Is Palantir's 30% Decline A Buy Signal?

Table of Contents

Analyzing Palantir's Recent Performance

The 30% decline in Palantir's stock price wasn't a sudden event; it's been a gradual decline influenced by several factors. Market sentiment towards growth stocks has soured, leading to a general sell-off across the tech sector. Profit-taking after a period of significant gains also contributed to the downward pressure on the PLTR price. Furthermore, some specific news events, such as slower-than-expected revenue growth in certain sectors, likely fueled investor concerns.

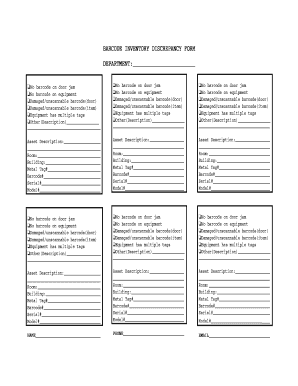

[Insert Chart/Graph showing PLTR stock price decline over a relevant period]

Examining Palantir's key financial metrics reveals a mixed picture. While revenue growth has been impressive in certain areas, particularly government contracts, profitability remains a challenge. Debt levels are relatively manageable, but investors are understandably concerned about the company's path to sustained profitability.

- Negative News Events: Slower-than-anticipated growth in the commercial sector; concerns about increasing competition.

- Competitor Performance: Compared to other data analytics firms, Palantir's growth has been slower in recent quarters, leading to negative comparisons among analysts.

- Analyst Ratings: Analyst ratings have been mixed, with some downgrading their price targets for PLTR stock, reflecting the uncertainty surrounding the company's future performance.

Evaluating Palantir's Long-Term Growth Potential

Despite the recent downturn, Palantir's long-term growth potential remains significant. The core business, providing cutting-edge data analytics solutions to governments and commercial clients, is firmly positioned within a rapidly expanding market. The global data analytics market is projected to experience substantial growth over the next decade, driven by increasing data volumes and the growing need for data-driven decision-making.

Palantir boasts a considerable technological advantage, offering highly sophisticated platforms for data integration, analysis, and visualization. However, the company faces fierce competition from established tech giants and nimble startups.

- Key Partnerships: Palantir has forged strategic partnerships with major players in various industries, providing access to wider markets and enhanced capabilities.

- Market Expansion: The company is actively expanding into new commercial markets, aiming to diversify its revenue streams and reduce its reliance on government contracts.

- AI Innovation: Palantir is investing heavily in artificial intelligence and machine learning, aiming to further enhance its platform's capabilities and remain competitive.

Assessing the Risk-Reward Ratio of Investing in Palantir

Investing in Palantir carries substantial risk. The company's stock price is notoriously volatile, and further price drops are certainly possible. Competition is intense, and regulatory hurdles could also impact the company's growth trajectory.

However, the potential rewards are equally significant. If Palantir succeeds in penetrating the commercial market and achieving sustained profitability, the upside potential is considerable. This makes a long-term investment strategy potentially more attractive than a short-term trade.

- Downside Risks: Further price drops due to market sentiment; increased competition; regulatory challenges.

- Upside Potential: Strong revenue growth driven by commercial market penetration; market share gains; increased profitability.

- Comparison to Peers: Compared to similar high-growth tech stocks, Palantir's risk-reward profile is relatively high, reflecting both its potential and its volatility.

Alternative Investment Considerations

Before making any investment decisions, it's crucial to explore alternative options within the data analytics sector. Companies like [Company A] and [Company B] offer similar services but with potentially different risk profiles. These companies may offer a more stable or less volatile investment opportunity compared to Palantir.

- Company A: [Brief description, focusing on differences with Palantir]

- Company B: [Brief description, focusing on differences with Palantir]

- Further Research: [Links to relevant resources for research on these alternative companies]

Conclusion: Is Palantir a Buy After its 30% Decline?

Palantir's 30% decline presents a complex investment scenario. While the company faces significant challenges, including competition and profitability concerns, its long-term growth potential in the booming data analytics market remains compelling. The risks are substantial, however, emphasizing the need for a long-term perspective and a thorough understanding of the company's financial performance and market position. Based on the analysis, while the current PLTR price might appear attractive, a cautious approach is warranted. The decision of whether to buy, hold, or sell ultimately depends on your individual risk tolerance and investment strategy. Consider carefully whether the Palantir price drop represents a buying opportunity, but always conduct your own thorough research before investing in Palantir stock (PLTR). Learn more about Palantir and its investment prospects before making a final decision. The recent decline in Palantir's stock price highlights the inherent volatility in the tech sector and the importance of careful due diligence for any investment decision.

Featured Posts

-

Suncor High Production Low Sales Understanding The Inventory Discrepancy

May 10, 2025

Suncor High Production Low Sales Understanding The Inventory Discrepancy

May 10, 2025 -

Increased Danish Influence In Greenland Following Trumps Actions

May 10, 2025

Increased Danish Influence In Greenland Following Trumps Actions

May 10, 2025 -

Go Compare Axe Wynne Evans After Strictly Controversy

May 10, 2025

Go Compare Axe Wynne Evans After Strictly Controversy

May 10, 2025 -

Former Becker Judge To Chair Nottingham Attacks Investigation

May 10, 2025

Former Becker Judge To Chair Nottingham Attacks Investigation

May 10, 2025 -

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025