Lower Rates, Easier Lending: China's Economic Response To Tariffs

Table of Contents

China's Aggressive Interest Rate Cuts to Counter Tariff Impacts

Facing slowing growth and reduced export demand due to tariffs, the People's Bank of China (PBOC) embarked on a series of interest rate cuts. The rationale was to reduce borrowing costs for businesses and consumers, encouraging investment and spending to offset the tariff-induced slowdown. These cuts weren't isolated events; they were carefully timed to coincide with escalating trade tensions.

- Specific Cuts: The PBOC lowered benchmark lending rates (LPR), including the one-year and five-year LPRs, multiple times throughout the period of trade tensions. They also adjusted other key rates like the 7-day reverse repo rate, influencing short-term interbank lending.

- Impact on Borrowing Costs: These reductions directly translated to lower borrowing costs for businesses seeking loans for expansion or working capital, and for consumers looking for mortgages or personal loans. Lower interest rates made borrowing more attractive, stimulating investment and consumption.

- Liquidity Injection: The PBOC also employed other tools, like adjusting the reserve requirement ratio (RRR) – the percentage of deposits banks must hold in reserve – to inject more liquidity into the financial system. This further reduced borrowing costs and enhanced the effectiveness of interest rate cuts.

Stimulating the Economy: China's Approach to Credit Easing

Beyond interest rate cuts, China implemented significant credit easing measures. The aim was to encourage lending to businesses and individuals, further fueling economic activity. These measures included:

- Relaxed Loan-to-Value Ratios (LTV): The government eased LTV requirements for mortgages, allowing individuals to borrow a larger percentage of a property's value. This boosted the real estate sector, a significant driver of economic growth in China.

- Reduced Collateral Requirements: Businesses found it easier to secure loans as collateral requirements were reduced. This particularly benefited small and medium-sized enterprises (SMEs), often lacking substantial collateral.

- Role of State-Owned Banks: State-owned banks played a crucial role in implementing these policies, channeling credit to prioritized sectors of the economy. However, this also created concerns about potential risks.

- Challenges and Risks: Increased credit easing carries inherent risks. The rapid expansion of credit could lead to rising levels of debt, increasing the risk of non-performing loans and potentially destabilizing the financial system.

Targeted Support: How China's Response Affects Specific Industries

China's response wasn't a blanket approach; it targeted specific sectors deemed crucial for economic growth.

- Manufacturing Sector: The manufacturing sector, significantly impacted by tariffs, received substantial support through lower interest rates and easier access to credit. Government initiatives focused on upgrading technology and promoting innovation within the sector.

- Real Estate Market: The easing of LTV ratios provided a boost to the real estate market, but also raised concerns about potential asset bubbles.

- Technology Investment: Investment in high-tech industries received significant government support, reflecting China's long-term strategic goals of technological self-reliance and innovation.

- Sectoral Impact: The effectiveness of these targeted measures varied across sectors. While some, like real estate, experienced a noticeable boost, others faced continued challenges due to global economic conditions.

Assessing the Success: Evaluating China's Economic Response to Tariffs

Evaluating the effectiveness of China's monetary policy response requires a nuanced perspective. While the measures succeeded in stimulating economic activity to some degree and prevented a sharper contraction, challenges remain:

- Economic Stimulus Effectiveness: The policies did prevent a more significant economic downturn, but the overall growth rate remained below pre-tariff levels.

- Inflationary Pressures: Increased credit and government spending pose a risk of inflationary pressures, requiring careful monitoring and potentially countervailing measures.

- Asset Bubbles: The easing of credit, particularly in the real estate sector, raises concerns about the potential formation of asset bubbles.

- Alternative Economic Strategies: While monetary policy played a central role, alternative strategies, such as fiscal policy adjustments and structural reforms, could have played a more significant role in mitigating the negative impacts of the tariffs.

Navigating Trade Tensions: The Ongoing Impact of China's Economic Response to Tariffs

China's interest rate cuts and easier lending policies provided a crucial buffer against the negative economic impacts of tariffs. However, these measures also introduced new challenges, such as potential inflationary pressures and the risk of asset bubbles. The long-term effects of these policies are still unfolding, and China's future economic strategies will undoubtedly continue to adapt to the evolving global trade landscape. Stay informed about China's economic policy, understand the implications of China's lower rates, and follow the ongoing effects of easier lending in China to gain a comprehensive understanding of this complex economic situation.

Featured Posts

-

Arsenali Akuzohet Per Shkelje Te Rregullave Te Uefa S Ne Ndeshjen Me Psg

May 08, 2025

Arsenali Akuzohet Per Shkelje Te Rregullave Te Uefa S Ne Ndeshjen Me Psg

May 08, 2025 -

Ethereum Price Forecast Factors Influencing Future Value And Potential Growth

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value And Potential Growth

May 08, 2025 -

Jury Finds Soulja Boy Guilty Of Abuse And Sexual Assault Awards 6 Million

May 08, 2025

Jury Finds Soulja Boy Guilty Of Abuse And Sexual Assault Awards 6 Million

May 08, 2025 -

Nikola Jokic And Most Nuggets Starters Rest After Double Overtime Loss

May 08, 2025

Nikola Jokic And Most Nuggets Starters Rest After Double Overtime Loss

May 08, 2025 -

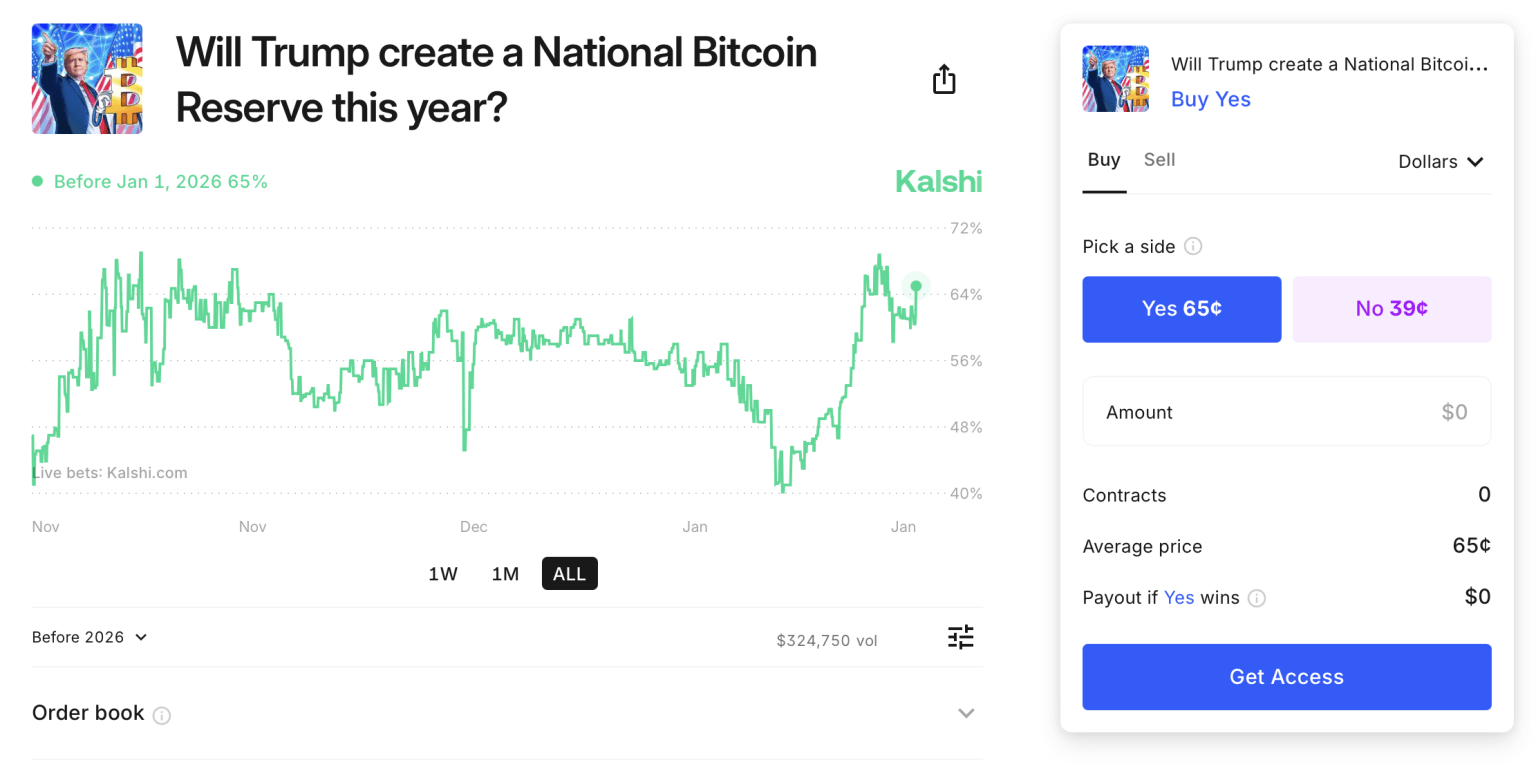

Could Trumps Policies Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025

Could Trumps Policies Send Bitcoin To 100 000 A Price Prediction Analysis

May 08, 2025

Latest Posts

-

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025

Mittwoch Lotto 6aus49 9 4 2025 Gewinnzahlen Und Zusatzzahl

May 08, 2025 -

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025

Xrps 2 Support Price Prediction And Market Outlook

May 08, 2025 -

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025

Xrps Potential Record High Grayscale Etf Filing And Market Analysis

May 08, 2025 -

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025

6aus49 Lottozahlen Mittwoch 9 4 2025 Aktuelle Gewinnzahlen Und Quoten

May 08, 2025 -

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025

6aus49 Lottozahlen Ergebnis Der Ziehung Am 12 April 2025

May 08, 2025