Is Bitcoin's Rebound Just The Beginning? A Comprehensive Analysis

Table of Contents

Analyzing the Drivers of Bitcoin's Recent Rebound

Several key factors have contributed to Bitcoin's recent price increase, suggesting a potential shift in the market dynamics. Understanding these drivers is crucial for assessing the sustainability of Bitcoin's rebound.

Institutional Investment and Adoption

The increasing adoption of Bitcoin by institutional investors is a significant catalyst for Bitcoin's rebound. Large-scale investments by sophisticated players lend credibility and stability to the market, reducing volatility and attracting further investment.

- Grayscale Bitcoin Trust (GBTC): GBTC, a publicly traded Bitcoin trust, holds a substantial amount of Bitcoin, indicating significant institutional interest.

- MicroStrategy's Holdings: MicroStrategy, a publicly traded business intelligence company, has made considerable investments in Bitcoin, demonstrating a corporate-level commitment to the cryptocurrency.

- Other Institutional Investors: Numerous other hedge funds, investment firms, and corporations are now allocating a portion of their portfolios to Bitcoin, driven by diversification strategies and the potential for long-term growth.

The impact of institutional investment extends beyond mere capital inflow. It brings increased liquidity, price stability, and a more mature investment environment, making Bitcoin a more attractive asset for a wider range of investors. This increased institutional participation is a key factor supporting Bitcoin's rebound and its potential for continued growth.

Macroeconomic Factors and Inflation

Global macroeconomic conditions, particularly inflationary pressures and economic uncertainty, are playing a significant role in Bitcoin's rebound. Many investors view Bitcoin as a hedge against inflation and a safe haven asset during times of economic instability.

- Soaring Inflation Rates: Many countries are experiencing elevated inflation rates, eroding the purchasing power of traditional fiat currencies.

- Geopolitical Uncertainty: Global geopolitical instability and conflicts create uncertainty in traditional markets, pushing investors towards alternative assets like Bitcoin.

- Quantitative Easing: Monetary policies like quantitative easing, while designed to stimulate economies, can also lead to inflation, further increasing Bitcoin's appeal as a store of value.

As macroeconomic headwinds persist, the demand for Bitcoin as a safe haven and inflation hedge is likely to remain strong, contributing to its price appreciation and supporting Bitcoin's rebound.

Technological Advancements and Network Upgrades

Significant technological advancements within the Bitcoin network have enhanced its scalability, efficiency, and overall functionality, fostering greater adoption and confidence in the long-term viability of Bitcoin.

- The Lightning Network: The Lightning Network is a layer-two scaling solution that significantly improves transaction speeds and reduces fees, addressing one of the historical criticisms of Bitcoin.

- Improved Security Protocols: Continuous improvements in security protocols enhance the robustness and resilience of the Bitcoin network against attacks.

- Increased Node Count: A growing number of nodes strengthens the decentralization and security of the Bitcoin network.

These technological upgrades address scalability concerns and enhance the overall user experience, making Bitcoin a more attractive and practical asset for wider adoption, thus contributing positively to Bitcoin's rebound and future potential.

Assessing the Potential for Continued Growth

While the drivers discussed above suggest a strong foundation for continued growth, several other factors need consideration when evaluating the potential for a sustained Bitcoin's rebound.

Market Sentiment and Public Perception

A noticeable shift in public perception towards Bitcoin has fueled the recent price increase. Positive news coverage, celebrity endorsements, and increased public awareness have all contributed to a more favorable market sentiment.

- Positive Media Coverage: Increased positive media coverage has helped demystify Bitcoin and attract new investors.

- Celebrity Endorsements: High-profile endorsements have lent further credibility and visibility to Bitcoin.

- Growing Public Awareness: Improved understanding of Bitcoin's technology and potential has broadened its appeal to a wider audience.

Positive market sentiment is crucial for attracting new investment and sustaining price appreciation. The current positive perception significantly bolsters the sustainability of Bitcoin's rebound.

Regulatory Landscape and Legal Developments

The evolving regulatory landscape surrounding Bitcoin will play a significant role in shaping its future. While regulations can introduce challenges, they can also provide legitimacy and clarity, potentially fostering greater adoption.

- Gradual Regulatory Clarity: Many jurisdictions are developing more comprehensive regulatory frameworks for cryptocurrencies, which can enhance investor confidence.

- Varying Regulatory Approaches: Different countries are adopting various regulatory approaches, ranging from outright bans to more permissive frameworks.

- Potential for Regulatory Uncertainty: Regulatory uncertainty remains a risk, as inconsistent or overly restrictive regulations could negatively impact Bitcoin's growth.

Navigating the evolving regulatory landscape will be crucial for Bitcoin's future growth, and a clear and consistent regulatory environment is likely to contribute positively to a sustained Bitcoin's rebound.

Supply and Demand Dynamics

The fundamental dynamics of supply and demand are central to Bitcoin's price. Bitcoin's fixed supply of 21 million coins creates inherent scarcity, a crucial factor in its potential for long-term price appreciation.

- Halving Events: The halving events, which reduce the rate of Bitcoin mining rewards, contribute to the scarcity of Bitcoin.

- Increasing Demand: Growing institutional and retail demand continues to outpace supply.

- Limited Supply: The fixed supply of Bitcoin acts as a natural deflationary mechanism, potentially driving price appreciation over the long term.

The interplay of limited supply and increasing demand creates a powerful dynamic that supports Bitcoin's price, making a sustained Bitcoin's rebound a likely scenario.

Conclusion

This analysis reveals that Bitcoin's recent rebound is supported by a confluence of factors: increased institutional investment, favorable macroeconomic conditions, technological advancements, positive market sentiment, and the underlying supply and demand dynamics. While regulatory uncertainty remains a potential risk, the overall outlook suggests that this rebound could be more than a temporary surge. The increasing institutional adoption, coupled with the inherent scarcity of Bitcoin and growing public awareness, points towards a strong potential for continued growth. While the future of Bitcoin remains uncertain, understanding the factors driving its rebound is crucial for informed investment decisions. Stay tuned for further updates and continue your research into the exciting world of Bitcoin's potential and its ongoing rebound.

Featured Posts

-

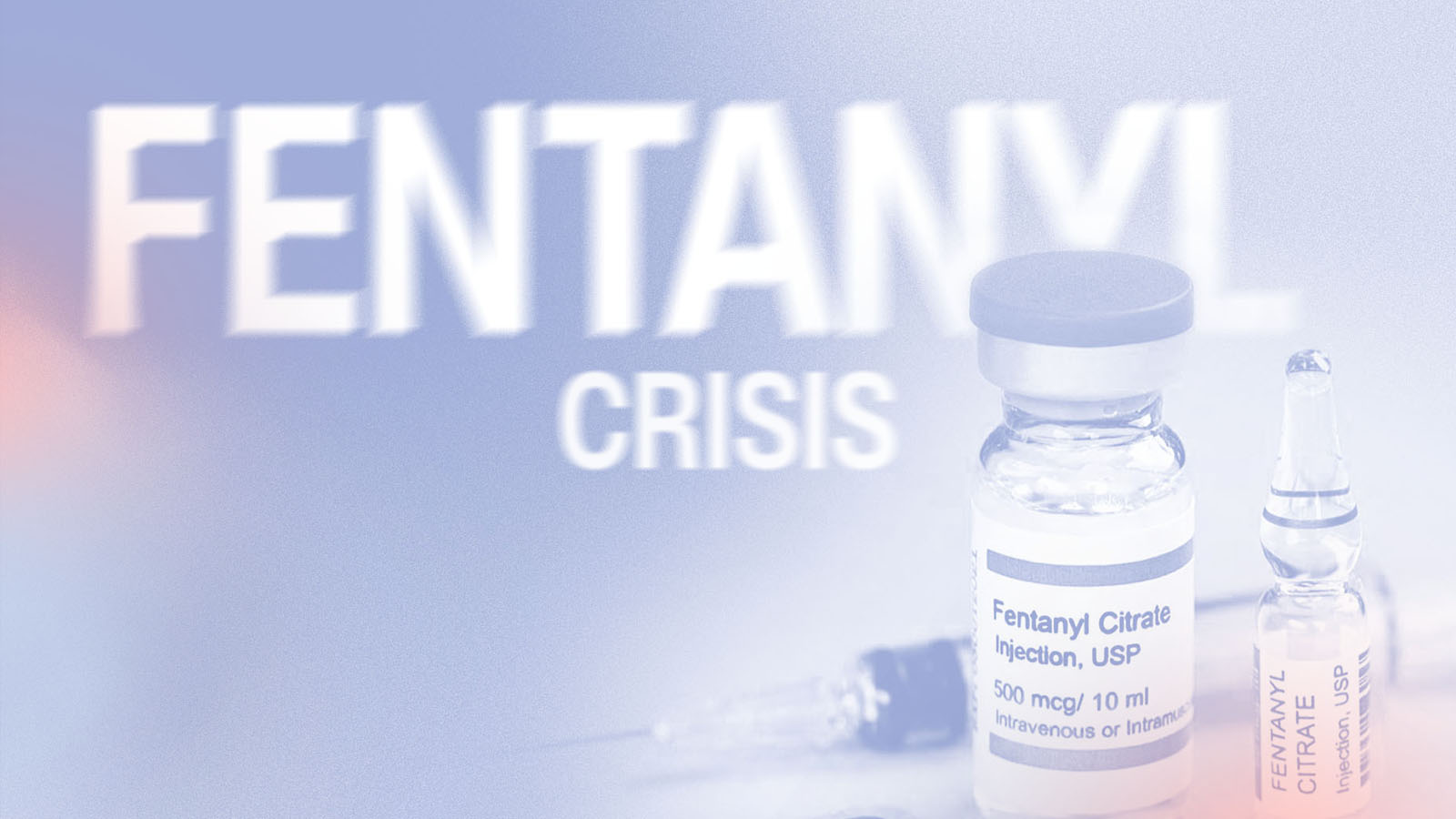

Analyzing The Link Between The Fentanyl Crisis And U S China Trade

May 09, 2025

Analyzing The Link Between The Fentanyl Crisis And U S China Trade

May 09, 2025 -

New Rules Sought By Indian Insurers For Bond Forward Markets

May 09, 2025

New Rules Sought By Indian Insurers For Bond Forward Markets

May 09, 2025 -

Bone Bruise Sidelines Jayson Tatum Game 2 Participation Uncertain

May 09, 2025

Bone Bruise Sidelines Jayson Tatum Game 2 Participation Uncertain

May 09, 2025 -

Unaffordable Homes How High Down Payments Exclude Canadians

May 09, 2025

Unaffordable Homes How High Down Payments Exclude Canadians

May 09, 2025 -

Stalking Charges Filed Against Woman Posing As Madeleine Mc Cann

May 09, 2025

Stalking Charges Filed Against Woman Posing As Madeleine Mc Cann

May 09, 2025

Latest Posts

-

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025 -

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025

Pam Bondi And James Comer Clash Over Epstein Files

May 09, 2025 -

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025

Should We See The Epstein Files Examining Ag Pam Bondis Decision

May 09, 2025 -

Attorney General Pam Bondis Amusement At James Comers Epstein Claims

May 09, 2025

Attorney General Pam Bondis Amusement At James Comers Epstein Claims

May 09, 2025 -

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025

Pam Bondi Laughs Comers Epstein Files Tirade Sparks Controversy

May 09, 2025