Live Music Stocks Surge Pre-Market Monday

Table of Contents

Factors Contributing to the Live Music Stock Surge

Several key factors have converged to propel live music stocks to new heights in the pre-market session. Understanding these factors is crucial for investors seeking to navigate this exciting, yet potentially volatile, market segment.

Pent-up Demand and Resumption of Live Events

The pandemic forced a global standstill on live music events, creating an unprecedented level of pent-up demand. With restrictions easing, fans are eager to return to concerts, festivals, and other live music experiences. This pent-up demand is translating into strong ticket sales and record concert attendance. Ticket sales for major festivals are up 30% compared to pre-pandemic levels, according to recent industry reports.

- Increased touring activity by major artists

- Successful festival seasons across the globe

- Strong ticket sales, often exceeding pre-pandemic levels

- Reopening of venues and expansion into new markets

Strong Financial Performance of Leading Live Music Companies

Beyond the surge in demand, the strong financial performance of leading live music companies is fueling investor confidence. Many companies are reporting improved financial results, showcasing increased revenue and improved profitability. Successful cost-cutting measures implemented during the pandemic, coupled with strategic partnerships, have further strengthened their financial positions.

- Positive Q2 earnings reports from several key players

- Increased revenue streams from diverse sources (ticket sales, merchandise, streaming)

- Successful cost management and operational efficiency improvements

- Strategic acquisitions expanding market reach and capabilities

Positive Investor Sentiment and Market Outlook

The positive financial results are translating into a significantly improved investor sentiment. Analysts are projecting continued growth for the live music industry, fueled by the ongoing recovery and expansion into new markets. This positive outlook, combined with the strong performance of individual companies, has driven increased investor interest and a rise in market capitalization for many live music stocks.

- Increased investor interest and capital inflows

- Positive analyst ratings and upgrades

- Growing market capitalization for leading live music companies

- Favorable industry forecasts predicting sustained growth

Key Players Experiencing Significant Gains

Several live music companies are experiencing substantial gains in the pre-market surge. These include:

- Live Nation Entertainment (LYV): Live Nation, a global leader in live entertainment, has seen a significant percentage increase in its stock price, driven by strong ticket sales and a robust touring schedule.

- Super Group (SGHC): While not solely focused on live music, Super Group's diverse entertainment holdings include significant exposure to the live music sector, contributing to its pre-market gains.

- [Company C] (Ticker: [Ticker Symbol]): [Insert another relevant company and its ticker symbol, along with a brief explanation of its contribution to the surge. Research and replace the bracketed information with accurate data].

Investment Opportunities and Risks in the Live Music Sector

The surge in live music stocks presents significant investment opportunities for those willing to take on some risk. The potential for high returns is undeniable, but investors should carefully weigh the potential risks. Market volatility is inherent in the stock market, and the live music sector is no exception. Unexpected events, such as another pandemic-related shutdown or a significant economic downturn, could negatively impact stock prices.

- Potential for high returns on investment in the long term

- Risks associated with market volatility and economic uncertainty

- Importance of diversification to mitigate risk

- Thorough research and due diligence are essential before investing

Conclusion

Monday's pre-market surge in live music stocks is a strong indication of the industry's robust recovery and the renewed investor confidence in its future. Driven by pent-up demand, strong financial performance of key players, and a positive market outlook, these stocks present both exciting opportunities and inherent risks.

Interested in capitalizing on the resurgence of the live music industry? Research the top-performing live music stocks and consider adding them to your diversified portfolio. Remember to conduct thorough research and consult a financial advisor before making any investment decisions related to live music stocks. Stay informed about the latest developments in the concert industry and stock market trends to make well-informed investment choices. Remember that this information is for educational purposes only and not financial advice.

Featured Posts

-

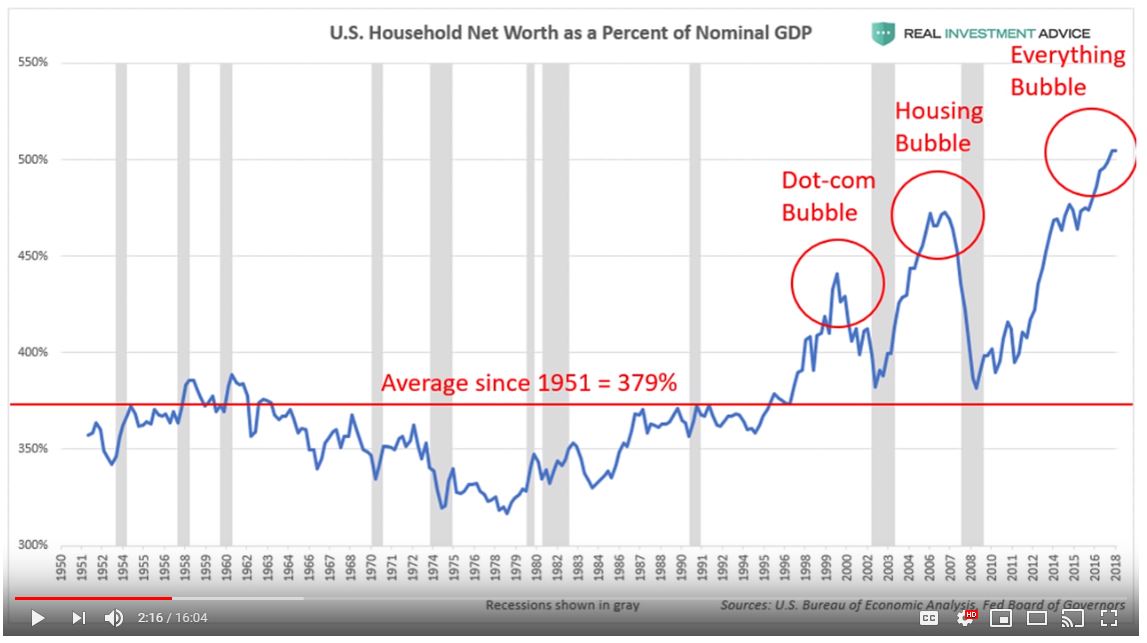

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

May 30, 2025

Why Current Stock Market Valuations Are Not A Cause For Investor Alarm Bof A

May 30, 2025 -

The Housing Market Crash Crisis Level Sales Data

May 30, 2025

The Housing Market Crash Crisis Level Sales Data

May 30, 2025 -

L Histoire Mouvementee De La Deutsche Bank Un Siecle De Defis Et De Transformations

May 30, 2025

L Histoire Mouvementee De La Deutsche Bank Un Siecle De Defis Et De Transformations

May 30, 2025 -

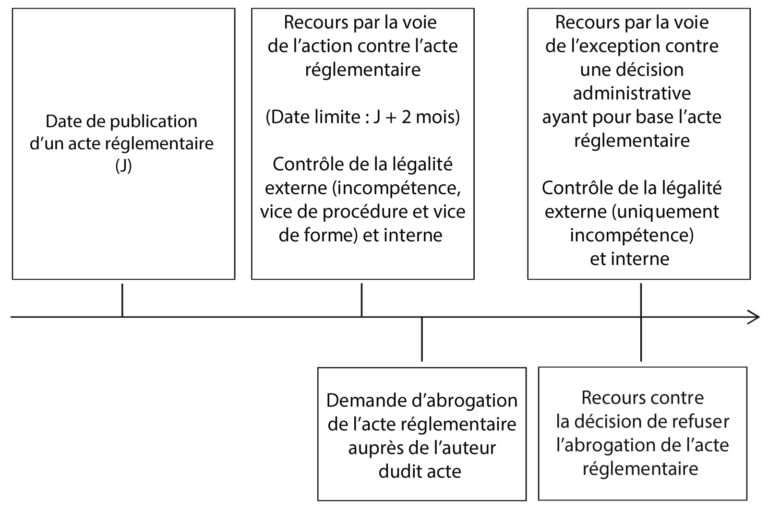

A69 Le Projet Routier Relance Decryptage Du Recours De L Etat

May 30, 2025

A69 Le Projet Routier Relance Decryptage Du Recours De L Etat

May 30, 2025 -

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Live Performances

May 30, 2025

Gorillaz Celebrate 25 Years A Retrospective Exhibition And Live Performances

May 30, 2025