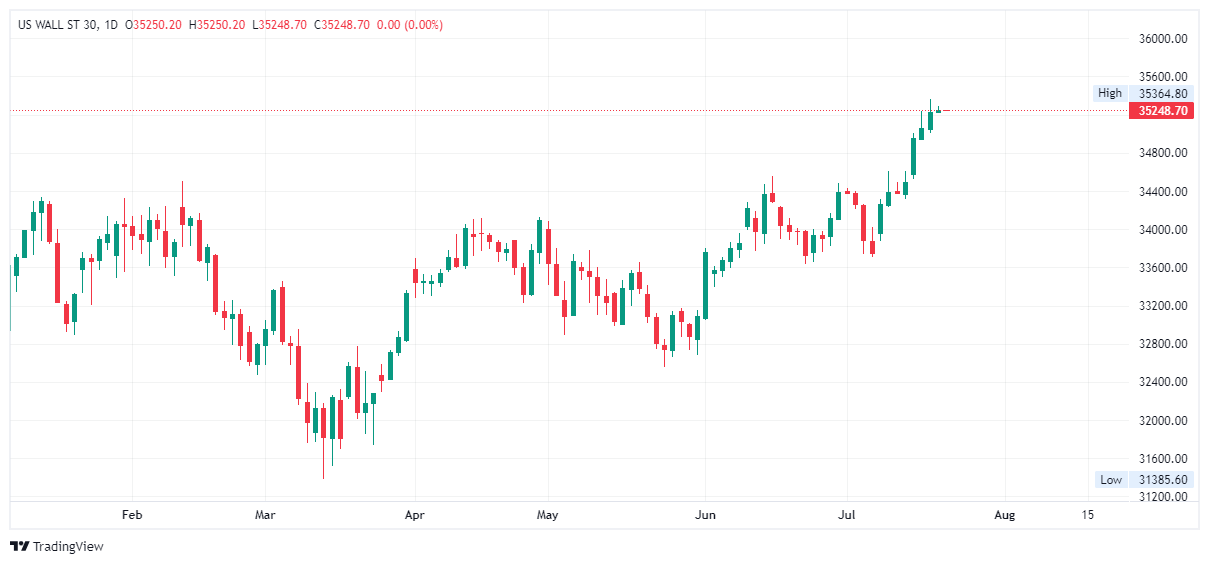

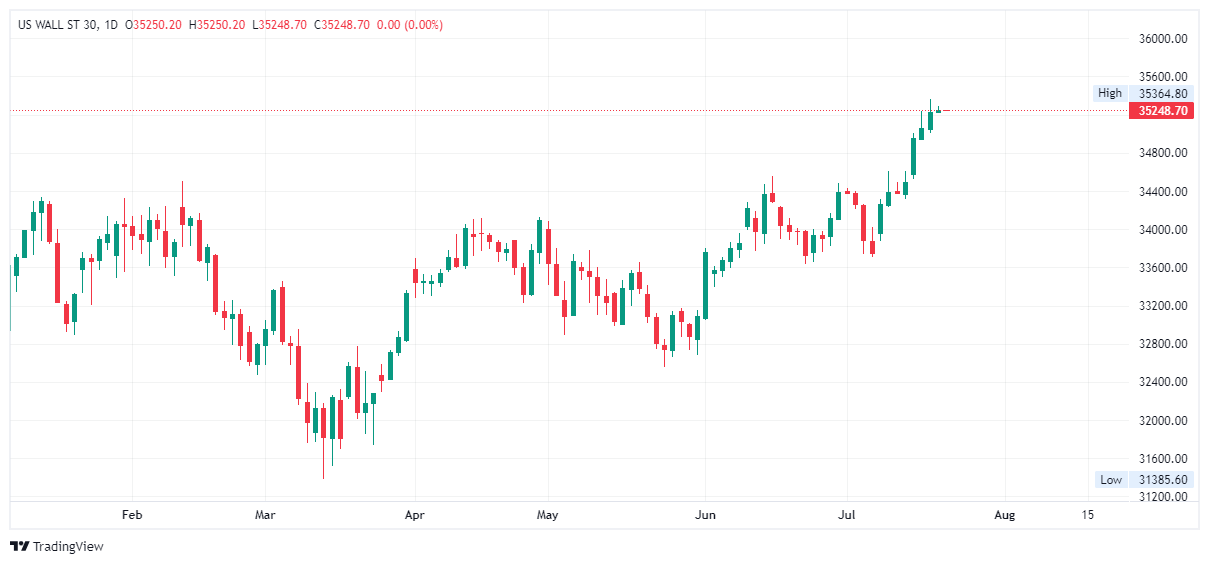

Market Rally: 1000-Point Dow Jump Sparks Investor Optimism

Table of Contents

Understanding the 1000-Point Dow Jump: Causes and Contributing Factors

The unprecedented 1000-point Dow jump wasn't a spontaneous event; it was the result of several converging factors that collectively shifted market sentiment.

Economic Indicators

Positive economic data played a crucial role in fueling this market rally. Several key indicators pointed towards a healthier-than-expected economic outlook:

- Lower-than-expected inflation: A slowdown in inflation eased concerns about aggressive interest rate hikes by the Federal Reserve, boosting investor confidence. Lower inflation generally translates to stronger consumer spending and increased corporate profits.

- Strong employment numbers: Robust job growth figures indicated a healthy labor market, further reinforcing the positive economic narrative. A strong job market signals consumer confidence and increased spending potential.

- Positive corporate earnings reports: Better-than-anticipated earnings reports from major corporations across various sectors showcased the resilience of the economy and boosted investor optimism. Strong earnings often translate to increased stock prices and higher investor returns.

These positive economic signals collectively contributed to a more optimistic outlook, driving significant investment activity.

Geopolitical Factors

Geopolitical developments also played a subtle yet important role in shaping the market rally.

- Easing of trade tensions: A reduction in trade disputes between major global economies reduced uncertainty and fostered a more positive investment environment. Reduced trade barriers lead to smoother supply chains and increased trade volume.

- Resolution of international conflicts: Positive developments in ongoing geopolitical conflicts helped to alleviate some global risk aversion, encouraging investors to seek higher-yielding assets. Reduced geopolitical instability encourages investment in riskier but higher-return assets.

These geopolitical shifts, though not the primary drivers, contributed to a more favorable global climate for investment.

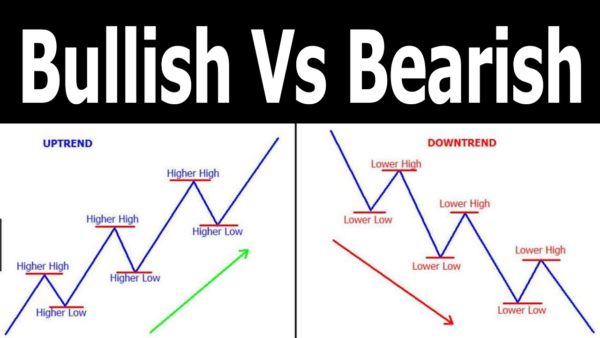

Market Sentiment Shift

Perhaps the most significant factor contributing to the market rally was a dramatic shift in investor psychology.

- Increased buying activity: The positive economic data and geopolitical developments led to a surge in buying activity, pushing stock prices higher. Increased demand leads to higher prices in a free market.

- Reduced selling pressure: As investor sentiment turned positive, the selling pressure on the market eased considerably, further contributing to the upward momentum. Decreased selling reinforces a positive market trend.

- Media coverage and social sentiment: Positive media coverage and upbeat social media sentiment amplified the market rally, creating a self-reinforcing cycle of optimism. Positive media narratives can significantly influence investor behavior and market trends.

Sector-Specific Performance During the Market Rally

The market rally did not impact all sectors equally. Some experienced significant gains while others lagged behind.

Winning Sectors

Certain sectors were disproportionately beneficiaries of the market's upward swing:

- Technology: The technology sector experienced substantial gains, driven by strong earnings reports and positive investor sentiment towards innovative companies. The tech sector is generally considered a growth sector and benefits from positive investor sentiment.

- Consumer Discretionary: The consumer discretionary sector also performed exceptionally well, reflecting increased consumer confidence and spending. Consumer discretionary spending is a key indicator of economic health and consumer confidence.

These sectors benefited from the broader market optimism and strong underlying fundamentals.

Lagging Sectors

Not all sectors shared in the market rally's success:

- Utilities: The utilities sector, typically considered a defensive investment, saw relatively muted gains, reflecting a shift towards riskier assets. Utilities are generally less volatile and tend to underperform during periods of increased risk appetite.

- Healthcare: The healthcare sector also underperformed, possibly due to sector-specific concerns or regulatory uncertainties. Healthcare is often subject to regulatory changes and can be less responsive to general market movements.

Investor Reactions and Outlook: Assessing the Sustainability of the Market Rally

The 1000-point Dow jump has sparked considerable debate about the sustainability of this market rally.

Expert Opinions

Market analysts and financial experts offer diverse perspectives:

- "While this market rally is encouraging, it's crucial to remain cautious and avoid excessive optimism," warns Sarah Chen, Chief Investment Strategist at Global Investments.

- "The rally is likely to be sustained, but we need to monitor inflation and interest rate decisions carefully," adds David Lee, Senior Economist at Economic Research Institute.

These varied viewpoints highlight the uncertainty surrounding the market's long-term trajectory.

Long-Term Implications

The long-term effects of this market rally remain to be seen:

- Economic Growth: The rally could signal stronger economic growth, but this depends on the sustained strength of the economic fundamentals.

- Inflation: The impact on inflation is uncertain, as the rally could either exacerbate or mitigate inflationary pressures.

- Interest Rates: The Federal Reserve's response to the rally and its impact on interest rates will be crucial in shaping the future market direction. Further rate hikes could dampen the market's momentum.

The market's future path depends on a complex interplay of economic and monetary factors.

Strategies for Investors

Given the market's volatility, prudent investment strategies are essential:

- Risk Management: Investors should carefully manage their risk exposure, avoiding excessive speculation.

- Diversification: A diversified investment portfolio across different asset classes can mitigate potential losses.

- Long-Term Investment Strategies: A long-term perspective is crucial, as short-term market fluctuations are to be expected.

Conclusion: Market Rally: Navigating the Aftermath of the 1000-Point Surge

The 1000-point Dow jump represents a significant market event driven by a confluence of positive economic indicators, favorable geopolitical developments, and a decisive shift in investor sentiment. While the rally has sparked optimism, experts caution against overconfidence, emphasizing the importance of careful monitoring and diversified investment strategies. The sustainability of this market upswing depends on several factors, including inflation, interest rate decisions, and overall economic strength.

Stay informed about future market movements by regularly checking our site for updates on the market rally. Understanding market dynamics is key to making sound investment choices. Navigating the complexities of a market rally requires informed decision-making and a long-term perspective. Remember to consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025 -

Nba

Apr 24, 2025

Nba

Apr 24, 2025 -

All Star Game 2024 Green Moody And Hield In Attendance

Apr 24, 2025

All Star Game 2024 Green Moody And Hield In Attendance

Apr 24, 2025 -

Analyzing The Business Model A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025

Analyzing The Business Model A Startup Airlines Reliance On Deportation Flights

Apr 24, 2025 -

Trump Administration Shows Willingness To Negotiate With Harvard After Major Lawsuit

Apr 24, 2025

Trump Administration Shows Willingness To Negotiate With Harvard After Major Lawsuit

Apr 24, 2025