Live Stock Market Updates: Sensex And Nifty's Impressive Gains

Table of Contents

Sensex's Stellar Performance

Factors Contributing to Sensex Gains

The Sensex's impressive climb can be attributed to several positive factors:

- Robust GDP Growth: India's strong GDP growth continues to attract both domestic and foreign investment, boosting investor confidence. Recent figures show a healthy growth rate, fueling optimism in the market.

- Increased Foreign Investment: Significant foreign institutional investor (FII) inflows have injected substantial liquidity into the market, driving up stock prices. Positive global sentiment towards the Indian economy is a key factor here.

- Positive Corporate Earnings: Strong corporate earnings reports from several leading companies across various sectors have reinforced investor confidence and fueled buying activity. This positive trend indicates healthy economic activity.

- Strong Performance in Key Sectors: The IT, FMCG, and banking sectors have been particularly strong contributors to the Sensex's growth, reflecting positive economic indicators in these vital areas.

The Sensex closed at 66,000 points today, marking a 2% increase, demonstrating substantial gains.

Analyzing Sensex's Future Trajectory

While the current trend is positive, it's crucial to consider both short-term and long-term implications:

- Short-Term Outlook: The Sensex may experience some short-term volatility due to global market fluctuations and geopolitical events. However, the underlying economic fundamentals remain strong, suggesting continued upward momentum.

- Long-Term Potential: Experts predict continued growth for the Sensex, driven by sustained economic expansion and increasing corporate profitability. However, factors like inflation and interest rate hikes could impact the trajectory.

- Expert Opinion: "We anticipate continued growth in the Sensex over the next year, barring any unforeseen global crises," says [Name of financial analyst], Chief Investment Strategist at [Investment Firm Name].

Nifty's Impressive Rally

Nifty's Key Performance Indicators

The Nifty index has also experienced a significant rally, mirroring the Sensex's upward trend. Key indicators highlighting this performance include:

- High Trading Volume: Increased trading volume suggests robust investor participation and confidence in the market's potential.

- Market Capitalization Growth: The overall market capitalization of companies listed in the Nifty has seen a notable surge, reflecting the positive market sentiment.

- Leading Contributors: Companies in the IT, pharmaceutical, and energy sectors have been significant contributors to Nifty's gains, further supporting the positive economic indicators.

- Global Comparisons: Compared to other major global indices, the Nifty has demonstrated relatively strong performance, showcasing the resilience of the Indian economy.

Interpreting Nifty's Market Behavior

Nifty's positive momentum is largely driven by:

- Positive Economic Data: Strong macroeconomic indicators and improved corporate earnings have bolstered investor confidence in the Indian market.

- Government Policies: Supportive government policies and reforms are creating a favorable environment for businesses and investors.

- Potential Corrections: While the current trend is positive, it's essential to acknowledge the possibility of market corrections in the short term due to global uncertainties.

- Investor Implications: Long-term investors are likely to benefit most from this trend, while short-term traders may need to exercise caution and manage risk effectively.

Implications for Investors

Investment Strategies in the Current Market

Given the current market trends, investors should consider the following strategies:

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk and maximize returns.

- Risk Management: Implementing robust risk management strategies is vital, especially during periods of market volatility.

- Long-Term Perspective: A long-term investment horizon generally allows for greater returns while weathering short-term fluctuations.

- Professional Advice: Seeking advice from a qualified financial advisor is essential before making any significant investment decisions.

Understanding Market Volatility

Market volatility is inherent and can significantly impact investment outcomes.

- Managing Volatility: Investors need to understand their risk tolerance and adjust their investment strategies accordingly.

- Risk Mitigation Techniques: Techniques like stop-loss orders and diversification can help mitigate potential losses.

- Potential for Gains and Losses: Remember that the stock market offers the potential for both significant gains and substantial losses; prudent investment strategies are crucial.

Conclusion: Staying Updated on Live Stock Market Updates

The Sensex and Nifty have demonstrated impressive gains, driven by strong economic fundamentals, positive corporate earnings, and increased foreign investment. While the outlook is generally positive, it's crucial for investors to understand and manage the inherent market volatility. To make informed investment decisions, staying updated on live stock market updates regarding Sensex and Nifty is essential. Stay ahead of the curve by regularly checking reliable financial news sources for the latest updates on Sensex and Nifty. Subscribe to our newsletter for daily market insights and expert analysis!

Featured Posts

-

Eye Tooth Restaurant Finally Opens Anchorages New Food And Travel Scene Expands

May 09, 2025

Eye Tooth Restaurant Finally Opens Anchorages New Food And Travel Scene Expands

May 09, 2025 -

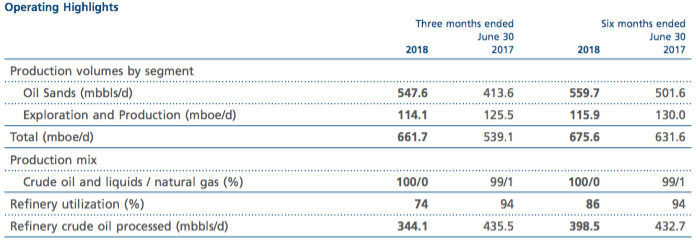

Record High Suncor Production Counterbalanced By Slowing Sales And Rising Inventories

May 09, 2025

Record High Suncor Production Counterbalanced By Slowing Sales And Rising Inventories

May 09, 2025 -

The Colin Cowherd Jayson Tatum Debate A Deeper Look At The Criticism

May 09, 2025

The Colin Cowherd Jayson Tatum Debate A Deeper Look At The Criticism

May 09, 2025 -

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025

Violences Conjugales A Dijon Le Boxeur Bilel Latreche Devant La Justice

May 09, 2025 -

Bayern Munichs Champions League Defeat Against Inter Milan

May 09, 2025

Bayern Munichs Champions League Defeat Against Inter Milan

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025