Is This Hot New SPAC Stock The Next MicroStrategy? Investor Analysis

Table of Contents

Understanding the SPAC's Business Model and Bitcoin Strategy

[Insert SPAC Ticker Symbol Here]'s initial public offering (IPO) aimed to raise capital for the acquisition of a company operating within the burgeoning Bitcoin ecosystem. The SPAC's stated goal is to identify and merge with a business significantly involved in Bitcoin mining, blockchain technology, or a related sector. This strategy differs from MicroStrategy's direct Bitcoin purchases; [Insert SPAC Ticker Symbol Here] aims for indirect exposure through acquiring a company actively engaged in the Bitcoin industry.

This approach presents both advantages and disadvantages. While potentially offering a more diversified exposure to the crypto market, the success hinges on the acquired company's performance. MicroStrategy, on the other hand, directly holds Bitcoin, offering greater control but with higher exposure to Bitcoin's price volatility.

- SPAC's target acquisition sector: Bitcoin mining, blockchain infrastructure, or Bitcoin-related services.

- The SPAC's management team and their experience: [Insert details about the management team and their relevant experience. Highlight any experience in finance, technology, or the cryptocurrency sector.]

- The SPAC's financial projections and risk factors: [Insert details about the SPAC's financial projections, including revenue forecasts, profitability targets, and identified risk factors. Link these projections to potential Bitcoin price movements.]

- Comparison of the SPAC's market capitalization to MicroStrategy's: [Provide a comparison, highlighting the relative size and valuation of the two companies.]

Financial Performance and Valuation Analysis

Currently, [Insert SPAC Ticker Symbol Here] is a cash shell, with its financial performance solely dependent on its future acquisition. Analyzing its potential requires scrutinizing the target company’s financials. Post-merger, evaluating the performance will involve examining key financial metrics like revenue growth, profitability margins, and debt levels. The valuation will depend on factors such as the acquired company's market position, technological innovation, and competitive landscape.

The potential return on investment (ROI) is highly sensitive to Bitcoin's price. Bullish scenarios, where Bitcoin's price appreciates significantly, could lead to substantial returns. However, bearish market conditions could result in significant losses.

- Key financial ratios and metrics: [Provide examples of key financial metrics to be monitored post-merger, like revenue growth, EBITDA margin, and Price-to-Earnings ratio.]

- Comparison to similar SPACs or Bitcoin-related companies: [Compare the SPAC's valuation and potential returns with similar companies in the market.]

- Risk assessment: market volatility, regulatory changes, etc.: [Detail the risks associated with investing in the SPAC, particularly focusing on Bitcoin price volatility, regulatory uncertainty, and competition.]

- Potential upside and downside scenarios: [Outline different scenarios based on varying Bitcoin prices and market conditions.]

Market Sentiment and Investor Perception

Market sentiment towards [Insert SPAC Ticker Symbol Here] and Bitcoin is crucial. News articles, social media chatter, and analyst reports provide valuable insights. Positive sentiment, fueled by bullish Bitcoin predictions and successful acquisitions within the crypto space, could boost the SPAC's stock price. Conversely, negative sentiment, perhaps triggered by regulatory crackdowns or a Bitcoin price crash, could lead to significant price declines. Comparing the investor sentiment surrounding this SPAC to that of MicroStrategy will offer valuable context.

- Recent news affecting the SPAC's stock price: [Summarize recent news and events impacting the SPAC's stock price.]

- Social media sentiment analysis (positive/negative): [Analyze social media sentiment, noting the proportion of positive and negative comments.]

- Analyst ratings and price targets: [Summarize analyst ratings and price targets for the SPAC.]

- Comparison of investor sentiment to MicroStrategy's stock: [Compare the investor sentiment towards the SPAC with that surrounding MicroStrategy.]

Risks and Potential Downsides

Investing in SPACs inherently carries risks, amplified by the volatility of Bitcoin. Regulatory hurdles, both for SPACs and cryptocurrencies, present significant challenges. Technological disruptions, competition within the Bitcoin mining and blockchain space, and the inherent risk of the target company failing to meet expectations, are all factors to consider. Diversification and careful risk management are paramount.

- Specific risks related to the SPAC's target acquisition: [Detail specific risks associated with the SPAC's planned acquisition.]

- Bitcoin price volatility risk: [Highlight the substantial risk associated with Bitcoin's price fluctuations.]

- Regulatory uncertainty surrounding cryptocurrencies: [Discuss potential regulatory changes affecting the cryptocurrency industry and the SPAC.]

- Competition in the Bitcoin mining/blockchain space: [Analyze the competitive landscape and the SPAC's ability to compete effectively.]

Conclusion: Is This Hot New SPAC Stock the Next MicroStrategy? A Final Verdict

This analysis reveals that while [Insert SPAC Ticker Symbol Here] presents an intriguing opportunity to gain exposure to the Bitcoin market, it’s far from a guaranteed path to MicroStrategy-like success. The similarities lie in the pursuit of Bitcoin-related opportunities, but the strategies differ significantly. The SPAC’s success hinges on the successful identification and integration of a viable target company.

Before making any investment decisions, thorough due diligence is critical. Consider the risks involved, carefully evaluate the SPAC’s financial projections, and assess market sentiment. Is this SPAC the next MicroStrategy? Only time will tell, but a cautious and well-informed approach is essential. Conduct your own comprehensive research before investing in this hot new SPAC stock and its Bitcoin strategy. Remember, a deep understanding of the risks involved is crucial for informed investment decisions in the dynamic world of SPACs and Bitcoin. Consider consulting a financial advisor before making any investment decisions related to this SPAC stock analysis: MicroStrategy comparison.

Featured Posts

-

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025

The Ripple Effect Analyzing Xrps 400 Growth And Future Potential

May 08, 2025 -

Increased Lahore Zoo Ticket Prices Minister Aurangzebs Explanation

May 08, 2025

Increased Lahore Zoo Ticket Prices Minister Aurangzebs Explanation

May 08, 2025 -

Prelazna Vlada Reakcija Pavla Grbovica Na Predlozene Opcije

May 08, 2025

Prelazna Vlada Reakcija Pavla Grbovica Na Predlozene Opcije

May 08, 2025 -

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025

Sarkisian Offers Injury Update On Texas Longhorns Spring Practice

May 08, 2025 -

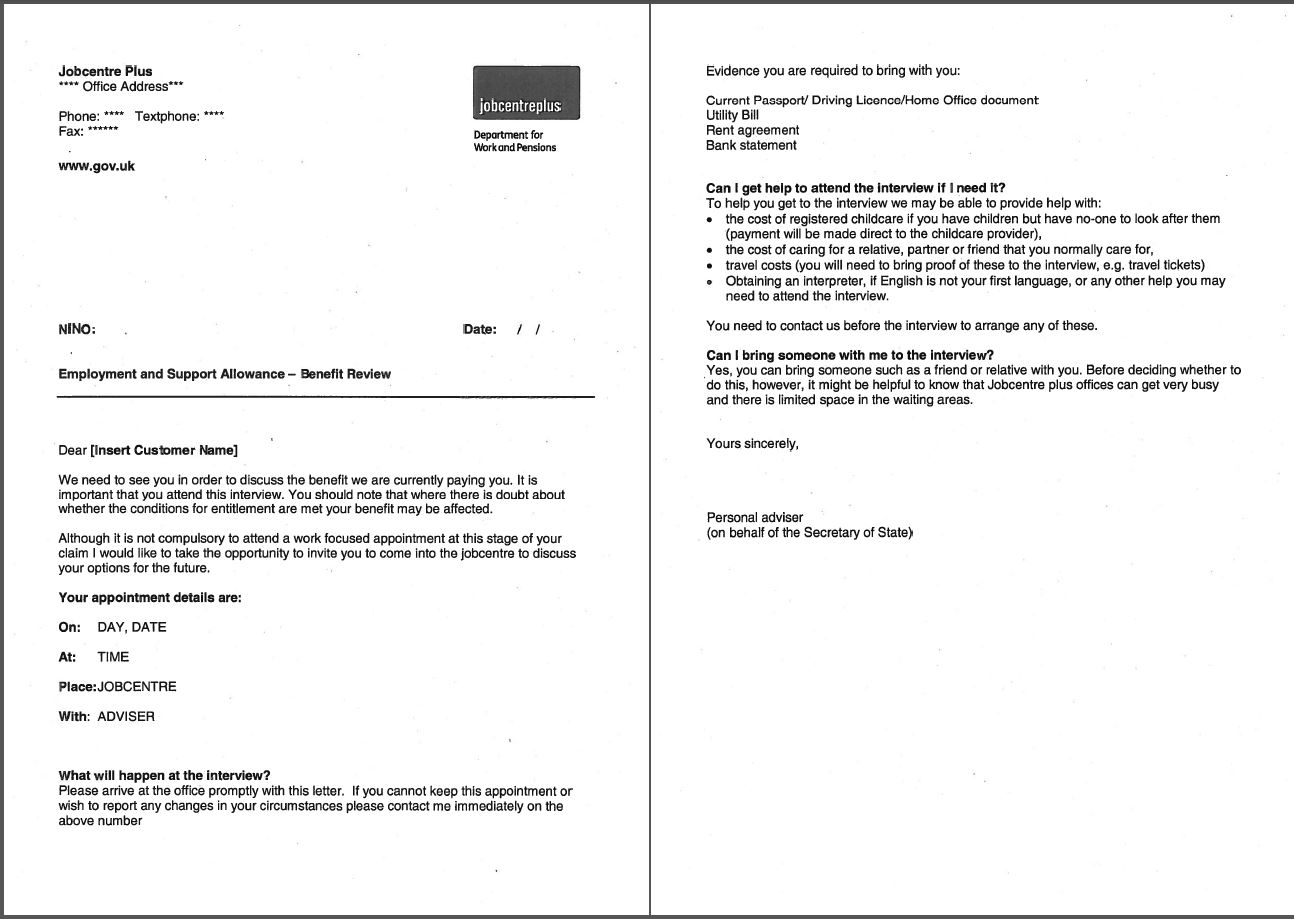

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025

Latest Posts

-

El Emotivo Gesto De Erick Pulgar Que Cautiva A Los Hinchas Del Flamengo

May 08, 2025

El Emotivo Gesto De Erick Pulgar Que Cautiva A Los Hinchas Del Flamengo

May 08, 2025 -

Nzal Marakana Barbwza Ydfe Thmn Alshrast Bfqdan Asnanh

May 08, 2025

Nzal Marakana Barbwza Ydfe Thmn Alshrast Bfqdan Asnanh

May 08, 2025 -

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Copa Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Gesto De Erick Pulgar Un Acto Que Conmueve A La Aficion Del Flamengo

May 08, 2025

Gesto De Erick Pulgar Un Acto Que Conmueve A La Aficion Del Flamengo

May 08, 2025 -

Brasileirao Jugador Argentino Recibe Suspension De Un Mes

May 08, 2025

Brasileirao Jugador Argentino Recibe Suspension De Un Mes

May 08, 2025