Jeanine Pirro's Stock Market Warning: Ignore The Market For Weeks?

Table of Contents

Understanding Jeanine Pirro's Concerns

Jeanine Pirro, known for her outspoken views and insightful commentary on political and social issues, often offers commentary on economic trends. While not a financial expert in the traditional sense, her perspectives are often rooted in a conservative, risk-averse approach to investing. Her current concerns about the stock market stem from a confluence of factors:

- Soaring Inflation: Pirro highlights the persistent threat of inflation, eroding purchasing power and potentially impacting corporate earnings. The continued rise in the consumer price index (CPI) is a major factor in her assessment.

- Aggressive Interest Rate Hikes: The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are another key concern. These hikes increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting stock valuations.

- Geopolitical Instability: The ongoing war in Ukraine, coupled with escalating tensions in other regions, introduces significant geopolitical risk. This uncertainty can trigger market volatility and negatively impact investor sentiment.

The Rationale Behind "Ignoring the Market"

Jeanine Pirro’s suggestion to “ignore the market” doesn't necessarily mean completely withdrawing from investments. It's more likely a recommendation to pause new investments and avoid impulsive trading decisions during this period of heightened uncertainty. The rationale behind this strategy is to:

- Minimize Losses: Waiting out a period of market volatility can help investors avoid significant losses that could occur during a downturn. By delaying investment decisions, you potentially sidestep immediate market corrections.

- Identify Better Entry Points: A period of market downturn can present opportunities to buy stocks at lower prices, creating better long-term value. A wait-and-see approach allows investors to capitalize on potential bargains once the market stabilizes.

- Reduce Emotional Decision-Making: Market volatility can trigger emotional reactions, leading to impulsive buying or selling decisions. By taking a step back, investors can make more rational, data-driven choices.

Alternative Perspectives and Expert Opinions

While Jeanine Pirro's stock market warning carries weight due to her public profile, it's crucial to consider alternative viewpoints. Many financial experts believe that the current market conditions present both risks and opportunities. Some argue that the recent dip represents a buying opportunity for long-term investors, while others recommend a more cautious approach depending on individual risk tolerance.

- Differing Market Predictions: Financial analysts hold vastly different predictions regarding future market performance. Some forecast continued volatility, while others anticipate a rebound in the near future.

- Long-Term vs. Short-Term Strategies: The optimal strategy heavily depends on an investor's time horizon. Long-term investors may view the current situation as a temporary setback, while short-term investors might need to reassess their portfolios more carefully.

- Divergent Opinions on Inflation and Interest Rates: The impact of inflation and interest rate hikes remains a subject of debate among financial experts. Some see these as temporary challenges, while others anticipate more prolonged consequences.

Practical Steps for Investors Considering Pirro's Advice

Investors considering Jeanine Pirro's stock market warning should take proactive steps to assess their situations:

- Portfolio Review: Carefully review your existing investment portfolio, evaluating the risk exposure of each asset.

- Risk Tolerance Reassessment: Re-evaluate your personal risk tolerance, understanding your comfort level with potential losses.

- Diversification Strategies: Ensure your portfolio is properly diversified across asset classes to mitigate risk.

- Seek Professional Advice: Consult a qualified financial advisor to discuss your options and create a personalized investment plan.

Conclusion: Weighing Jeanine Pirro's Stock Market Warning

Jeanine Pirro's stock market warning serves as a valuable reminder of the inherent risks involved in investing. While her advice to potentially ignore the market for weeks might resonate with some, it’s crucial to remember that every investor's situation is unique. Thoroughly assess your own risk tolerance, carefully consider Pirro's warning in the context of your financial goals, and make informed decisions about your investments. Remember that responsible investing involves a deep understanding of your personal circumstances and the market's complexities. Don't hesitate to seek professional financial guidance to navigate this period of market uncertainty and make the best decisions for your future.

Featured Posts

-

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025

Epstein Records Concealment Allegation Senate Democrats Target Pam Bondi

May 09, 2025 -

Yaroslavskaya Oblast Preduprezhdenie O Snegopadakh I Meteli

May 09, 2025

Yaroslavskaya Oblast Preduprezhdenie O Snegopadakh I Meteli

May 09, 2025 -

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025

Analysis Of Pam Bondis Comments Regarding The Death Of American Citizens

May 09, 2025 -

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025 -

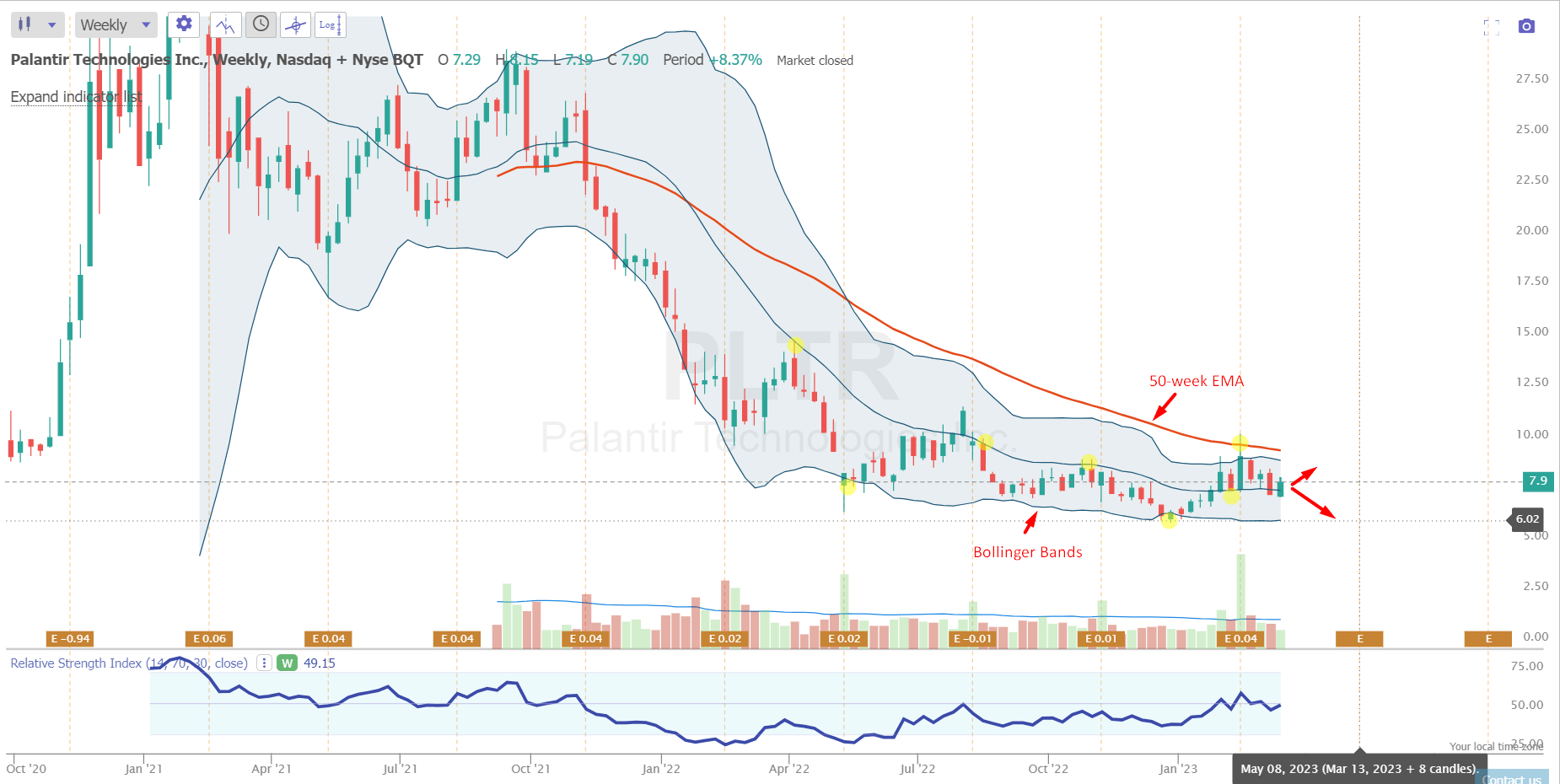

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Is Palantir Technologies Stock A Buy Now A Comprehensive Analysis

May 09, 2025

Latest Posts

-

The Casting Of David In High Potential Episode 13 An Analysis

May 10, 2025

The Casting Of David In High Potential Episode 13 An Analysis

May 10, 2025 -

High Potential Legacy And Continued Relevance In Psych Spiritual Development

May 10, 2025

High Potential Legacy And Continued Relevance In Psych Spiritual Development

May 10, 2025 -

Roman Fate Season 2 Potential Replacement Shows To Watch Before It Airs

May 10, 2025

Roman Fate Season 2 Potential Replacement Shows To Watch Before It Airs

May 10, 2025 -

Eleven Years Of High Potential Assessing Its Impact On Psych Spiritual Growth

May 10, 2025

Eleven Years Of High Potential Assessing Its Impact On Psych Spiritual Growth

May 10, 2025 -

High Potential Season 2 Release Date Episode Count And Renewal Status

May 10, 2025

High Potential Season 2 Release Date Episode Count And Renewal Status

May 10, 2025