table highlighting these key features, alongside a detailed analysis of strengths and weaknesses, would further illuminate XRP's competitive position within the broader cryptocurrency market. Analyzing its potential for market dominance relative to competitors is also essential.

Conclusion: Making Informed Decisions about XRP Investment

Investing in XRP presents both significant opportunities and substantial risks. While its focus on institutional adoption and low transaction fees makes it an attractive option for cross-border payments, the inherent volatility of the cryptocurrency market and regulatory uncertainty cannot be ignored.

Before investing in XRP or any cryptocurrency, conducting thorough research and understanding your risk tolerance is absolutely paramount. Seeking advice from a qualified financial advisor is highly recommended. Start your research on XRP and explore the exciting world of cryptocurrency investing today! Learn more about investing in XRP and building a diversified crypto portfolio for a more informed approach to this evolving market.

Featured Posts

-

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 08, 2025

Section 230 And Banned Chemicals A Judges Ruling On E Bay Listings

May 08, 2025 -

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 08, 2025

Open Ai Unveils Streamlined Voice Assistant Creation At 2024 Event

May 08, 2025 -

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025

Is Investing In Xrp Ripple Right For You A Financial Analysis

May 08, 2025 -

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025

Denver Nuggets Jokic Among Starters Benched After Grueling Game

May 08, 2025 -

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Latest Posts

-

Jayson Tatum Shares His Thoughts On The Great Larry Bird

May 08, 2025

Jayson Tatum Shares His Thoughts On The Great Larry Bird

May 08, 2025 -

Dwp Hardship Payments Reclaiming Universal Credit Overpayments

May 08, 2025

Dwp Hardship Payments Reclaiming Universal Credit Overpayments

May 08, 2025 -

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025

Am I Due A Universal Credit Refund From The Dwp

May 08, 2025 -

Larry Bird Jayson Tatum Offers Frank Opinion On Celtics Icon

May 08, 2025

Larry Bird Jayson Tatum Offers Frank Opinion On Celtics Icon

May 08, 2025 -

Are You A Universal Credit Recipient Check If You Re Owed Hardship Payment Money

May 08, 2025

Are You A Universal Credit Recipient Check If You Re Owed Hardship Payment Money

May 08, 2025