Is This Bitcoin Rebound A Sign Of Things To Come?

Table of Contents

Analyzing the Recent Bitcoin Rebound

Understanding the current Bitcoin rebound requires a multi-faceted approach. We need to examine both technical indicators and the broader macroeconomic landscape.

Technical Indicators

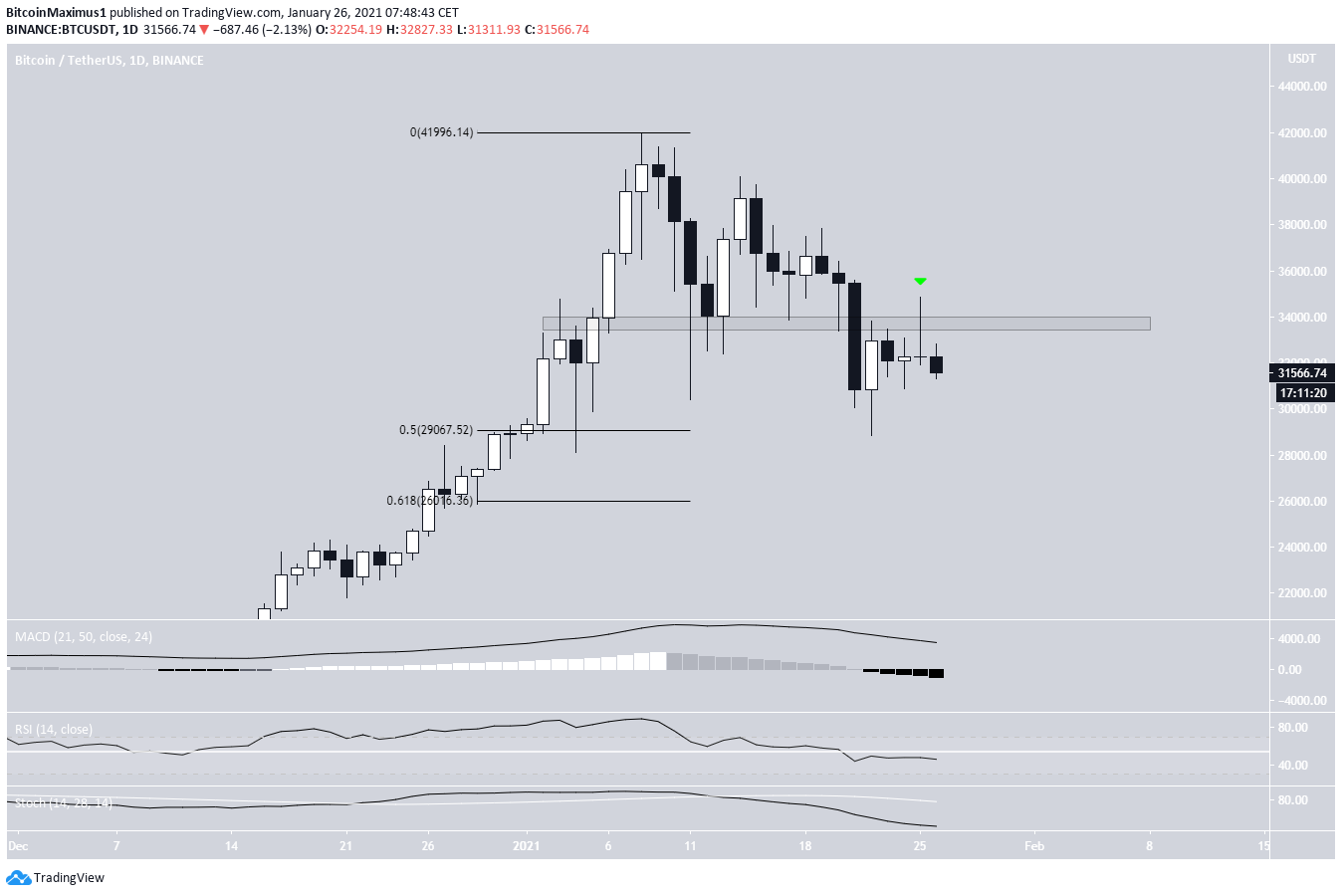

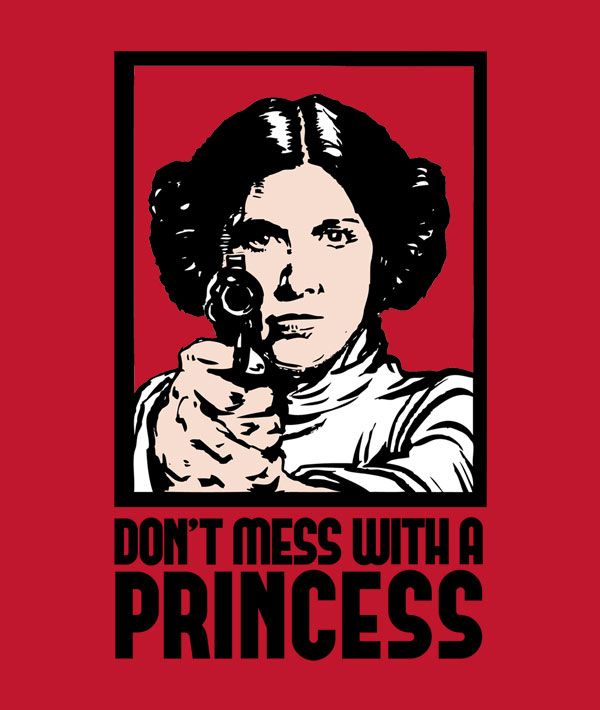

Technical analysis provides valuable insights into the short-term and medium-term trajectory of Bitcoin's price. Key indicators can help us assess the strength and sustainability of this rebound.

-

Moving Average Crossover: A bullish crossover of key moving averages (e.g., 50-day and 200-day) often signals a potential trend reversal. Has this occurred in the recent Bitcoin price action, suggesting a more sustained upward movement? Analyzing these crossovers alongside volume data provides a clearer picture.

-

RSI Levels: The Relative Strength Index (RSI) measures the momentum of price changes. An RSI above 70 generally suggests an overbought condition, while below 30 indicates an oversold condition. Is the current RSI level for Bitcoin sustainable, or does it point to an imminent correction?

-

Volume Confirmation: Increased trading volume accompanying a price rise confirms the strength of the upward trend. Without sufficient volume, a price increase might be a temporary, unsustainable rally. Examining volume data alongside price charts is crucial for validating the rebound's significance. [Insert relevant chart showing price and volume].

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin's price. Global events and economic policies can affect investor sentiment and the overall market.

-

Inflationary Pressures: Bitcoin is often touted as a hedge against inflation. High inflation rates can drive investors towards alternative assets like Bitcoin, potentially boosting its price. However, rising interest rates designed to combat inflation can have a negative impact.

-

Interest Rate Hikes: Increased interest rates generally reduce the attractiveness of riskier assets like cryptocurrencies. As interest rates rise, investors may shift their funds to higher-yielding, less volatile investments, potentially leading to a Bitcoin price correction.

-

Geopolitical Instability: Global uncertainty, such as wars or political upheavals, can trigger a "flight to safety," pushing investors towards Bitcoin as a decentralized, less regulated asset. However, such events can also lead to broader market sell-offs, impacting Bitcoin negatively.

Factors Contributing to Potential Long-Term Growth

Despite the volatility, several factors could contribute to Bitcoin's long-term growth.

Institutional Adoption

The increasing adoption of Bitcoin by institutional investors is a key driver of its potential for long-term growth.

-

Grayscale Investments: This major asset manager's significant holdings in Bitcoin have a considerable impact on market sentiment and liquidity.

-

MicroStrategy's Bitcoin Holdings: MicroStrategy's substantial Bitcoin investments demonstrate the growing confidence of large corporations in Bitcoin as a long-term asset.

-

Other Institutional Investors: Many other institutional investors, including pension funds and hedge funds, are allocating a portion of their portfolios to Bitcoin, further legitimizing it as an asset class.

Technological Advancements

Technological improvements within the Bitcoin network enhance its scalability, usability, and overall efficiency.

-

Lightning Network Scalability: The Lightning Network offers faster and cheaper transactions, addressing one of Bitcoin's historical limitations. This improvement could lead to greater adoption as a payment method.

-

Taproot Upgrade: This upgrade improved the privacy and efficiency of Bitcoin transactions, making it a more attractive option for users and businesses.

-

Future Technological Advancements: Ongoing development and research continue to improve Bitcoin's functionality and potential. Future upgrades could further enhance its capabilities and attract wider adoption.

Potential Risks and Challenges

While the future of Bitcoin looks promising, several risks and challenges remain.

Regulatory Uncertainty

The regulatory landscape for cryptocurrencies remains uncertain in many jurisdictions. This uncertainty can significantly impact Bitcoin's price and adoption.

-

Varying Regulatory Approaches: Different countries have varying approaches to regulating cryptocurrencies. This inconsistency can create uncertainty and complexity for investors.

-

Potential for Increased Regulation: Increased regulatory scrutiny could potentially stifle innovation and adoption, potentially leading to price drops.

-

Tax Implications: The tax implications of Bitcoin transactions can be complex and vary across jurisdictions, making it a significant consideration for investors.

Market Volatility

The cryptocurrency market, including Bitcoin, is inherently volatile. Significant price swings are common and can pose considerable risk to investors.

-

Historical Volatility: Reviewing Bitcoin's historical price charts reveals periods of extreme volatility, highlighting the need for careful risk management.

-

Risk Management Strategies: Diversification, dollar-cost averaging, and setting stop-loss orders are essential risk management strategies for Bitcoin investors.

-

Emotional Decision Making: Avoid making impulsive trading decisions based on fear or greed. Stick to a well-defined investment strategy.

Conclusion

The recent Bitcoin rebound presents a complex picture. While several factors suggest potential for continued growth, including increasing institutional adoption and technological advancements, significant risks remain, particularly concerning regulatory uncertainty and inherent market volatility. Careful analysis of technical indicators, macroeconomic conditions, and potential future developments is crucial for investors.

Call to Action: Understanding the nuances of this Bitcoin rebound is critical for making informed investment decisions. Continue your research and stay informed on the latest developments in the Bitcoin market to best assess whether this rebound is truly a sign of things to come. Learn more about Bitcoin investment strategies and stay updated on the latest BTC price analysis to navigate the dynamic world of Bitcoin and cryptocurrency investments effectively.

Featured Posts

-

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025

Did Saturday Night Live Make Counting Crows Famous

May 08, 2025 -

Amazon Primes Most Gripping War Movies A Ranked List

May 08, 2025

Amazon Primes Most Gripping War Movies A Ranked List

May 08, 2025 -

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025

Micro Strategy Stock Vs Bitcoin A 2025 Investment Comparison

May 08, 2025 -

360

May 08, 2025

360

May 08, 2025 -

Minister Aurangzeb Addresses Public Concerns Over Lahore Zoo Ticket Costs

May 08, 2025

Minister Aurangzeb Addresses Public Concerns Over Lahore Zoo Ticket Costs

May 08, 2025

Latest Posts

-

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025

Andor Season 1 Where To Watch All Episodes Online

May 08, 2025 -

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025

Watch Andor Season 1 On Hulu And You Tube A Guide

May 08, 2025 -

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025

Princess Leias Return 3 Reasons To Expect A Cameo In The Upcoming Star Wars Show

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025

3 Reasons A Princess Leia Cameo In The New Star Wars Show Is Likely

May 08, 2025