Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir Technologies, a prominent player in the data analytics industry, provides cutting-edge software platforms to government and commercial clients. Since its IPO, the company has experienced significant market fluctuations, making it a compelling—yet risky—investment opportunity. This article aims to provide you with the necessary information to make an informed decision about whether Palantir Technologies stock is a buy now.

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are primarily derived from two key sectors: government contracts and commercial partnerships. Understanding the strengths and weaknesses of each is crucial to assessing the company's overall financial health.

Government Contracts: Government contracts form a substantial portion of Palantir's revenue, driven by demand for advanced data analytics in national security and defense. This sector provides a degree of stability, as government spending on these initiatives tends to be less volatile than the commercial market. However, it's also subject to political shifts and budget fluctuations.

- Examples of Government Contracts: Palantir works with numerous intelligence agencies and defense departments worldwide. The specifics of these contracts are often kept confidential due to national security concerns.

- Percentage of Revenue from Government: While the exact percentage fluctuates, government contracts traditionally contribute a significant portion of Palantir's annual revenue.

- Potential Future Growth: Continued investment in national security and intelligence gathering suggests potential for future growth in this sector. However, competition and budget constraints remain potential challenges.

Commercial Partnerships: Palantir is aggressively expanding its presence in the commercial sector, offering its powerful data analytics platforms to a range of industries including finance, healthcare, and manufacturing. Success here is crucial for long-term growth and diversification.

- Examples of Key Commercial Clients: While Palantir often keeps client names confidential, it has publicly acknowledged partnerships with significant players in various sectors.

- Growth Rate in this Sector: The commercial sector shows promising growth potential, but penetrating this highly competitive market presents ongoing challenges.

- Challenges in the Commercial Market: Competition from established players and the need to adapt the platform to diverse industry needs pose significant hurdles. Successfully navigating data privacy regulations is also paramount.

Financial Performance and Valuation

Analyzing Palantir's financial performance and valuation is crucial for determining whether the stock is currently undervalued or overvalued.

Revenue Growth and Profitability: Palantir has demonstrated consistent revenue growth in recent years, although profitability has been a more challenging target. Examining key financial metrics like revenue growth, earnings per share (EPS), and free cash flow offers insight into the company's financial health.

- Key Financial Figures: Investors should carefully review Palantir's quarterly and annual financial reports to track key metrics and compare performance year-over-year.

- Comparison to Industry Peers: A comparative analysis of Palantir's financial performance against its competitors provides a broader perspective on its relative success.

- Projected Future Financial Performance: Analyst forecasts can provide insight into potential future growth, but it's essential to consider the inherent uncertainties involved in such projections.

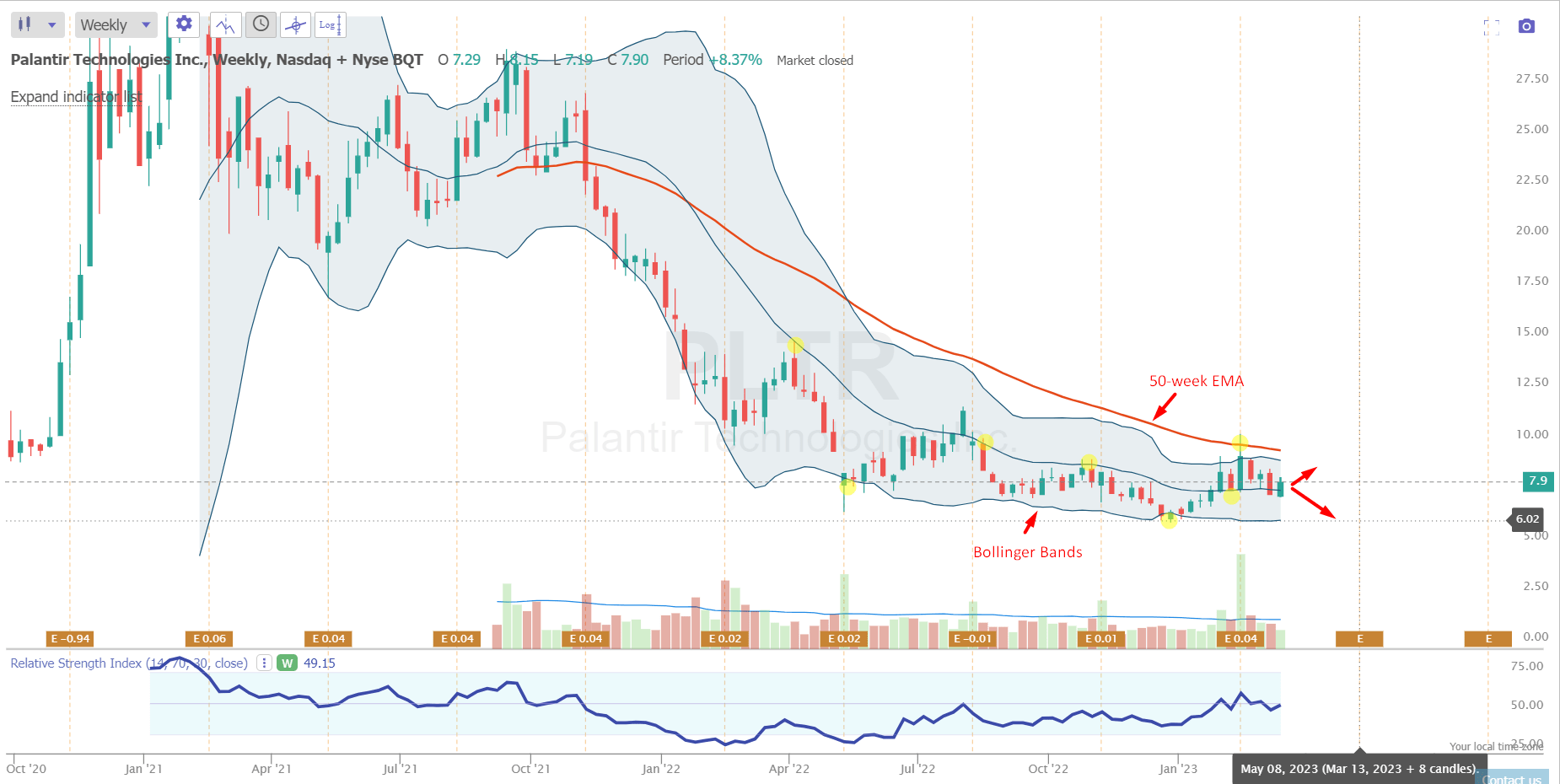

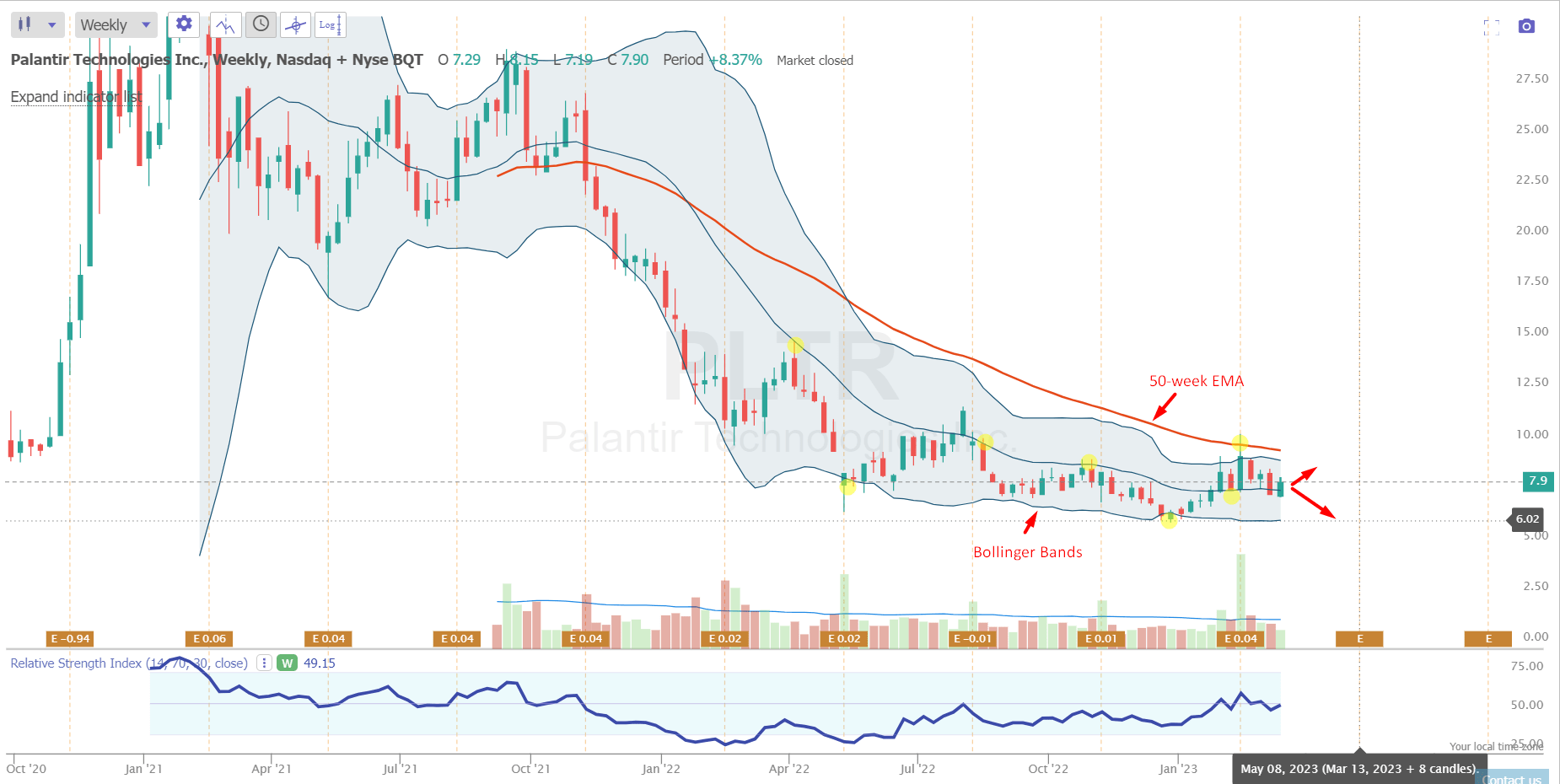

Stock Valuation and Price-to-Sales Ratio: The price-to-sales ratio (P/S) is a common metric used to evaluate the valuation of technology companies, particularly those that are not yet profitable. Comparing Palantir's P/S ratio to its historical performance and to those of comparable companies provides an understanding of its relative valuation.

- Current Stock Price: The fluctuating stock price reflects market sentiment and investor expectations regarding Palantir's future performance.

- P/S Ratio: A high P/S ratio might indicate that the market has high expectations for future growth, while a low P/S ratio might suggest undervaluation.

- Comparison to Competitors' Valuations: Comparing Palantir's valuation to those of its competitors provides valuable context for determining if its stock is fairly priced.

Risks and Challenges

While Palantir possesses significant potential, several risks and challenges could impact its future performance and the value of its stock.

Competition: The data analytics market is intensely competitive. Palantir faces competition from established technology giants, as well as from smaller, more specialized companies.

- Key Competitors: Microsoft, Google, and Amazon, among others, are major competitors in this space. Each possesses substantial resources and established market presence.

- Their Market Share: Analyzing the market share of key competitors helps to understand Palantir's position within the industry.

- Palantir's Competitive Advantages/Disadvantages: Palantir's proprietary technology and expertise in handling sensitive data give it a competitive advantage, but its high prices and complex systems can be limitations.

Dependence on Government Contracts: Palantir's significant reliance on government contracts exposes it to political risks and budget uncertainties. Changes in government priorities or budget cuts could negatively impact the company's revenue.

- Potential Risks: Reduced defense spending or shifts in government policy could lead to decreased demand for Palantir's services.

- Strategies to Mitigate Risks: Diversification into the commercial sector is a key strategy for reducing reliance on government contracts.

Technological Disruption: Rapid advancements in artificial intelligence (AI), evolving data privacy regulations, and the ever-present threat of cybersecurity breaches could disrupt Palantir's market position.

- Potential Disruptive Technologies: The emergence of more advanced AI algorithms and cloud-based data analytics platforms could pose a challenge.

- Strategies to Mitigate These Risks: Continuous innovation and investment in research and development are essential for staying ahead of the curve.

Conclusion

Determining whether Palantir Technologies stock is a buy now requires a careful evaluation of its business model, financial performance, and the inherent risks involved. While Palantir's innovative technology and strong presence in the government sector offer potential for future growth, its dependence on government contracts, high valuation, and competitive market pose significant challenges. The analysis presented suggests a need for cautious optimism. While growth potential exists, the inherent risks warrant thorough due diligence before making any investment decision regarding Palantir Technologies stock.

Call to Action: This analysis provides a starting point for your own research. Remember that this is not financial advice, and the information presented here should not be the sole basis for your investment decisions. Conduct your own thorough research, consulting with a qualified financial advisor before investing in Palantir Technologies stock or any other security. Consider exploring further resources such as Palantir's investor relations website and financial news outlets to gather a comprehensive understanding before making any investment decisions related to Palantir Technologies stock.

Featured Posts

-

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 09, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 09, 2025 -

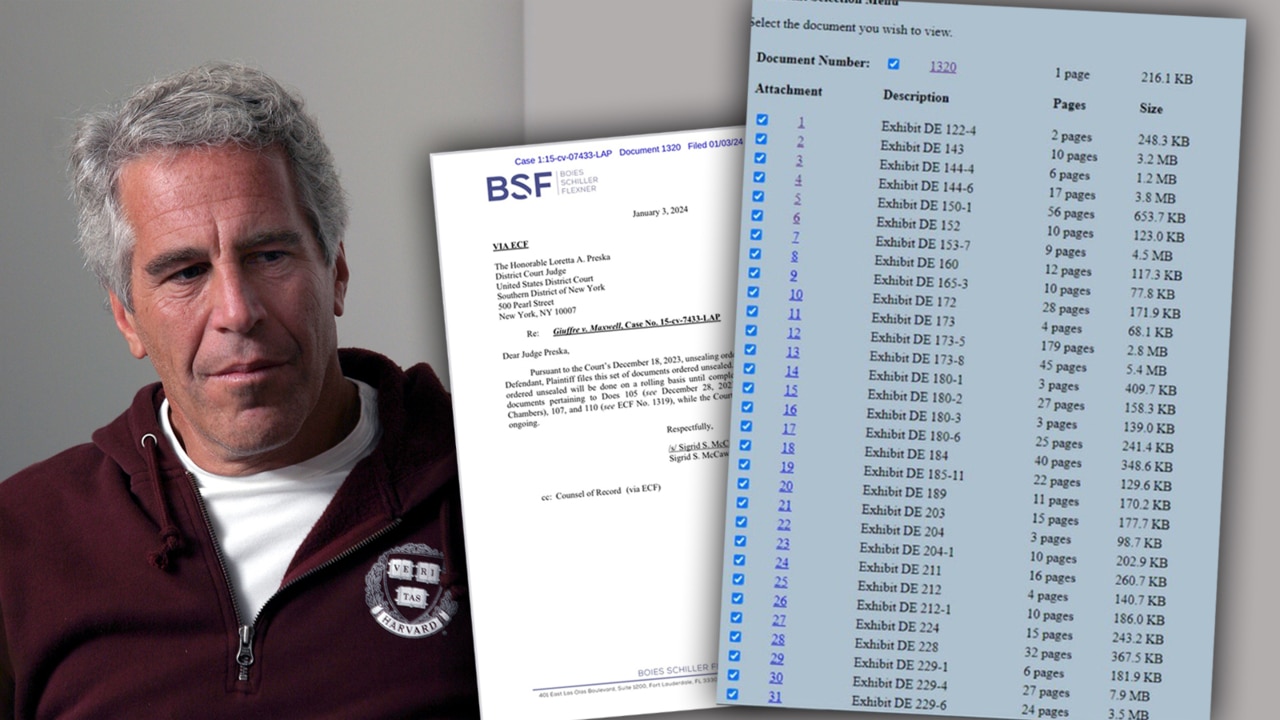

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025 -

Rio Ferdinands Bold Champions League Prediction Arsenal Or Psg

May 09, 2025

Rio Ferdinands Bold Champions League Prediction Arsenal Or Psg

May 09, 2025 -

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025 -

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025

Nhs Data Breach In Nottingham Stabbing Victims Families Demand Answers

May 09, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo On Odin Na 9 Maya

May 09, 2025 -

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025

Pakistan Awaits Imf Decision On Crucial 1 3 Billion Loan Amidst Regional Tensions

May 09, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 09, 2025 -

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025

Dogovor Makrona I Tuska Novaya Glava Vo Franko Polskikh Otnosheniyakh

May 09, 2025 -

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025

Oboronnoe Soglashenie Makron Tusk 9 Maya Analiz I Prognozy

May 09, 2025