Live Nation Entertainment Stock (LYV): A Deep Dive Into Investment Strategies

Table of Contents

1. Understanding Live Nation Entertainment's Business Model

Live Nation Entertainment is the world's leading live entertainment company, dominating the industry through its diverse portfolio of businesses. Its success hinges on a multifaceted business model that generates revenue through several key channels. This makes LYV stock a complex, but potentially rewarding, investment.

1.1 Ticketmaster's Role: Ticketmaster, a subsidiary of Live Nation, holds a near-monopoly on ticket sales for major concerts and events. This provides a substantial and relatively stable revenue stream for LYV.

- Revenue Diversification: Ticketmaster's reach extends beyond just ticket sales; it offers various services to venues and artists, further diversifying LYV's income streams.

- Market Share Dominance: Ticketmaster's market share provides a significant competitive advantage, solidifying LYV's position within the industry.

- Technological Advancements: Constant innovation in ticketing technology, including mobile ticketing and dynamic pricing, enhances efficiency and revenue generation.

- Potential Antitrust Concerns: Ticketmaster's dominance occasionally faces scrutiny from regulators, posing a potential risk to the company's future operations.

1.2 Venue Ownership and Operations: Live Nation owns and operates a vast network of venues globally, ranging from intimate clubs to massive stadiums. This direct control over venues allows for greater control over costs and revenue streams.

- Geographic Diversification: Venues spread across various geographic locations help mitigate risks associated with regional economic downturns.

- Venue Types: The diverse portfolio of venues—stadiums, amphitheaters, and clubs—caters to a wide range of artists and events.

- Operational Efficiency: Efficient venue management and operational practices contribute directly to LYV's profitability.

- Maintenance Costs: The substantial costs of maintaining and upgrading these venues can impact overall profitability.

1.3 Artist Management and Sponsorship: Live Nation's artist management division represents numerous prominent musicians, while its sponsorship deals with major brands generate significant revenue.

- Long-Term Contracts: Long-term contracts with artists provide revenue predictability and stability.

- Risk Mitigation: Diversifying across artists mitigates the risk associated with individual artist performance.

- Brand Partnerships: Strategic brand partnerships enhance revenue streams and elevate the brand image of both Live Nation and its partners.

- Impact on Profitability: The success of artist management and sponsorship deals directly contributes to the overall profitability of the company.

2. Analyzing LYV Stock Performance and Valuation

Understanding the past performance and valuation of LYV stock is crucial for any investment strategy. Analyzing key metrics provides valuable insights into potential returns and risks.

2.1 Historical Stock Performance: Live Nation's stock price has historically mirrored the health of the live entertainment industry. The COVID-19 pandemic, for example, significantly impacted its performance, but its recovery has been noteworthy.

- Year-over-Year Growth: Examining year-over-year growth patterns helps to identify underlying trends and growth potential.

- Key Financial Metrics: Analyzing key financial metrics such as Earnings Per Share (EPS) and revenue growth is vital in assessing profitability and financial health.

- Dividend History: While not a primary focus, understanding the dividend history (if any) can provide insight into the company's financial stability and shareholder return policies.

2.2 Valuation Metrics: Comparing LYV's valuation metrics (like P/E ratio and Price-to-Sales ratio) to its competitors allows for a relative assessment of its investment potential.

- Comparison to Peers: Benchmarking against industry peers provides context for understanding LYV's valuation relative to its competition.

- Growth Prospects: Future growth prospects are a key factor in determining a company's intrinsic value.

- Intrinsic Value Estimation: Various valuation models can be used to estimate the intrinsic value of LYV stock.

2.3 Risk Assessment: Investing in LYV stock carries inherent risks, including those related to economic downturns, increased competition, and regulatory changes.

- Interest Rate Sensitivity: Changes in interest rates can influence borrowing costs and overall investment sentiment.

- Inflation Impact: Inflation can affect operating costs and consumer spending on live entertainment.

- Potential for Boycotts or Negative Publicity: Negative publicity or boycotts can negatively impact revenue and stock price.

3. Investment Strategies for Live Nation Entertainment Stock (LYV)

The optimal investment strategy for Live Nation Entertainment Stock (LYV) depends on individual risk tolerance and investment goals.

3.1 Long-Term Holding Strategy: A buy-and-hold approach is suitable for investors with a long-term horizon and higher risk tolerance.

- Growth Potential: The long-term growth potential of the live entertainment industry supports this strategy.

- Dividend Reinvestment (if applicable): Reinvesting dividends can accelerate long-term returns.

- Weathering Market Fluctuations: Long-term investors can better withstand short-term market volatility.

3.2 Short-Term Trading Strategy: Short-term trading involves leveraging market trends and news events to capitalize on short-term price fluctuations.

- Risk Tolerance: This strategy requires higher risk tolerance due to the potential for quick losses.

- Technical Analysis: Technical analysis techniques are commonly used to identify short-term trading opportunities.

- Potential for Quick Gains and Losses: The potential for quick profits is accompanied by an equally high risk of losses.

3.3 Dividend Investing (if applicable): If LYV offers a dividend, it can be a source of passive income and contribute to overall investment returns.

- Dividend Yield: The dividend yield indicates the percentage return based on the dividend payout.

- Payout Ratio: The payout ratio reveals the proportion of earnings paid out as dividends.

- Sustainability of Dividends: Analyzing the sustainability of dividend payments is crucial for long-term investors.

4. Conclusion:

Investing in Live Nation Entertainment Stock (LYV) offers the potential for significant returns but involves considerable risk. Understanding LYV's business model, analyzing its historical performance and valuation, and carefully considering various investment approaches are crucial for making informed decisions. Remember to conduct thorough research and, if necessary, consult a financial advisor before investing. Ready to explore the potential of Live Nation Entertainment Stock (LYV)? Start your research now!

Featured Posts

-

Moto Gp Sprint Races High Risk Low Reward A Statistical Deep Dive

May 29, 2025

Moto Gp Sprint Races High Risk Low Reward A Statistical Deep Dive

May 29, 2025 -

Athletic Club Jugadores Historicos Que Vistieron La Camiseta Numero 23

May 29, 2025

Athletic Club Jugadores Historicos Que Vistieron La Camiseta Numero 23

May 29, 2025 -

Mamardashvili Sorprende El Analisis Del Partido

May 29, 2025

Mamardashvili Sorprende El Analisis Del Partido

May 29, 2025 -

Understanding Joan Mirs Mixed Feelings After Best Moto Gp Showing Since India 2023

May 29, 2025

Understanding Joan Mirs Mixed Feelings After Best Moto Gp Showing Since India 2023

May 29, 2025 -

Fariolis Opvolger Van Der Gijp Is Kritisch

May 29, 2025

Fariolis Opvolger Van Der Gijp Is Kritisch

May 29, 2025

Latest Posts

-

Four Key Issues Foreign Office Issues Urgent Greece Travel Warning For Brits

May 30, 2025

Four Key Issues Foreign Office Issues Urgent Greece Travel Warning For Brits

May 30, 2025 -

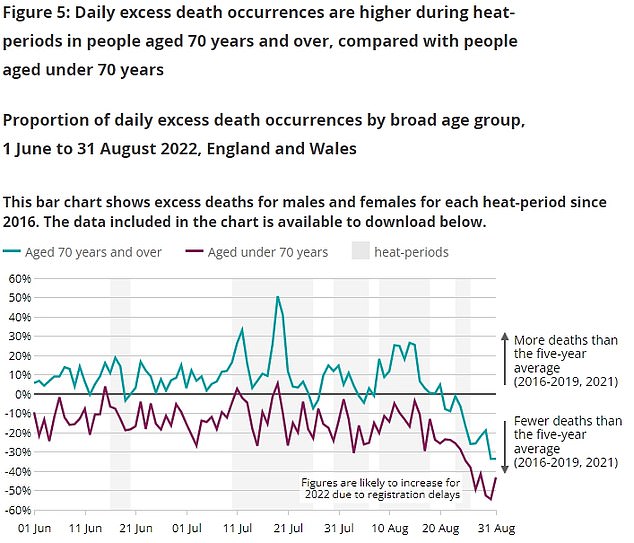

The Impact Of Extreme Heat 311 Deaths In England Reveal Urgent Need For Action

May 30, 2025

The Impact Of Extreme Heat 311 Deaths In England Reveal Urgent Need For Action

May 30, 2025 -

Greece Travel Warning Urgent Advice For British Citizens From The Foreign Office

May 30, 2025

Greece Travel Warning Urgent Advice For British Citizens From The Foreign Office

May 30, 2025 -

Englands Heatwave Death Toll Reaches 311 Lessons Learned And Future Preparations

May 30, 2025

Englands Heatwave Death Toll Reaches 311 Lessons Learned And Future Preparations

May 30, 2025 -

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025

Rising Temperatures Rising Deaths 311 Fatalities In Englands Heatwave

May 30, 2025