Is Palantir Stock A Good Buy Before May 5th Earnings Release?

Table of Contents

Analyzing Palantir's Recent Performance and Growth Trajectory

Palantir Technologies, a data analytics and software company known for its powerful platforms like Gotham and Foundry, has experienced a mixed bag of results recently. Understanding its recent performance is crucial for assessing the potential of Palantir stock.

Revenue Growth and Profitability

Palantir's revenue growth has been a key focus for investors. While the company has shown consistent revenue growth, profitability remains a key area of scrutiny. Analyzing these figures against previous quarters and industry benchmarks is vital.

- Revenue Growth: [Insert actual Q1 2024 revenue figures if available before publication, otherwise use projected figures and cite source]. Compare this to previous quarters and highlight the percentage increase or decrease. This shows the trend in revenue growth for Palantir.

- Profitability Margins: [Insert data on gross and operating margins. Explain if margins are improving or declining and analyze the reasons behind the trend]. This section demonstrates the company's efficiency in converting revenue into profit.

- Key Drivers of Growth: Identify the main factors contributing to Palantir's revenue growth, such as increased government contracts, expansion into new markets, or the success of its Foundry platform. For example, mention if new large government contracts have been secured.

- Analyst Expectations: Compare Palantir's actual performance against the expectations set by financial analysts. Did the company beat or miss expectations? This comparison contextualizes the results.

Key Performance Indicators (KPIs)

Analyzing key performance indicators provides a deeper understanding of Palantir's operational efficiency and future growth potential.

- Customer Acquisition Cost (CAC): [Insert data on CAC. Explain if it's increasing or decreasing, and analyze the implications for profitability]. A declining CAC indicates improved efficiency in acquiring new customers.

- Customer Churn Rate: [Insert data on customer churn. Analyze the reasons for churn and discuss its impact on revenue]. A lower churn rate suggests higher customer satisfaction and retention.

- Average Revenue Per User (ARPU): [Insert data on ARPU. Analyze the factors driving ARPU growth or decline]. An increase in ARPU reflects either increased usage or higher pricing per customer.

- KPI and Stock Price Correlation: Discuss how changes in these KPIs have historically correlated with movements in Palantir's stock price.

Evaluating Market Sentiment and Analyst Predictions

Understanding market sentiment and analyst predictions surrounding Palantir stock is crucial for informed investment decisions.

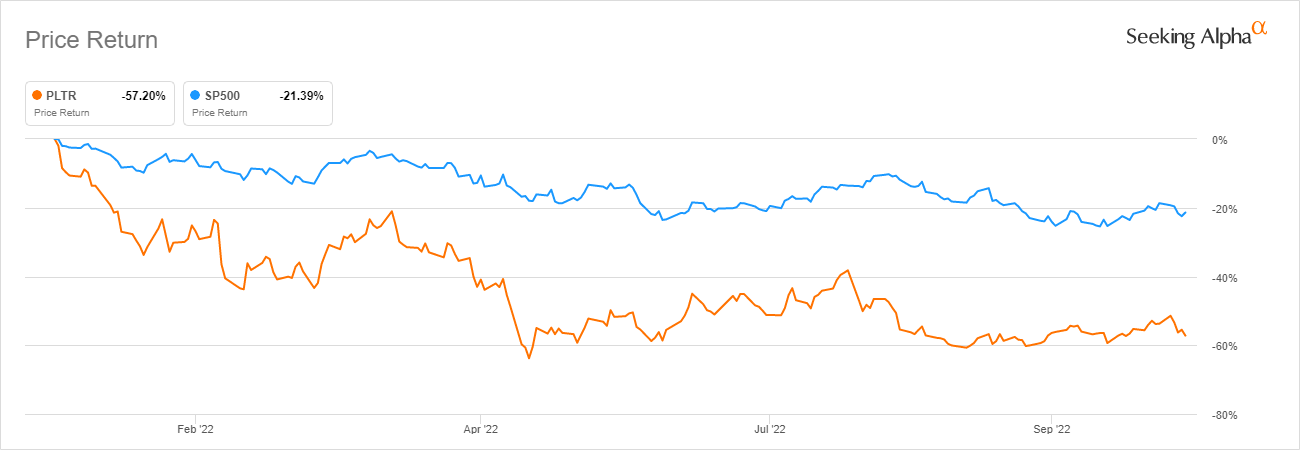

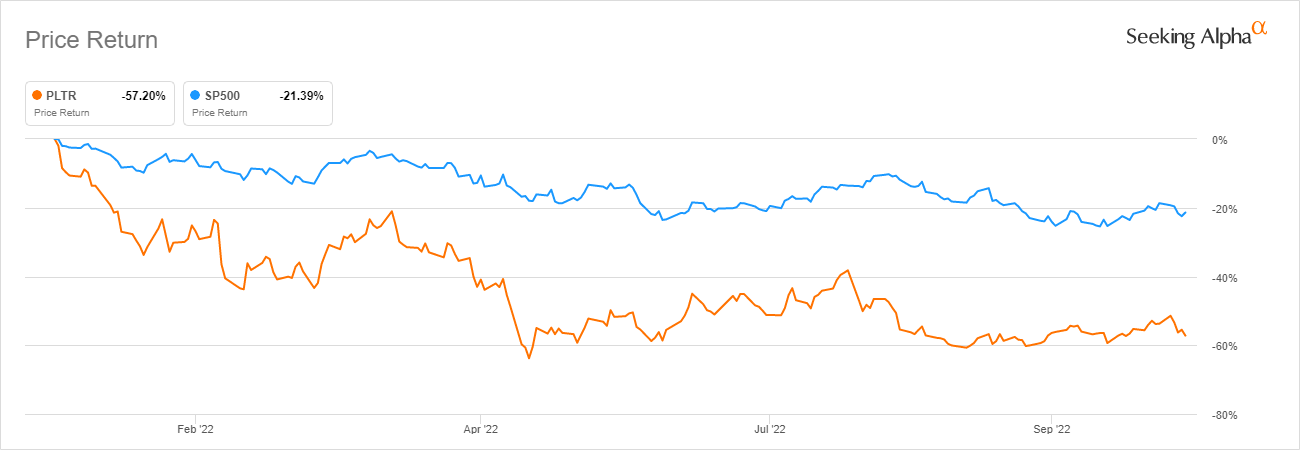

Stock Price Volatility and Trading Volume

Analyzing the recent stock price fluctuations and trading volume can reveal investor sentiment towards Palantir.

- Stock Price Movements: [Include a chart showcasing recent PLTR stock price movements. Highlight significant peaks and troughs]. This visualization helps investors grasp the recent volatility.

- Significant News Events: Discuss any recent news events (e.g., new contract wins, partnerships, regulatory changes) that have significantly impacted the stock price. These events influence market sentiment.

- Trading Volume: Analyze the trading volume alongside price movements. High volume during price increases often signifies strong bullish sentiment, while high volume during price decreases may suggest bearish pressure.

Analyst Ratings and Price Targets

Examining analyst ratings and price targets provides a summary of professional opinions on Palantir stock.

- Analyst Consensus: [Include a table summarizing the ratings (buy, hold, sell) and price targets from various reputable financial analysts]. This offers a consolidated view from experts.

- Range of Opinions: Highlight the diversity of opinions among analysts, noting any significant disagreements and their justifications. Different perspectives provide a more comprehensive picture.

- Analyst Credibility: Consider the track record and reputation of the analysts providing ratings and targets. The credibility of the source matters significantly.

Assessing Risks and Opportunities Before the Earnings Release

Before investing in Palantir stock, it's essential to carefully weigh the potential risks and rewards.

Potential Upside and Downside

The earnings release could significantly impact Palantir's stock price, presenting both opportunities and risks.

- Upside Catalysts: Identify factors that could lead to a positive price movement, such as exceeding earnings expectations, strong revenue growth, positive guidance for future quarters, successful new product launches, or strategic partnerships. These catalysts create potential for increased value.

- Downside Risks: Discuss potential negative factors, such as missing earnings expectations, disappointing revenue growth, negative guidance, increased competition, cybersecurity breaches, or geopolitical uncertainties that could negatively affect the stock. These risks can diminish the stock's value.

Long-Term Growth Prospects

Palantir operates in the rapidly growing big data and artificial intelligence markets, presenting significant long-term growth potential. However, competition is fierce.

- Competitive Advantages: Analyze Palantir's competitive advantages, such as its strong government relationships, advanced data analytics capabilities, and experienced team. These strengths are important for future success.

- Competitive Disadvantages: Acknowledge potential disadvantages, such as high customer acquisition costs, reliance on government contracts, or challenges in scaling its operations. These weaknesses need to be considered.

- Market Disruption: Discuss the potential for technological advancements and market disruptions to impact Palantir's long-term growth. Technological change is a constant factor that needs analysis.

- Long-Term Growth Forecasts: Summarize long-term growth forecasts from analysts and research firms. These provide a perspective on future potential.

Conclusion: Should You Buy Palantir Stock Before Earnings?

This analysis highlights both the potential upside and downside of investing in Palantir stock before the May 5th earnings release. While Palantir demonstrates growth in several key areas, the volatility of the stock and the uncertainties surrounding the upcoming earnings announcement warrant caution. The company’s long-term prospects in the burgeoning AI and data analytics markets are promising, but considerable risks remain.

Recommendation: Based on the current information, a "wait-and-see" approach might be prudent. Monitor the earnings release closely and assess the post-earnings market reaction before making any investment decisions. This approach is advisable given the inherent uncertainty.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct thorough due diligence and consult with a qualified financial advisor. Remember that this analysis is for informational purposes only and should not be considered financial advice. Carefully weigh the risks and rewards before investing in Palantir stock.

Featured Posts

-

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025

Your Nl Federal Election Candidates Profiles And Platforms

May 09, 2025 -

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025

India Stock Market Today Sensex And Nifty 50 Close Flat Amidst Volatility

May 09, 2025 -

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashevs Game Winner

May 09, 2025

Vegas Golden Knights Defeat Minnesota Wild In Overtime Barbashevs Game Winner

May 09, 2025 -

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025

Plantation De Vignes A Dijon 2500 M Dans Le Secteur Des Valendons

May 09, 2025 -

Farcical Conduct Proceedings In Nottingham Families Seek Postponement

May 09, 2025

Farcical Conduct Proceedings In Nottingham Families Seek Postponement

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025