The Ripple Effect: Analyzing XRP's 400% Growth And Future Potential

Table of Contents

XRP's Recent Price Surge: A Deep Dive

Analyzing the Factors Contributing to the 400% Growth:

XRP's remarkable 400% price increase isn't a random event; it's the result of a confluence of factors. Let's dissect the key drivers:

-

Increased Institutional Adoption: Several large financial institutions are increasingly exploring and adopting Ripple's technology for cross-border payments. While specific details are often kept confidential due to competitive reasons, the growing interest from this sector is undeniably a major catalyst for XRP's price appreciation.

-

Growing Partnerships with Financial Institutions: Ripple has strategically forged partnerships with numerous banks and financial institutions globally. These partnerships, showcasing the real-world application of RippleNet, bolster confidence in XRP and its underlying technology. Examples include partnerships with major banks in the US, Europe, and Asia (specific examples would be added here if publicly available).

-

Positive Regulatory Developments: While the SEC lawsuit casts a shadow, some positive regulatory developments in certain jurisdictions are fostering a more favorable environment for XRP adoption. The evolving global regulatory landscape continues to be a key factor shaping XRP’s future.

-

Technical Upgrades and Improvements to the RippleNet network: Constant improvements to RippleNet's speed, efficiency, and scalability contribute to its attractiveness for financial institutions and consequently, to the demand for XRP. Upgrades often lead to increased transaction volume and network usage, potentially influencing XRP's price.

-

Market Sentiment and Overall Crypto Market Trends: The broader cryptocurrency market's positive sentiment, along with increasing interest in blockchain technology, contributes to XRP's price appreciation. However, XRP's growth also reflects a more specific market sentiment directly related to Ripple's progress and legal battles.

-

Specific Price Movements: (This section would include bullet points detailing specific price movements and significant dates, accompanied by charts and graphs showing price trends). For example: "On [Date], XRP reached a high of [Price] following [Event]."

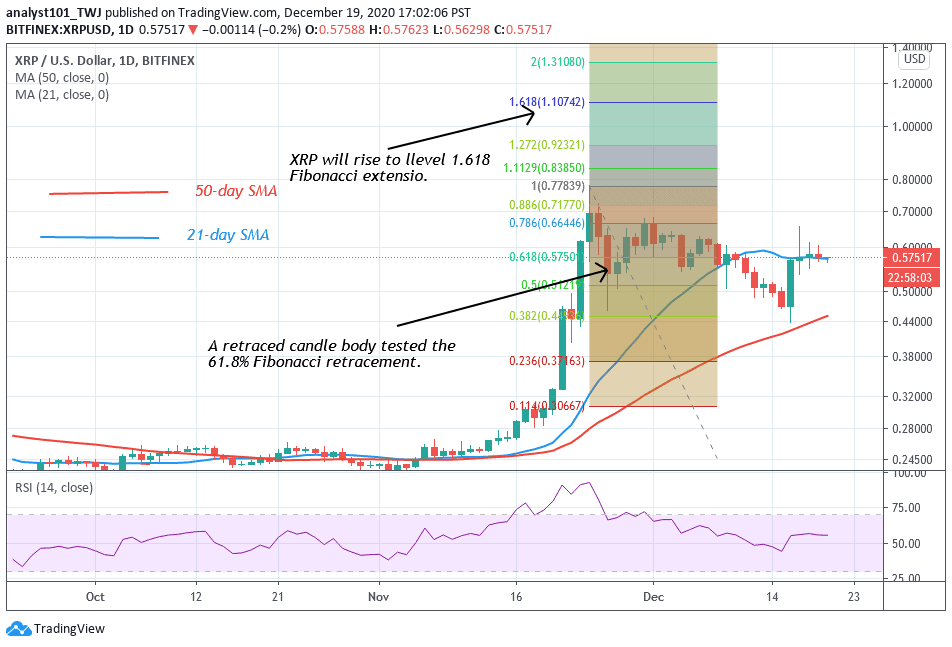

Technical Analysis of XRP's Chart:

(This section would incorporate relevant charts and graphs illustrating price trends, support and resistance levels, and key indicators like RSI and MACD, with detailed explanations of their implications for XRP's price).

Understanding Ripple's Technology and its Role in XRP's Success

RippleNet and its Impact on Cross-Border Payments:

RippleNet revolutionizes cross-border payments by offering a faster, cheaper, and more transparent alternative to traditional banking systems. Its key features include:

- Near real-time settlement: Transactions are processed much faster than traditional methods.

- Reduced fees: Lower transaction costs compared to SWIFT and other traditional systems.

- Enhanced transparency: Increased visibility and traceability of transactions.

- Improved security: Utilizing blockchain technology for enhanced security and reliability.

These advantages make RippleNet an attractive proposition for financial institutions seeking to streamline their international payment operations.

XRP's Function within the Ripple Ecosystem:

XRP serves as a bridge currency within the Ripple ecosystem, facilitating faster and more efficient transactions on RippleNet. It acts as a liquidity provider, enabling seamless conversions between different fiat currencies. This unique role is crucial for RippleNet's functionality and contributes to the demand for XRP.

Navigating the Regulatory Landscape for XRP

The SEC Lawsuit and its Implications:

The ongoing legal battle between Ripple and the SEC remains a significant factor influencing XRP's price and future. The lawsuit's outcome will have a profound impact on the regulatory landscape for XRP and the entire cryptocurrency market. (This section needs a concise summary of the case and potential outcomes).

Regulatory Developments Around the Globe:

The regulatory environment for cryptocurrencies varies significantly across countries. While some countries are adopting a more progressive approach, others remain cautious. The evolving regulatory landscape poses both challenges and opportunities for XRP's global adoption. (This section needs details on how different countries are regulating crypto, focusing on XRP).

Predicting XRP's Future Potential: Opportunities and Challenges

Factors Contributing to Future Growth:

Several factors could contribute to XRP's future growth:

- Increased adoption by financial institutions: Continued expansion of RippleNet's user base among banks and financial institutions.

- Expansion of RippleNet into new markets: Reaching new geographic regions and market segments.

- Technological advancements and improvements to the Ripple ecosystem: Enhancing RippleNet's capabilities and user experience.

- Positive resolution of the SEC lawsuit: A favorable outcome could significantly boost investor confidence.

Potential Risks and Challenges:

Despite its potential, XRP faces certain risks and challenges:

- Continued regulatory uncertainty: The evolving regulatory landscape poses ongoing risks.

- Competition from other payment solutions: Other blockchain-based payment solutions pose competitive pressure.

- Market volatility and overall crypto market trends: The cryptocurrency market's inherent volatility can impact XRP's price.

Conclusion

XRP's recent 400% growth reflects a confluence of factors, including increased institutional adoption, strategic partnerships, technical upgrades, and broader market sentiment. However, the regulatory landscape, particularly the SEC lawsuit, remains a significant factor influencing its future. Understanding RippleNet's technology, XRP's role within the ecosystem, and the regulatory challenges is crucial for navigating the complexities of this digital asset. While the future of XRP remains uncertain, thorough research on XRP and its ecosystem is essential for making informed investment decisions. Continue your research on XRP and make informed investment decisions.

Featured Posts

-

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025

Hargreaves Predicts Winner Arsenal Or Psg In Champions League Final

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025 -

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025

Can Xrp Hit 3 40 Analyzing Ripples Resistance Levels

May 08, 2025 -

Kripto Lider In Oezellikleri Ve Gelecegi Yatirimcilar Icin Bir Rehber

May 08, 2025

Kripto Lider In Oezellikleri Ve Gelecegi Yatirimcilar Icin Bir Rehber

May 08, 2025 -

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025

How To Watch Oklahoma City Thunder Vs Houston Rockets Game Preview And Betting Tips

May 08, 2025

Latest Posts

-

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025

Dwp Overhaul Universal Credit Changes And Potential Loss Of Benefits

May 08, 2025 -

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025

Dwp Increases Home Visits For Benefit Claimants Impact And Concerns

May 08, 2025 -

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025

Saglik Bakanligi Personel Alimi 37 Bin Kisi Icin Son Basvuru Tarihleri Yaklasiyor

May 08, 2025 -

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025

Acil Saglik Bakanligi 37 Bin Personel Aliyor Basvuru Sartlari Ve Nasil Basvurulur

May 08, 2025