Will Trump's 100-Day Speech Impact Bitcoin's Price? A Prediction

Table of Contents

Trump's 100-Day Speech: Economic Themes and Bitcoin's Sensitivity

Trump's 100-day speech focused heavily on key economic themes that could indirectly, yet significantly, influence Bitcoin's price. These themes weren't directly about cryptocurrencies, but their ripple effects on the broader financial landscape are undeniable.

-

Focus on Deregulation: Trump's emphasis on deregulation across various sectors could potentially boost investor confidence, leading to a "risk-on" environment where investors are more willing to allocate capital to higher-risk assets, including Bitcoin. Less regulatory scrutiny could also encourage greater institutional investment in the cryptocurrency market.

-

Infrastructure Spending Plans: Massive infrastructure projects require substantial funding, potentially leading to increased inflation. Inflation can, in turn, drive investors towards Bitcoin as a hedge against inflation, increasing demand and pushing up the price.

-

Tax Policy Changes: Changes to capital gains taxes, for example, could significantly impact investment decisions in cryptocurrencies. Lower taxes might incentivize more investment, while higher taxes could have the opposite effect. Understanding the nuances of these changes is key to predicting the Bitcoin price reaction.

-

Trade Policy Shifts: Trump's trade policies, including tariffs and trade wars, could significantly affect global capital flows and ultimately Bitcoin adoption. Increased uncertainty in global markets might drive investors toward the perceived safety and decentralization of Bitcoin.

These themes could influence Bitcoin's price through:

-

Investor Sentiment Shifts: A positive outlook on Trump's economic policies could create a "risk-on" environment, benefiting Bitcoin. Conversely, negative sentiment could lead to a "risk-off" environment, driving investors towards safer assets and potentially depressing Bitcoin's price.

-

Changes in the US Dollar's Value: Trump's economic policies could influence the value of the US dollar. A weakening dollar could make Bitcoin, priced in USD, more attractive to international investors, increasing demand.

-

Impact on Overall Market Volatility: The uncertainty surrounding Trump's policies could increase overall market volatility, making Bitcoin, known for its volatility, even more susceptible to price swings.

Historical Context: Presidential Speeches and Cryptocurrency Market Reactions

Examining past instances where presidential speeches or policy announcements impacted Bitcoin provides valuable context. While a direct comparison to Trump's 100-day speech is difficult due to the relatively nascent nature of the cryptocurrency market at that time, we can analyze broader trends:

-

Examples of Positive or Negative Reactions: Announcements related to regulatory clarity have historically led to positive price movements in Bitcoin, while announcements hinting at stricter regulation have often resulted in negative reactions.

-

Factors Driving Reactions: These reactions are driven by several factors including the specific content of the announcement, the market's existing sentiment, and the overall macroeconomic environment. News coverage and social media also play significant roles in amplifying these reactions.

-

Unpredictable Nature of the Cryptocurrency Market: It's crucial to remember that the cryptocurrency market is inherently volatile and unpredictable. Presidential speeches are just one of many factors influencing Bitcoin's price.

Market Sentiment and Speculation Surrounding Trump's Policies

Market sentiment toward Trump's presidency significantly influenced Bitcoin's price before and after his 100-day speech.

-

Role of Social Media and News Coverage: Social media and mainstream news played a pivotal role in shaping public opinion and influencing investor decisions regarding Bitcoin. Positive news surrounding Trump's economic agenda could lead to increased interest in Bitcoin, while negative news could create uncertainty.

-

Influence of Large Institutional Investors and Crypto Whales: The actions of large institutional investors and "whales" (individuals holding significant amounts of Bitcoin) can significantly impact the price. Their trading activity can amplify existing market trends, further magnifying the impact of Trump's speech.

-

Trading Volume and Price Volatility: Increased trading volume around the time of the speech would indicate heightened interest and potential price volatility. Analyzing this data can offer insights into the market's reaction.

The speech likely either reinforced or altered pre-existing market expectations regarding Trump's economic policies and their potential impact on Bitcoin.

Predicting the Impact: A Probabilistic Approach

Precisely predicting Bitcoin's price is inherently challenging.

-

High Volatility: Bitcoin's price is famously volatile, making accurate predictions extremely difficult. Many factors beyond political speeches influence its price.

-

Multiple Influencing Factors: Numerous factors beyond presidential speeches, including technological advancements, regulatory changes, and overall market sentiment, influence Bitcoin's price.

-

Technical Analysis: Combining technical analysis (chart patterns, trading volume) with fundamental analysis (economic factors, policy announcements) is crucial for a more holistic prediction.

Based on different scenarios, we can consider a range of potential outcomes: from a slight price increase due to increased investor confidence to a significant drop if the speech triggered negative market sentiment.

Conclusion

While pinpointing the exact impact of Trump's 100-day speech on Bitcoin's price is challenging due to the volatile nature of the cryptocurrency market and numerous influencing factors, the speech's economic themes—particularly regarding deregulation, infrastructure spending, and trade—could have indirectly affected investor sentiment and market behavior. Considering various factors beyond the speech itself, such as market sentiment and technical analysis, is crucial for a comprehensive understanding.

Understanding the complex interplay between political events and cryptocurrency markets is crucial for navigating this dynamic space. Stay informed about upcoming policy announcements and their potential impact on Bitcoin's price. Continue researching and learning more about how political events affect the value of Bitcoin and other cryptocurrencies to make informed investment decisions. Keep analyzing the relationship between Trump's policies and Bitcoin's price for a deeper understanding of this complex interaction.

Featured Posts

-

Skuadra E Psg Se 11 Lojtaret Qe Shkelqejne

May 09, 2025

Skuadra E Psg Se 11 Lojtaret Qe Shkelqejne

May 09, 2025 -

Viral Podcast Ignites Daycare Debate Psychologists Claims Face Scrutiny

May 09, 2025

Viral Podcast Ignites Daycare Debate Psychologists Claims Face Scrutiny

May 09, 2025 -

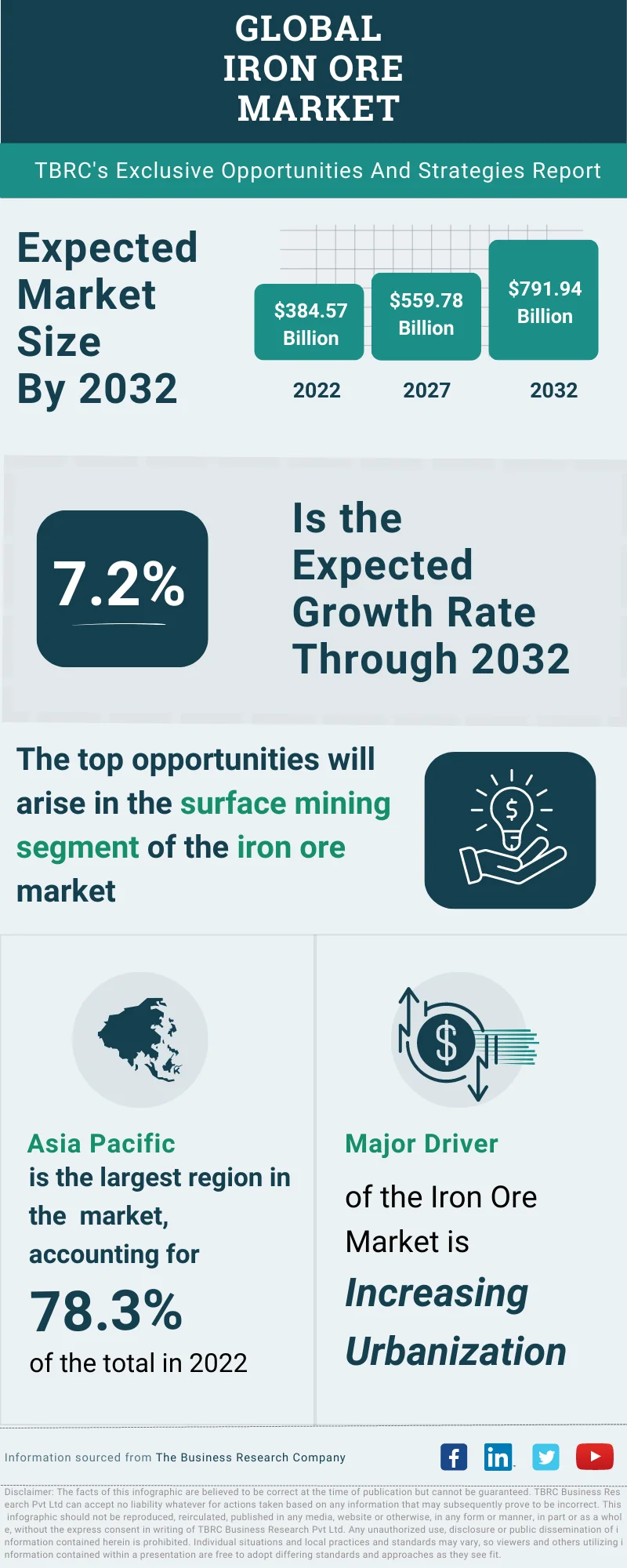

Iron Ore Market Volatility The Role Of Chinas Steel Production Cuts

May 09, 2025

Iron Ore Market Volatility The Role Of Chinas Steel Production Cuts

May 09, 2025 -

I Klimatiki Allagi Kai Ta Xamila Xionia Sta Imalaia

May 09, 2025

I Klimatiki Allagi Kai Ta Xamila Xionia Sta Imalaia

May 09, 2025 -

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025

Latest Posts

-

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025

High Potential Still A Psych Spiritual Powerhouse 11 Years On

May 09, 2025 -

High Potential Finale Two Actors From 7 Year Old Abc Series Reunite

May 09, 2025

High Potential Finale Two Actors From 7 Year Old Abc Series Reunite

May 09, 2025 -

High Potential Analyzing The Risky Season 1 Finale And Its Success

May 09, 2025

High Potential Analyzing The Risky Season 1 Finale And Its Success

May 09, 2025 -

The Impact Of High Potentials Season 1 Finale On Abc

May 09, 2025

The Impact Of High Potentials Season 1 Finale On Abc

May 09, 2025 -

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025