Is A US XRP ETF Imminent? Analyzing Recent Ripple Developments And XRP Price Action

Table of Contents

The Ripple-SEC Lawsuit: A Pivotal Factor

The ongoing Ripple-SEC lawsuit is a pivotal factor influencing the possibility of an XRP ETF. This legal battle, centered around whether XRP is an unregistered security, has created significant regulatory uncertainty. The outcome will profoundly impact XRP's price and the likelihood of SEC approval for an XRP ETF. Keywords: Ripple SEC lawsuit, SEC, XRP lawsuit, legal battle, summary judgment, court ruling, regulatory uncertainty.

- Summary of the lawsuit's key arguments: The SEC argues that Ripple sold XRP as an unregistered security, violating federal securities laws. Ripple contends that XRP is a cryptocurrency and not a security.

- Analysis of recent court decisions and their significance: Recent court rulings have offered some clarity, but the ultimate outcome remains uncertain. A favorable ruling for Ripple could significantly boost investor confidence and increase the chances of an XRP ETF approval.

- Expert opinions on the likely outcome of the lawsuit: Legal experts offer varying opinions, highlighting the complexity of the case and the potential for different interpretations of securities law.

- How the lawsuit's resolution could influence SEC approval of an XRP ETF: A clear victory for Ripple could pave the way for SEC approval, while an unfavorable ruling could delay or even prevent the launch of an XRP ETF.

XRP Price Action and Market Sentiment

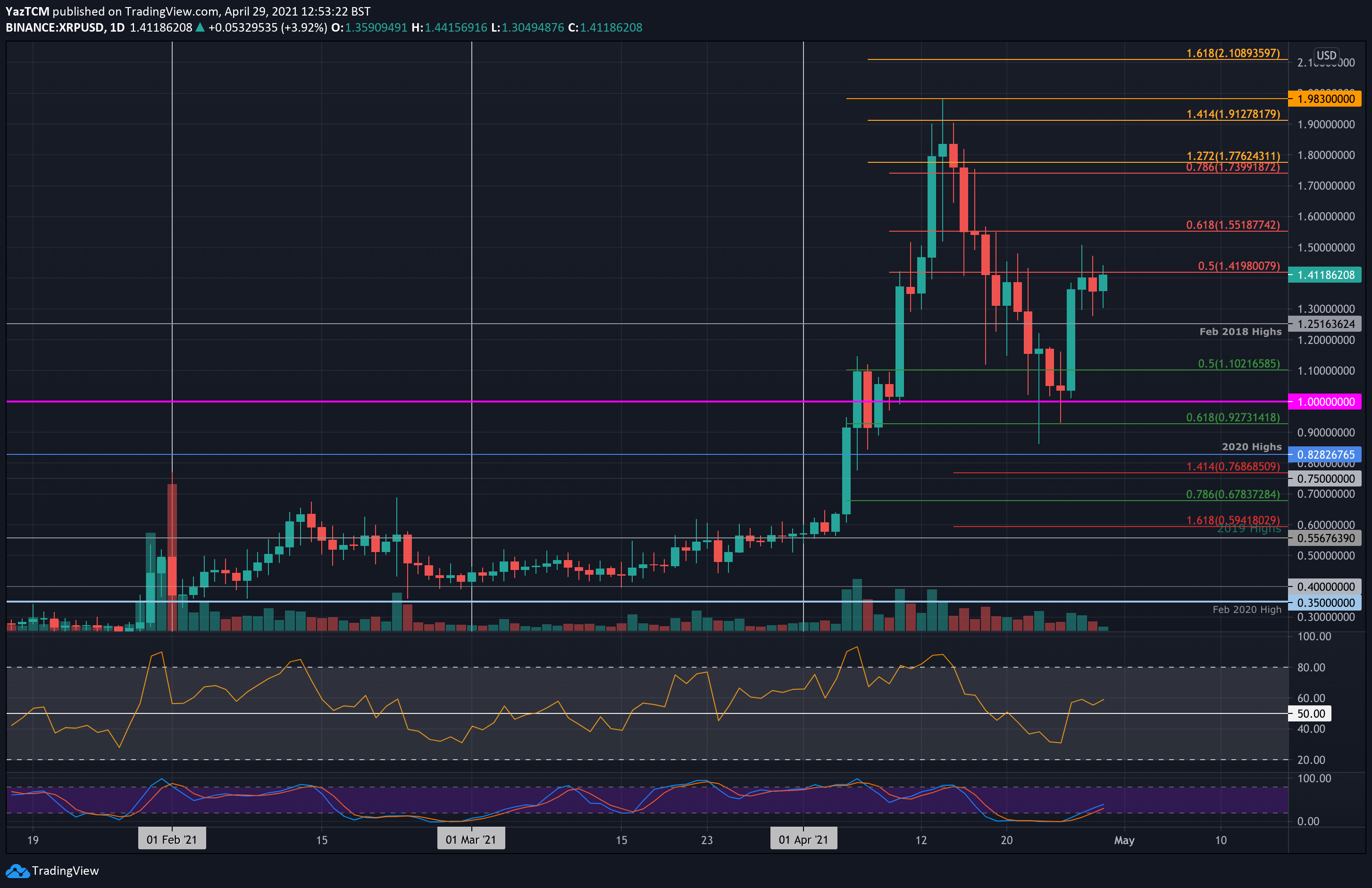

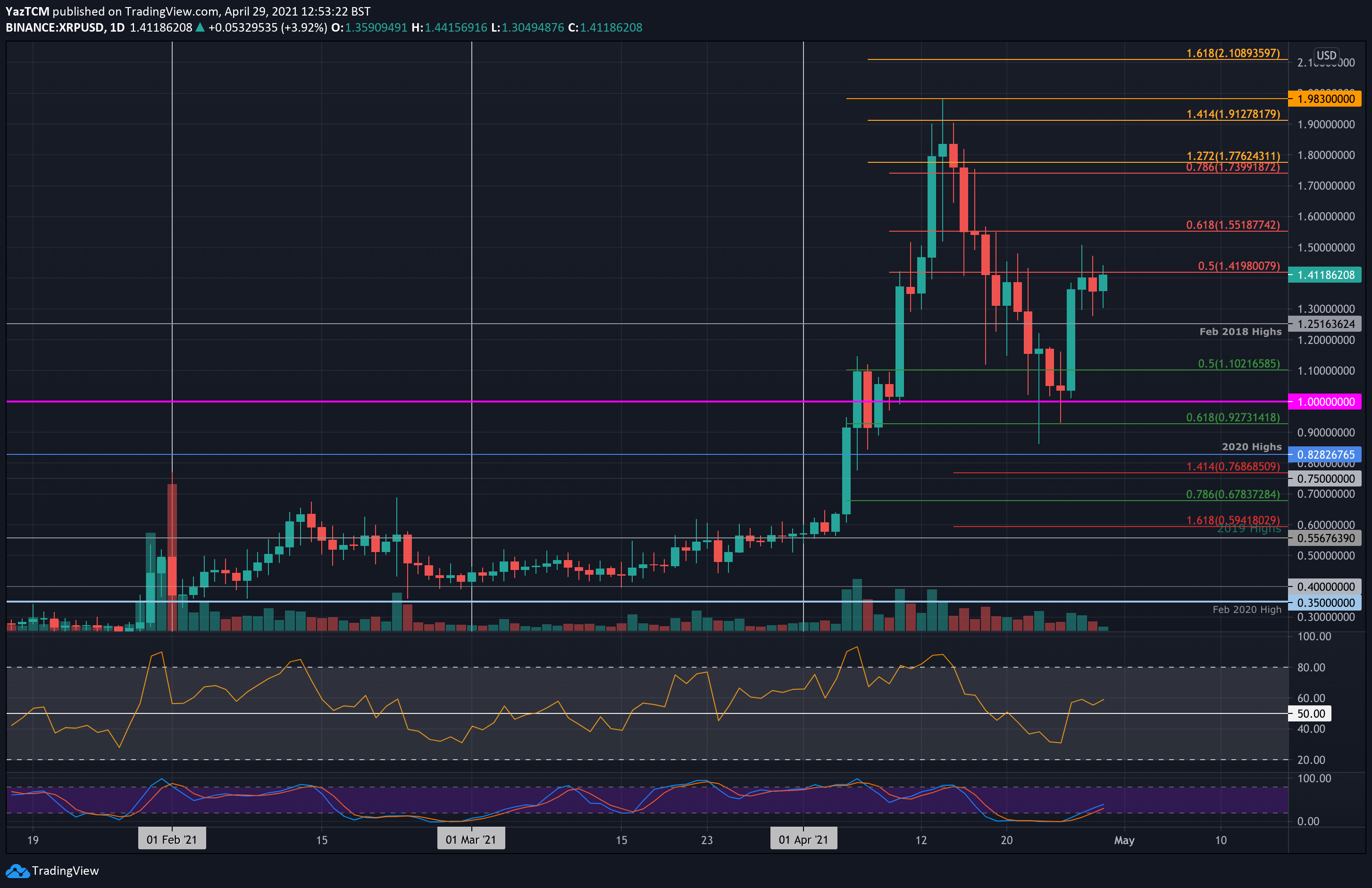

XRP's price has been highly volatile, reflecting the uncertainty surrounding the Ripple-SEC lawsuit and broader cryptocurrency market trends. Analyzing XRP's price action alongside news events provides valuable insights into investor sentiment and market expectations. Keywords: XRP price prediction, XRP price chart, market capitalization, trading volume, investor sentiment, bullish, bearish.

- Recent price highs and lows of XRP: Tracking XRP's price fluctuations reveals periods of significant gains and losses directly correlated with developments in the lawsuit.

- Correlation between price action and news events (e.g., court rulings, regulatory announcements): Positive news tends to drive XRP's price upwards, while negative news often results in price drops.

- Analysis of trading volume and market capitalization: High trading volume often indicates increased investor interest, while market capitalization reflects the overall value of XRP in the market.

- Overview of current investor sentiment (bullish or bearish): Investor sentiment is a crucial factor affecting XRP's price and the overall market.

- Comparison of XRP price performance to other cryptocurrencies: Comparing XRP's performance to Bitcoin and Ethereum offers insights into its relative strength and potential future growth.

The SEC's Stance on Cryptocurrency ETFs and the Path Forward for XRP

The SEC's approach to cryptocurrency ETFs is critical to the future of XRP. Its past decisions regarding Bitcoin and Ethereum ETF applications provide a framework for understanding potential hurdles for an XRP ETF. Keywords: SEC regulations, cryptocurrency regulation, ETF approval process, Bitcoin ETF, Ethereum ETF, regulatory framework, Grayscale, spot Bitcoin ETF.

- The SEC's past decisions on cryptocurrency ETF applications: The SEC has previously rejected several Bitcoin ETF applications, citing concerns about market manipulation and investor protection.

- Key regulatory hurdles for XRP ETF approval: The SEC may have similar concerns about XRP, especially given the ongoing lawsuit. Establishing a robust framework for preventing market manipulation will be crucial for approval.

- Comparison of the regulatory landscape for XRP versus Bitcoin and Ethereum: The regulatory landscape for cryptocurrencies is complex and constantly evolving. The SEC's treatment of Bitcoin and Ethereum provides a point of reference, but XRP’s unique circumstances require separate consideration.

- Potential scenarios for SEC approval or rejection of an XRP ETF: Several scenarios are possible, ranging from swift approval to prolonged delays or outright rejection.

The Impact of a US XRP ETF Approval on the Market

The approval of a US XRP ETF would likely have a significant impact on the cryptocurrency market. Increased liquidity, trading volume, and investor interest are all probable outcomes. Keywords: Market impact, ETF launch, price volatility, investment opportunities, liquidity, trading volume.

- Projected price movements following ETF approval: ETF approval could lead to a substantial increase in XRP's price, attracting both institutional and retail investors.

- Increased trading volume and liquidity in the XRP market: An ETF would provide easier access to XRP, significantly increasing trading volume and liquidity.

- Potential for attracting new investors to the cryptocurrency space: The accessibility of an ETF could draw a wider range of investors into the cryptocurrency market.

- Comparison of the market impact of a potential XRP ETF to other successful ETF launches: Analyzing the market impact of other successful ETF launches can offer insights into the potential scale of XRP's impact.

Conclusion

The question of whether a US XRP ETF is imminent remains complex, dependent on the resolution of the Ripple-SEC lawsuit and the SEC's evolving stance on cryptocurrency regulation. However, understanding these factors is crucial for investors. A favorable outcome in the lawsuit could significantly increase the chances of approval, potentially leading to increased price volatility and liquidity. Conversely, continued regulatory uncertainty could delay or prevent the launch of an XRP ETF. Stay informed on the latest developments surrounding the XRP ETF and continue your research to make informed investment decisions. Keep monitoring the situation to capitalize on future opportunities in the evolving XRP market. The potential benefits of an XRP ETF are significant, but careful analysis of the risks is essential.

Featured Posts

-

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyses

May 01, 2025

Ryan Coogler Et Le Reboot De X Files Rumeurs Et Analyses

May 01, 2025 -

Analysis Kamala Harris Unclear Remarks At Louis Armstrong Musical

May 01, 2025

Analysis Kamala Harris Unclear Remarks At Louis Armstrong Musical

May 01, 2025 -

Panoramas Chris Kaba Episode Independent Police Complaints Commissions Ofcom Referral

May 01, 2025

Panoramas Chris Kaba Episode Independent Police Complaints Commissions Ofcom Referral

May 01, 2025 -

Kensington Palace Shares Thoughtful Photo Of Prince William

May 01, 2025

Kensington Palace Shares Thoughtful Photo Of Prince William

May 01, 2025 -

Wall Street Banks Sell Final Portion Of Elon Musks X Debt Exclusive

May 01, 2025

Wall Street Banks Sell Final Portion Of Elon Musks X Debt Exclusive

May 01, 2025