Jim Cramer's Foot Locker (FL) Pick: A Genuine Winner?

Table of Contents

Cramer's Rationale Behind the Foot Locker Investment

Understanding Jim Cramer's rationale is crucial to evaluating the investment potential of Foot Locker. While specific quotes and the exact source of his recommendation require referencing the original broadcast or article (which should be linked here if available), we can generally outline the type of arguments he likely presented. Cramer's bullish stance probably stemmed from several factors:

-

Potential for Turnaround: Foot Locker has faced challenges in recent years, but Cramer might have identified signs of a potential turnaround, such as improved inventory management or successful new product launches. He might highlight efforts to enhance the customer experience, both online and in-store.

-

Brand Strength and Market Positioning: Foot Locker remains a recognizable brand with a strong presence in the athletic footwear and apparel market. Cramer may have pointed to the company's exclusive partnerships, leveraging its relationships with major brands like Nike and Adidas to secure unique product offerings.

-

Market Trends: The continued strength of the athleisure market and the growing sneaker resale market could have been cited as positive indicators for Foot Locker's future performance. Cramer might have highlighted Foot Locker's ability to capitalize on these trends.

Bullet Points:

- Key financial indicators Cramer may have emphasized could include improving same-store sales, increased online sales, or cost-cutting measures.

- Market trends Cramer may have mentioned include the enduring popularity of athletic footwear, particularly among younger demographics, and the increasing demand for limited-edition sneakers.

- Strategic initiatives such as Foot Locker's investments in its digital platform, loyalty programs, and omnichannel strategy were likely part of his assessment.

Foot Locker's Financial Performance and Prospects

To determine the validity of Cramer's recommendation, a thorough examination of Foot Locker's financial performance is necessary. While recent quarterly earnings reports should be consulted for precise data, we can discuss general aspects of the company's financial health.

-

Revenue Growth and Trends: Foot Locker's recent revenue growth has been a key metric for analysts. Growth may be inconsistent, showing periods of expansion and contraction depending on market conditions and consumer spending. Analyzing the trends in revenue growth is crucial in assessing future prospects.

-

Profitability Margins and Changes: Profit margins are directly influenced by factors like sales, cost of goods sold, operating expenses, and overall economic conditions. Foot Locker's profitability margins can indicate the effectiveness of its cost management strategies and the pricing power of its brand.

-

Debt Levels and Financial Health: High debt levels can pose a significant risk, particularly during economic downturns. Foot Locker's debt-to-equity ratio and credit ratings are important factors in evaluating its financial stability.

Challenges Facing Foot Locker:

- Competition: Intense competition from other athletic retailers, including online giants like Amazon, and increasingly from direct-to-consumer brands like Nike, poses a constant challenge.

- Changing Consumer Preferences: Shifts in consumer preferences, especially regarding fashion trends in athletic wear, require Foot Locker to adapt its offerings constantly.

- Supply Chain Issues: Global supply chain disruptions can significantly impact the availability of products and the company's ability to meet consumer demand.

Bullet Points:

- Key financial ratios such as the Price-to-Earnings (P/E) ratio and the debt-to-equity ratio offer valuable insights into Foot Locker's valuation and financial health.

- Upcoming product releases and strategic partnerships with popular brands can influence future sales and revenue growth.

- Comparing Foot Locker's financial performance to its industry benchmarks helps assess its relative strength and competitiveness.

Alternative Perspectives and Expert Opinions

It's crucial to consider alternative viewpoints before making an investment decision. While Cramer might be bullish, other analysts may hold dissenting opinions. Some might point to the continued competitive pressures, concerns about consumer spending, or macroeconomic factors such as inflation as reasons for caution.

Bullet Points:

- Criticisms of Cramer's recommendation may focus on the company's vulnerability to economic downturns or the challenges posed by e-commerce giants.

- Alternative investment options in the retail sector might offer more stable returns or higher growth potential, depending on risk tolerance.

- Potential downside risks include decreased consumer spending, increased competition, and supply chain disruptions. Mitigation strategies could involve diversification of investments and thorough risk assessment.

Technical Analysis of Foot Locker Stock (FL)

(Optional Section: If including technical analysis, insert charts and discuss relevant indicators like moving averages, RSI, and support/resistance levels. Clearly state the limitations of technical analysis and its reliance on past performance).

Conclusion

Jim Cramer's opinion on Foot Locker provides one perspective, but deciding whether FL is a "genuine winner" requires a thorough evaluation. Weighing the potential for a turnaround against the challenges facing the company, along with considering alternative viewpoints and conducting thorough due diligence, is essential. Remember to carefully analyze Foot Locker's financial performance, understand the competitive landscape, and consider the potential risks before making any investment decisions. Is Jim Cramer right about Foot Locker? Do your own research and decide if Foot Locker (FL) is a genuine winner for your portfolio. Learn more about Foot Locker's financials and market position before making an investment decision.

Featured Posts

-

Jalen Brunson Vs Luka Doncic Trade Assessing The Long Term Impact On The Dallas Mavericks

May 15, 2025

Jalen Brunson Vs Luka Doncic Trade Assessing The Long Term Impact On The Dallas Mavericks

May 15, 2025 -

Nhl Referee Technology The Impact Of Apple Watches

May 15, 2025

Nhl Referee Technology The Impact Of Apple Watches

May 15, 2025 -

Ai Digest Creating Engaging Podcasts From Tedious Scatological Data

May 15, 2025

Ai Digest Creating Engaging Podcasts From Tedious Scatological Data

May 15, 2025 -

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025

Actie Tegen Npo Baas Frederieke Leeflang Wat Staat Er Op Het Spel

May 15, 2025 -

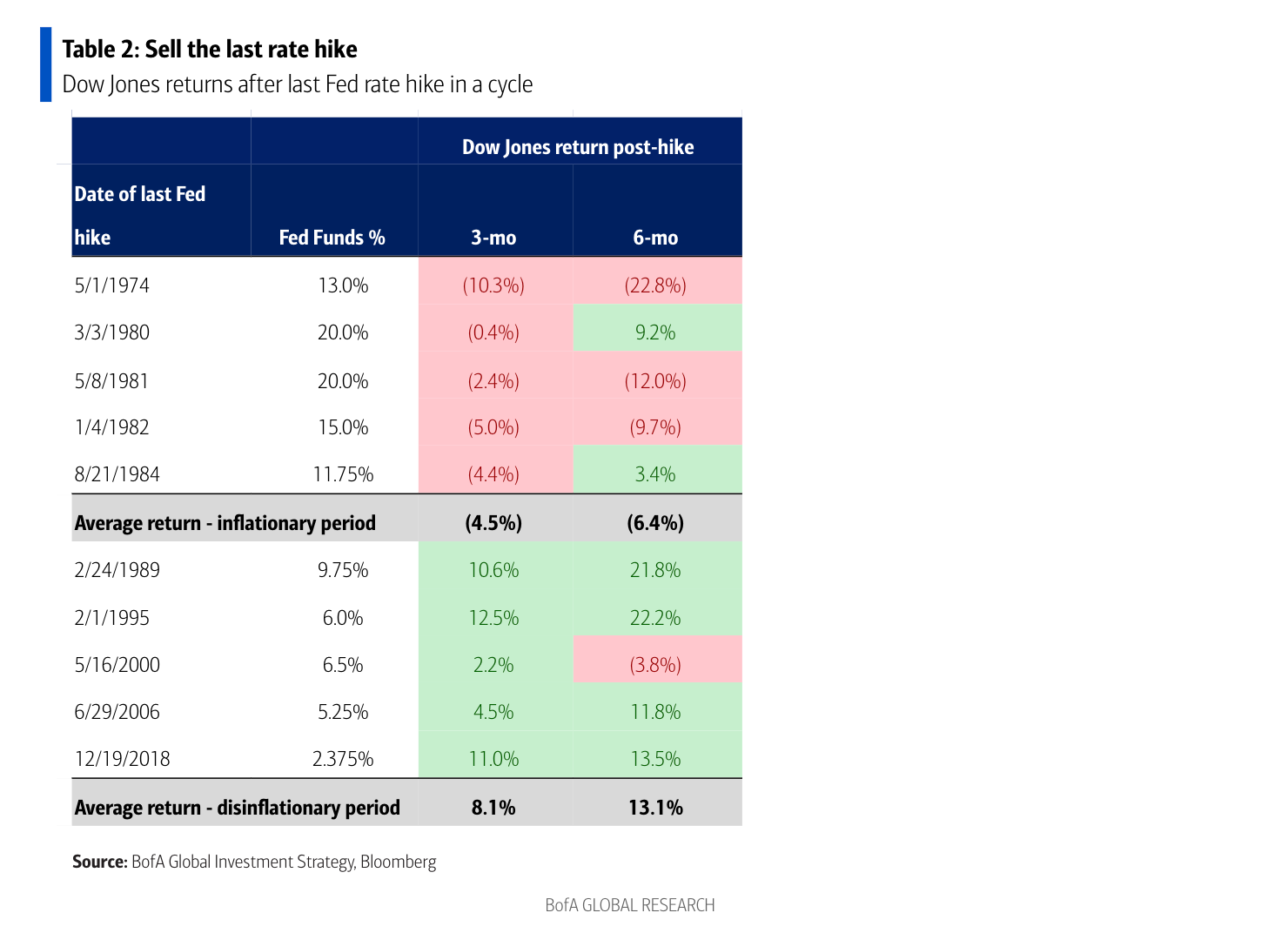

Stock Market Valuation Concerns Bof A Offers Reassurance

May 15, 2025

Stock Market Valuation Concerns Bof A Offers Reassurance

May 15, 2025