Riot Platforms Stock Price Analysis: Factors Influencing RIOT's Performance

Table of Contents

Bitcoin Price Volatility and its Impact on RIOT

The price of Bitcoin (BTC) has a profound and direct impact on Riot Platforms' profitability and, consequently, its stock price. This is a crucial factor in any RIOT stock analysis.

Direct Correlation: Bitcoin Price and RIOT Profitability

- Increased Bitcoin price leads to higher revenue: A rising Bitcoin price directly translates to increased revenue for Riot Platforms as the value of mined Bitcoin increases.

- Decreased Bitcoin price reduces profitability: Conversely, a falling Bitcoin price diminishes profitability, potentially leading to losses.

- Impact on investor sentiment and stock valuation: Bitcoin's price movement significantly influences investor sentiment, directly affecting the valuation of RIOT stock. A bullish Bitcoin market often correlates with a bullish RIOT stock price, and vice-versa.

Riot Platforms' financial performance is inextricably linked to the Bitcoin price. Each Bitcoin mined represents a direct revenue stream, the value of which is determined entirely by the prevailing Bitcoin market price. Therefore, charting Bitcoin's price alongside RIOT's stock price often reveals a strong positive correlation. A simple analysis of historical data would clearly demonstrate this relationship.

Market Sentiment and Speculation: The Ripple Effect of Bitcoin News

The overall sentiment surrounding Bitcoin significantly influences RIOT's stock price.

- Positive Bitcoin news boosts RIOT: Positive news, such as institutional adoption or regulatory clarity, often leads to increased investor confidence in both Bitcoin and Bitcoin mining stocks like RIOT.

- Negative Bitcoin news negatively impacts RIOT: Conversely, negative news, such as regulatory crackdowns or security breaches, can trigger sell-offs, affecting RIOT's stock price negatively.

- Role of social media and news coverage in influencing investor sentiment: Social media platforms and mainstream news outlets play a crucial role in shaping investor sentiment, amplifying both positive and negative news, and impacting the price of RIOT stock.

Market sentiment acts as a powerful multiplier. Even small price fluctuations in Bitcoin can be magnified in the RIOT stock price due to the leveraged nature of mining operations and the speculative nature of the cryptocurrency market. This means investors need to carefully monitor not only the Bitcoin price but also the overall market sentiment surrounding the cryptocurrency.

Operational Efficiency and Mining Capacity of Riot Platforms

Riot Platforms' operational efficiency and mining capacity are key determinants of its financial health and stock price. Analyzing these factors is crucial for understanding the long-term prospects of RIOT.

Hash Rate and Mining Output: The Engine of RIOT's Performance

- Higher hash rate = more Bitcoin mined: A higher hash rate, which represents the computational power dedicated to Bitcoin mining, translates to a greater number of Bitcoins mined, boosting revenue.

- Technological advancements and upgrades: Investments in newer, more energy-efficient mining hardware directly impact the hash rate and operational costs, influencing profitability and the RIOT stock price.

- Energy costs and their impact on profitability: Energy costs are a significant expense for Bitcoin miners. Fluctuations in energy prices directly impact the profitability of mining operations and the attractiveness of investing in RIOT.

The efficiency of Riot Platforms' mining operations is pivotal. Upgrades to mining hardware, strategic energy sourcing, and effective management of operational costs directly influence the company's ability to generate profit, ultimately impacting the RIOT price.

Expansion Plans and Infrastructure Investments: Future Growth and Stock Valuation

Riot Platforms' strategic investments in new mining facilities and infrastructure greatly influence investor perception and future stock valuation.

- Impact of new mining farm announcements on investor sentiment: Announcements of new mining farm construction or acquisitions often signal growth and increased future Bitcoin production, leading to positive market sentiment and potentially boosting the RIOT stock price.

- Risks associated with large-scale expansion: Large-scale expansion projects inherently carry risks, including potential delays, cost overruns, and unforeseen regulatory hurdles. Investors must carefully consider these factors.

- Long-term strategic vision and its reflection in stock price: A clearly articulated long-term vision, coupled with successful execution of expansion plans, strengthens investor confidence and can positively influence the RIOT stock price.

Expansion plans are crucial for evaluating Riot Platforms’ long-term potential. These expansion strategies represent a bet on future Bitcoin price growth and increased market share.

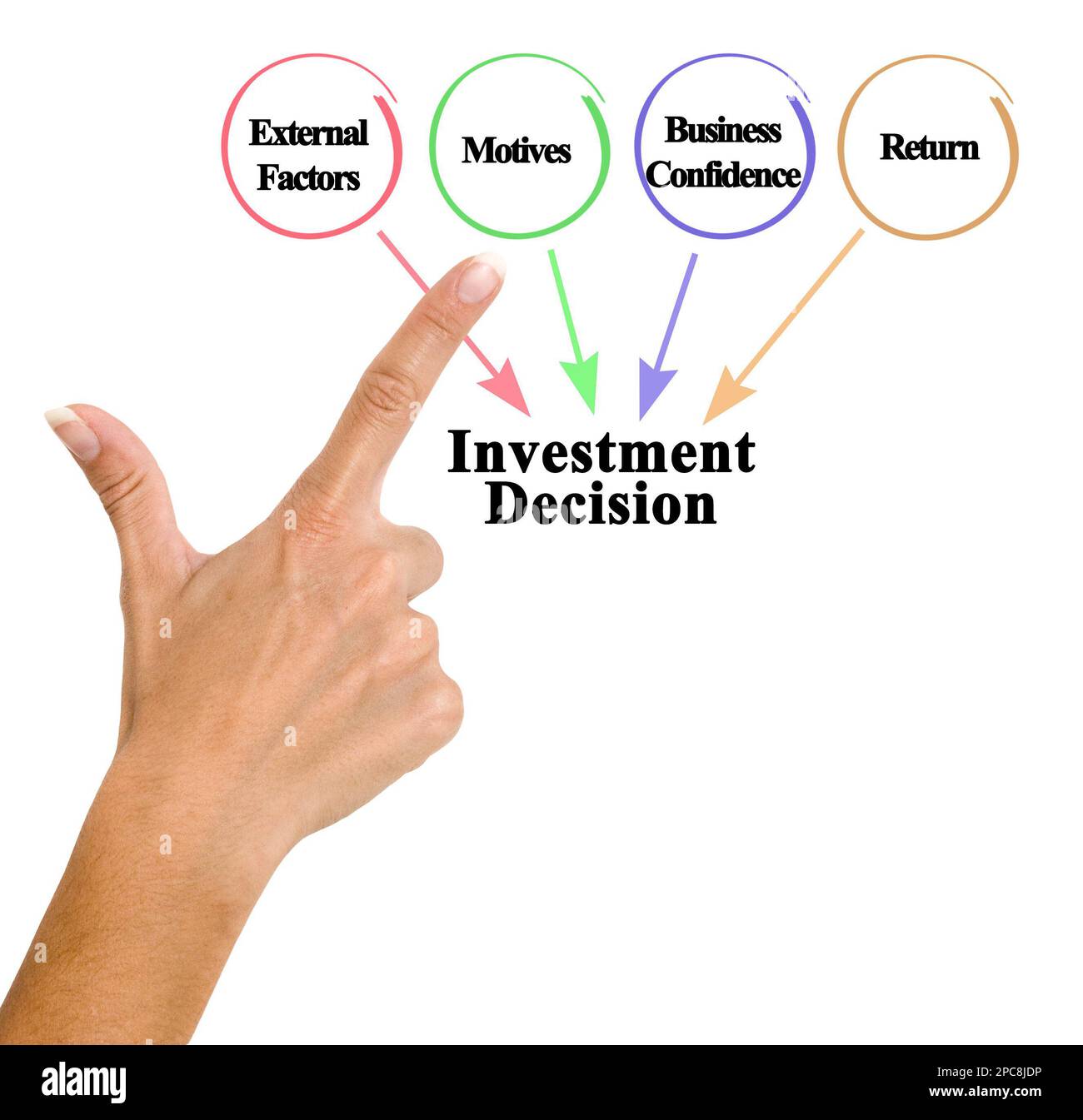

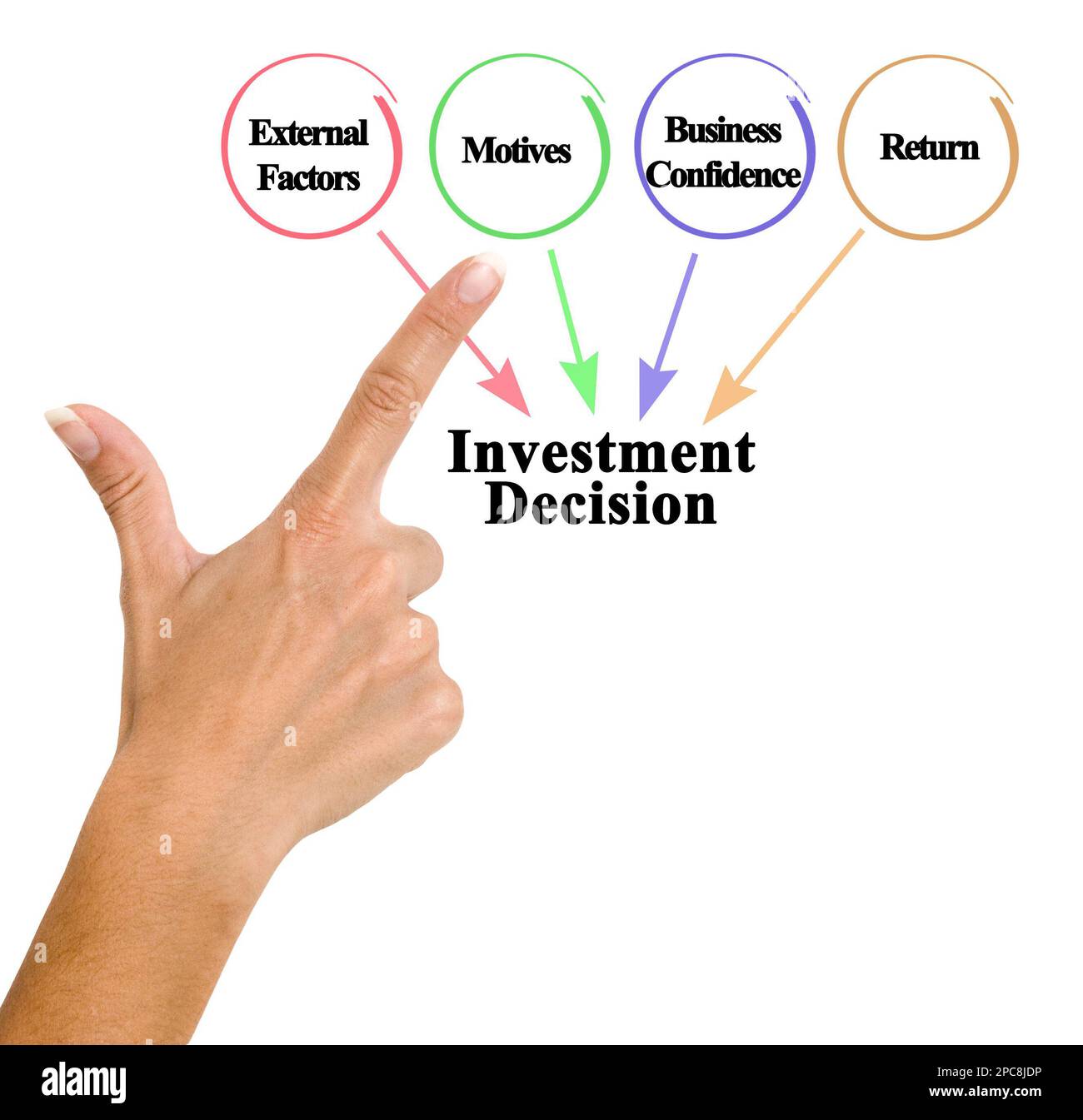

Macroeconomic Factors and Regulatory Landscape

Broad macroeconomic conditions and the regulatory landscape significantly influence the overall investment climate and impact RIOT's performance.

Regulatory Changes and Government Policies: Navigating the Legal Seas

- Impact of stricter regulations on mining operations: Stringent regulations on cryptocurrency mining can increase operational costs and limit growth, negatively impacting RIOT's stock price.

- Changes in energy policies and their impact on operational costs: Government policies affecting energy prices, subsidies, and availability can substantially affect the profitability of Bitcoin mining.

- Potential for new regulations to positively or negatively affect the industry: Regulatory clarity can increase investor confidence, while uncertainty can lead to volatility.

The regulatory environment is dynamic and crucial to consider. Positive regulatory developments can boost investor confidence and the RIOT price, while negative changes can create uncertainty and volatility.

Overall Economic Conditions: The Wider Economic Context

- Impact of inflation on investor sentiment: High inflation often reduces investor appetite for riskier assets like cryptocurrency mining stocks, potentially putting downward pressure on RIOT's stock price.

- Interest rate hikes and their effect on stock valuations: Interest rate increases generally lead to lower stock valuations across the board, including RIOT stock, as investors seek safer, higher-yielding investments.

- General market trends and their relationship to RIOT’s stock price: The overall performance of the stock market often influences investor sentiment towards individual stocks, including RIOT.

Macroeconomic factors play a critical role in shaping investment decisions. A strong economy generally supports riskier assets, while an economic downturn may lead to investors seeking safety, impacting the RIOT price negatively.

Conclusion

The price of Riot Platforms (RIOT) stock is a complex interplay of Bitcoin's price, the efficiency of its mining operations, macroeconomic conditions, and regulatory developments. Understanding these interconnected factors is crucial for investors. Conduct thorough due diligence, stay updated on the latest news regarding Riot Platforms, Bitcoin price movements, and relevant regulatory changes before making any investment decisions. Stay informed to make well-informed decisions regarding your investment in Riot Platforms and other Bitcoin mining stocks.

Featured Posts

-

Fortnite Tmnt Skins How To Get Every Turtle In The Game

May 03, 2025

Fortnite Tmnt Skins How To Get Every Turtle In The Game

May 03, 2025 -

Chinas Trade War Resilience Fact Or Fiction A Look Behind The Curtain

May 03, 2025

Chinas Trade War Resilience Fact Or Fiction A Look Behind The Curtain

May 03, 2025 -

La Seine Musicale 2025 2026 Concerts Danse Cinema Et Jeunes Publics

May 03, 2025

La Seine Musicale 2025 2026 Concerts Danse Cinema Et Jeunes Publics

May 03, 2025 -

Francafrique Le Discours De Macron Depuis Le Gabon Et Ses Implications

May 03, 2025

Francafrique Le Discours De Macron Depuis Le Gabon Et Ses Implications

May 03, 2025 -

1 Mayis Kocaeli Siddet Olaylari Ve Arbede Detaylari

May 03, 2025

1 Mayis Kocaeli Siddet Olaylari Ve Arbede Detaylari

May 03, 2025