Investment In Amundi DJIA UCITS ETF: Understanding NAV Fluctuations

Table of Contents

Factors Influencing Amundi DJIA UCITS ETF NAV

Several factors influence the daily and longer-term movement of the Amundi DJIA UCITS ETF NAV. Understanding these elements is key to managing your investment effectively.

Market Performance of the Dow Jones Industrial Average

The primary driver of the ETF's NAV is the performance of its underlying index, the DJIA. The ETF aims to track the DJIA's performance closely, meaning that movements in the index directly impact the ETF's NAV.

- Positive market trends: Increases in the DJIA generally lead to an increase in the Amundi DJIA UCITS ETF NAV. A rising market reflects positive investor sentiment and increased company valuations.

- Negative market trends: Conversely, declines in the DJIA typically result in a decrease in the ETF's NAV, signaling negative investor sentiment and decreased valuations.

- Impact of individual DJIA component performance: The performance of individual companies within the DJIA also influences the overall index movement and, consequently, the ETF's NAV. Strong performance by a major component can boost the NAV, while underperformance can negatively impact it. This highlights the importance of DJIA performance analysis and understanding index tracking. The correlation between the ETF NAV and Dow Jones Industrial Average is generally high, but not perfect due to factors discussed below.

Currency Fluctuations

If you hold the Amundi DJIA UCITS ETF in a currency different from the US dollar (USD), the base currency of the DJIA, currency fluctuations can affect your investment returns and the NAV you observe.

- Impact of USD/EUR exchange rates (example): If you hold the ETF in Euros (EUR), a strengthening USD against the EUR would reduce the EUR value of your investment, thus impacting the NAV you see expressed in EUR.

- Hedging strategies: Some ETFs offer hedging strategies to mitigate currency risk. However, these strategies come with their own costs and may not completely eliminate the impact of currency fluctuations on the NAV impact.

- Understanding FX risk and currency risk is vital, especially for international investors. Careful consideration of these factors is essential for managing your overall investment.

Expense Ratio and Management Fees

The ETF's expense ratio, also known as the Total Expense Ratio (TER), represents the annual cost of managing the fund. This fee, while seemingly small, can impact the NAV over time.

- Calculation of the impact of fees on NAV: The expense ratio is deducted from the fund's assets, reducing the NAV slightly over time. The longer you hold the ETF, the greater the cumulative effect of these fees.

- Comparison to other ETFs: It is important to compare the expense ratio of the Amundi DJIA UCITS ETF to similar ETFs tracking the DJIA to ensure it is competitive. Lower management fees and a low total expense ratio (TER) contribute to a higher net return for investors.

- Long-term effects of fees: The seemingly small cost impact of the expense ratio can have a significant impact on your long-term returns, contributing to NAV erosion over time. This needs to be factored into your investment analysis.

Interpreting Amundi DJIA UCITS ETF NAV Changes

Understanding how to interpret changes in the Amundi DJIA UCITS ETF NAV is crucial for effective investment management.

Daily NAV Updates and Reporting

The Amundi DJIA UCITS ETF's NAV is typically calculated and reported daily.

- Sources for NAV data: You can find daily NAV updates on the Amundi website, your brokerage platform, and financial news websites.

- Timing of updates: The timing of these updates may vary slightly depending on the source, but it usually reflects the closing price of the DJIA.

- Potential delays in reporting may occur due to market closures or unexpected events. However, generally, NAV updates and daily NAV information is readily available. The commitment to price transparency is a key feature of ETFs.

Analyzing NAV Trends vs. Market Trends

Comparing the ETF's NAV performance to the overall market performance of the DJIA helps in understanding its tracking ability.

- Tracking performance against the benchmark index: Analyze how closely the ETF's NAV tracks the DJIA. Small deviations are expected, but significant differences warrant investigation.

- Identifying periods of outperformance or underperformance: This analysis allows investors to identify periods where the ETF outperforms or underperforms its benchmark and understand the reasons behind these deviations.

- Analysis of tracking error: This analysis helps assess the effectiveness of the ETF's tracking methodology and identify any sources of tracking error. Comparing the NAV analysis to benchmark performance and the market comparison is essential for evaluating the investment's effectiveness.

Using NAV to Inform Investment Decisions

Investors can use NAV fluctuations to make informed investment decisions.

- Strategies for leveraging NAV fluctuations: Dollar-cost averaging (investing a fixed amount at regular intervals regardless of NAV) can mitigate the risk of investing a lump sum at a market peak.

- Buy low/sell high strategies: While risky, experienced investors may attempt to time the market based on NAV fluctuations, aiming to buy at lower NAVs and sell at higher NAVs. However, perfect market timing is difficult.

- Risk management considerations: Always consider your risk tolerance before making investment decisions based solely on NAV movements. Effective risk mitigation strategies are vital. Using buy signals and sell signals should be part of a broader investment plan, not the sole determinant.

Conclusion

Understanding the factors that influence the Amundi DJIA UCITS ETF NAV is vital for successful investing. By analyzing market trends, currency fluctuations, and expense ratios, investors can better interpret NAV changes and make informed decisions. Remember to regularly monitor the Amundi DJIA UCITS ETF NAV and consider the information provided here as part of your overall investment strategy. Learn more about managing your investment in the Amundi DJIA UCITS ETF and understanding its NAV fluctuations today.

Featured Posts

-

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025

Trade War Intensifies Amsterdam Stock Market Opens Down 7

May 24, 2025 -

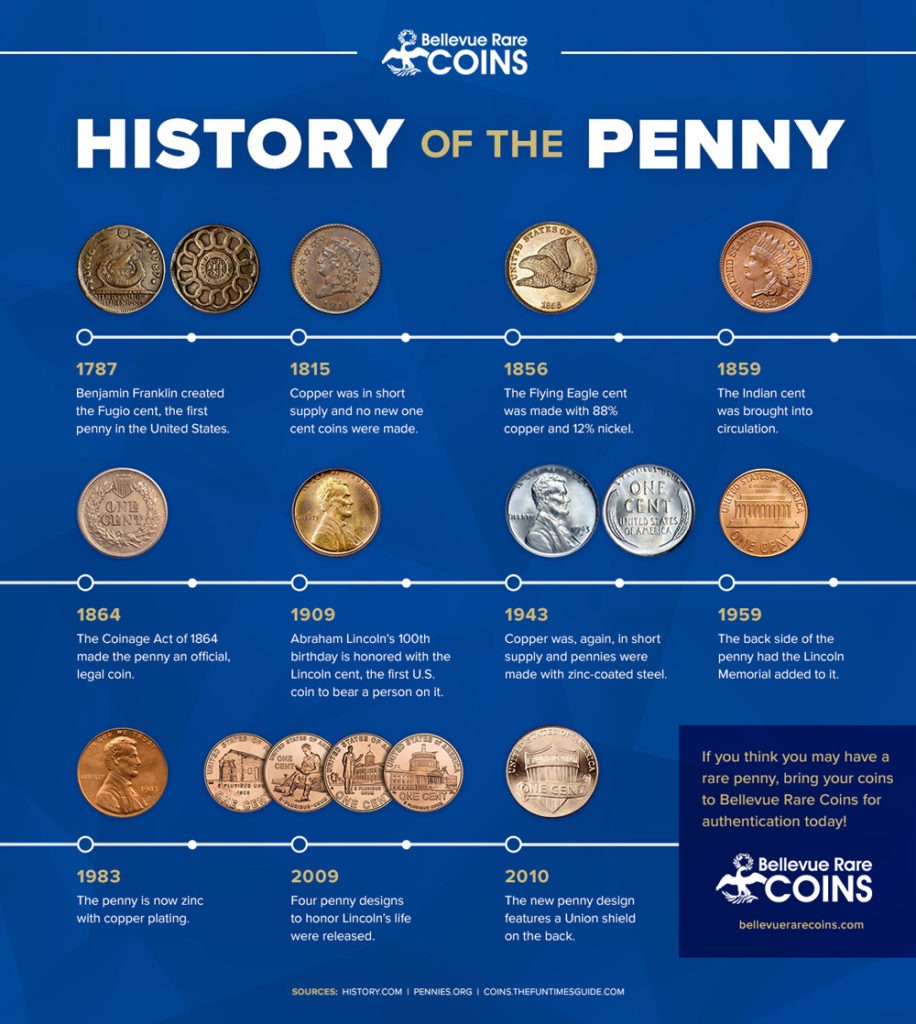

U S Penny Phase Out Circulation To End By Early 2026

May 24, 2025

U S Penny Phase Out Circulation To End By Early 2026

May 24, 2025 -

Ecb Faiz Politikasi Ve Avrupa Borsalarindaki Etkisi

May 24, 2025

Ecb Faiz Politikasi Ve Avrupa Borsalarindaki Etkisi

May 24, 2025 -

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025

Escape To The Country Your Guide To A Peaceful Retreat

May 24, 2025 -

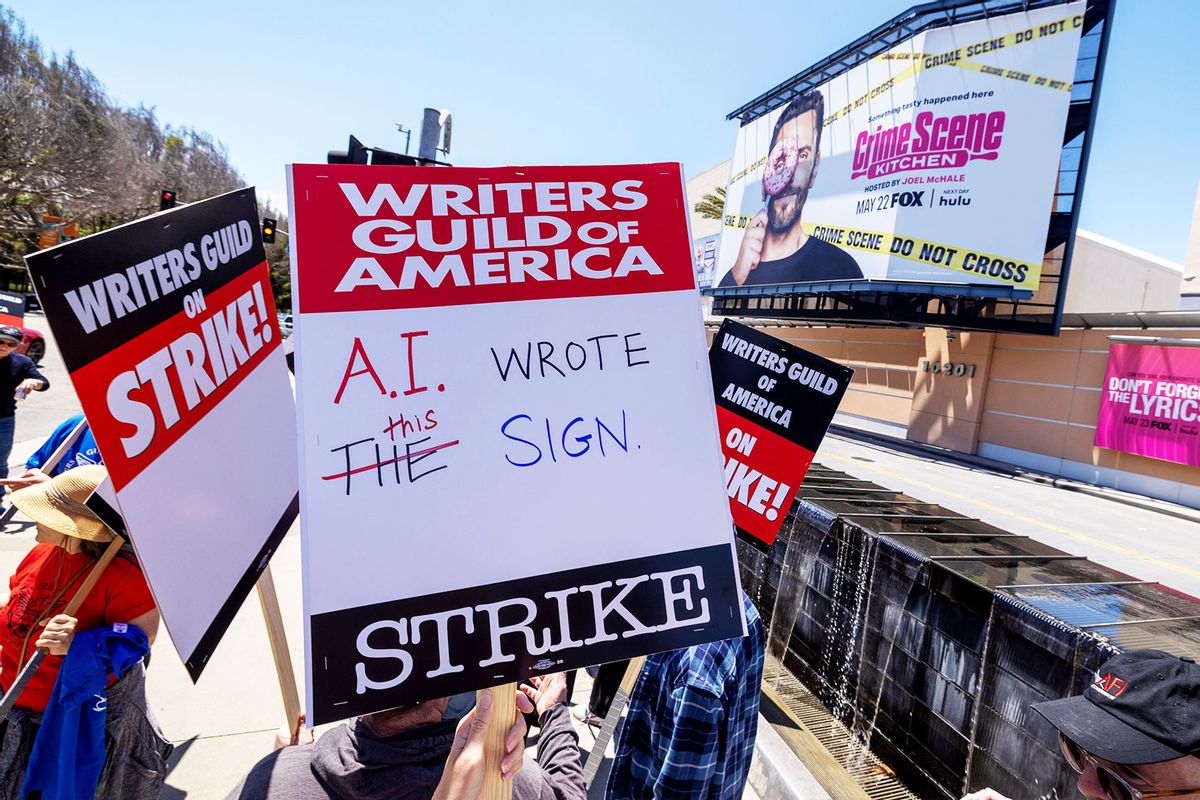

Actors And Writers Strike The Impact On Hollywood

May 24, 2025

Actors And Writers Strike The Impact On Hollywood

May 24, 2025