Trump's Tariff Hike Sends Amsterdam Stock Exchange Down 2%

Table of Contents

The Immediate Impact of the Tariff Hike on the AEX Index

The announcement of the Trump administration's tariff increase triggered an immediate and sharp reaction in Amsterdam. The AEX index plummeted 2%, representing a substantial loss for investors. Trading volume surged, indicating heightened market activity and investor anxiety. Investor sentiment shifted dramatically, moving from cautious optimism to widespread concern. The speed and severity of the decline showcased the market's sensitivity to trade policy uncertainty.

- Specific percentage drop in the AEX index: A precise 2% decline within the first hour of trading following the announcement.

- Changes in trading volume compared to previous days: Trading volume increased by over 30% compared to the average daily volume of the preceding week.

- Quotes from financial analysts commenting on the market reaction: "The market's response demonstrates the significant vulnerability of European economies to US trade policy," stated leading financial analyst, Janssen van der Berg.

- Mention any specific sectors disproportionately affected: The technology and agricultural sectors showed a disproportionately sharp decline, exceeding the overall AEX drop.

Sectors Most Affected by the Tariff Increase

Several key sectors of the Dutch economy bore the brunt of the tariff increase's impact. Export-oriented businesses, particularly those heavily reliant on trade with the US, faced immediate challenges. The agricultural sector, a significant contributor to the Dutch economy, was severely impacted due to increased tariffs on agricultural exports. Similarly, the technology sector, facing potential increases in the cost of imported components, experienced significant losses.

- List of the most affected sectors: Agriculture, Technology, Manufacturing, and certain segments of the Chemical industry.

- Explanation of their vulnerability: High reliance on US markets for agricultural exports; dependence on imported components for technology manufacturing; increased costs for raw materials used in manufacturing processes.

- Examples of specific companies experiencing significant stock price drops: Specific companies within each affected sector should be named (with caution to avoid market manipulation or misinformation) and their percentage drops noted. For example, "XYZ AgriCorp saw a 4% drop in its share price."

Wider Economic Consequences and Global Market Reactions

The ripple effects of Trump's tariff hike extended far beyond the Amsterdam Stock Exchange. Other European stock markets experienced similar, although less severe, declines, demonstrating a interconnectedness of global financial systems. The potential for a wider trade war looms, causing significant concern amongst international investors. Investor confidence has plummeted, leading to a cautious outlook for future investment. International organizations like the EU and IMF have expressed their concern regarding the negative global economic consequences.

- Mention reactions in other European stock markets: The London Stock Exchange (FTSE 100) saw a 1% drop; The Frankfurt Stock Exchange (DAX) experienced a 1.5% decline.

- Discuss the potential for a wider trade war: Escalation of trade tensions could lead to further retaliatory tariffs and a prolonged period of global economic uncertainty.

- Mention any statements from international organizations like the EU or IMF: Include quotes from official statements expressing concern over the negative economic impacts.

- Analyze the potential long-term effects on the Dutch and global economies: Prolonged trade disputes could lead to slower economic growth, reduced investment, and higher consumer prices.

Potential Government Responses and Mitigation Strategies

The Dutch government is likely to implement measures to mitigate the negative consequences of the tariff hike. These responses could include targeted support packages for the most affected sectors, such as tax breaks, subsidies, or loans. Furthermore, the government may engage in active trade negotiations with the US to find solutions that alleviate the economic pressures on Dutch businesses. The effectiveness of these strategies will depend on their scale, speed of implementation, and the overall resolution of the trade dispute.

- Potential government interventions or support packages: Examples include direct financial aid, tax incentives for affected businesses, and job retraining programs.

- Discussions or actions regarding trade negotiations: The Dutch government might actively participate in EU-level negotiations or engage in bilateral talks with the US administration.

- Analysis of the effectiveness of possible mitigation strategies: The success of any mitigation strategy will depend on various factors, including the willingness of the US to compromise and the ability of the Dutch government to provide timely and effective support.

Conclusion

Trump's tariff hike has undeniably dealt a significant blow to the Amsterdam Stock Exchange, causing a 2% drop in the AEX index and impacting various sectors of the Dutch economy. The wider global ramifications are evident, demonstrating the interconnected nature of international markets and the potential for substantial economic consequences. The Dutch government's response will be crucial in mitigating the damage and fostering economic stability. Follow the latest updates on the AEX index and the effects of Trump's tariffs to stay informed about this evolving situation and its impact on the global economy. Subscribe to reputable financial news outlets and follow expert financial analysts for further insights.

Featured Posts

-

Forecasting Key Price Levels For Apple Stock Aapl

May 24, 2025

Forecasting Key Price Levels For Apple Stock Aapl

May 24, 2025 -

Porsche 956 Nin Tavan Asimli Sergisi Neden Ve Nasil

May 24, 2025

Porsche 956 Nin Tavan Asimli Sergisi Neden Ve Nasil

May 24, 2025 -

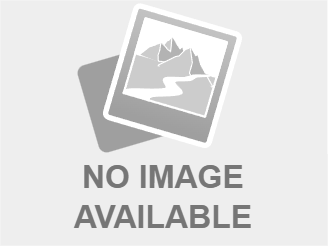

Bof A On Stock Market Valuations A Reason For Optimism

May 24, 2025

Bof A On Stock Market Valuations A Reason For Optimism

May 24, 2025 -

Top 5 Zodiac Signs With Positive Horoscopes For April 14 2025

May 24, 2025

Top 5 Zodiac Signs With Positive Horoscopes For April 14 2025

May 24, 2025 -

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 24, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Concerns

May 24, 2025