Live Nation Entertainment (LYV): What The Smart Money Is Investing In

Table of Contents

Live Nation's Dominant Market Position and Competitive Advantages

Live Nation's success stems from its formidable market position and a range of competitive advantages.

Ticketmaster Monopoly

Ticketmaster, a subsidiary of Live Nation Entertainment, controls a significant portion of the primary ticketing market in many countries. This dominance translates to:

- High Market Share: Ticketmaster's market share allows it to command premium pricing for ticket sales, significantly impacting Live Nation's revenue streams.

- Pricing Power: The high barrier to entry in the ticketing market gives Live Nation considerable pricing power, leading to higher profit margins.

- Data Collection Advantages: Ticketmaster's vast database provides invaluable insights into consumer preferences, allowing for targeted marketing and improved event planning.

- Potential Antitrust Concerns: The company has faced antitrust scrutiny in the past, and ongoing regulatory oversight represents a potential risk. However, Live Nation argues that its market position is a result of organic growth and superior service, not anti-competitive practices.

Diversified Revenue Streams

Live Nation’s business isn't solely reliant on ticketing. Its diversified revenue streams mitigate risk and ensure consistent income:

- Revenue from Ticketing Fees: Ticketmaster's sales contribute significantly to LYV's overall revenue.

- Venue Rentals: Live Nation owns and operates numerous venues globally, generating rental income from concerts and other events. Examples include iconic venues like the O2 Arena in London.

- Sponsorship Deals: Live Nation secures lucrative sponsorship deals with brands seeking to reach its large audience.

- Artist Management Fees: Live Nation's artist management division represents some of the world’s biggest music acts, earning fees from touring and other activities. This generates recurring revenue streams tied to artist success.

Strong Brand Recognition and Customer Loyalty

Live Nation benefits from strong brand recognition and a high degree of customer loyalty:

- Brand Loyalty among Concertgoers: The Live Nation brand is synonymous with live music experiences, fostering strong customer loyalty.

- Effective Marketing Strategies: Live Nation employs sophisticated marketing strategies to promote its events and attract new customers.

- Data-Driven Insights into Customer Preferences: Data gathered through Ticketmaster provides crucial insights into audience preferences, allowing for more effective marketing and event planning.

Financial Performance and Growth Prospects

Live Nation's financial performance demonstrates impressive growth and positions it for continued expansion.

Historical Financial Data Analysis

Analyzing LYV's financial statements reveals robust growth over recent years:

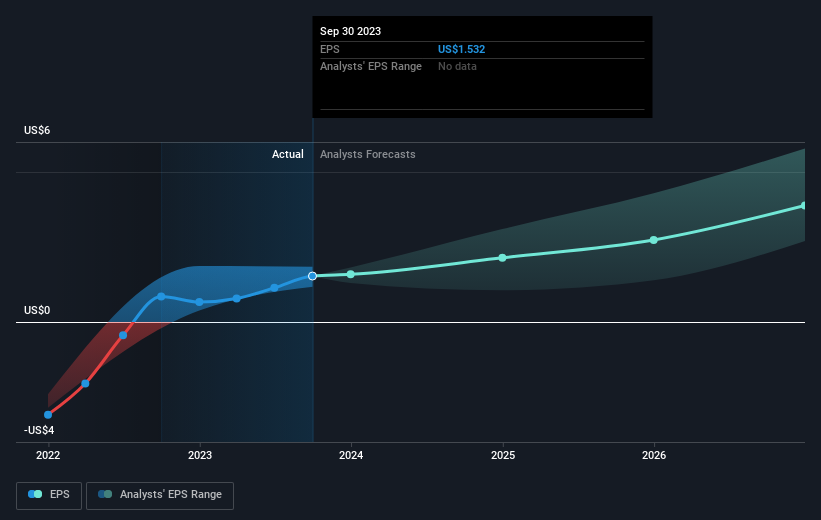

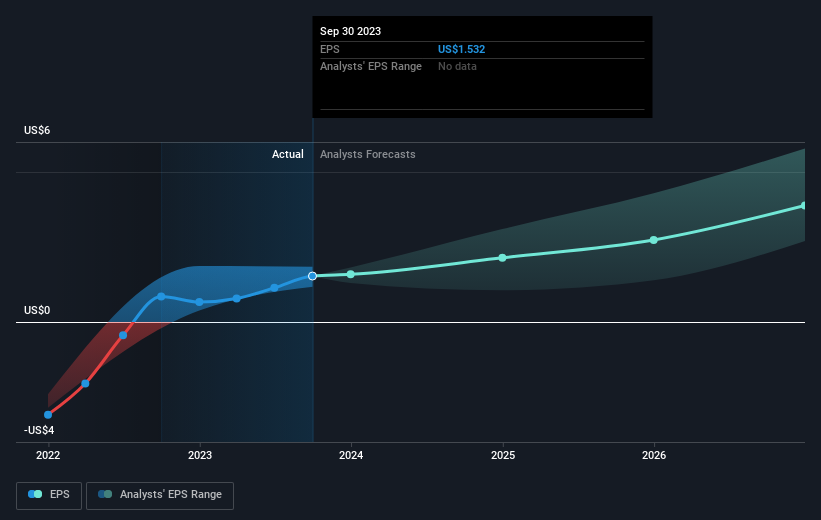

- Year-over-Year Revenue Growth: Consistently positive revenue growth showcases strong market demand for live events. (Specific data and charts would be included here from financial reports).

- Profitability Trends: Improving profit margins demonstrate effective cost management and increasing pricing power. (Specific data and charts would be included here from financial reports).

- Return on Equity (ROE): A strong ROE indicates efficient utilization of shareholder investment. (Specific data and charts would be included here from financial reports).

- Debt-to-Equity Ratio: Monitoring the debt-to-equity ratio helps assess the company’s financial risk. (Specific data and charts would be included here from financial reports).

Future Growth Potential

Several factors point to strong future growth potential for Live Nation Entertainment (LYV):

- Increasing Demand for Live Experiences: The post-pandemic surge in demand for live music and entertainment demonstrates the enduring appeal of in-person events.

- Expansion into New Geographical Markets: Live Nation continues to expand its operations into new markets globally, tapping into untapped revenue streams.

- Potential Acquisitions: Strategic acquisitions of smaller promoters and venues could further enhance Live Nation's market position.

- Technological Advancements: Live Nation is exploring innovative technologies, such as virtual and augmented reality concerts, to enhance the fan experience and reach a wider audience.

Risks and Challenges Facing Live Nation Entertainment (LYV)

Despite its strong position, Live Nation faces certain risks and challenges:

Economic Downturns and Recessions

Economic downturns significantly impact consumer spending on discretionary items like concert tickets:

- Sensitivity of Discretionary Spending to Economic Conditions: During recessions, consumer spending on entertainment typically declines, potentially impacting ticket sales.

- Potential for Reduced Ticket Sales During Recessions: Live Nation's revenue is vulnerable to economic fluctuations.

Competition and Technological Disruption

Live Nation faces competition from smaller promoters and the potential impact of disruptive technologies:

- Competition from Smaller Promoters: Smaller, independent promoters offer competition in specific regional markets.

- Challenges from Streaming Services: The rise of streaming services has altered music consumption habits, potentially impacting the demand for live concerts.

- Potential Disruption from Virtual Reality Concerts: While Live Nation is exploring VR technology, the potential for widespread adoption of virtual concerts poses a threat to its core business.

Regulatory Scrutiny

Ongoing regulatory scrutiny related to Ticketmaster’s market dominance represents a significant risk:

- Ongoing Legal Challenges: Antitrust concerns and lawsuits could lead to fines or regulatory changes impacting Live Nation's operations.

- Potential Fines or Regulations: Increased regulation could curb Live Nation's pricing power and limit its future growth.

- Impact on Future Growth: The outcome of regulatory investigations will be crucial for Live Nation's future expansion.

Conclusion

Live Nation Entertainment (LYV) boasts a dominant market position, diversified revenue streams, and strong prospects for future growth. While economic downturns, competition, and regulatory risks exist, the company's impressive financial performance and strategic initiatives suggest it’s well-positioned to navigate these challenges. After considering Live Nation Entertainment (LYV)'s strong fundamentals and growth potential, it’s time to do your own due diligence and explore this exciting investment opportunity. Consider adding LYV to your portfolio for exposure to the thriving live music industry. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025 -

Overwhelmingly Positive First Reactions For Bring Her Back The New Horror Film From The Talk To Me Director

May 29, 2025

Overwhelmingly Positive First Reactions For Bring Her Back The New Horror Film From The Talk To Me Director

May 29, 2025 -

Is Arne Slot De Juiste Opvolger Bij Ajax Voor En Nadelen Besproken

May 29, 2025

Is Arne Slot De Juiste Opvolger Bij Ajax Voor En Nadelen Besproken

May 29, 2025 -

La Admiracion De Fede Valverde Por Toni Kroos

May 29, 2025

La Admiracion De Fede Valverde Por Toni Kroos

May 29, 2025 -

Update Cuaca Jawa Timur Hujan Terus Mengguyur Waspada Banjir

May 29, 2025

Update Cuaca Jawa Timur Hujan Terus Mengguyur Waspada Banjir

May 29, 2025

Latest Posts

-

Analysis Of Thompsons Monte Carlo Performance

May 31, 2025

Analysis Of Thompsons Monte Carlo Performance

May 31, 2025 -

Griekspoor Defeats Zverev In Indian Wells Upset

May 31, 2025

Griekspoor Defeats Zverev In Indian Wells Upset

May 31, 2025 -

Top Ranked Zverevs Early Exit At Indian Wells

May 31, 2025

Top Ranked Zverevs Early Exit At Indian Wells

May 31, 2025 -

Monte Carlo Thompsons Unfortunate Outcome

May 31, 2025

Monte Carlo Thompsons Unfortunate Outcome

May 31, 2025 -

Zverevs Second Round Exit At Indian Wells

May 31, 2025

Zverevs Second Round Exit At Indian Wells

May 31, 2025