LVMH Stock Takes A Hit: 8.2% Decline After Q1 Sales Report

Table of Contents

Q1 Sales Figures Miss Analyst Expectations

LVMH's Q1 2024 sales report revealed figures that fell short of analyst expectations, triggering the significant drop in the LVMH stock price. This underperformance can be attributed to several key factors:

Lower-than-anticipated growth in key markets

- China's slower-than-expected recovery: While China is a crucial market for luxury goods, its post-pandemic recovery has been slower than anticipated, impacting LVMH's sales significantly. The easing of zero-COVID restrictions hasn't translated into the expected surge in luxury spending.

- Weakening European consumer spending: Inflation and rising interest rates in Europe have led to reduced consumer confidence, impacting spending on discretionary items, including luxury goods. This dampened demand in a traditionally strong market for LVMH.

- Impact of inflation on high-end purchases: The global inflationary environment has made high-end purchases less accessible for many consumers, affecting sales across LVMH's various brands. Consumers are becoming more price-sensitive, even within the luxury segment.

Detailed analysis of the sales figures reveals a particularly pronounced underperformance in specific geographic regions and product categories. While precise figures may vary depending on the source, reports indicate significant deviations from projected growth rates, highlighting the severity of the shortfall.

Impact of the global economic slowdown

The global economic slowdown is a significant contributing factor to LVMH's Q1 underperformance.

- Rising interest rates: Central banks globally are raising interest rates to combat inflation, increasing borrowing costs and reducing consumer spending power.

- Potential recessionary pressures: The threat of a recession in major economies is further dampening consumer confidence and reducing demand for luxury goods, a discretionary purchase.

- Reduced consumer confidence impacting luxury spending: Uncertainty about the economic outlook leads consumers to postpone or cancel non-essential purchases, including luxury items. This cautious approach directly impacts the performance of brands like Louis Vuitton and Dior. This decreased consumer confidence is a key factor affecting LVMH stock.

Analysis of LVMH's Portfolio Performance

While LVMH boasts a diverse portfolio of luxury brands, the Q1 results show variations in performance across its various holdings.

Performance of individual brands

- Louis Vuitton: While generally a strong performer, Louis Vuitton's growth may have been impacted by the factors mentioned above, particularly the slowdown in key markets.

- Dior: Similarly, Dior's performance may have been affected by reduced consumer spending and changing market dynamics.

- Other brands: Other brands within the LVMH portfolio likely experienced varying degrees of success or underperformance, depending on their specific market segments and geographic exposure. Further analysis of individual brand performance is needed to provide a complete picture.

Analyzing specific sales figures for individual brands is crucial for a thorough understanding of the overall decline in LVMH stock.

Impact on future growth projections

The disappointing Q1 results have led analysts to revise their future growth projections for LVMH downwards. This impacts investor confidence and long-term investment strategies.

- Revised growth forecasts: Several analysts have already lowered their earnings per share (EPS) estimates for LVMH for the remainder of 2024.

- Impact on investor confidence: The downward revision of forecasts significantly impacts investor sentiment. This reduced confidence is directly reflected in the LVMH stock price.

- Implications for long-term investment strategies: The Q1 results necessitate a reassessment of long-term investment strategies, with investors potentially adjusting their portfolios based on the revised outlook.

Investor Reaction and Market Sentiment

The release of the Q1 sales report triggered immediate and significant volatility in the LVMH stock price.

Stock price volatility

- Sharp decline: The 8.2% drop in LVMH stock price is a clear indication of the market's negative reaction to the disappointing sales figures.

- Trading volume: The trading volume likely increased significantly following the report's release, reflecting heightened investor activity and uncertainty.

- Short-selling activities: The significant decline may have been exacerbated by short-selling activities, as investors bet against further declines in the LVMH stock price.

Analyst recommendations and ratings

Following the Q1 results, several analysts have revised their recommendations and price targets for LVMH stock. Some may have downgraded their rating, reflecting a more cautious outlook. This impacts investor decisions, contributing to the overall market sentiment surrounding LVMH stock.

Conclusion

The 8.2% decline in LVMH stock after its Q1 sales report highlights the challenges facing the luxury goods sector in the current economic climate. The underperformance in key markets, compounded by macroeconomic headwinds, has significantly dampened investor confidence. While LVMH possesses a powerful brand portfolio, the Q1 results necessitate adapting to evolving consumer behavior and proactively addressing challenges. Careful monitoring of LVMH stock and its subsequent performance reports is crucial for investors navigating this evolving landscape in the luxury market. Stay informed on the latest news and analyses regarding LVMH stock and make well-informed investment decisions.

Featured Posts

-

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office

May 24, 2025

Analyzing Stitchpossibles Weekend Performance Implications For The 2025 Box Office

May 24, 2025 -

Delayed Promotions Accenture To Upgrade 50 000 Staff Members

May 24, 2025

Delayed Promotions Accenture To Upgrade 50 000 Staff Members

May 24, 2025 -

Maryland Softballs Comeback Win Over Delaware 5 4

May 24, 2025

Maryland Softballs Comeback Win Over Delaware 5 4

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Development

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition A Platform For Collaboration And Development

May 24, 2025 -

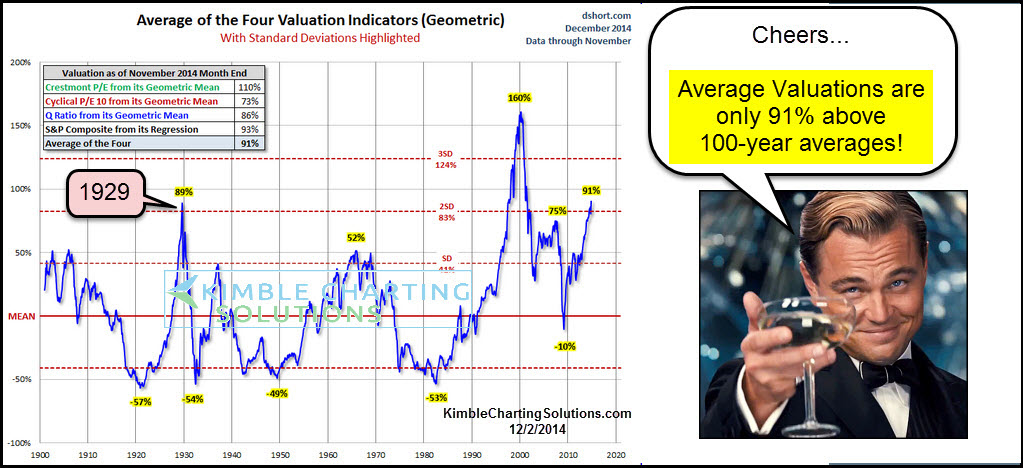

Bof A On Stock Market Valuations A Reason For Optimism

May 24, 2025

Bof A On Stock Market Valuations A Reason For Optimism

May 24, 2025