Investing In Uber's Self-Driving Technology: An ETF Approach

Table of Contents

Understanding the Appeal of Autonomous Vehicle Technology

The Market Potential of Self-Driving Cars

The market for self-driving vehicles is poised for explosive growth. Industry analysts predict a massive expansion, driven by several factors: increased safety, reduced congestion, and improved efficiency in transportation and logistics.

- Market research data: Reports from firms like McKinsey & Company and Deloitte project multi-trillion dollar market valuations for autonomous vehicles by 2030.

- Projected growth rates: Annual growth rates exceeding 20% are frequently cited, reflecting the rapid technological advancements and increasing adoption of self-driving solutions.

- Potential impact on various industries: Self-driving technology is set to revolutionize ride-sharing, logistics (autonomous trucking), delivery services, and even public transportation. This widespread impact promises significant returns for investors.

Self-driving cars promise to fundamentally change how we move people and goods, leading to increased efficiency, reduced accidents, and new business models. The potential disruption is enormous, presenting an attractive opportunity for investors.

Uber's Role in the Autonomous Vehicle Revolution

Uber is not just a ride-sharing company; it's a significant player in the development and deployment of autonomous driving technology. Its significant investments in research and development, strategic partnerships, and ambitious goals position it as a major contender in this race.

- Key milestones: Uber's self-driving program has achieved significant milestones, including extensive testing miles accumulated and collaborations with leading technology companies.

- Partnerships: Collaborations with sensor technology developers, AI specialists, and mapping companies showcase Uber's commitment to building a robust autonomous driving ecosystem.

- Ongoing research and development: Continuous innovation and investment in advanced technologies demonstrate Uber's long-term commitment to autonomous driving, promising future breakthroughs.

Uber’s competitive advantages lie in its extensive data sets, existing infrastructure, and global reach. However, the company faces intense competition from established automakers and tech giants, presenting challenges to its market dominance.

Indirect Investment through ETFs: A Smarter Approach

Why ETFs are Suitable for Self-Driving Tech Investment

Investing directly in Uber's self-driving technology is complicated and risky. ETFs offer a more accessible and diversified approach.

- Diversification benefits: ETFs spread risk by investing in multiple companies across the autonomous vehicle sector, including technology companies, automakers, and suppliers.

- Lower risk: Diversification significantly reduces the impact of a single company's failure on your overall investment.

- Ease of access: ETFs are easily traded on major exchanges, making it convenient to invest in this sector.

- Cost-effectiveness: ETFs generally have lower expense ratios compared to actively managed mutual funds, offering better value for investors.

ETFs provide a powerful tool for managing risk while still gaining exposure to the growth potential of the autonomous driving sector.

Identifying Relevant ETFs

Several ETFs offer exposure to companies involved in autonomous vehicle technology and related fields. Remember to always research thoroughly before investing.

- Example ETFs: Look for ETFs that focus on technology, robotics, artificial intelligence, and automotive sectors. Specific ticker symbols will vary depending on your market and broker. (Note: Mentioning specific ETF tickers requires financial expertise and is beyond the scope of this general article. Always conduct your own research before investing.)

- Researching ETFs: Check the ETF's holdings to see if they align with your investment goals. Examine past performance (while remembering that past performance is not indicative of future results) and expense ratios.

- Checking ETF holdings: Most brokers provide tools to view the complete list of holdings for any given ETF, allowing you to assess the level of exposure to autonomous driving companies.

Carefully analyzing the ETF's holdings, expense ratios, and performance history is crucial to making an informed investment decision.

Risk Management and Due Diligence

Understanding the Risks Involved

Investing in autonomous vehicle technology carries inherent risks.

- Regulatory hurdles: The regulatory landscape for self-driving cars is still evolving, presenting potential delays and uncertainties.

- Technological challenges: Autonomous driving is a complex technology, and unexpected technical issues can impact the performance of related companies.

- Competition: The autonomous vehicle market is highly competitive, with many players vying for market share.

- Economic downturns: Economic fluctuations can negatively impact the demand for self-driving vehicles and related technologies.

Understanding and assessing these risks is crucial for making sound investment decisions.

Conducting Thorough Research

Thorough research is paramount before investing in any ETF.

- Review ETF prospectuses: Carefully read the prospectus to understand the ETF's investment strategy, risks, and fees.

- Compare performance data: Analyze the ETF's historical performance (though again, past performance is not an indicator of future results).

- Understand expense ratios: Compare the expense ratios of different ETFs to choose the most cost-effective option.

Utilize reputable financial resources and consult with a financial advisor before committing your capital.

Conclusion

Investing in Uber's self-driving technology directly can be complex. However, using an ETF approach offers a more accessible and diversified way to participate in this potentially lucrative sector. By carefully selecting ETFs with exposure to autonomous driving technology, investors can gain exposure to companies like Uber and its competitors while mitigating risk. Remember to conduct thorough research and understand the inherent risks before making any investment decisions. Start exploring suitable ETFs for investing in Uber's self-driving technology today!

Featured Posts

-

High Flying Tequila Brands Challenges And Opportunities Ahead

May 19, 2025

High Flying Tequila Brands Challenges And Opportunities Ahead

May 19, 2025 -

New Photos Of Jennifer Lawrence And Cooke Maroney Fuel Baby No 2 Speculation

May 19, 2025

New Photos Of Jennifer Lawrence And Cooke Maroney Fuel Baby No 2 Speculation

May 19, 2025 -

El Apoyo Ciudadano Permite La Declaratoria Mensaje De Ana Paola Hall

May 19, 2025

El Apoyo Ciudadano Permite La Declaratoria Mensaje De Ana Paola Hall

May 19, 2025 -

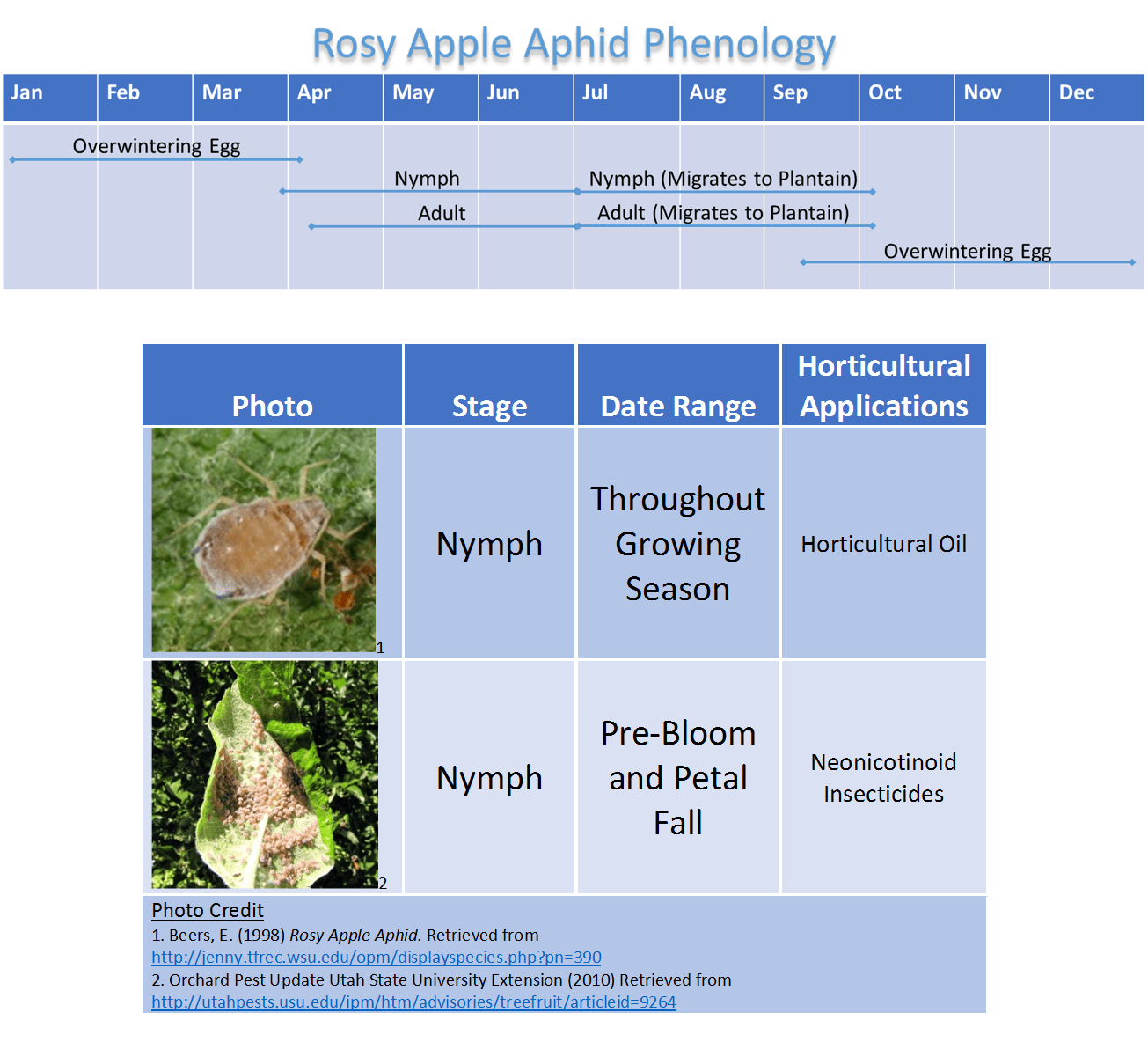

Rosy Apple Aphid Threatens Apple Harvest 10 30 Reduction Predicted

May 19, 2025

Rosy Apple Aphid Threatens Apple Harvest 10 30 Reduction Predicted

May 19, 2025 -

Ufc 313 Rookie Report Fresh Faces To Watch

May 19, 2025

Ufc 313 Rookie Report Fresh Faces To Watch

May 19, 2025