Is The Fed Making A Mistake? Analyzing The Delayed Rate Cuts

Table of Contents

Arguments for Delayed Rate Cuts

The Federal Reserve's cautious approach to rate cuts stems from several key considerations. Delaying rate cuts, while potentially risky, offers certain advantages in the current economic environment.

Inflationary Pressures

- Persistent Inflation: Inflation remains significantly above the Fed's 2% target. The Consumer Price Index (CPI) and Producer Price Index (PPI) continue to show elevated levels, indicating persistent inflationary pressures. Premature rate cuts risk exacerbating this situation.

- Data Points: Recent CPI and PPI figures show inflation stubbornly above the target, with core inflation remaining sticky. This data underscores the need for a cautious approach to monetary policy adjustments.

- Wage-Price Spiral Risk: A rapid increase in wages, fueled by a tight labor market, could lead to a wage-price spiral, where rising wages drive up prices, leading to further wage demands, and so on. Delaying rate cuts aims to prevent such a scenario.

Labor Market Strength

- Low Unemployment: The unemployment rate remains historically low, signaling a strong labor market. This strength provides the Fed with some leeway to maintain a tighter monetary policy.

- Robust Job Growth: Job growth continues to be robust, further supporting the argument for a cautious approach to rate cuts. A premature easing of monetary policy could overheat the labor market and fuel further inflationary pressures.

- Potential for Wage Inflation: A tight labor market can lead to upward pressure on wages, potentially contributing to inflationary pressures. The Fed's delayed rate cuts aim to manage this risk.

Global Economic Uncertainty

- Geopolitical Risks: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other regions, creates significant uncertainty in the global economic outlook.

- Energy Price Volatility: Fluctuations in energy prices add further complexity to the economic landscape, making it challenging to predict the impact of monetary policy changes.

- Supply Chain Disruptions: Lingering supply chain disruptions continue to contribute to inflationary pressures, adding another layer of complexity to the Fed's decision-making process. These factors necessitate a cautious approach to rate cuts.

Arguments Against Delayed Rate Cuts

Despite the arguments in favor of delayed rate cuts, there are compelling counterarguments to consider. The potential negative consequences of delaying rate reductions warrant careful consideration.

Recessionary Risks

- Lagged Effects of Monetary Policy: Monetary policy changes often have a lagged effect on the economy. Delaying rate cuts too long could push the economy into a recession before the benefits of the previous rate hikes are fully felt.

- Yield Curve Inversion: A persistent inversion of the yield curve (where short-term interest rates exceed long-term rates) is often seen as a predictor of an upcoming recession. This signals a potential risk of delayed rate cuts.

- Economic Slowdown: Continued high interest rates risk dampening economic growth, potentially triggering a recession.

Impact on Consumer Spending

- Reduced Consumer Confidence: High interest rates can erode consumer confidence and reduce spending, leading to a slowdown in economic activity.

- Higher Borrowing Costs: Higher interest rates increase borrowing costs for consumers and businesses, potentially hindering investment and economic growth.

- Decreased Demand: Reduced consumer spending can lead to decreased demand, potentially impacting businesses and employment.

Inequality Concerns

- Disproportionate Impact on Low-Income Households: Higher interest rates disproportionately affect lower-income households who are more reliant on credit and are more vulnerable to economic shocks.

- Increased Debt Burden: Increased borrowing costs can lead to an increased debt burden for lower-income families, further exacerbating economic inequality.

- Social and Economic Instability: This potential for increased economic hardship among vulnerable populations may lead to broader social and economic instability.

Alternative Policy Approaches

The Fed isn't limited to simply raising or lowering interest rates. Alternative strategies exist that could offer different ways to manage the economy.

- Forward Guidance: Clearly communicating the Fed's intentions and expectations to the market can influence expectations and behavior without immediate rate changes.

- Quantitative Easing (QE): QE involves the central bank purchasing assets to increase the money supply, aiming to lower long-term interest rates and stimulate lending and investment. This can be a useful tool to increase liquidity in the market but carries its own set of risks. The pros and cons of each must be carefully weighed against the current situation.

Historical Context and Comparison

Examining past instances of delayed rate cuts provides valuable insights. Comparing the current economic climate to previous cycles, particularly those with similar inflationary pressures and labor market conditions, can help assess the potential effectiveness of the Fed's strategy. However, it's crucial to remember that every economic cycle is unique, and historical parallels are not always perfect predictors of future outcomes.

Conclusion: Is the Fed's Approach on Delayed Rate Cuts Justified?

The debate surrounding the Fed's approach to delayed rate cuts is multifaceted. While delaying cuts offers a potential defense against persistent inflation and runaway wage growth, the risks of delaying action too long – a potential recession and increased economic inequality – are significant. The Fed's decision is a complex balancing act between these competing risks. Whether their approach proves effective remains to be seen, and the inherent uncertainties in economic forecasting make a definitive judgment challenging. The impact of delayed rate cuts will continue to unfold, requiring ongoing analysis and scrutiny. Stay informed about future developments and continue to analyze the impact of Federal Reserve policy on your financial well-being. The effectiveness of the Fed's monetary policy, particularly regarding these delayed rate cuts, remains a key area for ongoing observation and discussion.

Featured Posts

-

Is Your Drivers License Real Id Compliant Summer Travel Prep

May 10, 2025

Is Your Drivers License Real Id Compliant Summer Travel Prep

May 10, 2025 -

Who Is David In High Potential Episode 13 Actor And Casting Discussion

May 10, 2025

Who Is David In High Potential Episode 13 Actor And Casting Discussion

May 10, 2025 -

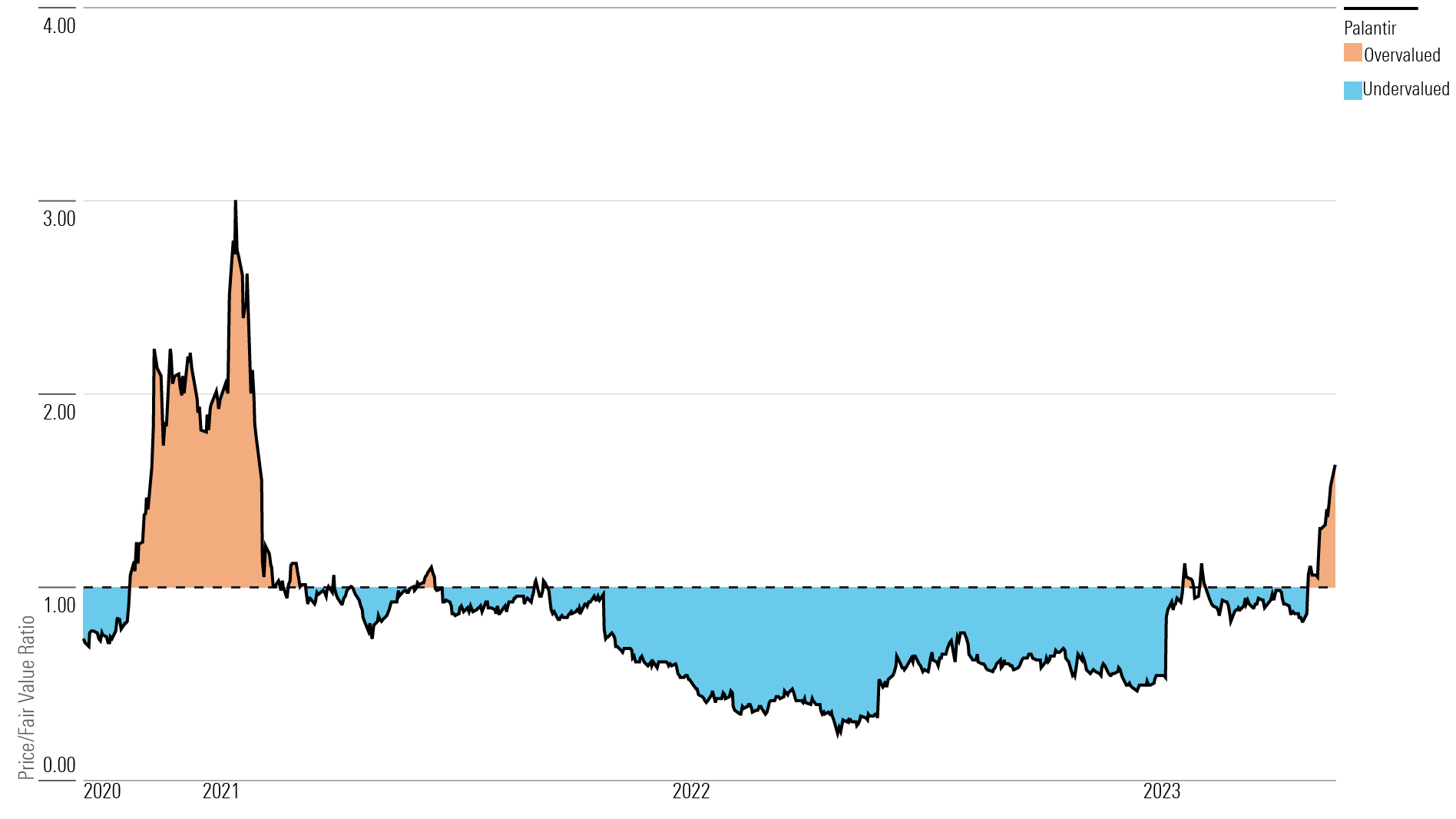

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025

Should You Buy Palantir Stock A Pre May 5th Earnings Review

May 10, 2025 -

Complete Guide To Nyt Strands Game 405 April 12th Saturday

May 10, 2025

Complete Guide To Nyt Strands Game 405 April 12th Saturday

May 10, 2025 -

Go Compare Pulls Wynne Evans Ads Following Sex Slur Controversy

May 10, 2025

Go Compare Pulls Wynne Evans Ads Following Sex Slur Controversy

May 10, 2025