Market Downturn: A Case Study Of Professional Selling And Individual Purchasing

Table of Contents

Impact of Market Downturn on Consumer Behavior

A market downturn significantly alters consumer behavior, impacting spending habits and purchasing priorities. Understanding these shifts is vital for businesses to adapt their strategies effectively.

Reduced Consumer Spending

Economic uncertainty leads to a dramatic reduction in consumer spending. Consumers become more cautious, prioritizing essential expenses over discretionary purchases.

- Prioritization of Essentials: Spending is focused on necessities like food, housing, and utilities. Non-essential items are often postponed or eliminated entirely.

- Significant Decrease in Discretionary Spending: Purchases like entertainment, travel, and new clothing are significantly curtailed. Consumers are more likely to repair existing items rather than replace them.

- Heightened Price Sensitivity: Consumers become acutely aware of prices and actively seek value for their money. Deals, discounts, and promotions become highly influential.

- Examples: Delaying major purchases like cars or houses, opting for cheaper grocery brands, canceling subscriptions to streaming services, foregoing restaurant meals in favor of home-cooked food.

Shift in Purchasing Priorities

During a market downturn, consumer priorities shift from luxury goods to practical, cost-effective options. Value and durability become key considerations.

- Focus on Value and Practicality: Consumers prioritize functionality and longevity over brand prestige or fashionable designs.

- Increased Demand for Cost-Effective Products and Services: Cheaper alternatives gain popularity as consumers seek to maximize their purchasing power.

- Weakening Brand Loyalty: Established brand loyalty may weaken as consumers are more willing to try cheaper alternatives or switch brands to find better deals.

- Examples: Switching from premium brands to store brands, repairing appliances instead of replacing them, choosing energy-efficient products to reduce long-term costs.

Increased Savings and Debt Reduction

A market downturn often motivates consumers to focus on financial stability, leading to increased savings and debt reduction efforts.

- Focus on Debt Reduction: Consumers prioritize paying down existing debts, such as credit card balances and loans.

- Reduced Willingness to Take on New Debt: Consumers are less likely to take out new loans or increase their credit card debt.

- Impact on Long-Term Investments: Investment activity may slow down as consumers become more risk-averse. Retirement planning may also be impacted.

- Examples: Increased use of budgeting apps and financial planning tools, prioritizing debt repayment over other expenses, cutting back on non-essential expenses to increase savings.

Adapting Professional Selling Strategies During a Market Downturn

Successfully navigating a market downturn requires businesses to adapt their sales strategies to reflect the changing consumer behavior.

Emphasizing Value Proposition

In a challenging economic climate, clearly articulating the value and return on investment (ROI) of products or services is paramount.

- Clear Value Articulation: Highlight the tangible benefits of your offerings and how they solve customer problems.

- Focus on Problem-Solving: Position your products or services as solutions to specific customer needs or pain points.

- Highlight Cost Savings and Long-Term Value: Demonstrate how your offerings can save customers money in the long run.

- Examples: Emphasizing the energy efficiency of appliances, showcasing the long-term cost savings of a business solution, highlighting the durability and longevity of a product.

Building Trust and Relationships

Building strong relationships with customers is crucial during a market downturn. Trust can mitigate price sensitivity and foster loyalty.

- Transparency and Open Communication: Maintain open and honest communication with customers about pricing and product features.

- Personalized Service: Provide personalized service that addresses individual customer needs and preferences.

- Strong Relationships: Focus on building long-term relationships based on trust and mutual understanding.

- Examples: Proactive customer service, customized solutions, transparent pricing strategies, loyalty programs.

Adapting Sales Tactics

Businesses need to adapt their sales tactics to reflect the changed economic landscape. This includes offering flexible payment options and targeted marketing.

- Flexible Payment Options: Offer flexible payment plans, financing options, or discounts to make purchases more accessible.

- Targeted Marketing Campaigns: Focus marketing efforts on highlighting value and cost savings, using targeted advertising to reach the right customers.

- Data-Driven Insights: Utilize data to understand changing consumer needs and adapt strategies accordingly.

- Examples: Offering discounts and promotions, using targeted advertising on social media, implementing loyalty programs, adjusting pricing strategies.

Conclusion

Navigating a market downturn requires a proactive and adaptable approach from both businesses and consumers. For businesses, emphasizing value, building trust, and adapting sales strategies are crucial for maintaining sales and market share during economic uncertainty. Consumers, on the other hand, need to prioritize needs, focus on value, and manage their finances wisely. Understanding the dynamics of consumer behavior during a market downturn, and adjusting sales and purchasing strategies accordingly, is key to successfully weathering the storm. By implementing the strategies discussed in this case study, businesses can mitigate the impact of a market downturn and maintain a strong position for future growth. Learn more about how to navigate your business through a market downturn by exploring [link to relevant resource].

Featured Posts

-

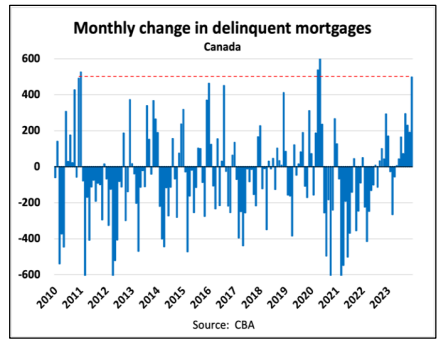

Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 28, 2025

Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 28, 2025 -

Nfl Draft 2024 Shedeur Sanderss Cleveland Browns Destination

Apr 28, 2025

Nfl Draft 2024 Shedeur Sanderss Cleveland Browns Destination

Apr 28, 2025 -

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025

U S Dollars Troubled Start Parallels To The Nixon Presidency

Apr 28, 2025 -

The Return Of High Gpu Prices A Market Analysis

Apr 28, 2025

The Return Of High Gpu Prices A Market Analysis

Apr 28, 2025 -

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025

Eva Longorias Culinary Encounter A World Renowned Chefs Fishermans Stew

Apr 28, 2025

Latest Posts

-

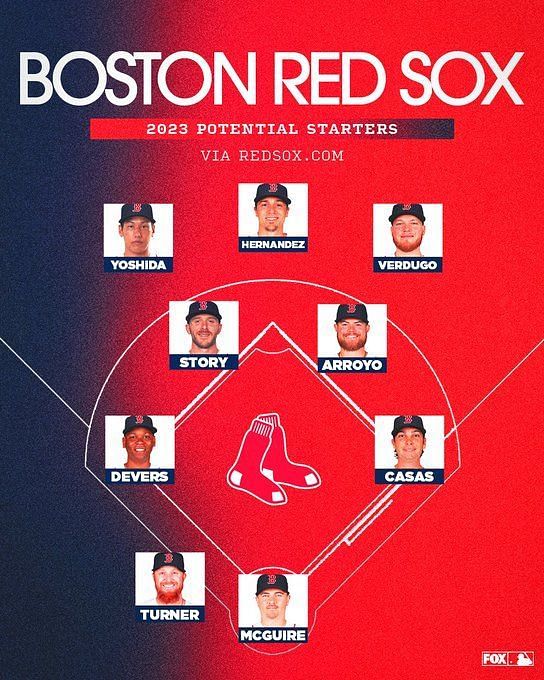

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025