Kato's Stance: US Treasuries Off The Table In Trade Discussions

Table of Contents

Kato's Rationale: Why US Treasuries are off the negotiating table.

Kato's decision to remove US Treasuries from trade discussions is rooted in several key factors, reflecting a reassessment of Japan's economic and geopolitical priorities.

Protecting Financial Stability

Using US Treasuries as bargaining chips in trade disputes carries significant risks to global financial stability. The sheer size and importance of the US Treasury market mean any perceived threat to its integrity could trigger a cascade of negative consequences.

- Threat of capital flight: The use of Treasuries as a weapon could undermine confidence in their safety and liquidity, potentially leading to large-scale capital flight from the US market.

- Increased borrowing costs for the US government: Reduced demand for US Treasuries would likely increase borrowing costs for the US government, impacting its fiscal policy and potentially slowing economic growth.

- Damage to the reputation of US Treasuries as a safe haven asset: The perception of US Treasuries as a secure investment is crucial to their global dominance. Undermining this perception could have long-lasting negative repercussions.

- Potential for retaliatory measures from other countries: Other countries holding significant US Treasury reserves might retaliate by reducing their holdings or employing similar tactics, further destabilizing markets.

Shifting Geopolitical Landscape

Kato's decision is also influenced by a broader shift in the geopolitical landscape. Japan is actively diversifying its economic and strategic partnerships, aiming for greater autonomy in its economic relations.

- Strengthening alliances with non-US trading partners: This move signals a focus on deepening relationships with countries in Asia and beyond, reducing reliance on the US as a primary trading partner.

- Reducing dependence on the US financial system: By detaching trade negotiations from US Treasury holdings, Japan aims to diminish its dependence on the US dollar and the US financial system.

- Pursuing alternative trade agreements and financial mechanisms: This decision indicates a push towards alternative trading frameworks and financial instruments, such as regional trade agreements and the increased use of other currencies in international trade.

Alternative Negotiation Strategies

The removal of US Treasuries necessitates exploring alternative strategies for resolving trade disputes. Japan will likely focus on:

- Diplomatic pressure and sanctions: Targeted diplomatic pressure and carefully calibrated sanctions could be used to achieve desired outcomes in trade negotiations.

- Targeted trade restrictions: Instead of using broad measures impacting the entire Treasury market, specific trade restrictions targeting particular industries or goods could be implemented.

- Focus on specific industry negotiations: Bilateral or multilateral negotiations focused on specific industry disputes could be a more effective approach.

- International cooperation and multilateral agreements: Strengthening international cooperation and utilizing existing multilateral agreements to resolve trade disagreements will become increasingly important.

Implications of Kato's Stance for Global Markets

Kato's stance carries significant implications for global financial markets, impacting various asset classes and international relations.

Impact on US-related markets

The decision could have several impacts on US-related markets:

- Potential increase in US Treasury yields: Reduced foreign demand for US Treasuries could drive up yields, making US government borrowing more expensive.

- Potential fluctuations in the US dollar exchange rate: The decreased demand for US Treasuries could potentially impact the value of the US dollar, causing fluctuations in exchange rates.

- Impacts on US equity markets: The overall uncertainty surrounding this shift could lead to increased volatility in US equity markets.

International Market Reactions

Other countries, particularly those heavily invested in US Treasuries, are likely to react in various ways:

- Diversification of foreign exchange reserves: Countries might accelerate their efforts to diversify their foreign exchange reserves, reducing their reliance on US dollar-denominated assets.

- Search for alternative safe haven assets: Investors might seek alternative safe-haven assets, potentially impacting the demand for other government bonds or precious metals.

- Potential for increased volatility in global financial markets: The uncertainty surrounding this shift could lead to increased volatility across global financial markets.

Long-Term Consequences and Future Outlook

Kato's decision could profoundly reshape the landscape of international trade and finance.

Reshaping the Landscape of International Trade

This shift is likely to:

- Lead to the emergence of new trade negotiation strategies: Countries will need to develop new approaches to trade negotiations that do not rely on using financial assets as leverage.

- Increase the emphasis on multilateral agreements: Strengthening existing multilateral trade agreements and exploring new ones could become more crucial in resolving trade disputes.

- Restructure global financial relations: The decreased reliance on US Treasuries could lead to a restructuring of global financial relations, potentially paving the way for greater financial diversification.

Potential for Future Escalation or De-escalation

The consequences of Kato's stance remain uncertain.

- Likelihood of retaliatory measures from other countries: Other countries might adopt similar strategies, potentially escalating tensions in international trade relations.

- Potential for diplomatic efforts to resolve the situation: Diplomatic efforts and negotiations could be employed to de-escalate tensions and find mutually beneficial solutions.

- Long-term impact on US-global relationships: This decision could have a long-term impact on the relationship between the US and other countries, affecting future economic and political collaborations.

Conclusion

Kato's decisive stance on removing US Treasuries from trade discussions marks a pivotal moment in international economics. This shift necessitates a reevaluation of traditional negotiation strategies and signals a potential reshaping of global financial landscapes. The implications for global markets are far-reaching, impacting everything from currency valuations to international relations. Understanding the full ramifications of "Kato's Stance" is crucial for navigating the evolving complexities of international trade. Stay informed about further developments regarding Kato's Stance and the evolving dynamics of US Treasuries in trade discussions.

Featured Posts

-

Tracee Ellis Ross On Dating Younger Men An Honest Conversation

May 06, 2025

Tracee Ellis Ross On Dating Younger Men An Honest Conversation

May 06, 2025 -

Could Ayo Edebiri Lead And Write A Live Action Barney Movie

May 06, 2025

Could Ayo Edebiri Lead And Write A Live Action Barney Movie

May 06, 2025 -

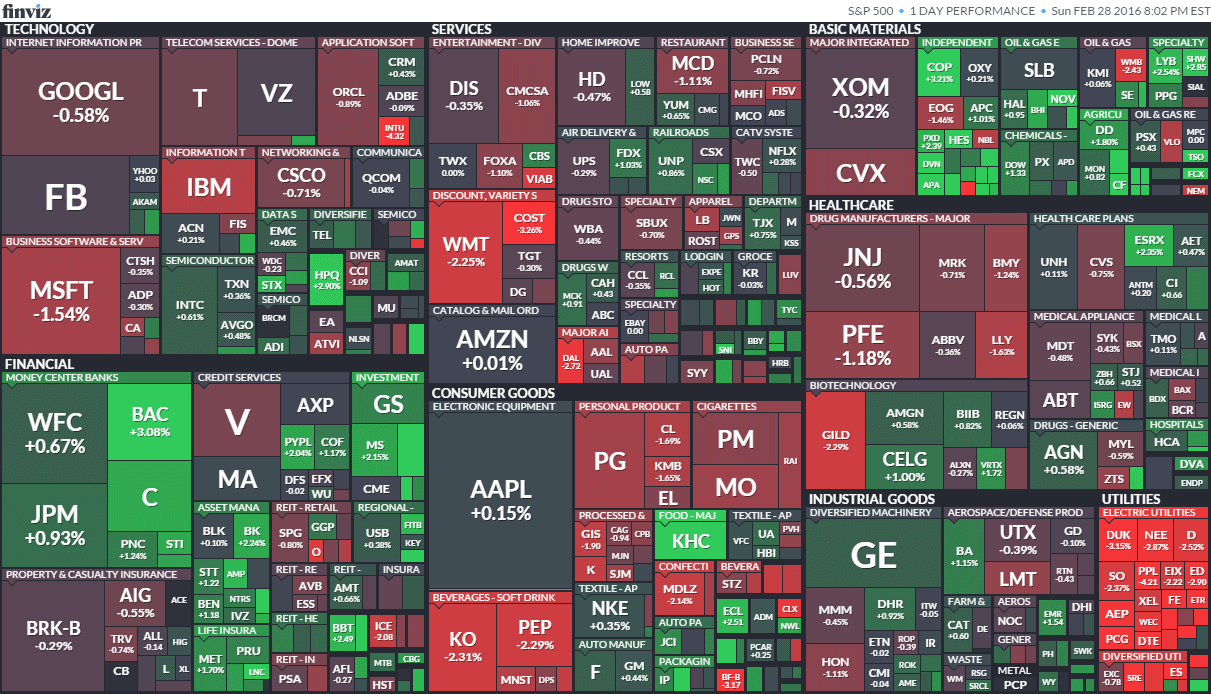

Dow Jones And S And P 500 Stock Market News For May 5th

May 06, 2025

Dow Jones And S And P 500 Stock Market News For May 5th

May 06, 2025 -

The Sabrina Carpenter Fortnite Character Addressing The Nsfw Backlash

May 06, 2025

The Sabrina Carpenter Fortnite Character Addressing The Nsfw Backlash

May 06, 2025 -

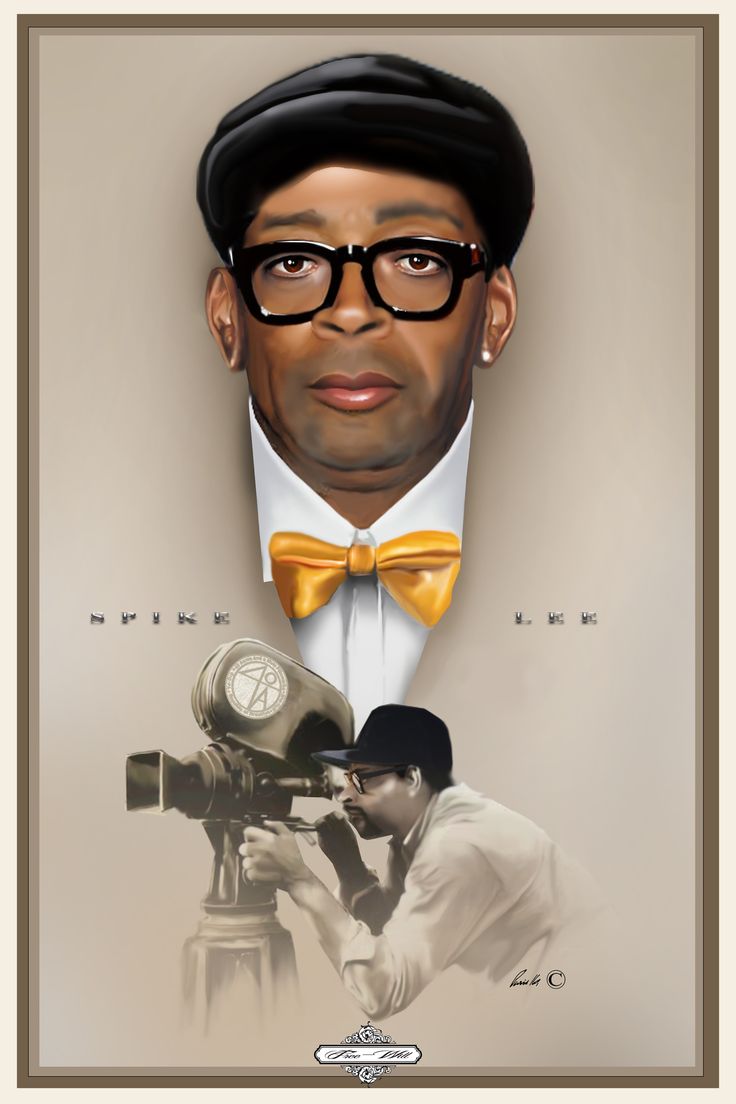

Spike Lees 40 Acres And A Mule X Supreme Collaboration A Deep Dive

May 06, 2025

Spike Lees 40 Acres And A Mule X Supreme Collaboration A Deep Dive

May 06, 2025