Should You Buy Palantir Stock? A Pre-May 5th Earnings Review

Table of Contents

Palantir's Recent Performance and Growth Prospects

Palantir's revenue growth and future prospects are key considerations for potential investors. Analyzing recent quarterly and annual financial reports is crucial for understanding the company's trajectory. Keywords: Palantir revenue growth, Palantir growth rate, Palantir commercial revenue, Palantir government contracts, Palantir future growth.

-

Strong Revenue Growth, but Profitability Remains a Focus: Palantir has demonstrated consistent revenue growth, fueled by strong performance in both its government and commercial sectors. However, achieving consistent profitability remains a key focus for the company. Investors should carefully analyze the margins and operational efficiency metrics in the upcoming earnings report.

-

Government and Commercial Diversification: Palantir's revenue stream is diversified across government and commercial contracts. The stability of government contracts provides a solid foundation, while the growth potential within the commercial sector presents exciting opportunities for expansion. The balance between these two sectors is an important factor to monitor.

-

Expansion into New Markets and Technological Advancements: Palantir is actively expanding into new markets and investing in cutting-edge technologies like artificial intelligence and machine learning. This proactive approach positions the company for future growth, but the success of these initiatives remains to be seen. Analyst predictions on the impact of these new ventures should be carefully considered.

-

Analyst Predictions Vary: Analyst predictions for Palantir's future growth and revenue projections vary widely. Some analysts foresee continued strong growth, while others express more cautious optimism. Understanding this range of opinions is vital for informed decision-making.

-

Geopolitical Impacts: Geopolitical events and global instability can significantly impact Palantir's business, particularly its government contracts. The current global landscape presents both opportunities and challenges that investors must carefully weigh.

Assessing Palantir's Valuation and Stock Price

Evaluating Palantir's valuation and stock price is crucial for determining its investment potential. Keywords: Palantir stock valuation, Palantir P/E ratio, Palantir stock price target, Palantir market capitalization, Palantir stock performance.

-

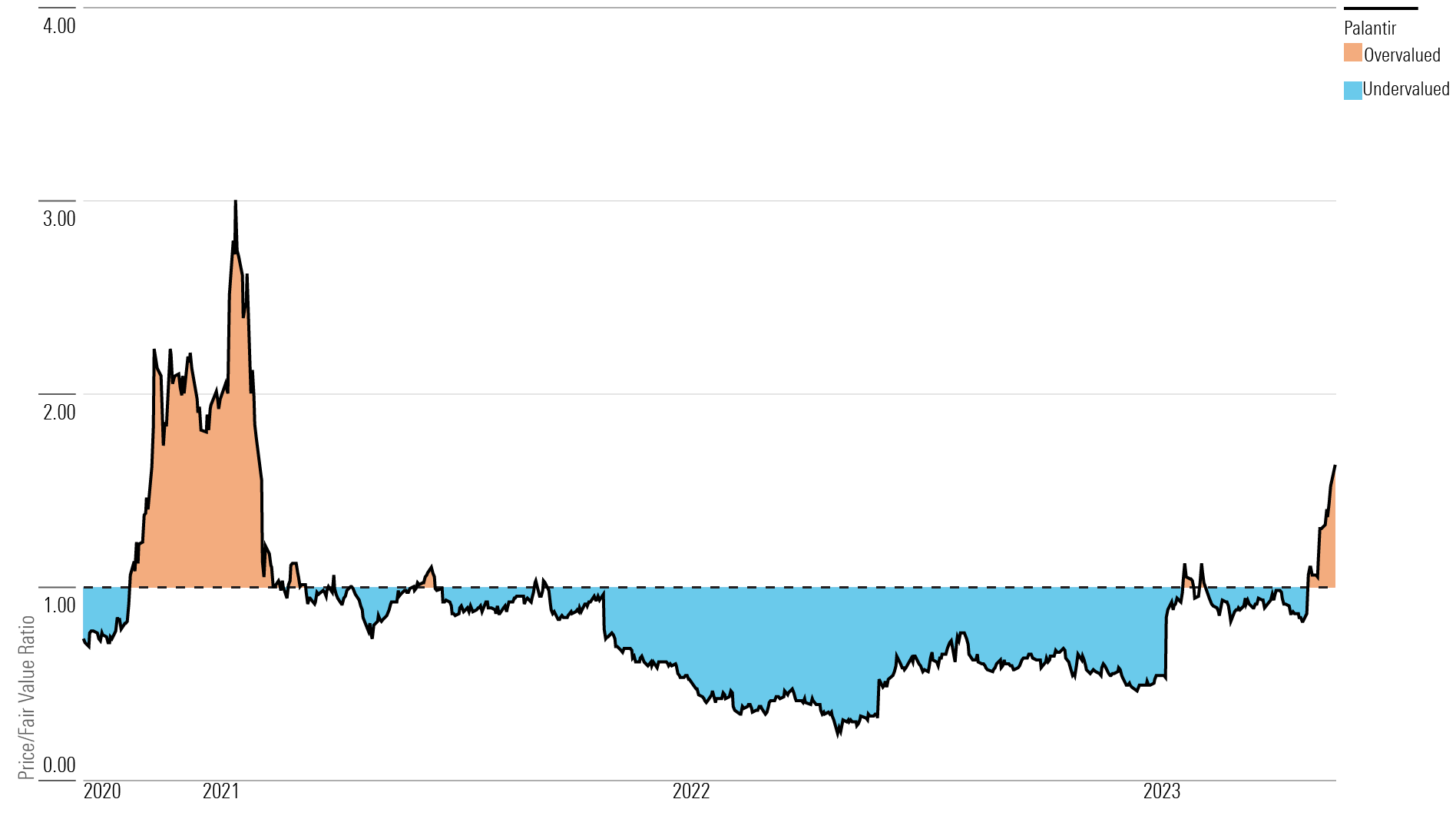

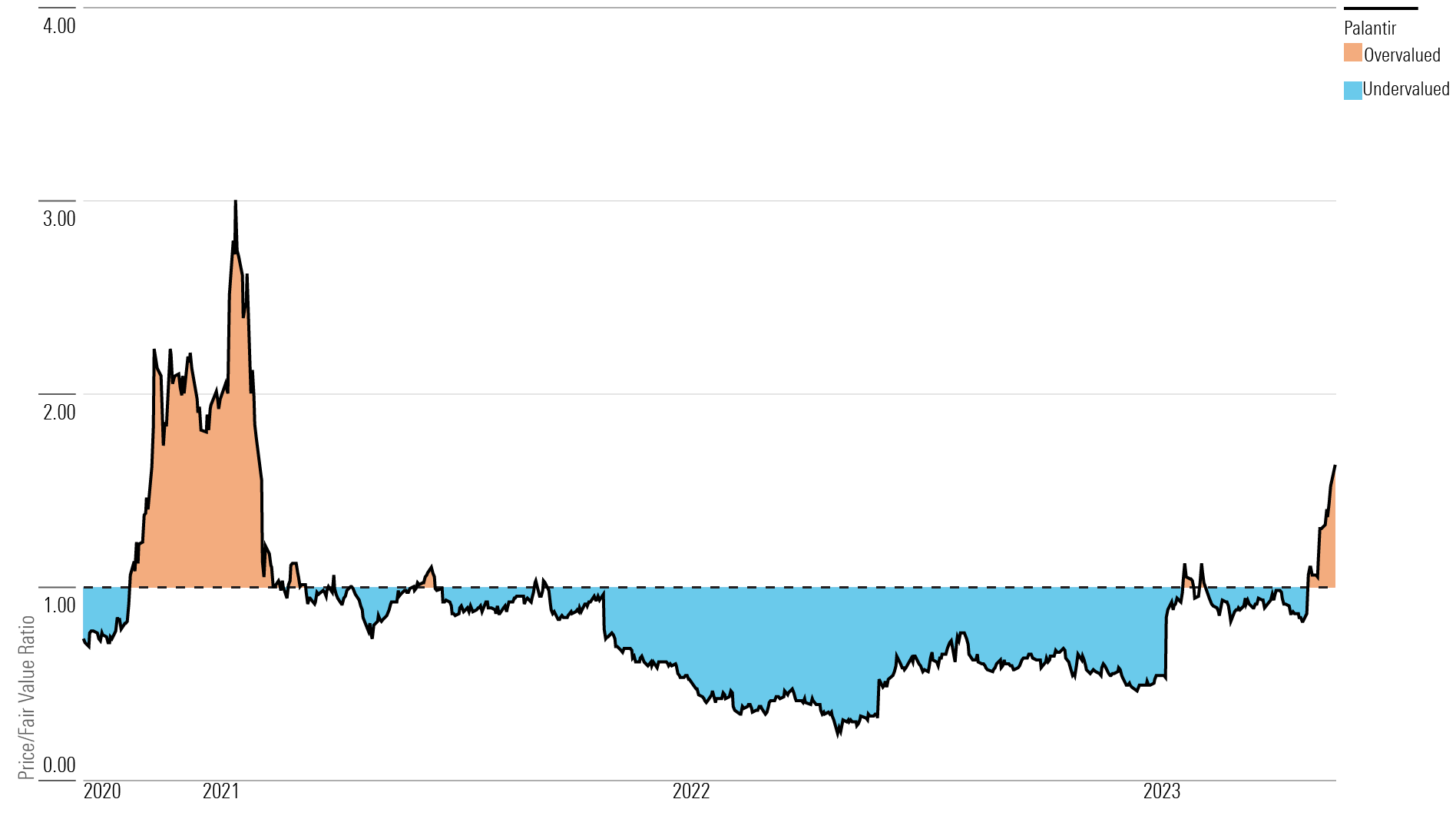

Valuation Compared to Competitors: Comparing Palantir's current valuation to its competitors within the data analytics and software industries is essential. Is it overvalued, undervalued, or fairly priced relative to its peers?

-

Key Valuation Metrics: Analyzing Palantir's Price-to-Earnings (P/E) ratio, along with other key valuation metrics like revenue growth, is necessary to gauge its attractiveness. High growth stocks often command higher P/E ratios, but this must be balanced against other factors.

-

Potential for Stock Price Appreciation: The potential for future stock price appreciation or depreciation depends on several factors, including earnings growth, market sentiment, and overall economic conditions. Scenario planning, based on various possible outcomes from the May 5th report, is beneficial.

-

Historical Stock Price Performance: Studying Palantir's historical stock price performance, including its volatility, provides valuable insights into its risk profile. Understanding past trends can help inform expectations for the future, but past performance is not indicative of future results.

-

Visualizing Performance with Charts: Using charts and graphs to visualize Palantir's stock price history aids in understanding its performance and volatility over time. This visual representation can help identify trends and patterns.

Key Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, potential investors must carefully consider several key risk factors. Keywords: Palantir risk factors, Palantir competition, Palantir debt, Palantir profitability, Palantir investment risks.

-

Competitive Landscape: Palantir faces competition from established players and emerging startups in the data analytics and software markets. Its ability to maintain its market share and differentiate its offerings is a critical factor.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. This dependence can expose the company to changes in government spending priorities and potential regulatory challenges.

-

Financial Risk Assessment: Assessing Palantir's debt levels and its ability to manage its financial risk is crucial. Investors need to evaluate the company's financial health and its capacity to withstand economic downturns.

-

Macroeconomic Factors: Macroeconomic factors such as inflation, interest rates, and overall economic growth can significantly impact Palantir's business and stock price. These broader economic forces must be considered.

-

Portfolio Diversification: Investing in Palantir should be part of a well-diversified investment portfolio to mitigate risk. Don't put all your eggs in one basket.

The Impact of the May 5th Earnings Report

The May 5th earnings report will likely have a significant impact on the Palantir stock price. Keywords: Palantir earnings report, Palantir earnings call, Palantir earnings surprise, post-earnings Palantir stock.

-

Potential Market Reactions: The market's reaction to the earnings report can be positive, negative, or neutral depending on whether Palantir meets or exceeds expectations. A positive surprise could lead to a stock price increase, while a negative surprise could cause a decline.

-

Earnings Impact on Stock Price: The reported earnings per share (EPS), revenue growth, and guidance for future quarters will all influence the stock price. Investors should analyze these key metrics carefully.

-

Earnings Call and Management Commentary: Reviewing the earnings call transcript and management's commentary is crucial for understanding the company's performance and future outlook. This provides more context than just the raw numbers.

-

Exceeding or Falling Short of Expectations: If Palantir exceeds analyst expectations, the stock price could rise. Conversely, if it falls short, the stock price could fall. The degree of surprise will influence the market's reaction.

Conclusion

This pre-earnings review examined key factors influencing the decision of whether to buy Palantir stock before May 5th. We analyzed Palantir's recent performance, valuation, and risk factors, along with the potential impact of the upcoming earnings. Remember to conduct your own thorough research before making any investment decisions. This analysis is for informational purposes only and does not constitute financial advice.

Call to Action: Carefully consider the information presented here and conduct your own comprehensive due diligence before deciding whether to buy Palantir stock. The upcoming earnings report is crucial, so stay informed and make an informed decision about your Palantir investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Caso De Discriminacion Arrestan A Estudiante Transgenero Por Usar Bano De Mujeres

May 10, 2025

Caso De Discriminacion Arrestan A Estudiante Transgenero Por Usar Bano De Mujeres

May 10, 2025 -

Is Palantirs 30 Decline A Buy Signal

May 10, 2025

Is Palantirs 30 Decline A Buy Signal

May 10, 2025 -

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Supply

May 10, 2025

Chinas Steel Production Cuts Impact On Iron Ore Prices And Global Supply

May 10, 2025 -

Us Debt Limit Potential August Expiration Raises Concerns

May 10, 2025

Us Debt Limit Potential August Expiration Raises Concerns

May 10, 2025 -

Lais Ve Day Speech A Stark Warning On Growing Totalitarianism In Taiwan

May 10, 2025

Lais Ve Day Speech A Stark Warning On Growing Totalitarianism In Taiwan

May 10, 2025