Investing In Palantir: Should You Buy Before May 5th? Wall Street's View

Table of Contents

Palantir's Recent Performance and Upcoming Earnings

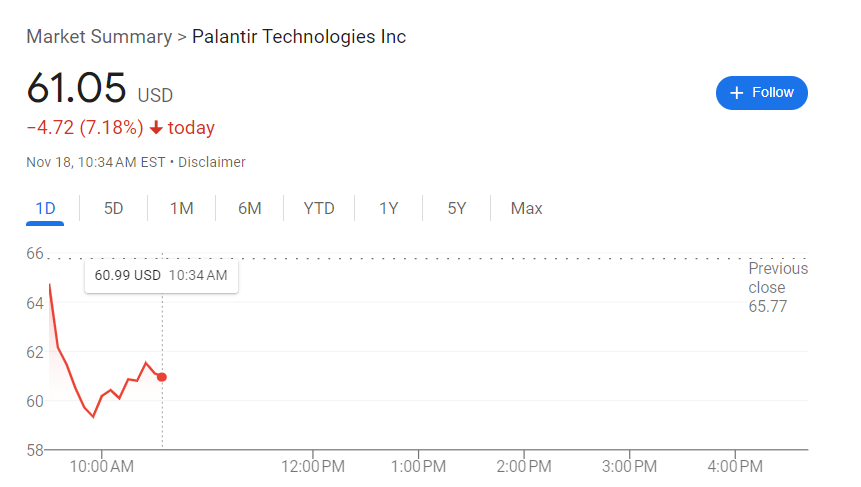

Palantir stock, like many tech stocks, has experienced significant volatility in recent months. Analyzing recent price fluctuations and trading volume is crucial for understanding the current market sentiment surrounding PLTR. The upcoming earnings report on May 5th is particularly significant, as it will offer a clearer picture of the company's financial health and future prospects. This could significantly impact the Palantir stock price, potentially leading to substantial gains or losses for investors.

- Recent News Impacting Palantir's Valuation: Recent contract wins with government agencies and commercial clients, coupled with strategic partnerships, have influenced investor confidence. However, any negative news regarding contract delays or competitive pressures could negatively affect the Palantir buy sentiment.

- Analyst Predictions for Earnings and Revenue Growth: Analysts' predictions for Palantir's Q1 2024 earnings and revenue growth vary. Some predict strong growth fueled by increased demand for its data analytics solutions, while others remain cautious due to economic uncertainties. These predictions directly impact the Palantir investment outlook.

- Comparison to Competitors: Palantir faces competition from established players in the data analytics market. Comparing Palantir's performance to competitors such as Databricks and Snowflake provides valuable context for assessing its competitive advantage and long-term potential. Understanding this competitive landscape is vital before making a Palantir stock purchase.

Wall Street's Sentiment Towards Palantir

Wall Street's sentiment towards Palantir is mixed. While some major investment banks maintain a positive outlook, others express concerns about its profitability and valuation. Understanding these differing viewpoints is crucial for any Palantir investment strategy.

- Buy, Sell, or Hold Ratings: Analyst ratings range from strong buys to holds and even sells. These ratings reflect the varied perspectives on Palantir's potential for future growth and profitability. The justifications behind these ratings often highlight key factors influencing the price of Palantir stock.

- Analyst Quotes and Consensus View: Prominent analysts have offered insights into Palantir's future prospects, with some emphasizing the company's innovative technology and growing market share, while others highlight the challenges in achieving sustainable profitability. The consensus view, while often providing a general direction, should not be the sole basis for a Palantir buy decision.

- Price Target Range: The range of price targets set by Wall Street analysts indicates a significant level of uncertainty about Palantir's future valuation. This wide range underscores the inherent risk associated with investing in this growth-oriented technology company.

Key Factors to Consider Before Investing in Palantir

Before investing in Palantir stock, it's essential to consider several key factors to make an informed decision.

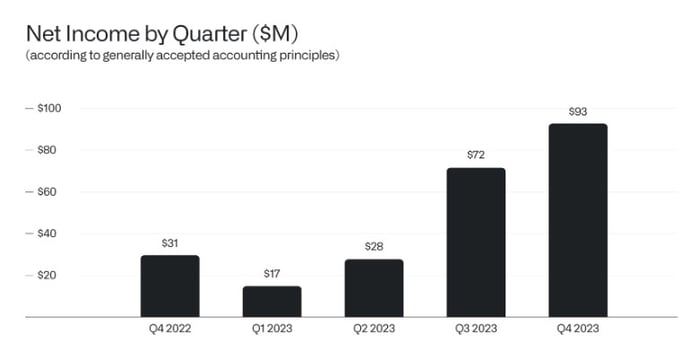

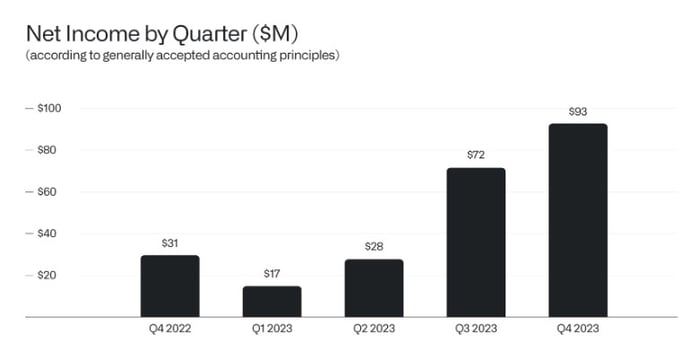

- Financial Health: Analyzing Palantir's financial health, including its debt levels, cash flow, and profitability, is critical. A thorough assessment of the company's financial position is essential for any investor considering a Palantir buy.

- Competitive Landscape: The data analytics sector is highly competitive. Assessing the competitive landscape and identifying potential threats to Palantir's market share is crucial for understanding the risks involved in a Palantir investment.

- Long-Term Growth Strategy: Palantir's long-term growth strategy and its ability to execute its plans are crucial factors to consider. A clear understanding of the company's strategic direction is essential for any long-term Palantir investment.

Alternative Investment Strategies

Investing in the data analytics sector doesn't solely rely on a Palantir investment.

- Competitor Analysis: Exploring alternative investments in companies such as Databricks, Snowflake, or other players in the data analytics sector offers diversification benefits. Comparing and contrasting Palantir with its competitors allows for a more strategic portfolio allocation.

- Portfolio Diversification: Diversifying your portfolio across multiple sectors reduces overall risk. Investing solely in Palantir stock may be too risky for some investors.

- Risk Tolerance: Aligning investments with your individual risk tolerance is crucial. Palantir, as a growth stock, inherently carries more risk compared to more established, less volatile companies.

Conclusion

The decision of whether or not to buy Palantir stock before May 5th is a personal one. Wall Street's perspective offers valuable insights, but it shouldn't be the sole determining factor. By carefully weighing the potential rewards and risks, analyzing Palantir's financial health, considering its competition, and understanding your own risk tolerance, you can make a more informed investment decision regarding your Palantir stock purchase. Remember to always consult a financial advisor before making significant investment choices in Palantir or any other stock.

Featured Posts

-

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Answer

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th Wall Streets Answer

May 10, 2025 -

Death Of Americas Pioneer Nonbinary Person A Reflection On Loss And Legacy

May 10, 2025

Death Of Americas Pioneer Nonbinary Person A Reflection On Loss And Legacy

May 10, 2025 -

Lidery Frantsii Velikobritanii Germanii I Polshi Otkazalis Posetit Kiev 9 Maya

May 10, 2025

Lidery Frantsii Velikobritanii Germanii I Polshi Otkazalis Posetit Kiev 9 Maya

May 10, 2025 -

The Uk City Facing A Caravan Crisis A Ghetto In The Making

May 10, 2025

The Uk City Facing A Caravan Crisis A Ghetto In The Making

May 10, 2025 -

Transgender Equality In Thailand The Bangkok Posts Perspective

May 10, 2025

Transgender Equality In Thailand The Bangkok Posts Perspective

May 10, 2025