Kering's Q1 Earnings: A 6% Share Price Drop

Table of Contents

Disappointing Q1 Revenue Figures & Their Impact on Kering's Stock

Kering's Q1 2024 revenue figures fell short of analyst expectations and previous year's performance, directly contributing to the substantial 6% share price decline. The reported revenue of €4.7 billion represented a concerning [Insert Percentage]% decrease compared to Q1 2023's figures. This underperformance was particularly stark when compared to the projected revenue of [Insert Analyst Predicted Revenue].

- Specific Revenue Numbers: €4.7 billion (or equivalent in USD).

- Percentage Change: [Insert Percentage]% decrease compared to Q1 2023.

- Revenue Breakdown by Brand: While specific brand breakdowns may vary, highlight underperforming brands and their revenue contributions. Example: Gucci experienced a [Insert Percentage]% decrease in revenue, significantly impacting overall performance. Yves Saint Laurent showed more resilience, with [Insert Percentage]% growth.

- Currency Fluctuations: Mention any significant currency exchange rate fluctuations that may have influenced the reported figures.

The discrepancy between actual and projected revenue, coupled with the slowing growth in key markets, clearly fueled investor anxieties, resulting in the immediate share price drop. Financial analysts attributed the decline to a combination of factors, including [mention specific analyst quotes if available].

Geographic Performance: Regional Variations in Sales Growth

Kering's geographic performance revealed a mixed bag, highlighting the impact of regional economic conditions and geopolitical factors on sales growth. While certain regions showed strong performance, others significantly underperformed, further contributing to the overall disappointing Q1 results.

- Strong Performers: [Mention specific regions like North America] demonstrated relatively strong growth, driven by [mention factors such as robust consumer spending or successful marketing campaigns].

- Underperforming Regions: [Mention specific regions like Europe or Asia] experienced a decline in sales, attributable to [mention factors such as economic slowdowns, geopolitical instability, or specific local market challenges].

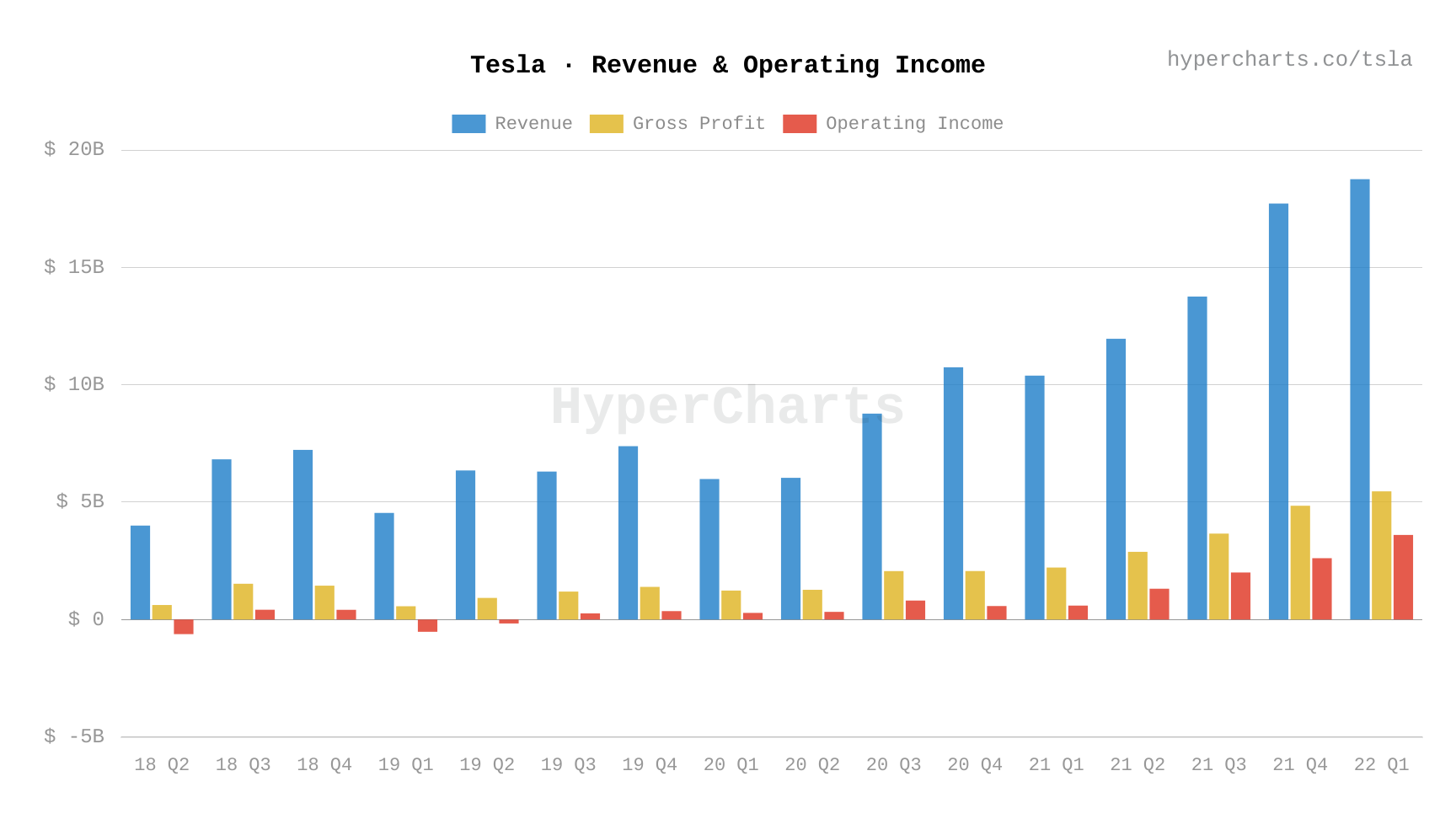

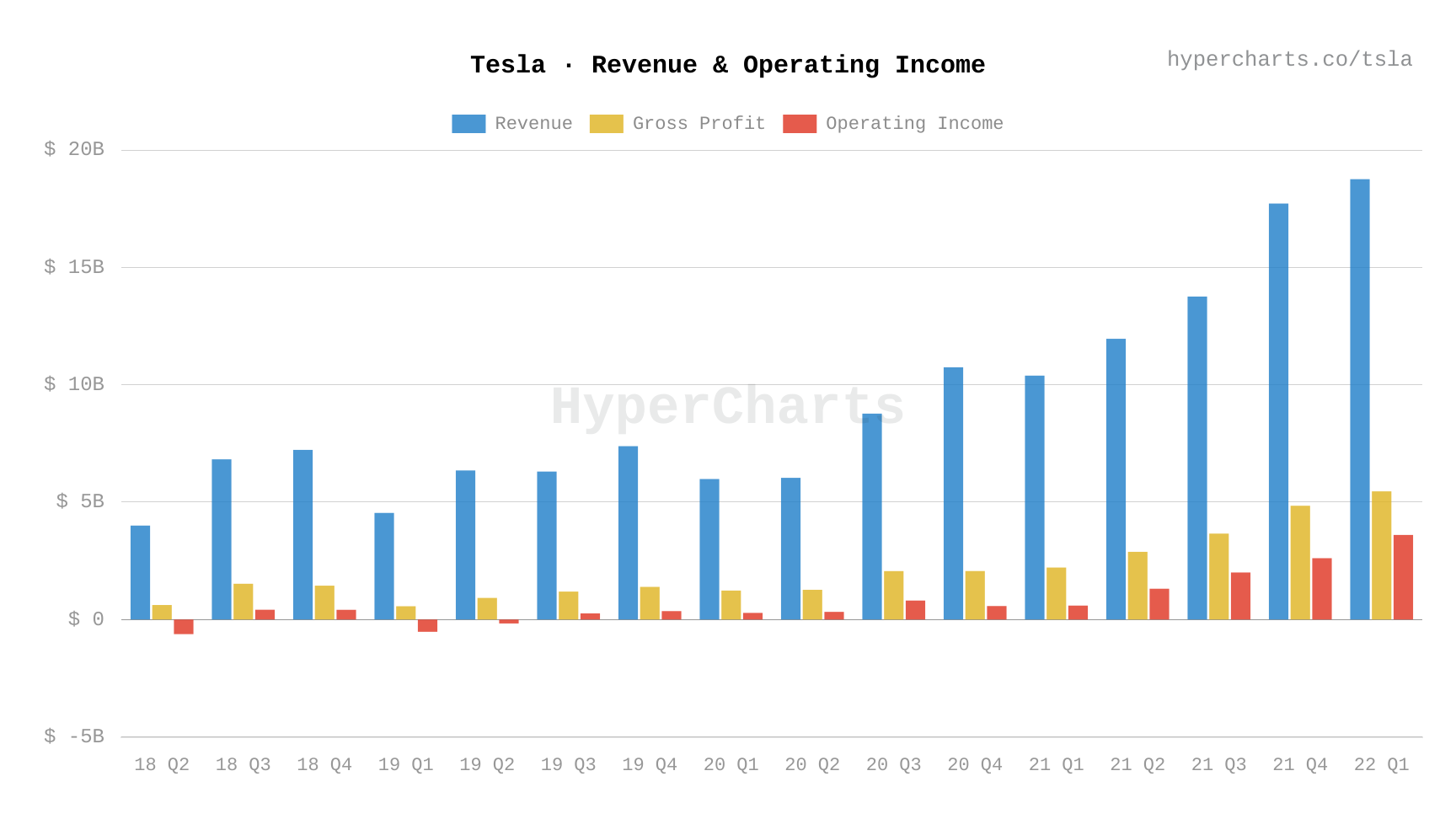

- Visual Representation: Include a chart or graph visually representing regional sales data for a clearer understanding of the variations.

The disparity in regional performance underlines the challenges faced by luxury brands in navigating a complex global economic landscape. The underperformance in key regions played a significant role in the overall weak Q1 numbers and the subsequent share price drop.

Brand-Specific Performance: Gucci's Slowdown and Other Brand Contributions

A deep dive into brand-specific performance reveals a significant slowdown at Gucci, the flagship brand of Kering. This underperformance significantly impacted the overall Q1 results.

- Gucci's Sales Figures: Detail Gucci's sales figures and compare them to previous quarters and years, highlighting the extent of the slowdown.

- Performance of Other Key Brands: Analyze the performance of other major brands like Yves Saint Laurent, Bottega Veneta, etc., and their contribution to the overall earnings. Highlight any successes or challenges they faced.

- Brand Strategy Changes: Discuss any significant shifts in brand strategies that may have impacted sales figures, such as changes in marketing campaigns, product lines, or pricing strategies.

The underperformance of Gucci, combined with the varying degrees of success from other brands, created an overall picture of inconsistent performance that heavily influenced the negative market reaction and the resulting share price drop.

Future Outlook and Investor Sentiment: Kering's Guidance and Market Reaction

Kering's guidance for the remainder of 2024 offers some insight into the company's expectations and potential for recovery. However, the market's reaction to this guidance will be crucial in determining the long-term impact on the share price.

- Key Predictions and Targets: Summarize Kering's management's key predictions and targets for the year, highlighting any revised expectations in light of the Q1 results.

- Investor Reaction: Analyze the initial investor reaction to the guidance, noting any shifts in investor sentiment.

- Analyst Predictions and Rating Changes: Summarize analyst predictions and any rating changes following the Q1 earnings announcement. This shows market confidence (or lack thereof) in Kering's future performance.

The overall sentiment among investors and analysts remains cautious following the Q1 earnings announcement. The market will closely monitor Kering's performance in the coming quarters to assess whether the company can successfully navigate the current challenges and deliver on its future guidance.

Conclusion: Analyzing the Implications of Kering's Q1 Earnings Report

Kering's Q1 2024 earnings report revealed a disappointing performance, characterized by lower-than-expected revenue, uneven regional growth, and a significant slowdown at its flagship brand, Gucci. These factors culminated in a 6% share price drop and raised concerns about the luxury goods sector's overall health. The company's future guidance will be key to restoring investor confidence. The underperformance of Kering's Q1 earnings highlights the challenges in maintaining consistent growth within the luxury goods market. The impact extends beyond Kering itself, potentially influencing the overall performance and investor sentiment towards other luxury brands.

Stay tuned for updates on Kering's Q2 earnings and further analysis of their performance within the competitive luxury goods market. Further examination of Kering’s strategies and market positioning will be crucial in understanding the long-term implications of this Q1 performance.

Featured Posts

-

La Chine Et La Liberte D Expression Le Cas Des Dissidents Francais

May 24, 2025

La Chine Et La Liberte D Expression Le Cas Des Dissidents Francais

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 24, 2025

Trumps Tariffs Trigger 2 Drop In Amsterdam Stock Exchange

May 24, 2025 -

Rio Tintos Defence Of Its Pilbara Operations Amidst Environmental Criticism

May 24, 2025

Rio Tintos Defence Of Its Pilbara Operations Amidst Environmental Criticism

May 24, 2025 -

Turnir Za 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 24, 2025

Turnir Za 4 Milliarda Pryamaya Translyatsiya Matcha Rybakinoy

May 24, 2025