Is Palantir Stock A Good Investment In 2024? Risks And Rewards

Table of Contents

Palantir Technologies (PLTR) has become a prominent player in the big data and government contracting space. But is Palantir stock a smart investment in 2024? This comprehensive analysis delves into the potential rewards and inherent risks associated with investing in this intriguing company, helping you determine if Palantir fits your portfolio strategy. We'll explore Palantir's strengths, its challenges, and ultimately, help you decide if a Palantir investment aligns with your risk tolerance and financial goals.

Palantir's Strengths and Growth Potential

Dominant Position in Government and Commercial Data Analytics

Palantir holds a strong position in both government and commercial data analytics. Its success stems from its powerful data integration and analysis platforms.

-

Strong Government Contracts: Palantir boasts significant contracts with key government agencies, including the CIA and the Department of Defense (DoD). These contracts provide a stable revenue stream and demonstrate the effectiveness of Palantir's technology in high-stakes environments. The long-term nature of these contracts offers predictability, a crucial factor for investors seeking stable returns.

-

Expanding Commercial Partnerships: While government contracts are substantial, Palantir is actively expanding its commercial partnerships. This diversification reduces reliance on government spending and opens doors to new revenue streams in sectors like finance, healthcare, and energy. Recent partnerships with major corporations underscore this growth strategy.

-

Increasing Adoption of Foundry Platform: Palantir's Foundry platform is a key driver of growth. This cloud-based platform offers data integration, analysis, and collaboration tools, making it attractive to a wide range of businesses seeking to improve data-driven decision-making. The platform's user-friendly interface and scalability contribute to its increasing adoption rate. The growing number of Foundry deployments signifies strong commercial traction and future potential.

-

Potential for Significant Revenue Growth: Analysts project significant revenue growth for Palantir in the coming years, fueled by the expansion of its commercial business and increasing demand for its data analytics solutions. This projected growth makes Palantir an attractive option for investors seeking strong capital appreciation.

Innovative Technology and Product Differentiation

Palantir's technological prowess is a significant competitive advantage.

-

Unique Technology (Gotham and Foundry): Palantir's flagship products, Gotham (for government clients) and Foundry (for commercial clients), are known for their ability to integrate and analyze vast amounts of data from diverse sources. This capability is crucial in today's data-driven world.

-

Competitive Advantages: The user-friendly interface, sophisticated algorithms, and robust security features of Palantir's platforms set it apart from competitors. The ability to handle complex, unstructured data is a key differentiator in a market increasingly demanding advanced analytical capabilities.

-

Recent Technological Advancements and Patents: Palantir consistently invests in research and development, leading to continuous innovation and the acquisition of patents that protect its intellectual property. These advancements solidify its position as a technology leader. Continued investment in AI and machine learning further enhance its analytical capabilities.

Long-Term Growth Prospects in the Big Data Market

The big data market is experiencing exponential growth, creating a favorable environment for Palantir.

-

Big Data Market Growth: The global big data market is projected to expand significantly over the next decade, driven by increasing data volumes and the need for advanced analytics. This provides a large and expanding market for Palantir's products and services.

-

Palantir's Market Share and Potential: While Palantir's market share is still developing, its potential to capture a significant portion of the expanding big data market is considerable. Its innovative technology and strong partnerships position it well for future market dominance.

-

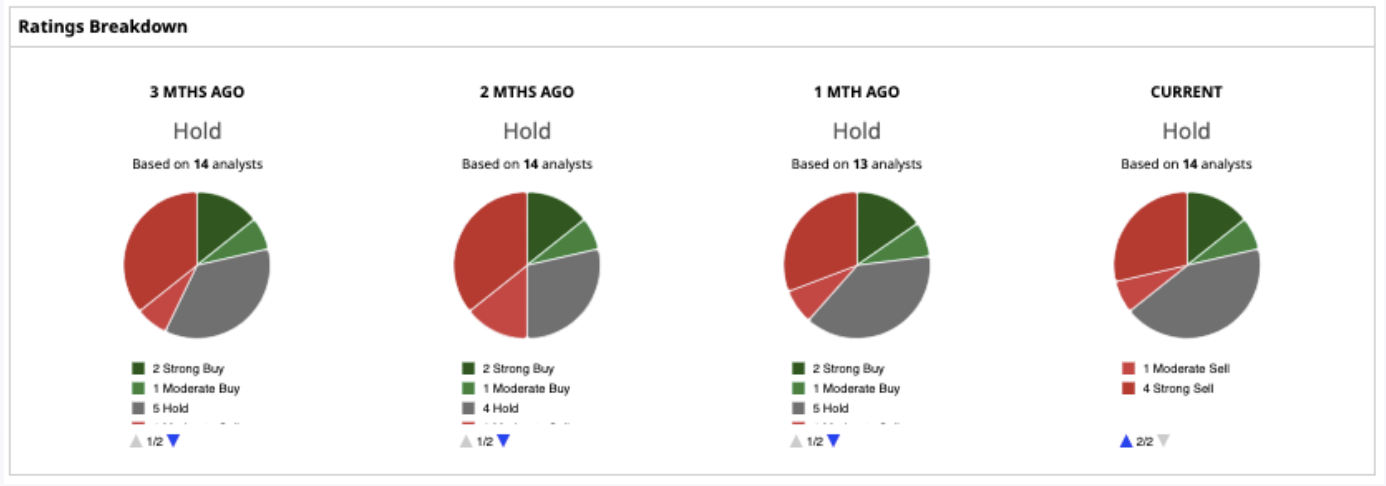

Analyst Opinions and Projections: Several reputable analysts have issued positive outlooks for Palantir, projecting substantial growth in revenue and market share. (Note: Include specific citations of analyst reports here). This positive sentiment further strengthens the argument for Palantir's investment potential.

Risks and Challenges Facing Palantir

High Valuation and Stock Volatility

Palantir's stock price has historically been quite volatile.

-

Stock Volatility: Investors should be aware of the inherent volatility associated with Palantir's stock. Past performance does not guarantee future results, and price fluctuations can be significant.

-

P/E Ratio and Market Capitalization: Analyzing Palantir's P/E ratio in comparison to its competitors is essential. A high P/E ratio can indicate a high valuation, potentially making the stock susceptible to corrections if earnings don't meet expectations. Similarly, monitoring the market capitalization provides insights into the company's overall size and value.

-

Stock Price Prediction Challenges: Predicting Palantir's future stock price with certainty is impossible. However, understanding the factors that drive price fluctuations (earnings reports, market sentiment, competitive landscape) can aid in informed investment decisions.

Dependence on Government Contracts

Palantir's revenue is significantly reliant on government contracts.

-

Percentage of Revenue from Government Contracts: A substantial portion of Palantir's revenue comes from government contracts. This reliance presents a risk, as changes in government policy or budget cuts could negatively impact the company's financial performance.

-

Risks Associated with Government Dependence: Government contracts are often subject to political and budgetary influences, creating uncertainty. Any shift in government priorities or funding could reduce the demand for Palantir's services.

-

Efforts to Diversify Revenue Streams: Palantir is actively working to diversify its revenue streams by expanding its commercial business. Success in this area will be crucial in mitigating the risk associated with its reliance on government contracts.

Competition in the Data Analytics Market

The data analytics market is highly competitive.

-

Main Competitors: Palantir faces stiff competition from major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These companies offer competing data analytics solutions and possess significant resources.

-

Competitive Landscape Analysis: A thorough analysis of the competitive landscape is essential. Understanding the strengths and weaknesses of competitors is crucial to assess Palantir's ability to maintain its market share and competitive advantage.

-

Maintaining Market Position: Palantir needs to continuously innovate and improve its products to stay ahead of the competition. Its ability to maintain its market position will be crucial for its long-term success.

Conclusion

Investing in Palantir stock in 2024 presents both significant opportunities and substantial risks. On the one hand, Palantir possesses strong technology, operates in a rapidly growing market, and is expanding its commercial reach. On the other hand, the high valuation, dependence on government contracts, and intense competition present challenges. Ultimately, whether Palantir stock is a good investment for you depends on your individual risk tolerance and investment goals. Thoroughly research the company and consult with a financial advisor before making any investment decisions regarding Palantir stock. Consider your long-term investment strategy and how Palantir aligns with your portfolio diversification. Remember to conduct your own due diligence before investing in Palantir stock.

Featured Posts

-

French Minister Proposes European Nuclear Shield Collaboration

May 10, 2025

French Minister Proposes European Nuclear Shield Collaboration

May 10, 2025 -

Up 40 In 2025 Evaluating The Investment Opportunity In Palantir Stock

May 10, 2025

Up 40 In 2025 Evaluating The Investment Opportunity In Palantir Stock

May 10, 2025 -

Uk Student Visa Restrictions Impact On Asylum Seekers

May 10, 2025

Uk Student Visa Restrictions Impact On Asylum Seekers

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

The Epstein Case Pam Bondis Claim Regarding The Client List

May 10, 2025

The Epstein Case Pam Bondis Claim Regarding The Client List

May 10, 2025