Japan's Central Bank Lowers Economic Growth Projection Due To Trade Tensions

Table of Contents

The Bank of Japan (BOJ) recently delivered a sobering assessment of Japan's economic future, lowering its growth projection significantly due to escalating trade tensions and growing global uncertainty. This decision underscores the considerable challenges facing Japan's economy and highlights the interconnectedness of the global marketplace. The implications are far-reaching, impacting not only Japan but also the broader global economic landscape. This analysis delves into the details of the BOJ's revised forecast, the impact of trade tensions, global uncertainties, and potential policy responses.

The Bank of Japan's Revised Growth Forecast

The BOJ revised its economic growth forecast downward, cutting the projection for the current fiscal year by 0.5 percentage points. This represents a significant shift from previous, more optimistic projections. The official BOJ statement cited a confluence of factors, primarily the intensification of trade disputes and the resulting uncertainty in the global economy. The revised forecast paints a picture of slower-than-anticipated economic expansion for Japan.

- Specific downward revision in GDP growth for the current fiscal year: The BOJ reduced its GDP growth projection from 1.0% to 0.5% for the fiscal year.

- Explanation of the methodology used by the BOJ for its projections: The BOJ employs a complex econometric model incorporating various economic indicators, including consumer spending, business investment, and export/import data.

- Mention any dissenting opinions within the BOJ regarding the forecast: While the overall consensus within the BOJ supported the downward revision, there were reportedly some members who advocated for an even more pessimistic outlook, reflecting the depth of concern regarding future economic growth.

Impact of Trade Tensions on Japan's Economy

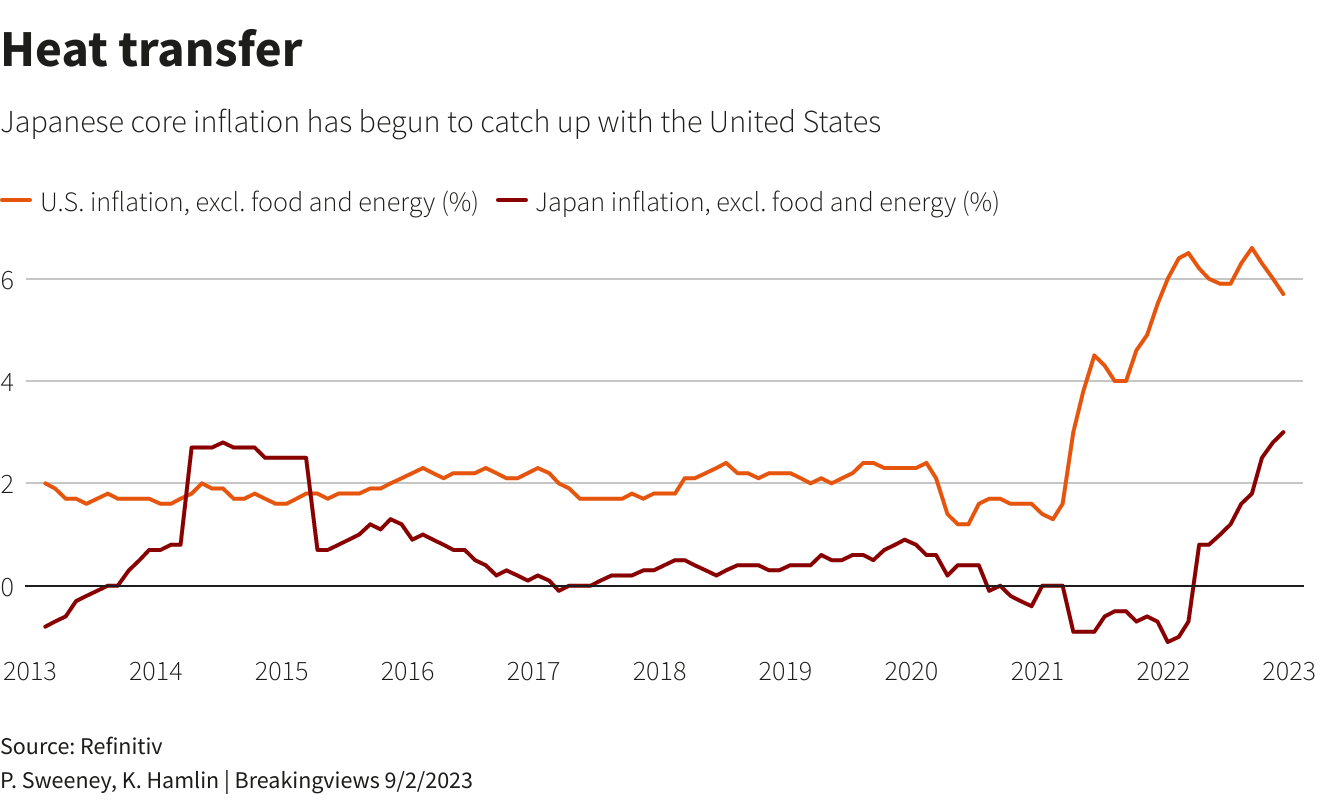

Trade disputes, particularly those involving major trading partners like the United States and China, are significantly impacting Japan's economy. The imposition of tariffs and trade barriers is directly hindering Japanese exports across various sectors. This is leading to decreased production, reduced investment, and ultimately, job losses.

- Decline in exports due to tariffs and trade barriers: Sectors such as automotive manufacturing and electronics have been particularly hard hit by reduced export demand resulting from tariffs and trade restrictions.

- Increased uncertainty affecting business investment decisions: The ongoing trade conflicts create an environment of considerable uncertainty, leading businesses to postpone or cancel investment projects. This dampens economic activity and growth.

- Weakening consumer spending due to economic anxieties: Growing uncertainty about the economic future is causing Japanese consumers to reduce their spending, further weakening overall economic performance.

- Specific examples of companies impacted by trade tensions: Several major Japanese automakers and electronics manufacturers have publicly acknowledged the negative impact of trade tensions on their sales and profits.

Global Uncertainty and its Role in the Downgrade

Beyond bilateral trade disputes, broader global uncertainties significantly contributed to the BOJ's decision to lower its growth projection. The slowing global growth rate, coupled with geopolitical risks in various regions, creates a precarious environment for the Japanese economy. The interconnectedness of the global economy means that events in other parts of the world can have substantial knock-on effects in Japan.

- Impact of global supply chain disruptions: Global supply chain disruptions, exacerbated by trade conflicts, are creating bottlenecks and increasing production costs for Japanese companies.

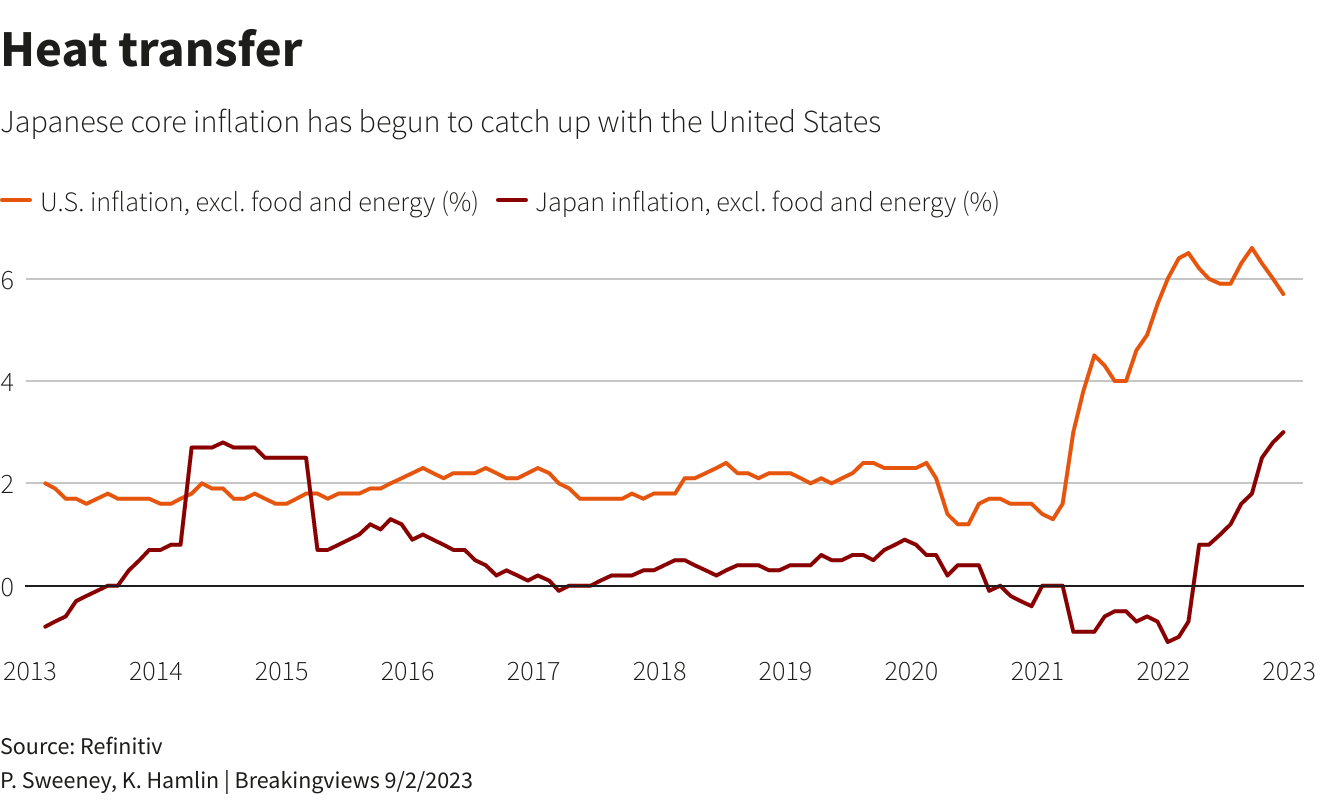

- Influence of fluctuating currency exchange rates: Fluctuations in the yen's exchange rate introduce added volatility and uncertainty into the economic outlook.

- Geopolitical risks and their effect on investor confidence: Geopolitical instability in different parts of the world erodes investor confidence, impacting investment flows into Japan.

Potential Policy Responses by the Bank of Japan

In response to the lowered growth projection, the BOJ may implement several monetary policy adjustments. These could include further interest rate cuts or expansions of quantitative easing programs to stimulate economic activity. However, the effectiveness of past interventions has been debated, highlighting the challenges facing the BOJ. Coordination with the Japanese government on fiscal stimulus measures is also a potential avenue.

- Possible further interest rate cuts: The BOJ could lower interest rates further to encourage borrowing and investment, but the potential for negative interest rates to negatively impact banks is also a consideration.

- Potential expansion of quantitative easing programs: The BOJ might expand its asset purchase programs to inject more liquidity into the economy.

- Coordination with the Japanese government on fiscal policy: Collaborative fiscal policy, such as government spending on infrastructure projects, could supplement monetary policy efforts.

Conclusion

The Bank of Japan's decision to lower its economic growth projection underscores the significant challenges facing Japan's economy. Escalating trade tensions and pervasive global uncertainty are major contributing factors. The potential policy responses, including monetary policy adjustments and fiscal stimulus, will be crucial in mitigating the negative impacts. The situation requires close monitoring and analysis. Stay updated on Japan's economic outlook by following the Bank of Japan's actions closely and learning more about the impact of trade tensions on Japan's economy. For further information, refer to the official Bank of Japan website and reputable financial news sources.

Featured Posts

-

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025

Frances Dominant Six Nations Victory A Warning To Ireland

May 02, 2025 -

A Look At Michael Sheens Charitable Giving The 1 Million Donation

May 02, 2025

A Look At Michael Sheens Charitable Giving The 1 Million Donation

May 02, 2025 -

Dallas And Carrie Actress Dies Daughter Amy Irvings Emotional Tribute

May 02, 2025

Dallas And Carrie Actress Dies Daughter Amy Irvings Emotional Tribute

May 02, 2025 -

Blay Styshn 6 Mwasfat Ser Wtarykh Alisdar Almtwqe

May 02, 2025

Blay Styshn 6 Mwasfat Ser Wtarykh Alisdar Almtwqe

May 02, 2025 -

Bank Of Canadas April Interest Rate Decision Impact Of Trump Tariffs

May 02, 2025

Bank Of Canadas April Interest Rate Decision Impact Of Trump Tariffs

May 02, 2025

Latest Posts

-

James B Partridges Stroud And Cheltenham Shows Dates And Venues

May 02, 2025

James B Partridges Stroud And Cheltenham Shows Dates And Venues

May 02, 2025 -

Bbcs 1bn Income Drop Unprecedented Problems Ahead

May 02, 2025

Bbcs 1bn Income Drop Unprecedented Problems Ahead

May 02, 2025 -

The Truth Behind The Nick Robinson And Emma Barnett Radio 4 Hosting Split

May 02, 2025

The Truth Behind The Nick Robinson And Emma Barnett Radio 4 Hosting Split

May 02, 2025 -

Finding Newsround On Bbc Two Hd A Simple Guide

May 02, 2025

Finding Newsround On Bbc Two Hd A Simple Guide

May 02, 2025 -

Ndcs Techiman South Election Petition Fails In High Court

May 02, 2025

Ndcs Techiman South Election Petition Fails In High Court

May 02, 2025