Major HMRC Website Failure Leaves UK Users Unable To Access Accounts

Table of Contents

Extent of the HMRC Website Outage

The HMRC website outage lasted for [Insert Duration of Outage Here], leaving millions of UK taxpayers locked out of their online accounts. This "HMRC service disruption" affected a wide range of online tax services, causing significant inconvenience and potential financial repercussions. The scale of the "HMRC website problems" was considerable, affecting both individual taxpayers and businesses. Specifically, the following services were unavailable:

- Unable to file self-assessment tax returns: This impacted millions of individuals and businesses facing crucial deadlines.

- Inability to view PAYE information: Employees were unable to access crucial details regarding their tax deductions and payments.

- Difficulty accessing tax credits information: Individuals relying on tax credits faced difficulties checking their eligibility and payments.

- Online tax payment issues: Many users reported problems submitting online tax payments during the outage. This "HMRC website failure" caused delays and potential late payment penalties for many.

Causes of the HMRC Website Failure

While the precise cause of the HMRC website failure remains officially unconfirmed at this time [Insert official statement or lack thereof if available], several possibilities exist. These "HMRC technical issues" could range from unexpected server overload due to high traffic to more serious problems. Potential causes include:

- Planned maintenance: While unlikely to cause such a widespread and prolonged outage, scheduled maintenance could have been a contributing factor if poorly managed.

- Unexpected server overload: A sudden surge in website traffic, perhaps triggered by a specific event or announcement, might have overwhelmed the HMRC servers.

- Security breach (if confirmed): While this is speculation without official confirmation, a cyberattack remains a possibility, although HMRC has not yet confirmed this as a cause.

- Software failure: A critical software bug or system failure could have caused the widespread "HMRC system crash".

Impact on UK Taxpayers

The HMRC website failure had a significant impact on UK taxpayers, causing considerable inconvenience and potentially leading to financial penalties. The "HMRC account access problems" resulted in:

- Missed tax return deadlines leading to fines: Taxpayers who were unable to file their returns on time faced potential penalties for late submission.

- Inability to access crucial tax information: This caused significant stress and anxiety for those needing access to their tax details for various reasons.

- Stress and anxiety caused by the disruption: The inability to access essential tax information caused widespread stress and anxiety amongst affected users.

- Lost productivity for businesses relying on HMRC services: Businesses dependent on timely access to HMRC services experienced productivity losses due to the outage.

HMRC's Response to the Website Failure

HMRC has issued [Insert details of official statement here – include links to press releases, social media posts etc.]. [Summarize the statement, including apologies, explanation of the issue (if any) and the steps taken to resolve it]. Their response included:

- Public announcements regarding the outage: [Describe the method of announcement].

- Timeline of resolution efforts: [Describe the timeline of the events leading up to the resolution of the issue]

- Communication channels used to update taxpayers: [Social media, press releases, etc.]

- Compensation offered (if any): [Detail any compensation offered to affected users].

The Fallout from the Major HMRC Website Failure and Next Steps

The major HMRC website failure underscored the critical need for robust and reliable online tax services. The disruption caused significant inconvenience, stress, and potential financial penalties for millions of UK taxpayers. The "HMRC website" needs to address the underlying issues to prevent future outages. To stay informed, monitor the HMRC website regularly for updates on service restoration and stability. Ensure access to your HMRC account by regularly checking for announcements and following HMRC's social media channels for timely updates. Stay updated on HMRC services to minimize potential disruption in the future. Understanding the issues and proactively managing your tax affairs is crucial.

Featured Posts

-

Poznata Kci Sve O Gini Marii Schumacher

May 20, 2025

Poznata Kci Sve O Gini Marii Schumacher

May 20, 2025 -

Naissance D Une Petite Fille Michael Schumacher Devient Grand Pere

May 20, 2025

Naissance D Une Petite Fille Michael Schumacher Devient Grand Pere

May 20, 2025 -

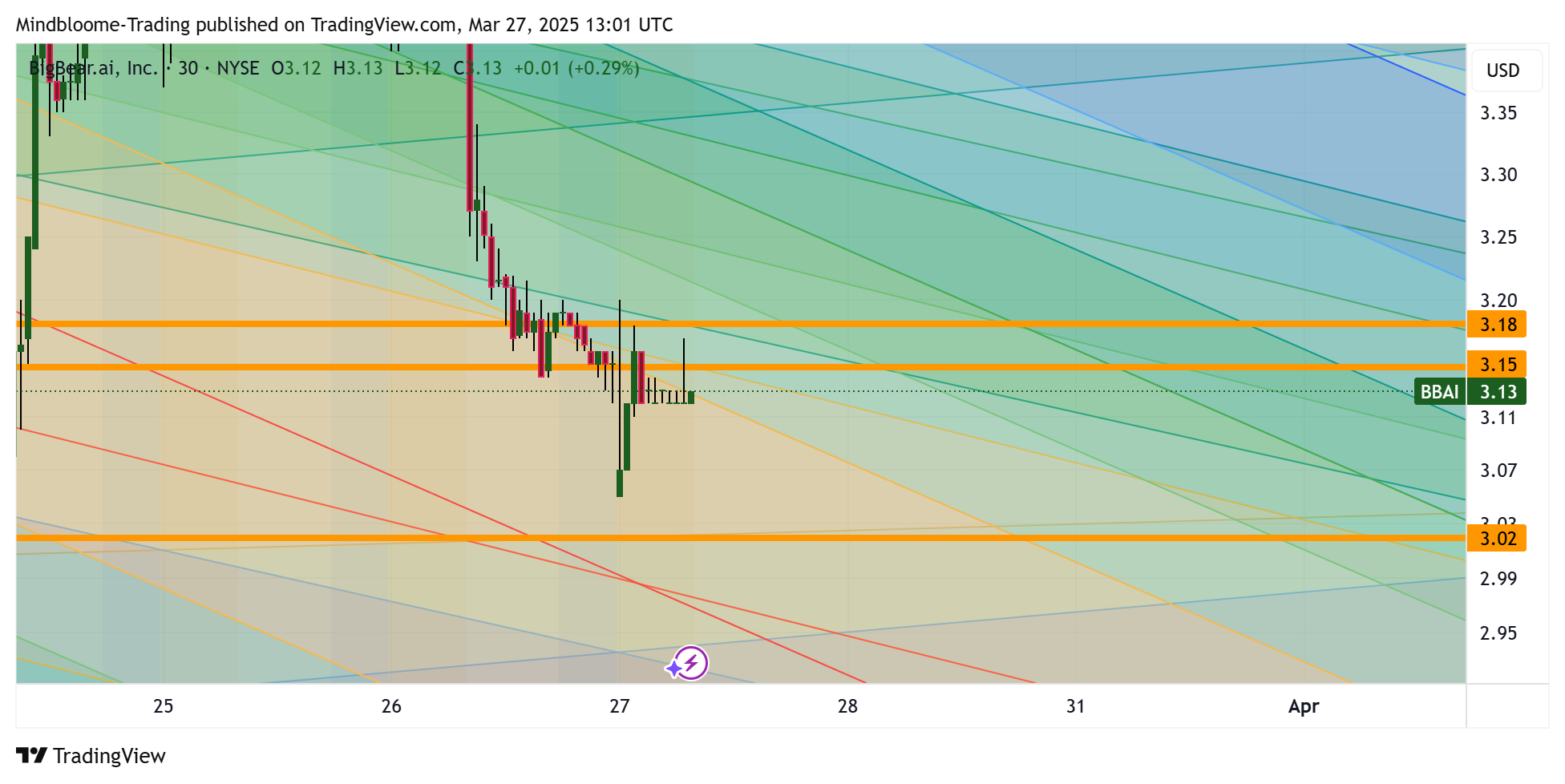

Big Bear Ai Holdings Inc Nyse Bbai Penny Stock Potential For Skyrocketing Growth

May 20, 2025

Big Bear Ai Holdings Inc Nyse Bbai Penny Stock Potential For Skyrocketing Growth

May 20, 2025 -

Burnham And Highbridge History Unveiled Photo Archive Opens

May 20, 2025

Burnham And Highbridge History Unveiled Photo Archive Opens

May 20, 2025 -

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025