Should You Buy XRP After Its 400% Increase? A Comprehensive Guide

Table of Contents

XRP's Recent Price Surge: Causes and Sustainability

Analyzing the reasons behind XRP's impressive 400% price jump is crucial to understanding its potential for future growth. Several factors have contributed to this surge, but it's essential to examine them critically to determine their long-term impact.

Analyzing the 400% Increase:

Several interconnected factors have fueled XRP's recent price appreciation:

- Ripple's ongoing legal battle with the SEC: While seemingly negative, recent developments in the Ripple case have been interpreted positively by some, leading to increased speculation. A favorable outcome could significantly boost XRP's price.

- Growing institutional interest in XRP: Several financial institutions are exploring the use of XRP for cross-border payments, signaling a growing acceptance of its utility. This increased institutional adoption can drive demand and price appreciation.

- Increased trading volume and market capitalization: Higher trading volume indicates increased investor interest and market confidence, often preceding price increases. A larger market capitalization suggests greater overall value and stability.

- Potential for future price fluctuations: It's crucial to remember that cryptocurrency markets are notoriously volatile. The 400% increase doesn't guarantee continued growth; significant price corrections are possible.

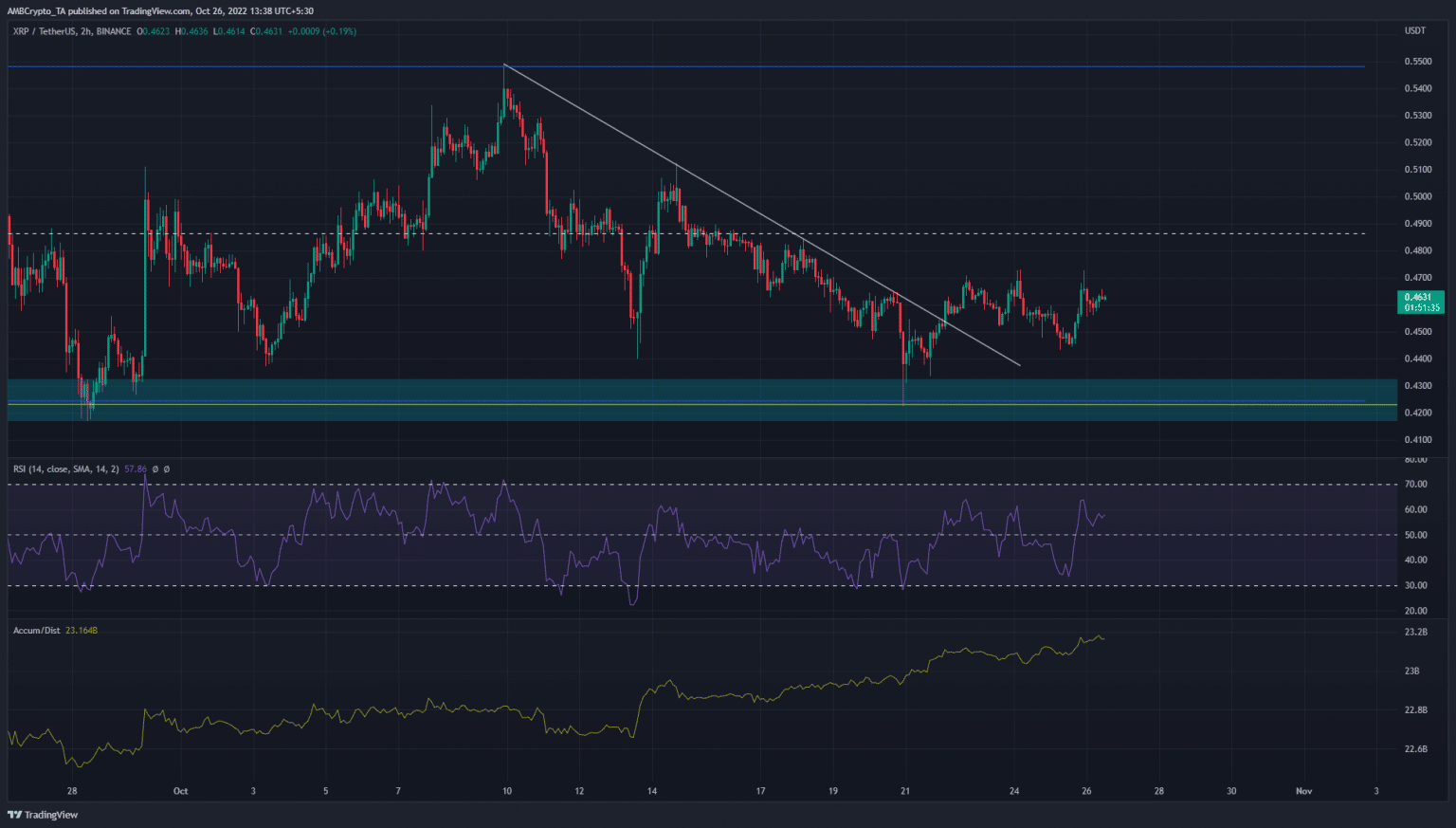

- Analysis of technical indicators: Technical analysis tools like moving averages and the Relative Strength Index (RSI) can provide insights into potential price trends, but they shouldn't be the sole basis for investment decisions.

While positive news and increased adoption have contributed to the price surge, it's crucial to acknowledge the potential for future price volatility. The market sentiment towards XRP remains dynamic, influenced by legal developments and broader market trends.

Understanding the Risks of Investing in XRP

Before considering investing in XRP, understanding the inherent risks is paramount. While the potential rewards are significant, the risks should not be underestimated.

Regulatory Uncertainty:

The ongoing legal battle between Ripple and the SEC presents a significant regulatory risk.

- The SEC lawsuit and its potential outcomes: The SEC's classification of XRP as a security carries substantial implications. An unfavorable ruling could severely impact XRP's price and adoption.

- Varying regulatory landscapes across different jurisdictions: Regulatory clarity surrounding cryptocurrencies differs globally. Uncertainty about future regulations in various jurisdictions adds to the investment risk.

- Potential for future regulatory actions: Even with a favorable ruling in the Ripple case, future regulatory actions could still negatively affect XRP's price.

Market Volatility:

The cryptocurrency market is known for its extreme volatility. XRP is no exception.

- Historical price volatility of XRP: XRP's past price charts illustrate its susceptibility to significant price swings, both upward and downward.

- Impact of market sentiment on XRP's price: Investor sentiment, news events, and broader market trends can dramatically impact XRP's price. FOMO (fear of missing out) and FUD (fear, uncertainty, and doubt) can significantly influence market behavior.

- Risk of significant price drops: Investors need to be prepared for potential sharp price drops, even after a substantial price increase like the recent 400% jump.

Investing in XRP involves significant risk. Diversification and a thorough understanding of the market are crucial for mitigating potential losses.

Factors to Consider Before Investing in XRP

Making an informed decision about investing in XRP requires careful consideration of several factors.

Your Investment Goals and Risk Tolerance:

Aligning your investment strategy with your financial goals and risk tolerance is essential.

- Short-term vs. long-term investment strategies: XRP's price is highly volatile, making it a riskier option for short-term investors. Long-term investors may be more willing to weather potential price fluctuations.

- Assessing your personal risk tolerance: Understand your comfort level with potential losses before investing in high-risk assets like XRP.

- Diversification of your investment portfolio: Never invest all your funds in a single asset, especially a high-risk one like XRP. Diversification reduces overall portfolio risk.

Fundamental Analysis of XRP:

Conduct thorough research into XRP's underlying technology and its potential use cases.

- RippleNet and its adoption by financial institutions: RippleNet's growing adoption by financial institutions for cross-border payments is a positive factor, but its success isn't guaranteed.

- XRP's role in cross-border payments: The efficiency and low cost of XRP for cross-border transactions are potential drivers of future growth, but competition exists in this space.

- Technological advancements and future developments: Stay updated on XRP's technological advancements and roadmap to assess its long-term prospects.

Thorough due diligence is crucial before investing in XRP or any other cryptocurrency.

Alternative Investment Options to XRP

Diversification is a cornerstone of sound investment strategy. Relying solely on XRP exposes you to significant risk.

Diversification Strategies:

Consider diversifying your portfolio across different asset classes.

- Exploring other cryptocurrencies with different functionalities and risk profiles: Explore other cryptocurrencies with varying functionalities and risk profiles to balance your exposure.

- Investing in traditional assets like stocks, bonds, and real estate: Traditional assets can provide stability and balance to a portfolio that includes high-risk cryptocurrencies.

- Seeking professional financial advice: Consult a qualified financial advisor to discuss your investment goals and determine the right asset allocation for your situation.

Don't put all your eggs in one basket. Diversification is key to managing investment risk effectively.

Conclusion

Should you buy XRP after its 400% increase? The decision is entirely dependent on your individual circumstances, risk tolerance, and investment goals. This guide has highlighted the factors influencing XRP's recent price surge, the associated risks, and the importance of thorough due diligence. By carefully weighing the potential benefits against the substantial risks, and by considering alternative investment options to diversify your portfolio, you can make an informed decision regarding your XRP investment strategy. Remember to conduct your own research and consider seeking professional financial advice before investing in XRP or any other cryptocurrency.

Featured Posts

-

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025

Will Xrp Reach 5 An Xrp Price Prediction Analysis Post Sec Lawsuit

May 08, 2025 -

50 Years Of Tension Analyzing Indias Recent Strikes On Pakistan

May 08, 2025

50 Years Of Tension Analyzing Indias Recent Strikes On Pakistan

May 08, 2025 -

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025 -

Inter Milans Victory Sends Feyenoord Packing In Europa League

May 08, 2025

Inter Milans Victory Sends Feyenoord Packing In Europa League

May 08, 2025 -

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Golem Mech Vo Ligata Na Shampionite

May 08, 2025

Latest Posts

-

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025 -

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025 -

Saglik Bakanligi Ndan 37 Bin Personel Alim Ilani Basvuru Tarihleri Ve Detaylar

May 08, 2025

Saglik Bakanligi Ndan 37 Bin Personel Alim Ilani Basvuru Tarihleri Ve Detaylar

May 08, 2025 -

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025

Saglik Bakanligi Personel Alimi 2024 37 Bin Hekim Disi Pozisyon Icin Basvuru Rehberi

May 08, 2025 -

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025

Saglik Bakanligi 37 Bin Personel Alimi Son Dakika Bilgileri Ve Basvuru Sartlari

May 08, 2025