Japan Trading House Shares Surge: Berkshire Hathaway's Long-Term Investment

Table of Contents

Berkshire Hathaway's Strategic Investment in Japanese Trading Houses

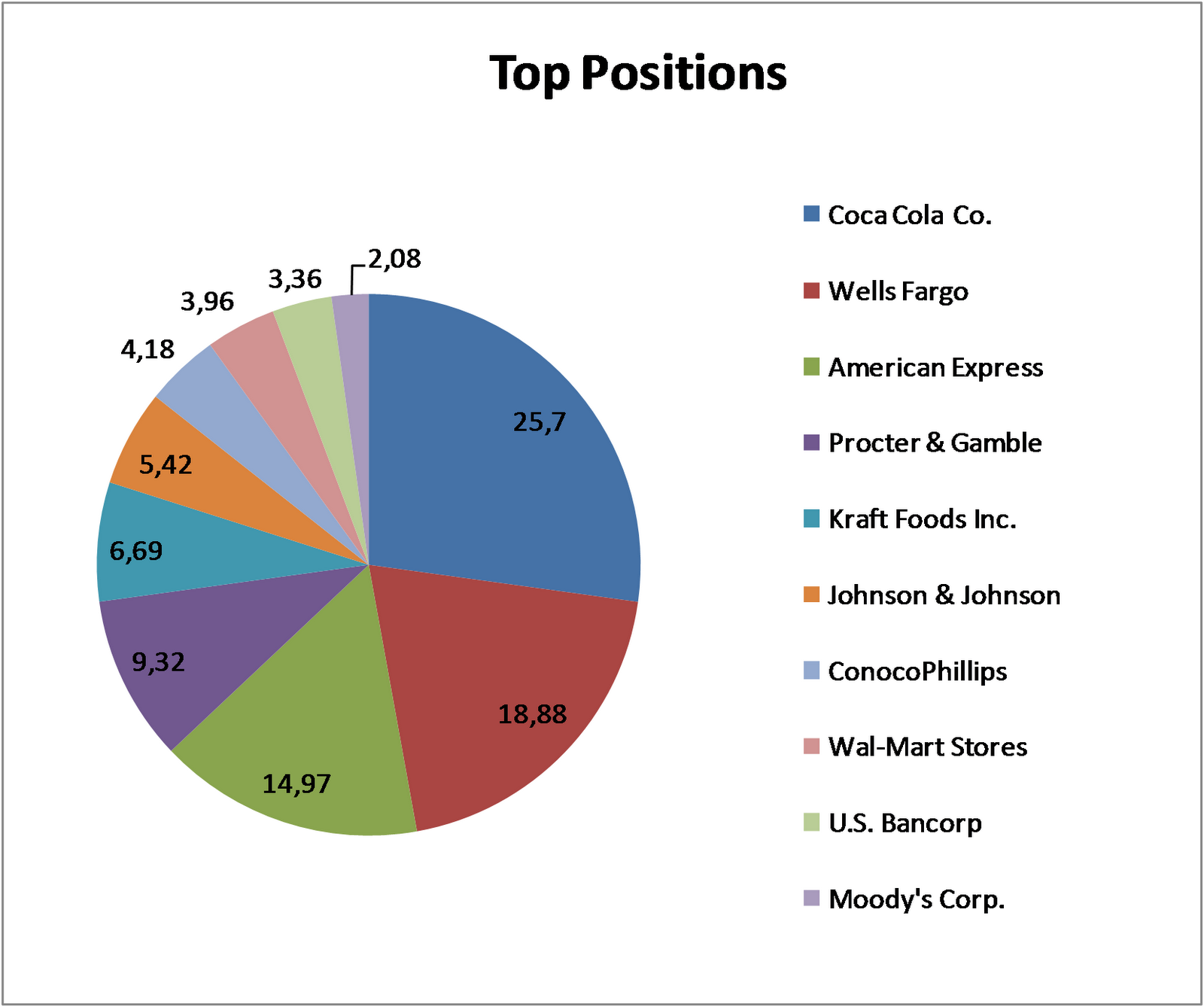

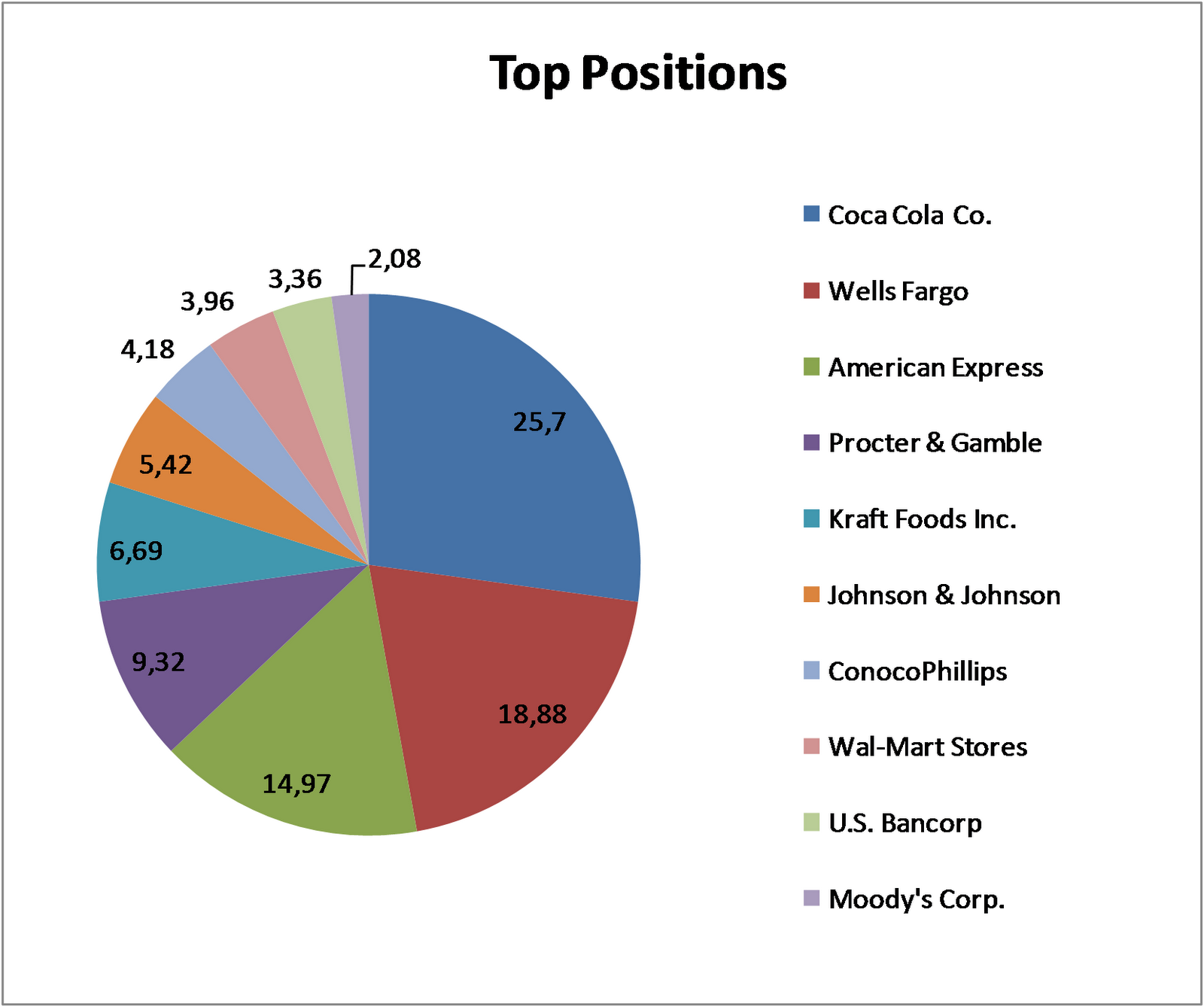

Berkshire Hathaway's significant investment in five major Japanese trading houses has sent shockwaves through the global financial markets. This bold move by Warren Buffett, the legendary investor, signifies a strong vote of confidence in these often-overlooked companies and their potential for long-term growth.

- The Companies: Berkshire Hathaway invested in five prominent Japanese trading houses: Mitsubishi Corporation, Mitsui & Co., Itochu Corporation, Sumitomo Corporation, and Marubeni Corporation.

- Investment Size and Significance: The investment represents a substantial portion of Berkshire Hathaway's portfolio, demonstrating the scale of Buffett's commitment. This significant financial backing underscores the potential for substantial returns and has injected new life into the sector.

- Warren Buffett's Confidence: Warren Buffett's decision to invest heavily in these companies showcases his long-term vision and confidence in their ability to navigate global economic shifts and maintain profitability. This endorsement has significantly boosted investor sentiment.

The implications of this investment are far-reaching. It has elevated the profile of these Japanese trading companies on the global stage, attracting increased investor interest and scrutiny. This increased attention has led to a reassessment of their value, contributing to the surge in share prices. The sheer weight of Berkshire Hathaway's reputation has significantly increased investor confidence in these previously less-scrutinized companies.

Analyzing the Surge in Japanese Trading House Share Prices

While Berkshire Hathaway's investment undoubtedly played a crucial role, several other factors contributed to the recent surge in Japan trading house share prices.

- Rising Commodity Prices: The substantial increase in commodity prices globally has directly benefited these trading houses, boosting their profits significantly. They profit from the buying, selling, and transporting of raw materials and resources.

- Increased Global Demand: Growing global demand for resources such as energy, metals, and agricultural products has created a favorable environment for these companies to thrive. This elevated demand further drives profitability.

- Strong Japanese Economy: A relatively strong Japanese economy provides a supportive domestic market and enhances the overall operational environment for these companies. This stability is a key factor in investor confidence.

- Undervaluation: Before Berkshire Hathaway's investment, some analysts argued that these Japanese trading houses were undervalued compared to their global peers. This undervaluation represented a significant opportunity for savvy investors.

However, it's crucial to acknowledge the potential risks associated with this surge. Market volatility is inherent in any investment, and economic uncertainties – including geopolitical instability and potential shifts in global demand – could negatively impact share prices. Careful risk assessment is essential before investing.

The Future Outlook for Japanese Trading House Shares

The future outlook for Japanese trading house shares appears promising, but careful consideration of several factors is necessary.

- Long-Term Growth Potential: These companies operate in crucial sectors such as energy, metals, and food, which are expected to experience continued growth in the long term. This sector diversification mitigates some of the inherent risks.

- Strategic Acquisitions and Expansion: Many of these trading houses are actively pursuing strategic acquisitions and expansion opportunities, potentially leading to further growth and profitability. This proactive approach signals an optimistic outlook.

- Berkshire Hathaway's Continued Influence: Berkshire Hathaway's continued investment provides a strong foundation of stability and inspires confidence among other investors. This continued presence adds a layer of security to these investments.

- Geopolitical Risks and Competition: Geopolitical risks and increased competition from other global players represent potential challenges. Investors should carefully monitor these potential risks.

For long-term investors with a higher risk tolerance, Japanese trading house shares might present a compelling opportunity. However, short-term investors should proceed with caution due to inherent market volatility.

Alternative Investment Options in the Japanese Market

While Japanese trading house shares offer exciting potential, investors should consider diversifying their portfolios. The Japanese market presents various other attractive investment options.

- Other Promising Sectors: The Japanese economy shows promising growth in sectors such as technology, healthcare, and renewable energy. Diversification within the Japanese market itself is a key strategy.

- Diversification Strategies: A well-diversified portfolio minimizes risk and maximizes potential returns. Investors should consider spreading their investments across multiple asset classes and sectors.

- Risk and Reward Profiles: Different investment opportunities within the Japanese market offer varying risk and reward profiles. Investors must carefully evaluate their risk tolerance before making investment decisions.

Conclusion:

Berkshire Hathaway's significant investment in Japanese trading houses has undeniably triggered a surge in their share prices, highlighting the potential for lucrative long-term investments in the Japanese market. While the future holds both opportunities and challenges, understanding the factors driving this surge, and considering the long-term potential, is crucial for investors. If you're looking for substantial returns and are interested in exploring Japan trading house shares, now is an opportune time to conduct thorough research and consider the investment potential carefully. Don’t miss out on this exciting opportunity – explore the world of Japanese trading house shares today!

Featured Posts

-

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025

Oklahoma City Thunder Vs Memphis Grizzlies A Crucial Matchup

May 08, 2025 -

Bitcoin Rally Predicted Analysts May 6th Chart Interpretation

May 08, 2025

Bitcoin Rally Predicted Analysts May 6th Chart Interpretation

May 08, 2025 -

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025 -

The China Factor Examining The Automotive Industrys Dependence And Risks

May 08, 2025

The China Factor Examining The Automotive Industrys Dependence And Risks

May 08, 2025 -

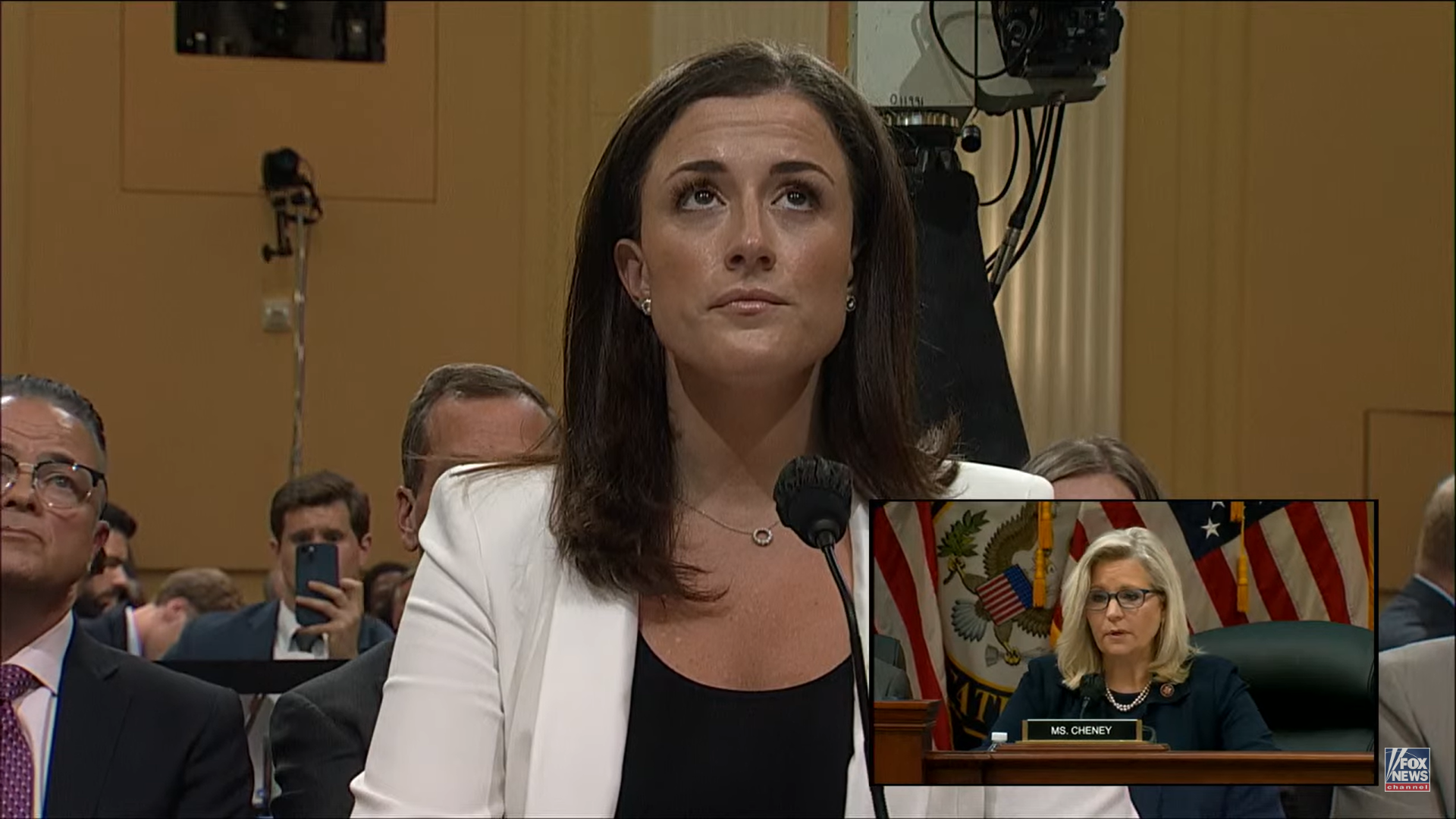

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025

Cassidy Hutchinsons Account Of January 6th A Forthcoming Memoir

May 08, 2025

Latest Posts

-

Latest Lottery Results Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025

Latest Lottery Results Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025 -

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Lottery Results

May 08, 2025

Winning Numbers Lotto Lotto Plus 1 And Lotto Plus 2 Lottery Results

May 08, 2025 -

April 16 2025 Lottery Results Check Winning Numbers

May 08, 2025

April 16 2025 Lottery Results Check Winning Numbers

May 08, 2025 -

Lotto Plus 1 And Lotto Plus 2 Winning Numbers Todays Latest Draw

May 08, 2025

Lotto Plus 1 And Lotto Plus 2 Winning Numbers Todays Latest Draw

May 08, 2025 -

Check Todays Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025

Check Todays Lotto Results Lotto Lotto Plus 1 And Lotto Plus 2

May 08, 2025