Is SK Hynix The New DRAM Leader? AI's Role In The Market Shift

Table of Contents

H2: SK Hynix's Recent Performance and Market Position

SK Hynix consistently ranks as one of the top three DRAM manufacturers globally, alongside Samsung and Micron. While Samsung traditionally holds the largest market share, SK Hynix’s share has been steadily increasing, indicating a strong competitive position. Key financial indicators, such as revenue growth and profitability, showcase a positive trajectory for the company. This growth is not solely reliant on increasing production; SK Hynix is strategically focusing on high-value, high-margin DRAM products.

- Recent Investments: SK Hynix has invested heavily in R&D and capacity expansion, focusing on advanced manufacturing processes and next-generation DRAM technologies. This proactive approach ensures they can meet the ever-increasing demand.

- Strategic Partnerships: Strategic alliances and acquisitions have further strengthened SK Hynix's position, providing access to new technologies and markets, and improving their supply chain resilience.

- Pricing Strategies: SK Hynix’s pricing strategies are carefully calibrated to maintain competitiveness while maximizing profitability. They demonstrate a keen understanding of market dynamics and customer needs.

H2: The Expanding Role of AI in the DRAM Market

The rise of artificial intelligence and machine learning is a significant driver of the DRAM market's expansion. AI applications, particularly in areas like deep learning and high-performance computing, are incredibly memory-intensive. These applications demand high-bandwidth memory (HBM) and other specialized DRAM types capable of handling massive datasets and complex computations.

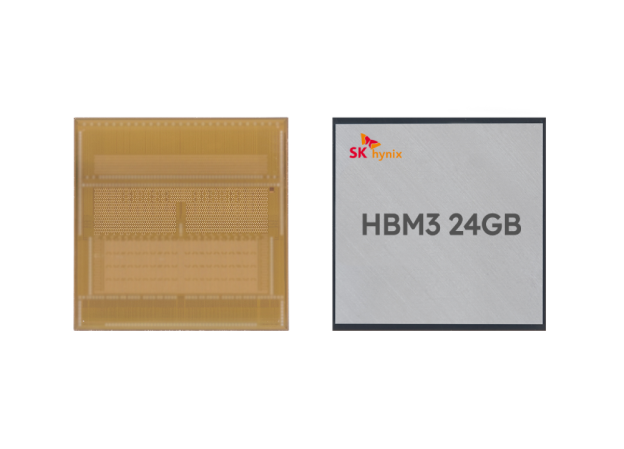

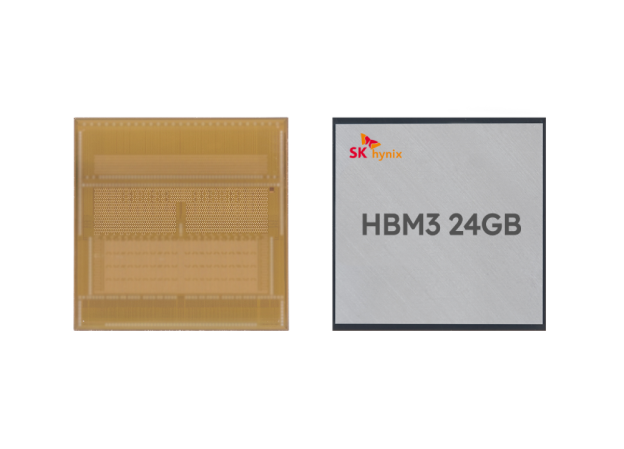

- Specialized DRAM for AI: GDDR (Graphics Double Data Rate) and HBM (High Bandwidth Memory) are crucial DRAM types fueling the AI revolution. HBM, with its stacked architecture, offers significantly higher bandwidth compared to traditional DRAM, making it ideal for AI accelerators and GPUs.

- Meeting AI Demand: SK Hynix is strategically positioning itself to capitalize on the growing AI market by aggressively investing in the development and production of HBM and other specialized DRAM solutions. They are actively engaging with AI hardware manufacturers to tailor their products to specific needs.

- Market Projections: The continued growth of AI is projected to dramatically increase the overall DRAM market size in the coming years, presenting significant opportunities for companies like SK Hynix that are well-positioned to meet this demand.

H2: Technological Advancements and Innovation at SK Hynix

SK Hynix's commitment to innovation is evident in its investments in advanced technologies like EUV (Extreme Ultraviolet) lithography and 3D stacking. EUV lithography enables the creation of smaller, more densely packed chips, leading to higher capacity and performance. 3D stacking allows for increased density and improved performance by vertically stacking memory layers.

- Technological Breakthroughs: SK Hynix regularly announces breakthroughs in DRAM technology, improving performance, power efficiency, and cost-effectiveness. These advancements help maintain their competitive edge.

- Intellectual Property: A strong portfolio of patents and intellectual property protects SK Hynix's innovations and reinforces its technological leadership. This provides a barrier to entry for competitors.

- Future Roadmap: SK Hynix's roadmap includes continued investment in advanced nodes and next-generation DRAM technologies, ensuring they stay at the forefront of the industry.

H2: Challenges and Risks for SK Hynix's Leadership Aspiration

Despite its strong position, SK Hynix faces significant challenges in its pursuit of DRAM market leadership. The semiconductor industry is notoriously cyclical, and economic downturns can significantly impact demand and profitability. Competition from established players like Samsung and Micron, as well as potential disruptions from new memory technologies, presents ongoing risks.

- Market Volatility: The cyclical nature of the semiconductor industry necessitates careful financial management and strategic planning to navigate periods of fluctuating demand.

- Geopolitical Risks: Global events and geopolitical instability can disrupt supply chains and impact production, posing a threat to SK Hynix's operations.

- Technological Disruption: The emergence of alternative memory technologies could potentially disrupt the DRAM market and challenge SK Hynix's dominance.

3. Conclusion:

SK Hynix's recent performance, strategic investments, and focus on innovation, particularly in the rapidly growing AI sector, position the company strongly for future growth in the DRAM market. While challenges remain, their commitment to technological advancements and meeting the burgeoning demand for specialized DRAM, especially HBM, increases their likelihood of significantly increasing their market share. Stay informed on the latest developments in the DRAM market and the ongoing competition to determine whether SK Hynix will truly become the new DRAM leader. Continue following our analysis on SK Hynix and the future of DRAM.

Featured Posts

-

Canadas Fiscal Health How Responsible Spending Can Secure Our Future

Apr 24, 2025

Canadas Fiscal Health How Responsible Spending Can Secure Our Future

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

Apr 24, 2025

Auto Dealers Intensify Fight Against Electric Vehicle Regulations

Apr 24, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Regarding Jan 6 Allegations

Apr 24, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Regarding Jan 6 Allegations

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025

The Bold And The Beautiful Spoilers Hopes Double Shocker Liams Promise To Steffy And Lunas Game Changing Move

Apr 24, 2025