Investment Opportunities: 270MWh BESS Financing In The Belgian Market

Table of Contents

The Growing Need for BESS in Belgium

The Belgian energy transition is accelerating, with ambitious targets for renewable energy integration. However, the intermittent nature of solar and wind power poses significant challenges to grid stability and reliability. This is where Battery Energy Storage Systems (BESS) play a crucial role.

Renewable Energy Integration Challenges

The intermittent nature of renewable energy sources like solar and wind necessitates effective solutions for managing fluctuating power output. BESS provide this crucial support, ensuring a consistent and reliable energy supply.

- Peak Demand Management: BESS can store excess energy generated during periods of low demand and release it during peak hours, reducing reliance on conventional power plants and lowering overall energy costs.

- Frequency Regulation: BESS provide fast-acting frequency regulation services, crucial for maintaining grid stability and preventing blackouts. They respond instantly to fluctuations in supply and demand, ensuring a stable frequency.

- Voltage Support Services: BESS can help regulate voltage levels across the grid, improving efficiency and reliability. They can quickly compensate for voltage drops, preventing disruptions to power supply.

These essential grid services highlight the critical role of BESS in supporting Belgium's ambitious renewable energy targets. This makes BESS financing Belgium an increasingly attractive proposition for investors. The Belgian energy transition is heavily reliant on the successful implementation of large-scale energy storage projects. Investing in renewable energy storage Belgium is not just a profitable venture, but a crucial contribution to the country's sustainable energy future.

Government Incentives and Regulatory Support

The Belgian government recognizes the vital role of BESS in its energy transition strategy and offers various incentives to encourage investment in the sector. These incentives aim to accelerate BESS deployment and make BESS financing Belgium more attractive.

- Subsidies: Several government programs offer direct subsidies for BESS projects, reducing the initial capital expenditure for developers. (Links to relevant official websites would be inserted here)

- Tax Breaks: Tax incentives, including accelerated depreciation and reduced corporate taxes, further enhance the financial attractiveness of BESS investments. (Links to relevant official websites would be inserted here)

- Streamlined Permitting Processes: The government has implemented streamlined permitting processes to accelerate the approval and construction of BESS projects, reducing project timelines and associated costs. (Links to relevant official websites would be inserted here)

These supportive Belgian energy policy initiatives create a favorable investment climate, making BESS subsidies Belgium a key factor in the overall profitability of BESS projects. This commitment to renewable energy investment Belgium signals a positive outlook for the sector’s long-term growth.

Financial Viability of 270MWh BESS Projects in Belgium

Investing in a 270MWh BESS project in Belgium presents a strong potential for substantial returns. A thorough analysis of the financial viability is crucial to assess the project's potential.

Return on Investment (ROI) Analysis

A realistic ROI analysis for a 270MWh BESS project must consider various factors, including capital expenditure (CAPEX), operational expenditure (OPEX), and revenue streams.

- Capital Expenditure (CAPEX): This includes the cost of battery systems, inverters, power electronics, and other infrastructure.

- Operational Expenditure (OPEX): This covers maintenance, insurance, and grid connection charges.

- Revenue Streams: Significant revenue can be generated through:

- Capacity Market Participation: Selling capacity to the grid operator to provide reserve power.

- Ancillary Services: Providing frequency regulation, voltage support, and other grid services.

Based on projected electricity prices (data would be inserted here) and grid service tariffs (data would be inserted here), a strong positive BESS ROI Belgium can be expected, making this a compelling investment opportunity. The analysis would demonstrate the significant BESS investment returns potential.

Risk Mitigation Strategies

While the potential returns are high, it's essential to consider potential risks associated with BESS investments. Effective mitigation strategies are crucial for ensuring project success.

- Technology Risks: These can be mitigated through careful selection of reputable technology providers and rigorous testing procedures.

- Regulatory Changes: Staying informed about evolving regulations and incorporating flexibility into project design can help address this risk.

- Market Volatility: Hedging strategies can be implemented to protect against fluctuations in electricity prices and grid service tariffs.

- Insurance Options: Comprehensive insurance coverage can protect against unforeseen events and equipment failures.

- Due Diligence Processes: Thorough due diligence is critical before investing in any BESS project.

By proactively addressing these potential risks, investors can significantly enhance the probability of achieving a successful outcome and maximizing BESS investment returns. Implementing robust BESS risk management strategies is key to successful BESS financing Belgium.

Accessing 270MWh BESS Financing in Belgium

Securing appropriate financing is crucial for the successful implementation of a 270MWh BESS project. Several financing options are available in the Belgian market.

Available Financing Options

Various financial avenues can support BESS financing Belgium projects:

- Bank Loans: Traditional bank loans can provide debt financing, but may require significant equity contributions.

- Project Finance: This structured financing approach involves multiple lenders and often includes equity partners.

- Green Bonds: These bonds specifically target environmentally friendly projects, often attracting investors seeking ESG-compliant investments.

- Private Equity: Private equity firms are increasingly investing in the renewable energy sector, including BESS projects.

Each option has advantages and disadvantages concerning interest rates, loan terms, and equity requirements. A detailed comparison of these options is crucial for making an informed decision.

Finding Suitable Project Developers and Partners

Partnering with experienced developers and EPC contractors is essential for successful project execution.

- Experience in the Belgian Market: Choose partners with a proven track record of successful BESS projects in Belgium.

- Technical Expertise: Ensure your partners possess the necessary technical expertise to manage the complex aspects of BESS project development and operation.

- Financial Stability: Select financially sound partners to mitigate financial risks associated with the project.

Collaboration with reputable BESS developers Belgium and BESS EPC contractors Belgium is vital for optimizing project delivery and maximizing returns.

Conclusion

The Belgian market presents a compelling opportunity for investors seeking high returns in the rapidly expanding BESS sector. The increasing demand for grid stabilization, coupled with supportive government policies and attractive financing options, makes investing in a 270MWh BESS project a potentially lucrative venture. By carefully assessing the financial viability, mitigating potential risks, and securing appropriate financing, investors can capitalize on the significant growth potential of the Belgian energy storage market. To learn more about BESS financing in Belgium and explore specific investment opportunities, contact us today.

Featured Posts

-

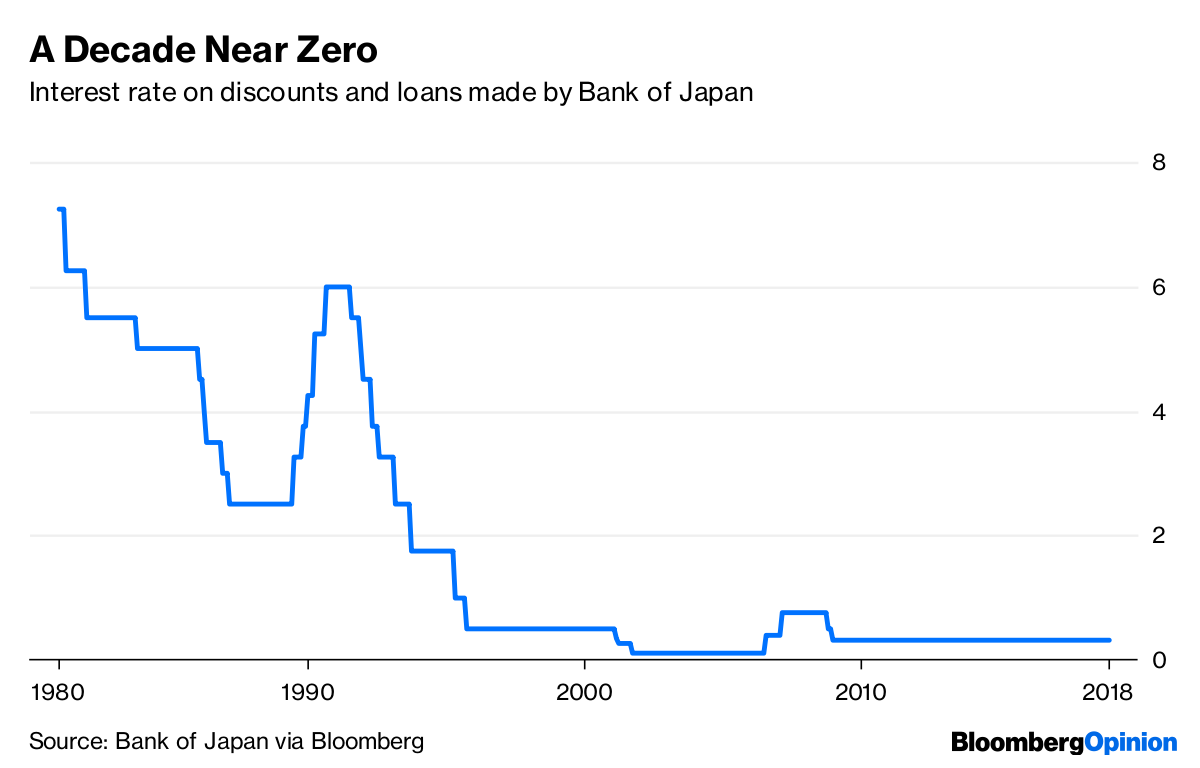

Bank Of Japans Revised Growth Forecast Reflects Trade War Concerns

May 03, 2025

Bank Of Japans Revised Growth Forecast Reflects Trade War Concerns

May 03, 2025 -

Discours De Macron Au Gabon La Rupture Avec La Francafrique Realite Ou Promesse

May 03, 2025

Discours De Macron Au Gabon La Rupture Avec La Francafrique Realite Ou Promesse

May 03, 2025 -

Remembering Poppy Atkinson A Joint Tribute From Manchester United And Bayern Munich

May 03, 2025

Remembering Poppy Atkinson A Joint Tribute From Manchester United And Bayern Munich

May 03, 2025 -

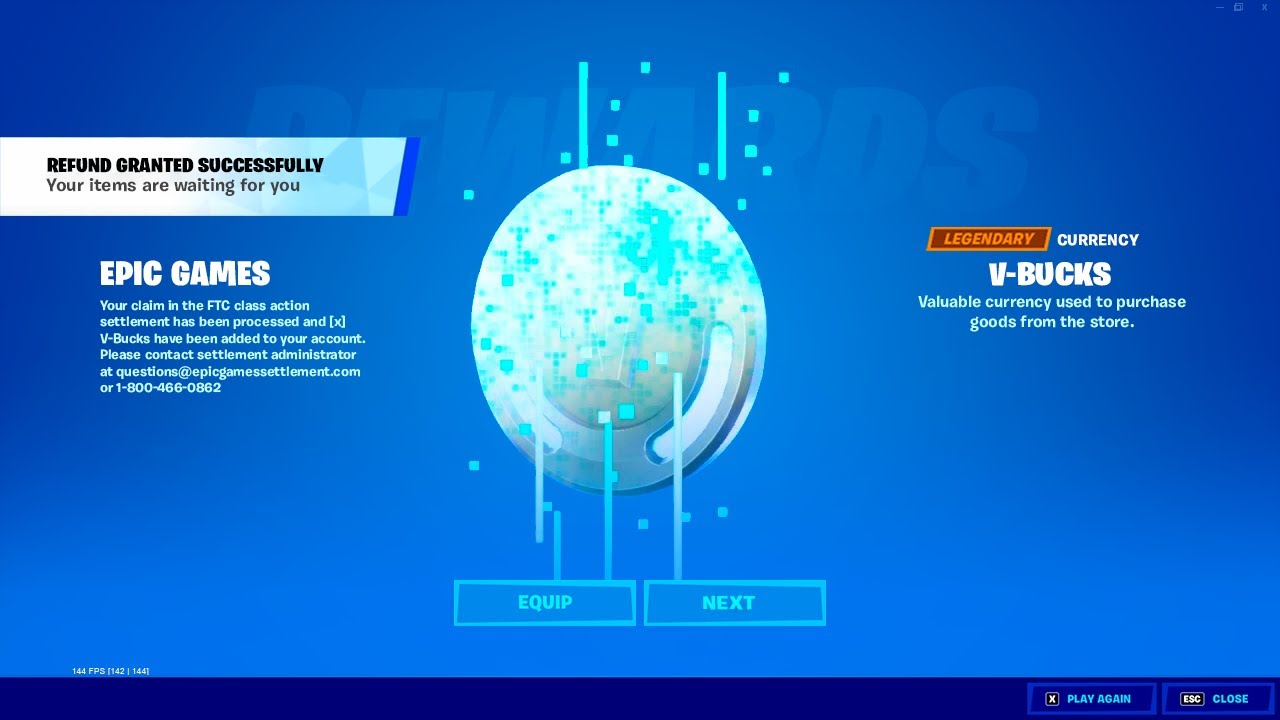

Understanding Fortnites Refunds And Upcoming Cosmetic Changes

May 03, 2025

Understanding Fortnites Refunds And Upcoming Cosmetic Changes

May 03, 2025 -

Exploring The Reasons For Chris Columbus Non Participation In Harry Potter And The Prisoner Of Azkaban

May 03, 2025

Exploring The Reasons For Chris Columbus Non Participation In Harry Potter And The Prisoner Of Azkaban

May 03, 2025