Is The Recent Bitcoin Rebound Sustainable? Expert Opinions And Market Analysis

Table of Contents

Analyzing the Drivers Behind the Recent Bitcoin Price Increase

Several intertwined factors have contributed to the recent Bitcoin price increase. Let's examine the key drivers:

Macroeconomic Factors Influencing Bitcoin

Global macroeconomic conditions significantly impact Bitcoin's price. High inflation, rising interest rates, and geopolitical uncertainty can all influence investor sentiment and drive demand for Bitcoin.

- Increased inflation: As traditional fiat currencies lose purchasing power due to inflation, investors often seek alternative assets like Bitcoin to hedge against inflation. The recent surge in inflation in many countries has likely contributed to increased Bitcoin demand.

- Falling interest rates (in certain contexts): While not universally applicable, in scenarios where interest rates fall, Bitcoin can become a more attractive investment compared to low-yielding savings accounts or bonds.

- Geopolitical instability: During times of geopolitical uncertainty, investors may view Bitcoin as a safe-haven asset, reducing their exposure to volatile traditional markets. The ongoing conflict in Ukraine and other global tensions have potentially fueled this demand.

Regulatory Developments and Their Impact

Regulatory clarity (or lack thereof) plays a significant role in influencing investor confidence and Bitcoin's price.

- Positive regulatory developments: Clearer and more supportive regulations in some jurisdictions can boost institutional investment in Bitcoin, leading to increased price stability and growth.

- Negative regulatory announcements: Conversely, harsh regulatory crackdowns or ambiguous regulations can create uncertainty and dampen investor enthusiasm, potentially triggering price drops.

- Impact of regulatory uncertainty: The ever-evolving regulatory landscape surrounding cryptocurrencies, particularly Bitcoin, inherently introduces volatility into its price.

Technical Analysis of Bitcoin's Price Chart

Technical analysis provides valuable insights into potential future price movements.

- Breakthrough of significant resistance levels: The recent price increase might be attributed to Bitcoin breaking through key resistance levels on its price chart, signaling a potential shift in momentum.

- Formation of bullish patterns: The appearance of bullish candlestick patterns (such as hammer or engulfing patterns) on the price chart could indicate a strengthening upward trend.

- Volume analysis confirming price movement: Increased trading volume accompanying price increases strengthens the signal, suggesting genuine buying pressure rather than artificial manipulation. Conversely, low volume increases could signal weakness.

Expert Opinions on Bitcoin's Future Price Trajectory

Analyzing expert opinions helps gauge the range of possibilities for Bitcoin's future price.

Bullish Predictions and Their Rationale

Many analysts predict continued Bitcoin growth based on several factors:

- Adoption by mainstream institutions: Increased adoption by large financial institutions and corporations could drive substantial price appreciation.

- Increasing scarcity of Bitcoin: With a fixed supply of 21 million Bitcoin, increasing demand in a finite supply could lead to higher prices.

- Technological advancements within the Bitcoin ecosystem: Developments like the Lightning Network, improving transaction speed and scalability, could enhance Bitcoin's usability and attractiveness.

Bearish Arguments and Potential Risks

However, some experts express concerns about the sustainability of the current Bitcoin rebound:

- Potential for a market correction: After a significant price increase, a period of correction or consolidation is common in any market, including cryptocurrencies.

- Regulatory headwinds affecting adoption: Stringent regulations in certain regions could stifle adoption and hinder price growth.

- Security concerns impacting investor confidence: Security breaches or vulnerabilities within the Bitcoin network could erode investor confidence and trigger price drops.

Assessing the Sustainability of the Bitcoin Rebound: A Balanced Perspective

To assess the sustainability of the recent Bitcoin rebound, we must weigh the bullish and bearish arguments.

- Long-term adoption trends: The continued mainstream adoption of Bitcoin will be a major determinant of its long-term price trajectory.

- Macroeconomic conditions: Persistent inflation or economic instability could continue to drive demand for Bitcoin as a hedge against risk.

- Regulatory landscape: The regulatory environment will significantly impact institutional investment and overall market sentiment.

- Technological innovations: Continued technological improvements enhancing scalability and usability will be crucial for sustained growth.

Conclusion: Is the Bitcoin Rebound Here to Stay?

The sustainability of the recent Bitcoin rebound remains uncertain. While bullish arguments—such as increasing mainstream adoption and macroeconomic factors—suggest potential for continued growth, bearish factors—like the possibility of market corrections and regulatory uncertainties—introduce significant risks. The long-term trajectory of the Bitcoin price hinges on the interplay of these factors. While a continued upward trend is possible, careful monitoring of market conditions and expert opinions is crucial.

While the sustainability of this Bitcoin rebound remains uncertain, understanding the factors at play is crucial. Continue to research the Bitcoin market, monitor expert opinions, and make informed decisions about your Bitcoin investments. Stay updated on all aspects of the Bitcoin price and future prospects.

Featured Posts

-

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025

Brezilya Nin Bitcoin Maas Oedemelerine Iliskin Yeni Yasasi

May 08, 2025 -

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Uyari

May 08, 2025

Kripto Para Piyasasinda Riskler Rusya Merkez Bankasi Ndan Oenemli Uyari

May 08, 2025 -

A Military Historians Choice More Realistic Wwii Movies Than Saving Private Ryan

May 08, 2025

A Military Historians Choice More Realistic Wwii Movies Than Saving Private Ryan

May 08, 2025 -

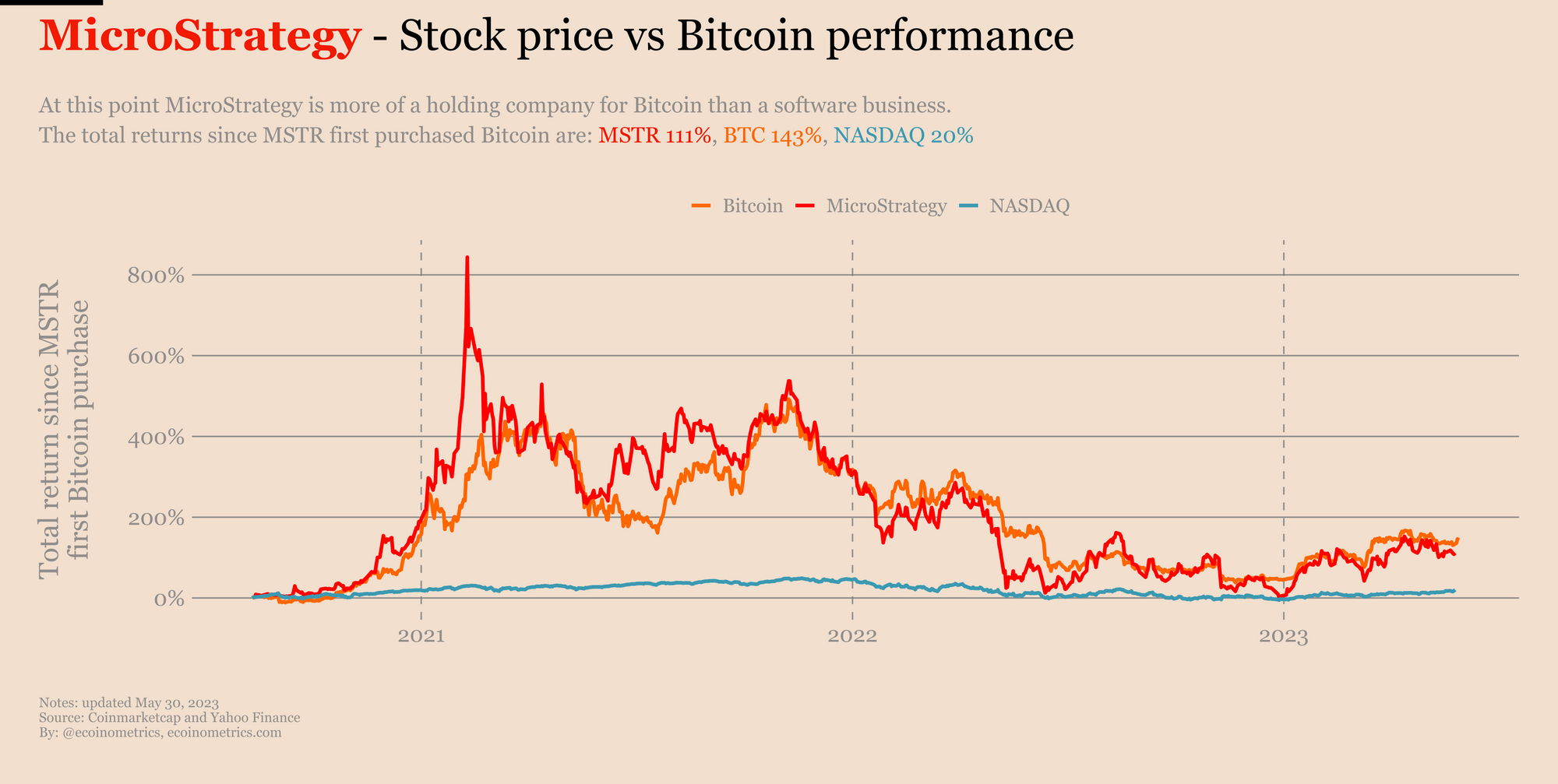

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025

Investing In 2025 Micro Strategy Stock Vs Bitcoin A Detailed Analysis

May 08, 2025 -

Possible Canada Post Strike In Late October What To Expect

May 08, 2025

Possible Canada Post Strike In Late October What To Expect

May 08, 2025

Latest Posts

-

Xrps Surge Outpacing Bitcoin And Other Cryptocurrencies After Secs Grayscale Etf Filing

May 08, 2025

Xrps Surge Outpacing Bitcoin And Other Cryptocurrencies After Secs Grayscale Etf Filing

May 08, 2025 -

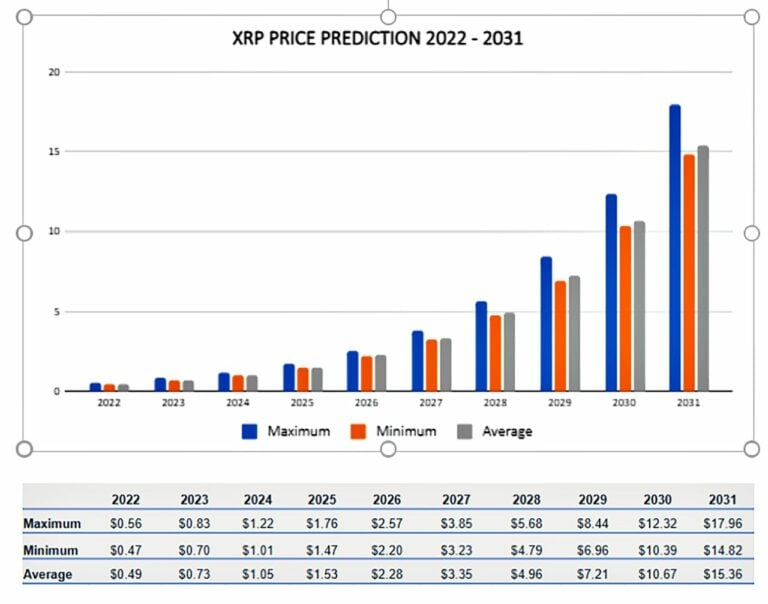

Xrp To 5 In 2025 A Comprehensive Look At The Potential

May 08, 2025

Xrp To 5 In 2025 A Comprehensive Look At The Potential

May 08, 2025 -

Will Xrp Hit 5 By 2025 Exploring The Possibilities

May 08, 2025

Will Xrp Hit 5 By 2025 Exploring The Possibilities

May 08, 2025 -

The Secs Stance On Xrp Implications For Investors And The Future Of Crypto

May 08, 2025

The Secs Stance On Xrp Implications For Investors And The Future Of Crypto

May 08, 2025 -

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can It Hit 5

May 08, 2025