The Housing Market Crash: Crisis-Level Sales Data

Table of Contents

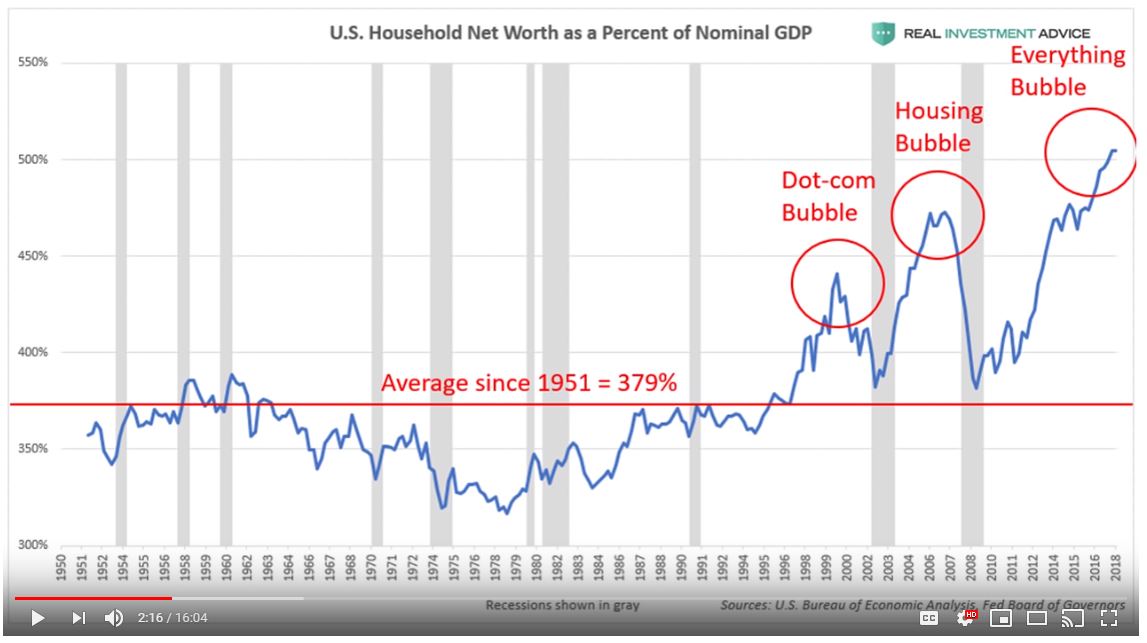

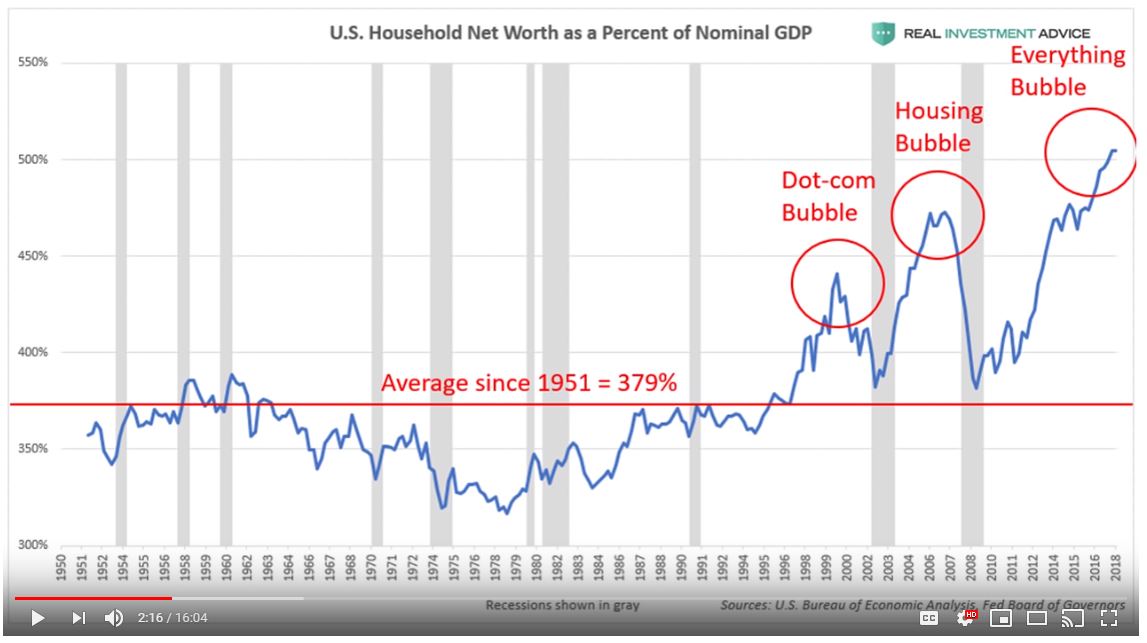

Causes of the Housing Market Crash

Several interconnected factors have contributed to this dramatic housing market crash and the resulting crisis-level sales data.

Rising Interest Rates

The Federal Reserve's aggressive interest rate hikes have significantly impacted housing affordability. The increase in mortgage rates has dramatically reduced purchasing power, making homeownership less accessible to many potential buyers.

- Impact on mortgage payments: Higher interest rates translate directly into higher monthly mortgage payments, stretching household budgets and limiting affordability.

- Reduced purchasing power: With increased borrowing costs, buyers can afford less expensive homes, leading to a decrease in demand for higher-priced properties.

- Increased borrowing costs: The higher cost of borrowing reduces the number of individuals who can qualify for a mortgage, further dampening buyer demand. This is particularly acute in the current climate of rising inflation and economic uncertainty.

These factors, compounded by the already existing affordability crisis in many markets, have significantly contributed to the decline in housing market activity, creating the current housing market crisis and impacting the property market. The correlation between interest rate hikes and the decline in sales data is undeniable.

Inflation and Economic Uncertainty

Soaring inflation and growing economic uncertainty have eroded consumer confidence, impacting the housing market significantly.

- Impact of inflation on construction costs: Increased costs of building materials have pushed up new home prices, reducing affordability and impacting the supply chain.

- Effect on consumer spending: With inflation eating into household budgets, consumers are more hesitant to make significant purchases like homes, leading to a decrease in buyer demand and resulting in the current real estate market downturn.

- Uncertainty about job security: Economic uncertainty and potential recession fears are causing many to postpone major purchases, including homes, creating a downward spiral in the housing market and causing a housing market crisis.

The combination of inflation and economic uncertainty has created a perfect storm, further exacerbating the decline in housing market activity, affecting the housing market crash, and causing crisis-level sales data.

Inventory Levels and Supply Chain Issues

While some areas experience high inventory levels, others struggle with supply chain disruptions that continue to impact new home construction.

- Over-supply in certain segments: In some markets, an oversupply of homes for sale has put downward pressure on prices, contributing to crisis-level sales data in the real estate market.

- Delays in new construction: Supply chain issues, including material shortages and labor constraints, have delayed new home construction, further tightening the supply in some areas and exacerbating the problem in other areas contributing to the housing market crisis.

- Impact on material costs: Increased costs of building materials have contributed to higher home prices and reduced affordability.

Regional Variations in Crisis-Level Sales Data

The housing market crash is not uniform across all regions. Significant variations exist in market performance depending on location and specific market conditions.

Geographic Analysis of Market Performance

The impact of the housing market crisis varies significantly across different regions and states. While some areas are experiencing dramatic declines in sales, others show more relative stability. For example, coastal markets like California are seeing more significant price corrections than some Midwest markets. These geographic variations are a major contributor to the crisis-level sales data seen across the country.

- Specific examples of regions with significant drops in sales: Certain metropolitan areas, particularly those highly sensitive to interest rate changes, have seen steep declines in home sales.

- Comparison of regional performance: A detailed analysis reveals substantial differences in the severity of the downturn, influenced by local economic conditions, job markets, and existing inventory levels.

- Factors contributing to regional variations: Local job markets, population growth, and pre-existing market conditions all play a crucial role in shaping regional differences in market performance.

Impact on Different Property Types

The crisis is affecting different property types differently.

- Sales figures for different property types: Luxury properties often see a more significant price correction than entry-level homes during economic downturns, affecting the property market and reflecting the crisis-level sales data.

- Variations in price drops: The magnitude of price reductions varies across different property segments, reflecting variations in demand and market conditions.

- Factors influencing the performance of different segments: Location, size, amenities, and overall market conditions play a role in how various property types are affected.

Potential Consequences of the Housing Market Crash

The housing market crash has significant implications for the broader economy and for individuals.

Impact on the Broader Economy

The ripple effects of this housing market crash are likely to impact the overall economy substantially.

- Impact on construction jobs: The decline in housing activity will inevitably lead to job losses in the construction industry and related sectors.

- Related industries: Businesses reliant on the housing market, such as furniture retailers and appliance stores, will also face negative consequences.

- Consumer spending: Reduced consumer confidence and decreased home equity could further dampen consumer spending and overall economic growth.

- GDP growth: The downturn in the housing sector is likely to negatively impact GDP growth.

Impact on Homeowners and Investors

The housing market crash poses significant challenges for existing homeowners and real estate investors.

- Potential for negative equity: Falling home prices could lead to some homeowners owing more on their mortgages than their homes are worth, leading to negative equity.

- Impact on investment returns: Real estate investors may experience reduced returns or even losses on their investments.

- Implications for refinancing: The rise in interest rates makes refinancing more expensive and less attractive for many homeowners.

- Foreclosure: In severe cases, homeowners may face foreclosure due to their inability to make mortgage payments.

Conclusion: Navigating the Housing Market Crash

This housing market crash, characterized by crisis-level sales data, is driven by a confluence of factors including rising interest rates, inflation, economic uncertainty, and supply chain issues. Regional variations exist, with some areas experiencing sharper declines than others, and the impact on different property types also varies. The consequences are far-reaching, potentially impacting the broader economy, homeowners, and real estate investors alike.

The severity of the crisis-level sales data necessitates careful planning and proactive measures. Homeowners should carefully monitor their financial situation, and investors need to reassess their portfolios. For more information on current mortgage rates and financial planning resources, consider consulting a financial advisor. Stay updated on the latest housing market crisis data and market analyses to make informed decisions in this challenging environment. Understanding the implications of this housing market crash is crucial for navigating the current market effectively.

Featured Posts

-

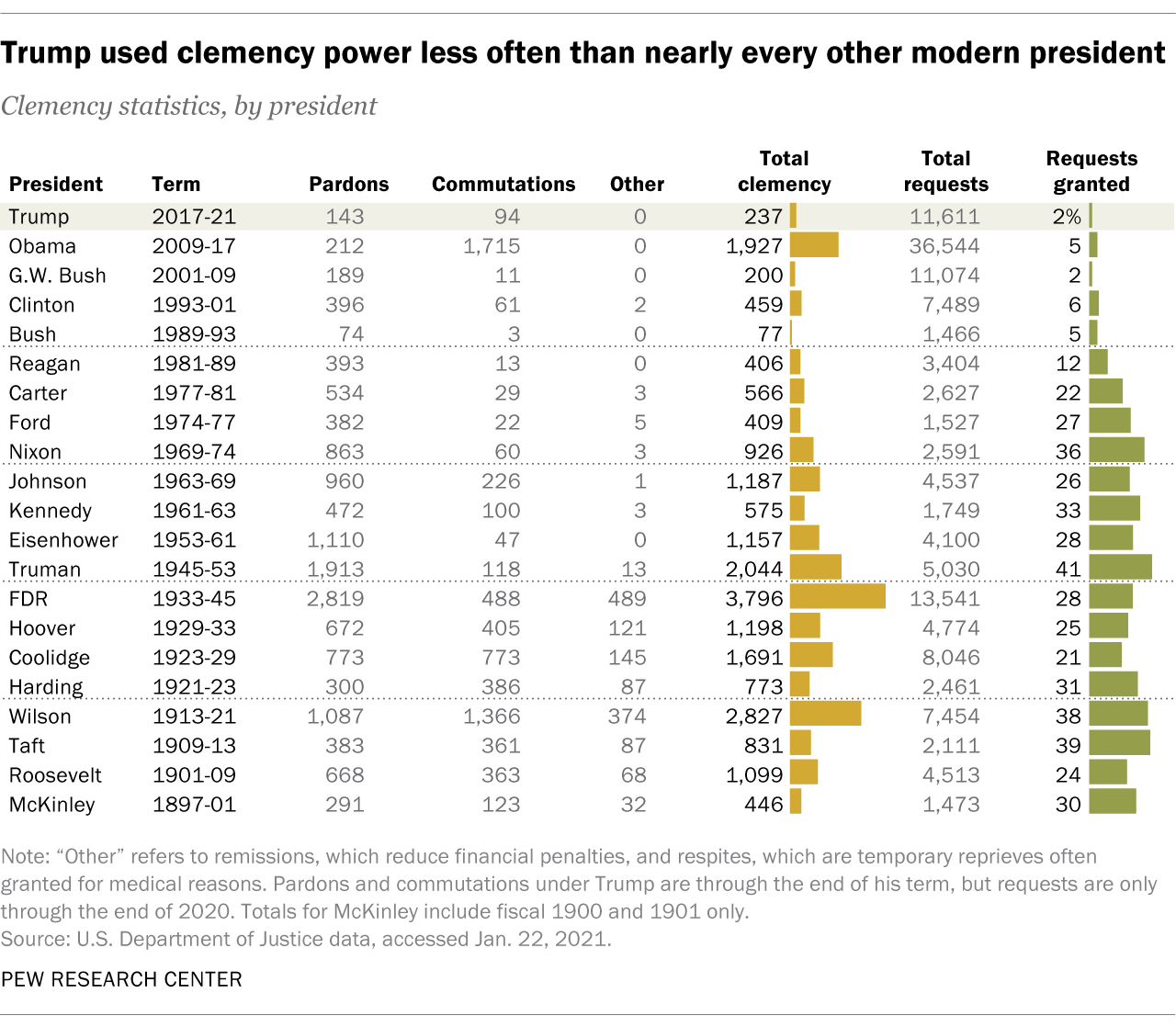

Trump Issues 26 Clemency Grants Details On The Pardons And Commutations

May 30, 2025

Trump Issues 26 Clemency Grants Details On The Pardons And Commutations

May 30, 2025 -

Pogoda V Izraile Preduprezhdenie Mada O Vozmozhnykh Opasnostyakh

May 30, 2025

Pogoda V Izraile Preduprezhdenie Mada O Vozmozhnykh Opasnostyakh

May 30, 2025 -

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025

L Integrale De L Emission Europe 1 Soir 19 03 2025

May 30, 2025 -

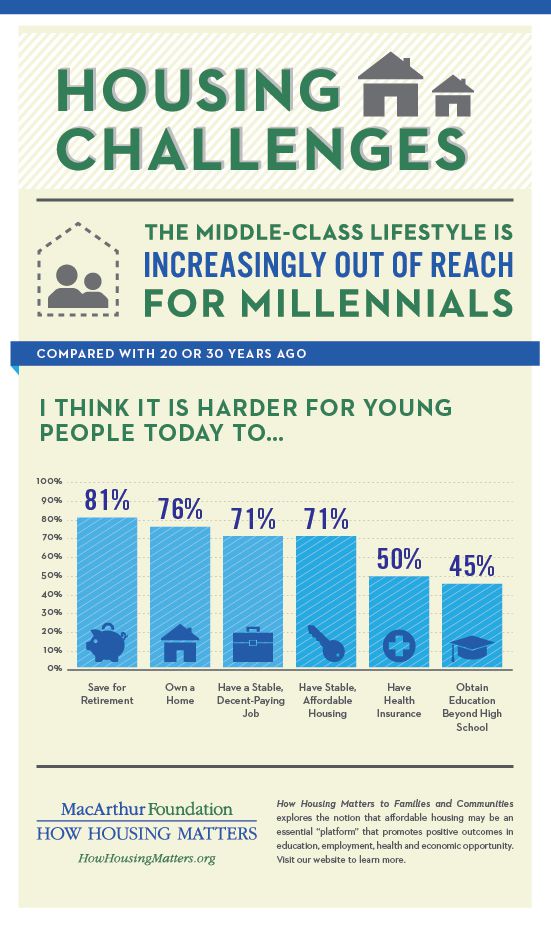

Are We In A Housing Crisis Record Low Home Sales

May 30, 2025

Are We In A Housing Crisis Record Low Home Sales

May 30, 2025 -

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025