The Return Of High GPU Prices: A Market Analysis

Table of Contents

Factors Contributing to the Resurgence of High GPU Prices

Several interconnected factors contribute to the current climate of high GPU prices. Let's examine the key players.

Increased Demand

Demand for GPUs has exploded across multiple sectors:

- Booming Gaming Market: The release of new game consoles and highly anticipated AAA titles has fueled a surge in gaming PC sales, significantly increasing the demand for high-performance GPUs. Games like Cyberpunk 2077 and Hogwarts Legacy notoriously require powerful hardware.

- Cryptocurrency Mining Resurgence: The fluctuating value of cryptocurrencies like Ethereum (before its merge) and others has led to renewed interest in cryptocurrency mining, driving up the demand for GPUs suitable for this purpose. The profitability of mining directly impacts GPU demand.

- AI and Machine Learning Explosion: The rapid advancements in artificial intelligence and machine learning are driving demand for powerful GPUs capable of handling complex calculations and deep learning tasks. Data centers and research institutions are major consumers.

Data from Jon Peddie Research indicates a significant year-on-year increase in GPU shipments, although this does not fully reflect the impact on pricing due to the uneven distribution and stock issues. The most sought-after high-end GPUs, such as the NVIDIA RTX 4090 and AMD Radeon RX 7900 XTX, are consistently sold out or available at inflated prices.

Persistent Supply Chain Issues

The global semiconductor shortage continues to plague the industry, impacting GPU production significantly:

- Global Chip Shortage: The ongoing global chip shortage limits the availability of essential components needed for GPU manufacturing, creating bottlenecks across the supply chain.

- Logistical Bottlenecks: Shipping delays, port congestion, and geopolitical instability further exacerbate the supply chain challenges, delaying the delivery of crucial components and finished products. The war in Ukraine, for example, disrupted supply lines for certain materials.

- Factory Closures and Slowdowns: Unexpected factory closures or production slowdowns due to various factors, including COVID-19 outbreaks and natural disasters, further constrain GPU production capacity. Manufacturing GPUs is a complex, multi-stage process.

The time it takes to manufacture a high-end GPU, from raw material sourcing to final assembly and testing, can range from several months to over a year. Any disruption along this lengthy process has significant ripple effects.

Scalper Activities and Market Manipulation

Scalpers, utilizing bots and other automated tools, aggressively purchase GPUs at retail prices and resell them at significantly inflated prices on secondary markets.

- Methods Used: Scalpers employ sophisticated techniques, including website monitoring tools and automated checkout systems, to quickly acquire large quantities of GPUs.

- Impact on Prices: Their activities artificially inflate prices, making it difficult for legitimate buyers to acquire GPUs at reasonable costs.

- Regulatory Efforts: While some regulatory efforts are underway to combat scalping, effectively enforcing these measures remains a challenge.

The actions of scalpers contribute significantly to the perception and reality of high GPU prices.

Increased Raw Material Costs

The cost of raw materials used in GPU manufacturing, such as silicon wafers and precious metals, has risen sharply:

- Impact on Manufacturing Costs: This increase in raw material costs directly translates into higher manufacturing costs for GPUs, contributing to increased retail prices.

- Price Fluctuations: The prices of these materials are subject to significant fluctuations due to global market conditions and geopolitical events.

- Specific Materials: Materials like silicon, copper, and various rare earth elements are crucial for GPU production and their price volatility has a direct impact.

Impact of High GPU Prices on Different Market Segments

The impact of high GPU prices varies across different market segments:

Gamers

Gamers face reduced accessibility to high-end gaming hardware, potentially leading to compromises in gaming experiences or delayed upgrades. Budget-conscious gamers might opt for older, less powerful GPUs or lower-resolution settings.

Cryptocurrency Miners

The high cost of GPUs significantly impacts the profitability of cryptocurrency mining operations, making it less attractive for many miners and potentially slowing down certain blockchain networks.

AI and Machine Learning Professionals

High GPU prices increase the cost of research and development in the AI and machine learning fields, potentially slowing down innovation and accessibility for smaller research teams and businesses. This can hinder the development and deployment of AI projects.

Potential Future Trends and Predictions

Several factors could influence future GPU prices:

Supply Chain Recovery

A gradual recovery of global supply chains is expected, but the timeline remains uncertain due to ongoing geopolitical uncertainties and potential unforeseen disruptions.

Technological Advancements

Advancements in GPU architectures and manufacturing processes could lead to increased production efficiency and potentially lower costs in the long term. However, these advancements often take time to translate into lower retail prices.

Price Stabilization

Predicting price stabilization is challenging. However, a balance between supply and demand, coupled with a cooling of the cryptocurrency market and a stabilization of raw material costs, could lead to a gradual decrease in GPU prices over the next few years. However, this is contingent upon various factors and could be influenced by unforeseen events.

Conclusion

The return of high GPU prices is a complex issue stemming from the interplay of increased demand across various sectors, persistent supply chain disruptions, scalper activities, and rising raw material costs. Understanding these factors is crucial for navigating the current market. The impact is felt acutely across gaming, cryptocurrency mining, and AI development. While a full return to pre-shortage prices remains uncertain, various factors could lead to price stabilization in the coming years.

Stay informed about the fluctuating landscape of high GPU prices and related market trends by following reputable industry news sources and subscribing to our newsletter for the latest analysis!

Featured Posts

-

Real Time Analysis The Economic Effects Of A Canadian Travel Boycott On The Us

Apr 28, 2025

Real Time Analysis The Economic Effects Of A Canadian Travel Boycott On The Us

Apr 28, 2025 -

Analyzing The Recent Market Dip Professional Vs Individual Investor Behavior

Apr 28, 2025

Analyzing The Recent Market Dip Professional Vs Individual Investor Behavior

Apr 28, 2025 -

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025

A Look Back 2000 Yankees Diary Victory Over The Royals

Apr 28, 2025 -

Addressing The Issue Of Oversized Trucks In America

Apr 28, 2025

Addressing The Issue Of Oversized Trucks In America

Apr 28, 2025 -

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

As Markets Swooned Pros Sold And Individuals Pounced A Market Analysis

Apr 28, 2025

Latest Posts

-

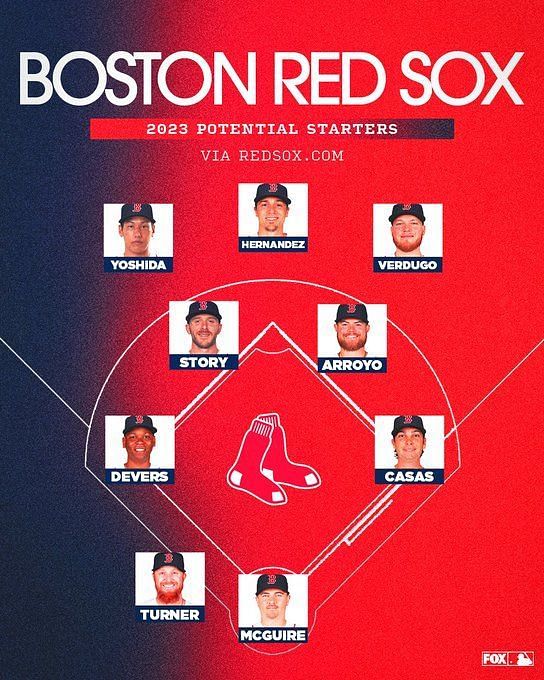

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025