MicroStrategy Stock Vs. Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, primarily a business intelligence company, has become synonymous with Bitcoin due to its aggressive investment strategy. This strategy significantly impacts its stock price, creating a unique investment opportunity—and a unique set of risks.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business involves providing business analytics and mobile software. However, its bold decision to acquire a massive amount of Bitcoin has fundamentally reshaped its identity and investor perception. As of [Insert most recent data available], MicroStrategy holds approximately [Insert quantity] Bitcoin, representing [Insert percentage]% of its total assets. This substantial Bitcoin holding directly correlates with its stock price: when Bitcoin's price rises, MicroStrategy's stock often follows suit, and vice-versa.

- Correlation: A strong positive correlation exists between Bitcoin's price and MicroStrategy's stock price.

- Risk: This strategy introduces considerable risk. A significant drop in Bitcoin's value could severely impact MicroStrategy's stock price and overall financial health.

Analyzing MicroStrategy Stock Performance

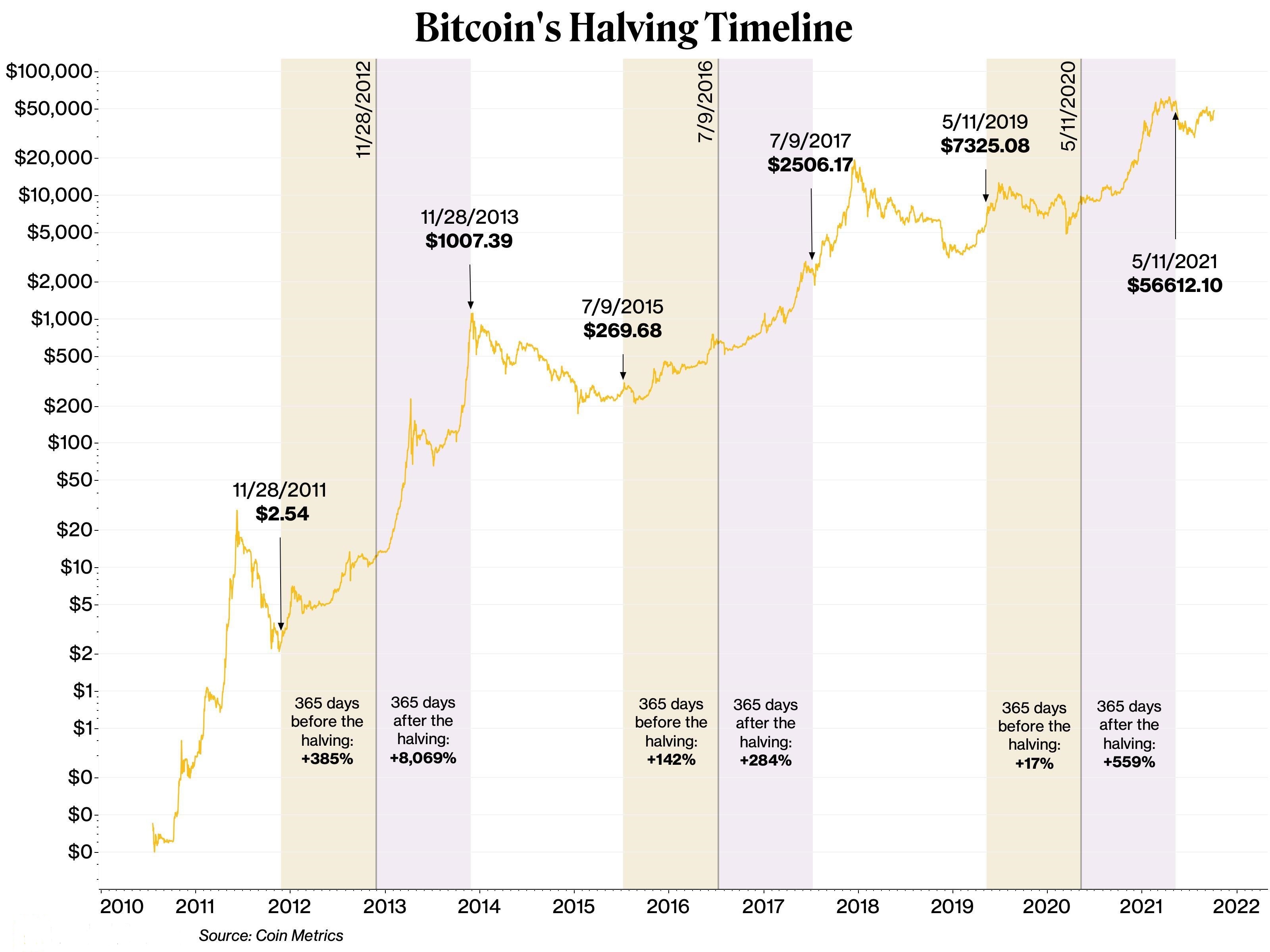

Analyzing MicroStrategy's stock performance reveals a clear connection to Bitcoin's price fluctuations. During Bitcoin's bull runs, MicroStrategy's stock has seen impressive gains. Conversely, Bitcoin's bear markets have negatively impacted MicroStrategy's stock price. However, it's crucial to remember that factors beyond Bitcoin influence MicroStrategy's stock price, including the company's own financial performance and overall market sentiment.

- Price Fluctuations: [Insert examples of specific periods where MicroStrategy's stock mirrored Bitcoin price movements, referencing chart/graph].

- Influencing Factors: Beyond Bitcoin, MicroStrategy's earnings reports, new product launches, and broader market trends also affect its stock price.

[Insert chart/graph visualizing MicroStrategy stock performance against Bitcoin price].

Bitcoin's Potential in 2025

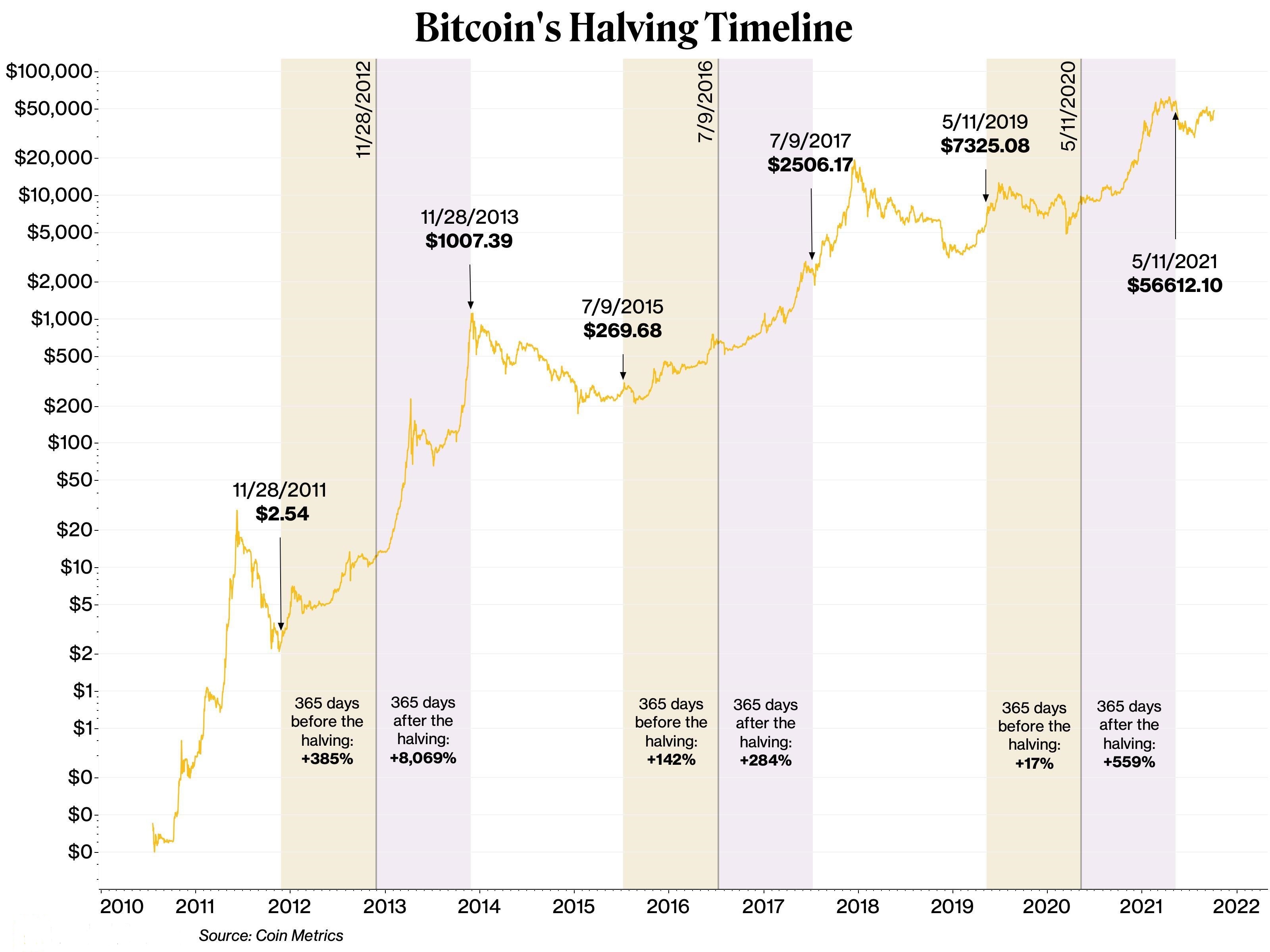

Bitcoin, the world's first and largest cryptocurrency, continues to evolve and attract significant attention. Predicting its future price is inherently speculative, but analyzing its current position and potential growth drivers offers valuable insights.

Bitcoin's Market Position and Adoption

Bitcoin's current market capitalization places it among the world's most valuable assets. Its increasing adoption by institutional investors, coupled with ongoing technological advancements like the Lightning Network (which enhances transaction speed and scalability), points towards a potentially bright future. Regulatory changes, both positive and negative, will also play a crucial role.

- Bullish Scenario (2025): Widespread institutional adoption, positive regulatory developments, and increasing technological advancements could propel Bitcoin's price significantly higher.

- Bearish Scenario (2025): Negative regulatory crackdowns, increased competition from altcoins, or a global economic downturn could negatively impact Bitcoin's price.

- Expert Opinions: [Cite predictions from reputable analysts or financial experts, including sources].

Risks Associated with Bitcoin Investment

Investing in Bitcoin carries substantial risk. Its price volatility is legendary, and the cryptocurrency market is susceptible to sharp, sudden drops. Other risks include:

- Regulatory Uncertainty: Governments worldwide are still developing regulatory frameworks for cryptocurrencies, creating uncertainty.

- Security Risks: Bitcoin wallets can be vulnerable to hacking and theft.

- Scams: The cryptocurrency space is rife with scams and fraudulent projects.

Bitcoin's historical volatility [Insert statistic, e.g., standard deviation] underscores the need for caution. Employing secure storage methods and diversifying your investment portfolio are crucial risk mitigation strategies.

MicroStrategy Stock vs. Bitcoin: A Direct Comparison

Choosing between MicroStrategy stock and Bitcoin depends heavily on your individual risk tolerance and investment goals.

Risk Tolerance and Investment Goals

MicroStrategy stock offers a less volatile path to potential Bitcoin exposure, albeit indirectly. Bitcoin itself, however, presents a significantly higher-risk, higher-reward scenario.

- Risk-Averse Investors: May prefer MicroStrategy stock for its (relatively) lower volatility, even if it offers less direct Bitcoin exposure.

- Risk-Tolerant Investors: Might opt for Bitcoin directly for potentially higher returns, accepting the increased volatility.

- Investment Goals: Long-term growth investors might find both attractive, while short-term traders might favor Bitcoin for its quicker price swings.

Diversification and Portfolio Allocation

Both MicroStrategy stock and Bitcoin can contribute to a diversified investment portfolio, but careful allocation is key. Holding both might offer a balance of exposure to Bitcoin's potential and MicroStrategy's underlying business.

- Diversified Portfolio Examples: [Provide examples of portfolio allocations, e.g., 5% MicroStrategy, 5% Bitcoin, 90% traditional assets].

- Allocation Suggestions: The percentage allocation should be determined based on individual risk tolerance and investment goals. Consult a financial advisor for personalized guidance.

Conclusion

Investing in either MicroStrategy stock or Bitcoin for 2025 presents both significant opportunities and considerable risks. MicroStrategy stock offers leveraged exposure to Bitcoin with reduced (but still present) volatility, while direct Bitcoin investment offers higher potential returns but with considerably higher risk. Understanding your personal risk tolerance, investment timeline, and overall portfolio diversification strategy is paramount. This comparison provides a framework for your research but is not financial advice. Make an informed decision about your 2025 investment strategy by carefully weighing the pros and cons of MicroStrategy stock versus Bitcoin. We encourage you to conduct thorough research and share your insights in the comments section below.

Featured Posts

-

Barcelona Inter Milan Champions League Semi Final A High Scoring Draw

May 08, 2025

Barcelona Inter Milan Champions League Semi Final A High Scoring Draw

May 08, 2025 -

Lower Rates Easier Lending Chinas Economic Response To Tariffs

May 08, 2025

Lower Rates Easier Lending Chinas Economic Response To Tariffs

May 08, 2025 -

Could Bitcoin Reach New Heights A 1 500 Price Surge Predicted

May 08, 2025

Could Bitcoin Reach New Heights A 1 500 Price Surge Predicted

May 08, 2025 -

Inter Milan Contract Expiry The Situation Of Four Key Players In 2026

May 08, 2025

Inter Milan Contract Expiry The Situation Of Four Key Players In 2026

May 08, 2025 -

Inter Milan Stuns Barcelona Reaches Champions League Final

May 08, 2025

Inter Milan Stuns Barcelona Reaches Champions League Final

May 08, 2025

Latest Posts

-

Nikola Jokic And Most Nuggets Starters Rest After Double Overtime Loss

May 08, 2025

Nikola Jokic And Most Nuggets Starters Rest After Double Overtime Loss

May 08, 2025 -

Shreveport Police Announce Arrests In Extensive Car Theft Case

May 08, 2025

Shreveport Police Announce Arrests In Extensive Car Theft Case

May 08, 2025 -

Nba Playoffs Trivia Triple Doubles Edition Test Your Knowledge

May 08, 2025

Nba Playoffs Trivia Triple Doubles Edition Test Your Knowledge

May 08, 2025 -

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025

Nc State Faces Recruiting Challenge After Raphaels Exit

May 08, 2025 -

Multiple Arrests Made In Shreveport Multi Vehicle Theft Investigation

May 08, 2025

Multiple Arrests Made In Shreveport Multi Vehicle Theft Investigation

May 08, 2025