Los Angeles Wildfires: A Reflection Of Our Times Through Betting Markets

Table of Contents

The Rise of Wildfire Prediction Markets

Prediction markets, platforms where individuals can bet on future events, are increasingly incorporating natural disasters like wildfires. These markets leverage collective intelligence, aggregating the opinions of many participants to generate odds reflecting the perceived probability of an event. While the concept might seem unusual, particularly in the context of devastating events like wildfires, they offer a fascinating glimpse into how risk is assessed and perceived.

- Increasing accuracy of wildfire prediction models informing market odds: Advances in meteorological modeling and satellite technology are allowing for more precise predictions of wildfire risk, directly influencing the odds offered in these markets. Sophisticated algorithms analyze factors like fuel load, weather patterns, and historical fire data to generate probability estimates.

- Different types of bets offered (e.g., severity, duration, affected areas): Betting markets are not simply binary ("will there be a wildfire?"). They offer more nuanced options, allowing bets on the severity (acreage burned), duration (number of days), and specific geographic areas affected by wildfires in Los Angeles.

- Examples of platforms offering wildfire prediction markets (if any exist): While dedicated platforms specifically for wildfire prediction markets are currently limited, the concept is gaining traction. It's likely that broader prediction markets incorporating various catastrophic events will soon include more specific wildfire-related options. Existing platforms focusing on weather derivatives could potentially expand to incorporate detailed wildfire risk assessments.

- Discuss the ethical considerations surrounding profiting from natural disasters: The ethical implications of profiting from the suffering caused by natural disasters are significant. Concerns arise about potentially exacerbating the problem or creating an incentive for inaction by those who profit from disaster prediction. Transparency and responsible use of such data are crucial.

Climate Change and Wildfire Odds

The undeniable link between climate change and increased wildfire risk in Los Angeles is clearly reflected in shifting odds within prediction markets. Rising temperatures, prolonged droughts, and more frequent Santa Ana winds create a perfect storm for catastrophic wildfires.

- Data demonstrating the increasing frequency and intensity of LA wildfires: Data from the past two decades shows a clear upward trend in both the number and intensity of wildfires in the Los Angeles area, with larger areas affected and greater property damage.

- How climate models predict future wildfire risk and influence market predictions: Climate models project a continued increase in wildfire risk in California, with longer fire seasons and more extreme fire behavior. These projections directly influence the odds set by prediction markets, reflecting a growing perceived probability of severe wildfires.

- Discussion of the role of drought, heatwaves, and Santa Ana winds in influencing odds: Prolonged droughts desiccate vegetation, making it highly flammable. Heatwaves increase the intensity of fires, and Santa Ana winds rapidly spread flames, all significantly impacting the odds in prediction markets.

- Expert opinions on the long-term implications of climate change on LA wildfire betting: Experts predict a continued rise in wildfire risk and severity, suggesting that odds in prediction markets will likely reflect this increased probability in the coming years.

The Socioeconomic Impact Reflected in the Markets

Socioeconomic factors play a crucial role in determining wildfire risk and, ideally, should be reflected in betting markets. However, the extent to which these factors are currently incorporated is debatable.

- Impact of housing density and building materials on wildfire damage and market odds: Higher-density housing and the use of flammable building materials increase both the risk of damage and the severity of losses during wildfires, impacting the insurance premiums and potentially the odds offered in prediction markets.

- The role of preventative measures (e.g., defensible space, fire-resistant landscaping) on market predictions: Communities that invest in preventative measures, such as creating defensible space around homes and using fire-resistant landscaping, should experience lower wildfire risk, a factor that – in theory – should be reflected in lower odds in prediction markets.

- Discussion of insurance premiums and their relation to wildfire risk and betting market trends: Insurance premiums in high-risk areas are significantly higher, reflecting the perceived risk. These premiums could, in turn, influence the odds set in prediction markets as insurers' risk assessments inform the market's collective understanding of risk.

- Analysis of potential biases in the markets based on socioeconomic factors: Biases can emerge if prediction markets predominantly reflect the perspectives of wealthier individuals who may have greater access to information or resources, potentially overlooking the vulnerabilities of lower-income communities.

Data Transparency and Market Accuracy

The reliability and transparency of data underpinning wildfire prediction markets are paramount. Without accurate and unbiased data, the market's predictions become unreliable.

- Sources of data used to inform wildfire prediction markets: Data sources would likely include historical fire records, meteorological data, satellite imagery, and fuel-load assessments.

- Potential inaccuracies or biases in data collection and analysis: Inaccuracies can stem from limitations in data collection, biases in modeling assumptions, or incomplete data sets. Addressing these limitations is crucial to ensure accurate market predictions.

- The level of transparency in the methodologies used by different platforms: Transparency in data sources and methodologies is vital for building trust and ensuring the integrity of the market. Openly sharing information allows for external scrutiny and helps identify and correct biases.

- The impact of data quality on the accuracy of market predictions: The accuracy of market predictions is directly tied to the quality and reliability of the underlying data. Poor data quality can lead to inaccurate odds and potentially misinformed decision-making.

Conclusion

Los Angeles wildfires are a devastating reality, and their impact extends beyond the immediate devastation. The emergence of prediction markets offers a unique – if somewhat unsettling – lens through which to examine the escalating risks and the complex interplay of environmental, social, and economic factors. While these markets offer insights, ethical considerations and data transparency must be paramount.

Understanding the trends in Los Angeles wildfire betting markets is crucial for preparedness and informed decision-making. Stay informed about the latest developments in wildfire prediction and mitigation efforts, and consider how you can contribute to reducing the risk of future Los Angeles wildfires.

Featured Posts

-

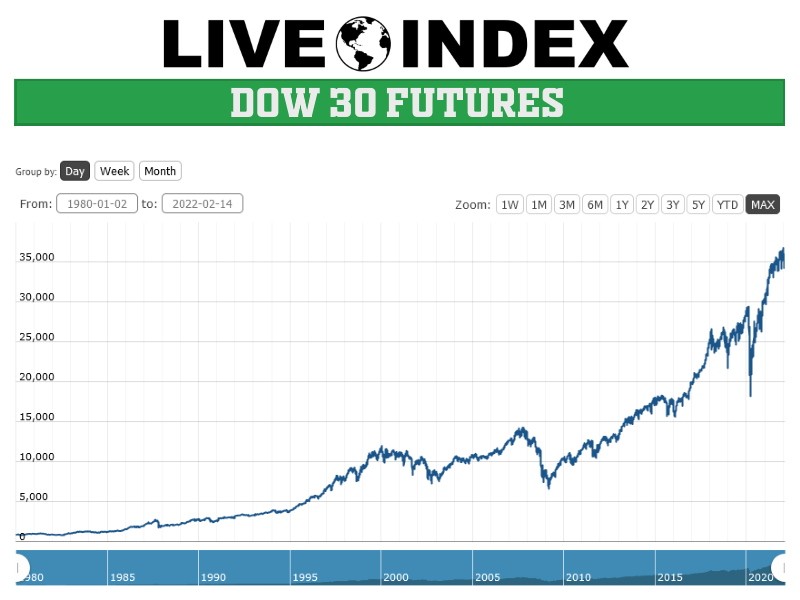

Analyzing The Dow Futures Impact Of Chinas Economic Policies On The Stock Market

Apr 26, 2025

Analyzing The Dow Futures Impact Of Chinas Economic Policies On The Stock Market

Apr 26, 2025 -

Auto Carrier Estimates 70 Million Impact From Increased Us Port Fees

Apr 26, 2025

Auto Carrier Estimates 70 Million Impact From Increased Us Port Fees

Apr 26, 2025 -

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025

Secret Service Closes Investigation Into White House Cocaine Discovery

Apr 26, 2025 -

Market Update Dow Futures And Chinas Economic Stability Amid Trade Concerns

Apr 26, 2025

Market Update Dow Futures And Chinas Economic Stability Amid Trade Concerns

Apr 26, 2025 -

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025

Anchor Brewing Company Closes After 127 Years The End Of An Era

Apr 26, 2025