Is This Hot New SPAC Stock A Smart Investment? Comparing It To MicroStrategy

Table of Contents

Understanding NewCo's Business Model and Potential

Target Company and Industry Analysis

NewCo's intended acquisition target is [Replace with Target Company Name and Brief Description], operating within the [Replace with Industry] sector. This industry is characterized by:

- Market size: [Replace with Market Size Data and Source] indicating significant growth potential.

- Growth potential: [Replace with Growth Projections and Rationale], driven by [Replace with Key Growth Drivers].

- Competitive advantages: [Replace with Target Company's Competitive Advantages], such as [List Specific Advantages, e.g., proprietary technology, strong brand recognition].

- Disruptive technologies: [If applicable, describe any disruptive technologies employed by the target company].

The success of the NewCo SPAC merger hinges on the target company's ability to deliver on its projected growth. Careful analysis of the target company valuation within the context of industry growth prospects is crucial for assessing the SPAC investment's viability.

Management Team and Track Record

NewCo's management team comprises [Replace with Key Personnel and Their Backgrounds]. Their relevant experience in the [Replace with Industry] sector includes:

- [List specific achievements and experiences of key personnel].

- [Highlight any past successes or notable failures].

- [Assess potential conflicts of interest, if any].

Evaluating the SPAC management's leadership experience and track record is paramount, as their expertise will significantly influence the post-merger success of the target company.

Financial Projections and Valuation

NewCo's projected financials post-merger indicate [Replace with Summary of Key Financial Projections]. This includes:

- Revenue projections: [Replace with Specific Revenue Projections and Assumptions].

- Profitability expectations: [Replace with Profitability Projections and Timeline].

- Discounted cash flow analysis (if available): [Summarize the DCF analysis and its implications for valuation].

Comparing these projections to industry peers and performing independent valuation analysis is essential before considering an investment in NewCo. Thorough due diligence is necessary to assess the reliability of the SPAC valuation and the financial projections.

MicroStrategy: A Case Study in High-Risk, High-Reward SPAC-like Investments

MicroStrategy's Bitcoin Strategy

MicroStrategy's significant investment in Bitcoin has dramatically impacted its stock price, showcasing both the potential for substantial gains and the risks associated with such a volatile asset.

- Bitcoin's volatility: Bitcoin's price fluctuations introduce significant risk to MicroStrategy's investment and overall financial performance.

- MicroStrategy's rationale for investment: [Explain MicroStrategy's reasoning behind its Bitcoin investment strategy].

- Impact on stock price: [Discuss the correlation between Bitcoin's price and MicroStrategy's stock price].

This high-risk, high-reward strategy demonstrates the potential upsides and downsides of unconventional investment approaches, similar to those taken by many SPACs.

Comparing MicroStrategy's Risk Profile to NewCo

Both MicroStrategy and NewCo present high-risk, high-reward investment profiles, but the nature of the risk differs significantly:

- Market volatility exposure: Both are subject to market volatility, but MicroStrategy's exposure is directly tied to Bitcoin's price, while NewCo's depends on the target company's performance.

- Reliance on a single strategy: MicroStrategy heavily relies on Bitcoin, while NewCo's success depends on the success of its target company within a specific industry.

- Financial leverage: Assess the level of debt and financial leverage for both entities and the implications for risk.

A comparative analysis of these factors is critical in understanding the distinct risk profiles and potential returns.

Lessons Learned from MicroStrategy's Investments

MicroStrategy's experience offers several key investment lessons:

- Importance of due diligence: Thorough research and analysis are crucial before investing in high-risk assets.

- Risk management strategies: Diversification and prudent risk management are vital for mitigating potential losses.

- Diversification: Investing in a diversified portfolio is essential to reduce overall risk.

Applying these lessons when evaluating NewCo and other high-risk investments is crucial for successful investing.

Assessing the Risks and Rewards of Investing in NewCo

Potential Upside and Downside

Investing in NewCo presents significant potential:

- High growth potential: Success hinges on the target company's ability to achieve its ambitious growth targets.

- Potential for significant returns: Successful execution could lead to substantial returns for investors.

- High risk: The inherent risks of SPAC investments, combined with the risks associated with the specific target company and its industry, are substantial.

- Potential for significant losses: Failure to achieve projected growth or unforeseen challenges could lead to significant losses.

A balanced assessment of both the potential upside and downside is essential.

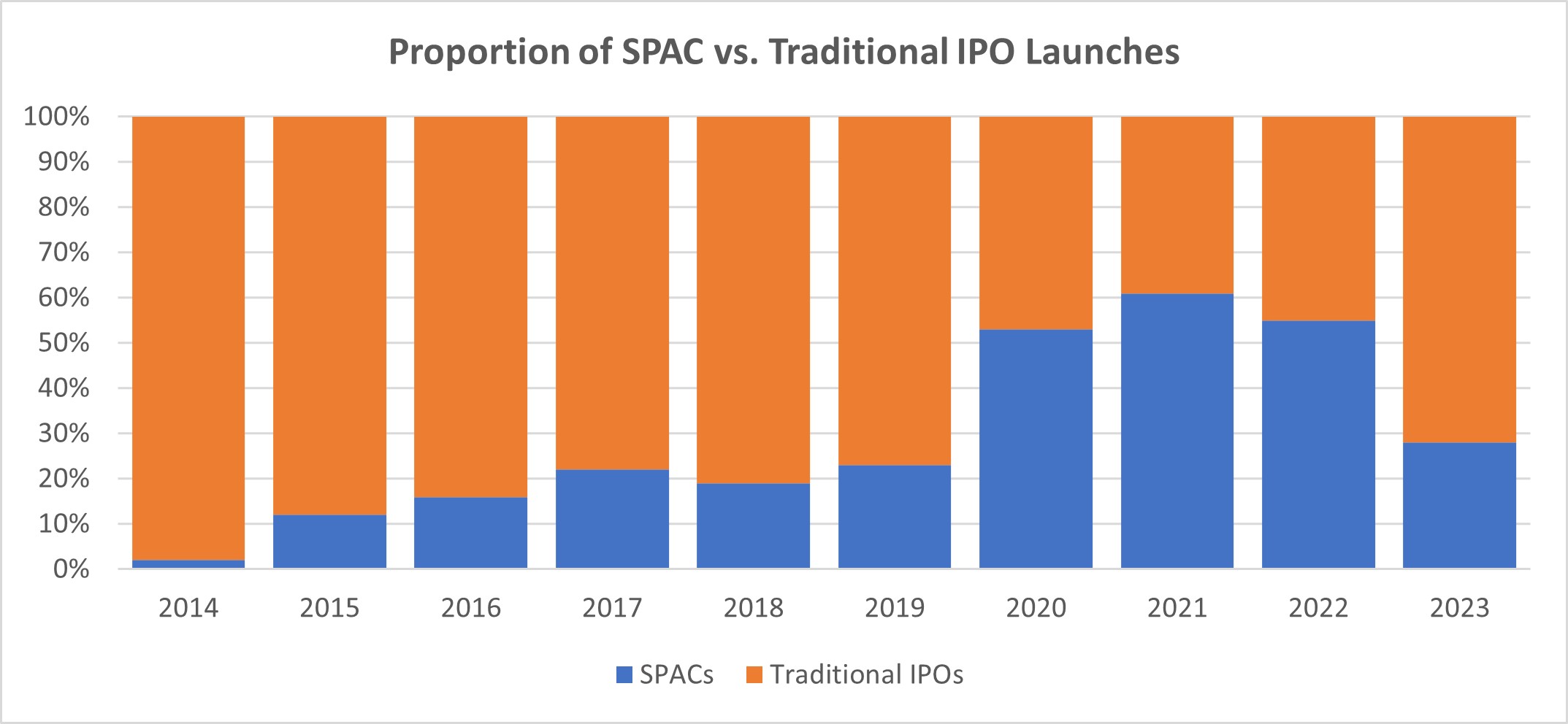

Comparison to Traditional IPOs

Investing in a SPAC like NewCo differs from investing in a traditional IPO in several ways:

- Faster access to capital for the target company: SPACs provide quicker access to capital than traditional IPOs.

- Less scrutiny in the pre-merger stage: SPACs typically undergo less rigorous scrutiny before the merger compared to traditional IPOs.

Understanding these differences helps investors evaluate the trade-offs involved in each investment approach.

Conclusion

Our comparison of NewCo and MicroStrategy highlights the inherent risks and rewards of investing in high-growth, high-risk ventures. MicroStrategy's Bitcoin strategy, while potentially lucrative, underscores the volatility associated with unconventional investments. Similarly, investing in NewCo requires a thorough understanding of the target company's prospects, the SPAC's management team, and the overall market conditions. Thorough due diligence, including a comprehensive risk assessment and consideration of diversification strategies, are paramount. Remember, both SPACs and Bitcoin investments present significant risks.

Before making any investment decisions regarding this hot new SPAC stock or similar ventures, conduct thorough research, diversify your portfolio, and seek professional financial advice. Remember, investing in SPACs, especially those with a high-risk profile, requires careful consideration and a thorough understanding of the associated risks. Is this hot new SPAC stock right for your investment strategy?

Featured Posts

-

Will Apples Ai Strategy Lead Or Lag

May 09, 2025

Will Apples Ai Strategy Lead Or Lag

May 09, 2025 -

Will Trumps 100 Day Speech Impact Bitcoins Price A Prediction

May 09, 2025

Will Trumps 100 Day Speech Impact Bitcoins Price A Prediction

May 09, 2025 -

Alpine Bosss Stern Warning To Doohan Latest F1 News

May 09, 2025

Alpine Bosss Stern Warning To Doohan Latest F1 News

May 09, 2025 -

Zatrudneniya V Prognozirovanii Mayskikh Snegopadov

May 09, 2025

Zatrudneniya V Prognozirovanii Mayskikh Snegopadov

May 09, 2025 -

Androids Design Overhaul Impact On Gen Z Smartphone Preferences

May 09, 2025

Androids Design Overhaul Impact On Gen Z Smartphone Preferences

May 09, 2025

Latest Posts

-

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025 -

High Potentials Bold Finale Why Abc Was Impressed

May 09, 2025

High Potentials Bold Finale Why Abc Was Impressed

May 09, 2025 -

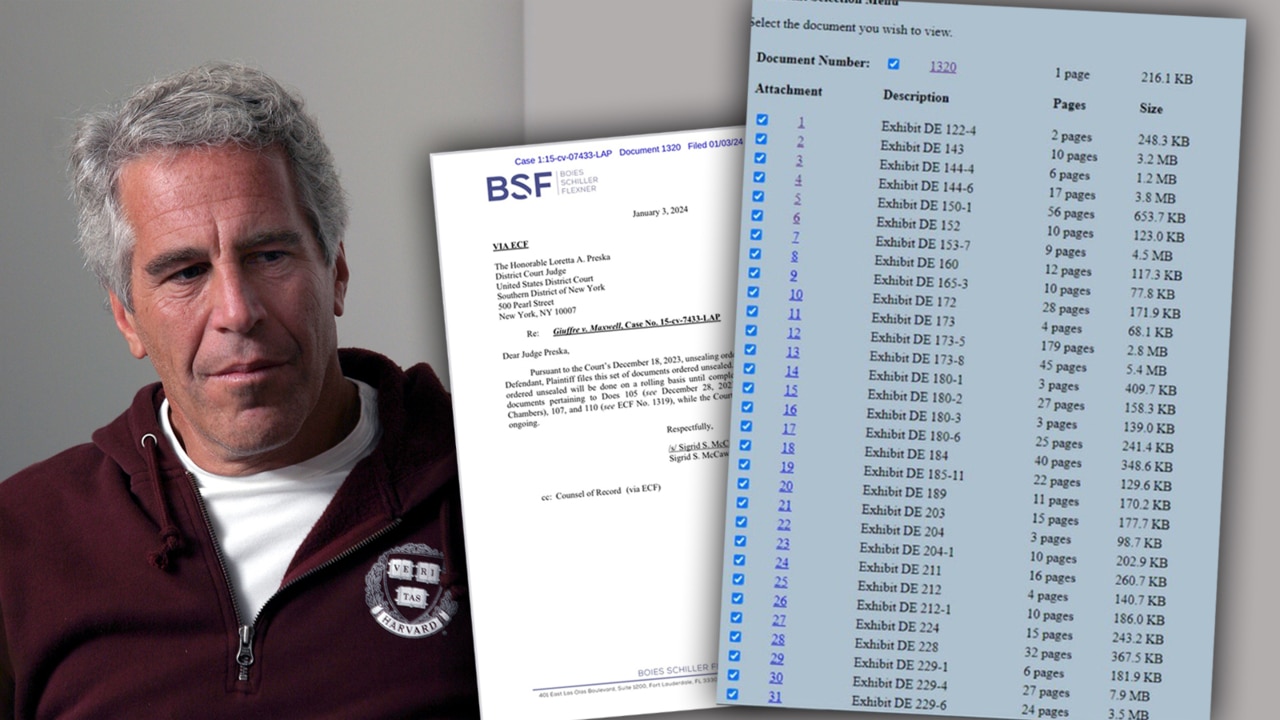

Pam Bondis Planned Release Of Documents Related To Epstein Diddy Jfk And Mlk

May 09, 2025

Pam Bondis Planned Release Of Documents Related To Epstein Diddy Jfk And Mlk

May 09, 2025 -

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025

Pam Bondi Epstein Diddy Jfk Mlk Documents Imminent Release

May 09, 2025 -

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025

Examining The Epstein Case Ag Pam Bondis Decision And Transparency

May 09, 2025