Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Considerations

Table of Contents

What is NAV and Why is it Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. In simpler terms, it's the intrinsic value of one share of the ETF. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated daily by taking the total market value of all the underlying DJIA stocks held by the ETF, adding any other assets, subtracting liabilities (like management fees), and then dividing by the total number of outstanding ETF shares.

The NAV of the Amundi Dow Jones Industrial Average UCITS ETF is directly linked to the performance of the DJIA. If the DJIA rises, the NAV generally rises as well, and vice versa. However, it’s important to note that the ETF's share price on the exchange might not always perfectly match its NAV. This difference is called the tracking error and can arise due to factors like supply and demand for the ETF shares, brokerage commissions, and the timing of trades.

- NAV reflects the ETF's intrinsic value. It provides a clear picture of the underlying assets backing each share.

- Daily NAV changes reflect market movements of the Dow Jones Industrial Average components. This makes NAV a reliable indicator of the ETF's performance.

- Tracking differences between NAV and market price are possible due to trading volume and market dynamics. While generally small, these differences are worth monitoring.

Factors Affecting the NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Several factors influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF. Understanding these factors is crucial for anticipating potential NAV fluctuations.

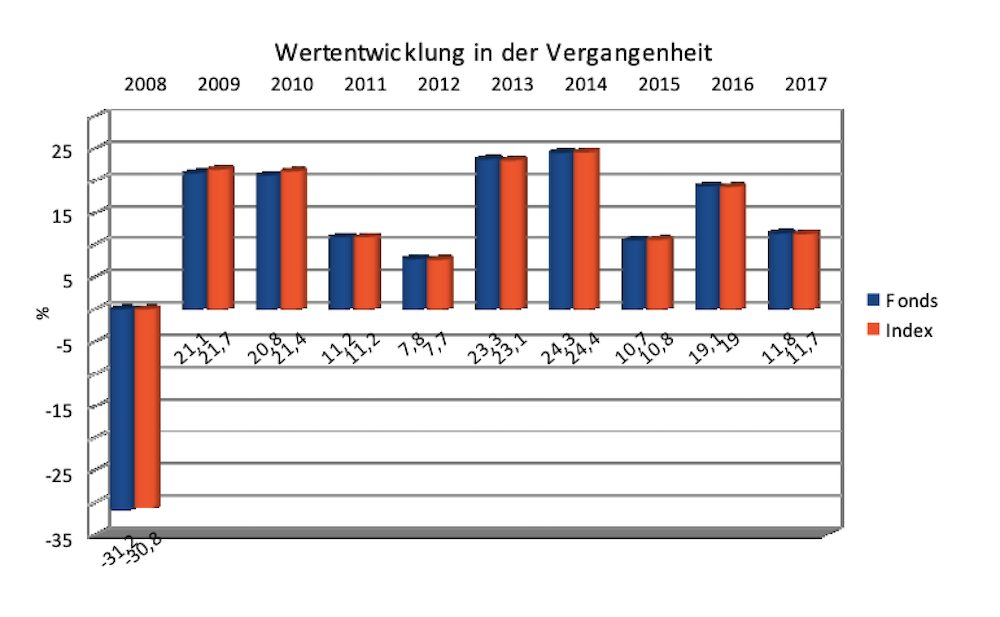

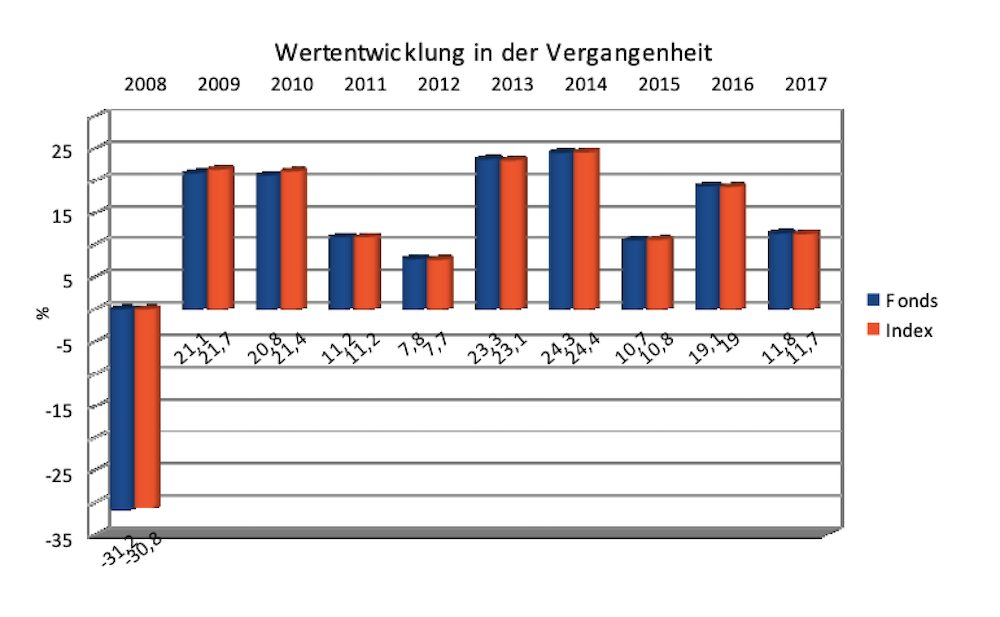

The most significant factor is the performance of the underlying Dow Jones Industrial Average components. If the constituent companies of the DJIA experience strong growth, the overall value of the index increases, consequently boosting the ETF's NAV. Conversely, a decline in the DJIA will typically lead to a decrease in the ETF's NAV.

- Positive performance of Dow Jones components increases NAV. Strong earnings reports, positive economic news, and increased investor confidence all contribute to higher NAVs.

- Negative market trends lead to NAV decline. Bear markets, economic downturns, and negative news about DJIA components can negatively impact the NAV.

- Dividend payouts slightly reduce NAV. When the underlying companies distribute dividends, the ETF receives these dividends, which are then typically passed on to ETF investors. This distribution slightly reduces the NAV.

- Currency fluctuations can impact NAV if the ETF holds international assets. While the Amundi Dow Jones Industrial Average UCITS ETF primarily tracks US-based companies, any indirect exposure to international markets through the companies' operations could lead to minor currency effects on the NAV.

Using NAV to Make Informed Investment Decisions in the Amundi Dow Jones Industrial Average UCITS ETF

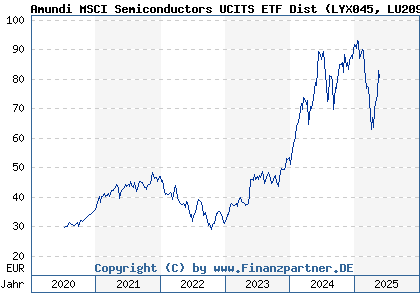

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is essential for making informed investment decisions. By regularly checking the published NAV data, typically available on the ETF provider's website and financial news sources, you can track the ETF's performance over time.

It's also crucial to compare the NAV to the ETF's market price. While they should generally be very close, discrepancies might present arbitrage opportunities or signal potential market inefficiencies. Long-term NAV trends provide a valuable gauge of the ETF's overall performance, helping you assess the success of your investment strategy.

- Regularly check the ETF's published NAV. Many financial websites provide this data.

- Compare NAV to market price to identify potential arbitrage opportunities. Small discrepancies can sometimes be exploited.

- Use long-term NAV trends to gauge investment performance. This allows for a more comprehensive view.

- Consider dollar-cost averaging to reduce risk associated with NAV fluctuations. This strategy involves investing a fixed amount of money at regular intervals, irrespective of NAV fluctuations, helping to mitigate risk.

Analyzing NAV in Relation to Investment Goals

NAV considerations are crucial for investors with different risk profiles. Conservative investors might prefer to focus on long-term NAV growth and stability, while more aggressive investors might be more tolerant of short-term NAV volatility to potentially capitalize on greater returns.

Analyzing NAV trends helps inform long-term investment strategies. For instance, consistent positive NAV growth could signal a sound investment, while prolonged NAV stagnation or decline may warrant reevaluation of the investment. Moreover, the Amundi Dow Jones Industrial Average UCITS ETF can be a valuable component of a diversified portfolio. Its NAV performance, relative to other asset classes, helps to inform asset allocation decisions.

Conclusion

This article emphasized the critical role of Net Asset Value (NAV) in understanding and managing investments in the Amundi Dow Jones Industrial Average UCITS ETF. Monitoring NAV, understanding its influencing factors, and relating it to the market price are key to making informed investment decisions. By incorporating NAV analysis into your investment strategy, you can optimize your portfolio and improve your investment outcomes.

Call to Action: Learn more about effectively utilizing NAV information to optimize your investment strategy with the Amundi Dow Jones Industrial Average UCITS ETF. Start monitoring your NAV today for better investment outcomes. Understanding NAV is key to successful Amundi Dow Jones Industrial Average UCITS ETF investing.

Featured Posts

-

Dylan Dreyers Today Show Mishap Leads To Rift With Co Stars

May 24, 2025

Dylan Dreyers Today Show Mishap Leads To Rift With Co Stars

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Nav And Investment

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Nav And Investment

May 24, 2025 -

The Last Rodeo A Review Of The Affecting Bull Riding Film

May 24, 2025

The Last Rodeo A Review Of The Affecting Bull Riding Film

May 24, 2025 -

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Kaming Aut I Ambitsii

May 24, 2025

Pobeditel Evrovideniya 2014 Konchita Vurst Zhizn Kaming Aut I Ambitsii

May 24, 2025 -

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025

Trumps Tariff Hike Sends Amsterdam Stock Exchange Down 2

May 24, 2025