Is Palantir Stock A Good Buy? Risks And Rewards Considered

Table of Contents

Palantir Technologies: A Company Overview

Palantir Technologies is a prominent player in the big data analytics market, specializing in software solutions for government and commercial clients. Its business model centers around providing powerful data integration and analysis platforms, enabling organizations to make better-informed decisions. Palantir's key offerings include Gotham, primarily used by government agencies for counterterrorism, fraud detection, and other critical missions, and Foundry, a platform designed for commercial enterprises to improve operational efficiency and decision-making.

- Key Offerings: Gotham (government), Foundry (commercial)

- Unique Selling Propositions (USPs): Sophisticated data integration capabilities, highly secure platforms, strong focus on user experience, and experienced data scientists supporting implementation.

- Target Markets: Government agencies (defense, intelligence, law enforcement), large commercial enterprises (finance, healthcare, energy).

- Competitive Advantages: Deep expertise in data analysis, strong relationships with government agencies, and a robust security infrastructure.

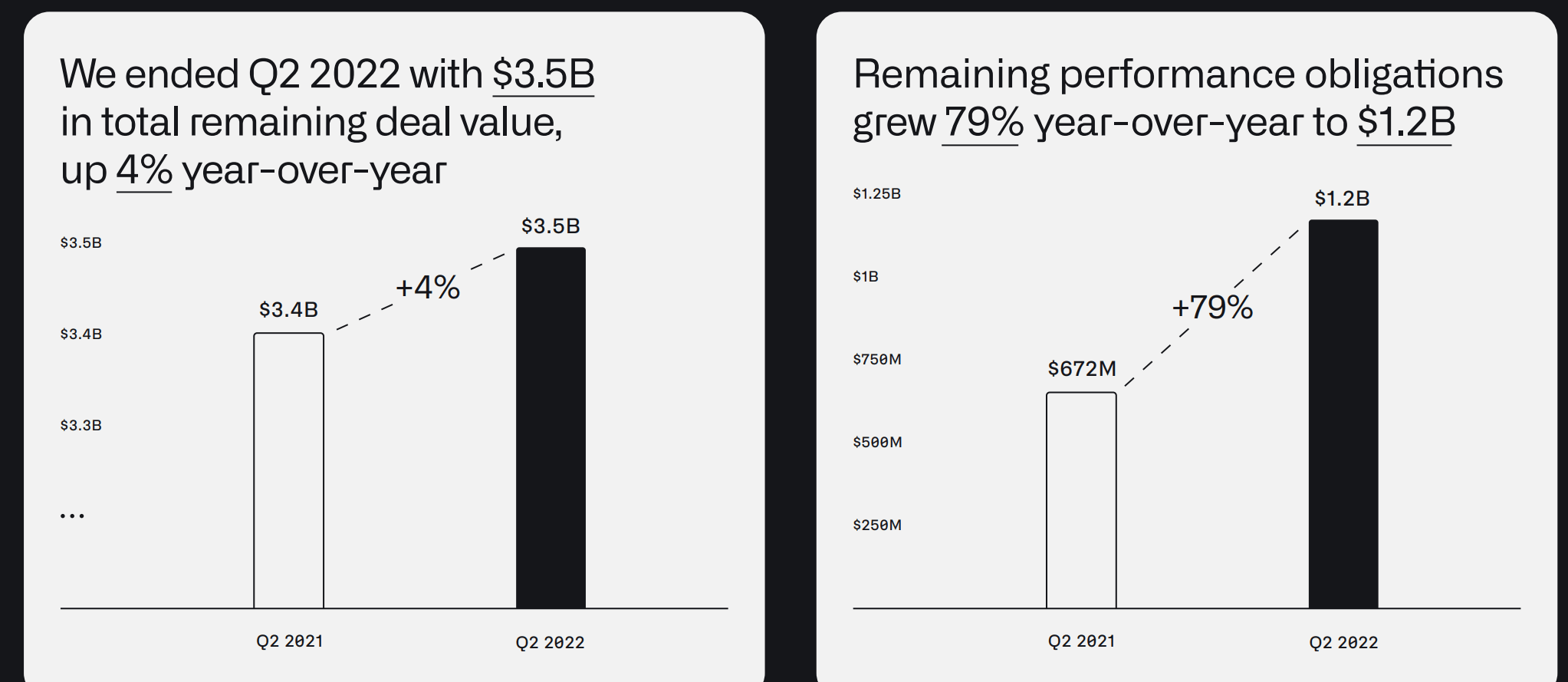

Financial Performance and Growth Potential of Palantir Stock

Analyzing Palantir's financial performance is crucial for evaluating Palantir stock. While the company has shown significant revenue growth, profitability has been a challenge, particularly in the early years. Investors need to carefully examine Palantir revenue trends, profitability margins, debt levels, and cash flow to gauge its financial health. Analyzing Palantir's financial statements, including quarterly and annual reports, is vital for understanding its financial trajectory. Future growth potential hinges on securing new contracts, expanding into new markets, and successfully developing innovative solutions within the big data analytics space. Monitoring Palantir stock price movements in relation to its financial performance is also essential for assessing its overall value proposition.

- Key Financial Metrics to Monitor: Revenue growth rate, operating margin, net income, debt-to-equity ratio, free cash flow.

- Growth Prospects: Expansion into new commercial sectors, international expansion, development of new AI-driven analytical tools.

- Significant Partnerships/Acquisitions: Tracking any strategic partnerships or acquisitions made by Palantir can indicate its expansion strategy and potential impact on Palantir stock value.

Market Position and Competitive Landscape: Evaluating Palantir Stock

Palantir operates in a highly competitive big data analytics market. Key competitors include established tech giants like Microsoft, Amazon (AWS), and Google, along with other specialized data analytics companies. Palantir's competitive advantages lie in its deep expertise in handling complex data sets, its strong relationships within government agencies, and its focus on highly secure, customized solutions. However, the company faces challenges from competitors offering cloud-based solutions and more established players with larger market shares. Analyzing the big data analytics market share and Palantir's position within it is critical for evaluating the long-term viability of Palantir stock.

Risks Associated with Investing in Palantir Stock

Investing in Palantir stock carries several risks that potential investors must carefully consider.

- High Valuation: Palantir's stock valuation might be considered high relative to its current earnings, presenting a risk if earnings growth doesn't meet market expectations.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending or policy.

- Intense Competition: Competition from large technology companies and other specialized firms poses a significant threat to market share and profitability.

- Economic Downturns: Economic recessions often lead to reduced spending on data analytics solutions, potentially impacting Palantir's revenue.

- Cybersecurity Risks: Data security breaches could severely damage Palantir's reputation and financial performance.

Is Palantir Stock a Buy, Sell, or Hold? A Balanced Assessment

Whether Palantir stock is a buy, sell, or hold depends on your individual risk tolerance and investment horizon. The potential for significant growth in the big data analytics market is undeniable, and Palantir's unique expertise offers it a strong position. However, the risks associated with high valuation, government contract dependence, and intense competition must be carefully weighed. A thorough analysis of Palantir's financial statements, its market position, and the competitive landscape is crucial before making an informed investment decision about Palantir stock. Different investors will have varying perspectives based on their risk profiles and investment goals.

Conclusion: Making Informed Decisions about Palantir Stock

This analysis of Palantir stock highlights both the significant potential upside and the considerable risks involved. The company's position in the rapidly growing big data analytics market presents opportunities for substantial growth, but factors like valuation, competition, and dependence on government contracts require careful consideration. Before making any investment decision regarding Palantir stock, conduct thorough due diligence, review recent financial statements, and consult with a qualified financial advisor to ensure the investment aligns with your risk tolerance and financial objectives. Remember that past performance is not indicative of future results, and investing in Palantir stock or any stock involves inherent risk.

Featured Posts

-

Harry Styles Debuts Retro Mustache During London Appearance

May 09, 2025

Harry Styles Debuts Retro Mustache During London Appearance

May 09, 2025 -

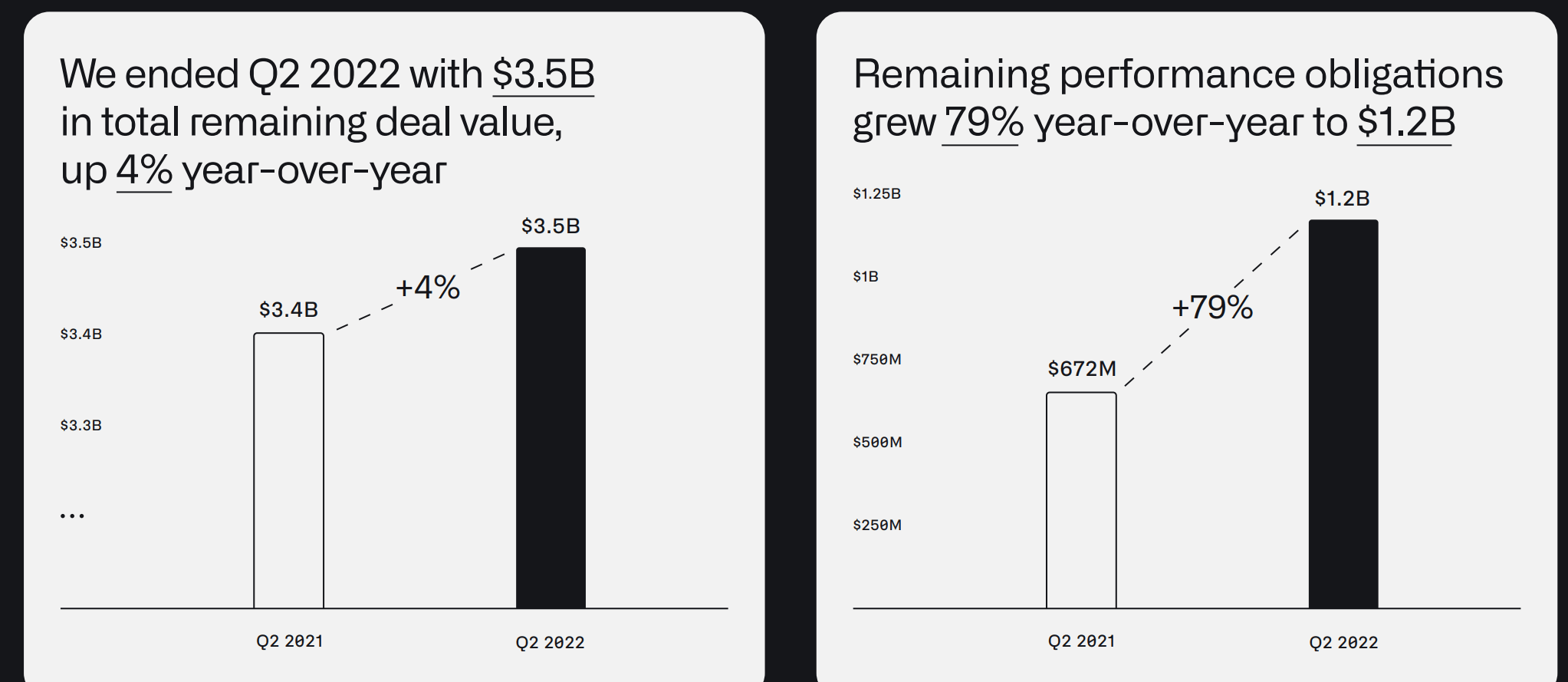

Accessible Stock Investment Thanks To Jazz Cash And K Trade

May 09, 2025

Accessible Stock Investment Thanks To Jazz Cash And K Trade

May 09, 2025 -

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025 -

The Feds Rationale Why Rate Cuts Remain Unlikely

May 09, 2025

The Feds Rationale Why Rate Cuts Remain Unlikely

May 09, 2025 -

2025 82 000

May 09, 2025

2025 82 000

May 09, 2025

Latest Posts

-

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025

French Minister Urges More Aggressive Eu Action Against Us Tariffs

May 09, 2025 -

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025

Eus Response To Us Tariffs French Minister Advocates For Stronger Action

May 09, 2025 -

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025

Frances Nuclear Shield A Proposal For Shared European Security

May 09, 2025 -

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025 -

French Minister Highlights Importance Of Shared Nuclear Defense In Europe

May 09, 2025

French Minister Highlights Importance Of Shared Nuclear Defense In Europe

May 09, 2025