Market Update: CAC 40 Weekly Report - March 7, 2025

Table of Contents

Key Market Movers This Week

Impact of Interest Rate Decisions

The European Central Bank's (ECB) surprise announcement of a 0.5% interest rate increase significantly impacted the CAC 40. This move, larger than many analysts predicted, aimed to combat persistent inflation.

- Specific interest rate changes: The ECB raised its main refinancing operations rate to 3.5%.

- Market reaction: The initial reaction was a sharp selloff, with the CAC 40 dropping over 1.5% immediately following the announcement.

- Impact on different sectors: The banking sector initially benefited from higher interest rates, while growth stocks in the technology sector suffered, reflecting investor concerns about reduced future earnings. Analysts at Société Générale projected a 10% decrease in tech sector valuations over the next quarter due to higher borrowing costs.

Geopolitical Events and Market Sentiment

Escalating tensions in Eastern Europe contributed to a sense of uncertainty in the market. The renewed conflict created concerns about energy security and potential supply chain disruptions, impacting investor sentiment.

- Specific events: Increased military activity in the region and subsequent sanctions imposed on several key exporters.

- Market reaction: A noticeable risk-off sentiment was observed, leading to investors moving towards safer assets like government bonds and away from equities.

- Impact on specific companies or sectors: Energy companies, particularly those with significant exposure to the affected region, experienced considerable price volatility. Several defense contractors saw their stock prices increase due to heightened demand. News outlets reported that the increased uncertainty in global supply chains could impact the automotive industry further.

Significant Company Performance

Several key CAC 40 companies experienced noteworthy performance fluctuations this week.

- Company names: LVMH, TotalEnergies, and BNP Paribas.

- Percentage change in stock price: LVMH saw a 1.8% decline, largely due to weaker-than-expected luxury goods sales in China. TotalEnergies recorded a 3% increase, fuelled by soaring oil prices due to the geopolitical instability. BNP Paribas saw a relatively flat performance (0.1% decrease), outperforming many other banks despite the interest rate hike.

- Reasons for the performance: Earnings reports, geopolitical sensitivity, and sector-specific factors played significant roles in the observed performance of these major players in the French market. LVMH’s reported sales figures confirmed analysts’ concerns about slower growth in the Asian market, while increased oil prices directly benefited TotalEnergies.

Sectoral Analysis

Performance of Key Sectors

The week saw a mixed performance across various sectors within the CAC 40.

- Sector name, percentage change, key drivers of performance:

- Energy: +4%, driven by rising oil prices due to geopolitical concerns.

- Finance: -1%, affected by the interest rate hike, though some banks showed resilience.

- Technology: -3%, negatively impacted by the higher interest rates and investor uncertainty.

- Consumer Goods: -2%, reflecting global economic slowdown concerns and specific company-level issues.

(A chart illustrating these percentage changes would be inserted here)

Outperforming and Underperforming Sectors

The energy sector significantly outperformed expectations, while the technology sector underperformed.

- Specific sectors, reasons for their performance: The energy sector's performance reflected the global impact of geopolitical instability. Conversely, the technology sector's underperformance stemmed from the heightened interest rate environment, which increased borrowing costs for tech companies and reduced investor appetite for growth stocks. Regulatory uncertainty related to data privacy further contributed to negative sentiment.

Technical Analysis of the CAC 40

Chart Patterns and Indicators

The CAC 40's weekly chart shows signs of consolidation after a period of decline.

- Chart patterns and indicators: The Relative Strength Index (RSI) is nearing oversold territory, suggesting a potential bounce. Moving averages indicate downward momentum but show a flattening trend.

- Support and resistance levels: Key support levels are around 7100, and resistance lies near 7300. (A chart showing the technical indicators and support/resistance levels would be included here).

Potential Future Trends

Based on the technical analysis, a short-term upward correction is possible. However, continued geopolitical instability and further interest rate hikes could hinder any sustained recovery.

- Potential future trends: A range-bound market is likely in the short term. A break above 7300 would suggest a stronger bullish trend, while a fall below 7100 would indicate further downward pressure.

Conclusion

This CAC 40 Weekly Report highlighted a volatile week influenced by significant interest rate adjustments, escalating geopolitical concerns, and varying company performance. The energy sector outperformed while the technology sector lagged. Technical analysis suggests potential short-term upward correction, but uncertainty persists.

Key Takeaways: Interest rate hikes, geopolitical tensions, and individual company performance significantly impact the CAC 40. The outlook remains uncertain, with both bullish and bearish possibilities.

Stay informed about the latest developments in the CAC 40 with our weekly market updates. Subscribe to our newsletter to receive future CAC 40 Weekly Reports directly to your inbox!

Featured Posts

-

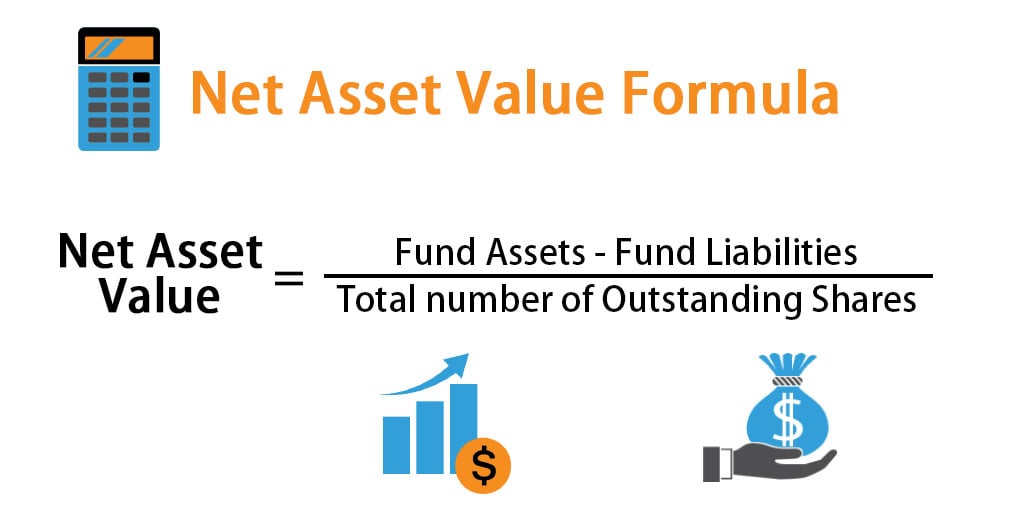

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025 -

A Relaxing Escape To The Country Benefits Of Rural Living

May 24, 2025

A Relaxing Escape To The Country Benefits Of Rural Living

May 24, 2025 -

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025

The Busiest Days To Fly Around Memorial Day 2025 A Travelers Guide

May 24, 2025 -

Repression Chinoise En France Les Dissidents Dans Le Viseur

May 24, 2025

Repression Chinoise En France Les Dissidents Dans Le Viseur

May 24, 2025 -

Rio Tintos Pilbara Defence A Response To Forrests Criticism

May 24, 2025

Rio Tintos Pilbara Defence A Response To Forrests Criticism

May 24, 2025