MicroStrategy Vs. Bitcoin: Which Investment Will Outperform In 2025?

Table of Contents

MicroStrategy's Business Model and Bitcoin Holdings

Understanding MicroStrategy's Bitcoin Strategy:

MicroStrategy's core business revolves around providing business intelligence, analytics, and mobile software. However, its investment strategy is heavily intertwined with Bitcoin. Under the leadership of CEO Michael Saylor, the company has adopted a bold strategy of accumulating Bitcoin as a treasury reserve asset, believing it to be a superior store of value compared to traditional assets like cash. This strategy has made MicroStrategy a significant player in the Bitcoin market, influencing both its price and the overall perception of Bitcoin as a legitimate investment.

- Key Factors Influencing MicroStrategy's Stock Price:

- Bitcoin's price: A direct correlation exists; when Bitcoin rises, MicroStrategy's stock often follows.

- Market sentiment towards Bitcoin: Positive news about Bitcoin adoption generally boosts MicroStrategy's stock.

- MicroStrategy's financial performance: Strong earnings reports and successful product launches can positively impact the stock independently of Bitcoin's price.

- Overall market conditions: Broader economic factors influence investor confidence and affect MicroStrategy's stock like any other publicly traded company.

Analyzing MicroStrategy's Stock Performance:

Historically, MicroStrategy's stock performance has been closely tied to Bitcoin's price fluctuations. Analyzing its stock chart reveals periods of significant gains aligned with Bitcoin bull runs, and conversely, substantial drops during bear markets. However, it's crucial to remember that MicroStrategy's fundamental business operations also play a role.

- Key Performance Indicators (KPIs) to Track for MicroStrategy:

- Revenue growth: Indicates the success of its core business operations.

- Earnings per share (EPS): A measure of profitability.

- Debt levels: High debt can increase financial risk.

- Customer acquisition and retention rates: Crucial for long-term sustainability.

Risks Associated with Investing in MicroStrategy:

Investing in MicroStrategy carries inherent risks, primarily its significant exposure to Bitcoin's price volatility. A sharp decline in Bitcoin's value could severely impact MicroStrategy's stock price and profitability.

- Specific Risks to Consider:

- Volatility: MicroStrategy's stock is highly volatile, experiencing significant price swings.

- Regulatory uncertainty: Changes in Bitcoin regulations could negatively affect MicroStrategy's holdings and operations.

- Competition: MicroStrategy faces competition in its core business, impacting its earnings potential.

- Bitcoin's long-term viability: The continued success of Bitcoin as an investment is essential for MicroStrategy's strategy.

Bitcoin's Market Position and Future Predictions

Bitcoin's Technological Advantages and Market Adoption:

Bitcoin's decentralized nature, limited supply (21 million coins), and transparent blockchain technology are key factors contributing to its perceived long-term value. The increasing adoption by institutional investors, coupled with growing individual interest, fuels its market growth.

- Factors Contributing to Bitcoin's Price:

- Demand: Increased demand from investors and users pushes the price upward.

- Supply: The fixed supply of Bitcoin creates scarcity, potentially driving price appreciation.

- Regulatory developments: Positive regulatory changes can boost investor confidence.

- Technological advancements: Improvements to the Bitcoin network enhance its scalability and efficiency.

Predicting Bitcoin's Price in 2025:

Predicting Bitcoin's price in 2025 is inherently speculative. Various models and analysts offer different projections, ranging from conservative estimates to incredibly bullish forecasts. The halving events (reducing the rate of new Bitcoin creation), institutional adoption, and regulatory developments are significant factors influencing these predictions.

- Different Price Prediction Scenarios:

- Conservative: Assumes moderate growth based on historical trends.

- Moderate: Takes into account increasing adoption and potential regulatory clarity.

- Bullish: Projects exponential growth based on optimistic assumptions.

Risks Associated with Investing in Bitcoin:

Bitcoin investing is notoriously risky. Its price is highly volatile, susceptible to market manipulation, and subject to significant price swings.

- Specific Risks to Consider:

- Price volatility: Bitcoin's price can fluctuate dramatically in short periods.

- Security risks: While the Bitcoin network is secure, exchanges and individual wallets can be vulnerable to hacks.

- Regulatory uncertainty: Governments worldwide are still developing regulatory frameworks for cryptocurrencies.

- Technological risks: Potential vulnerabilities in the Bitcoin network, though rare, pose a risk.

Comparative Analysis: MicroStrategy vs. Bitcoin in 2025

Weighing the Pros and Cons of Each Investment:

| Feature | MicroStrategy | Bitcoin |

|---|---|---|

| Risk | High (tied to Bitcoin price, business performance) | Very High (extreme price volatility) |

| Potential Return | High (if Bitcoin price rises significantly) | Potentially very high (but also very low) |

| Diversification | Limited (heavily reliant on Bitcoin) | Can be part of a diversified portfolio |

| Liquidity | Relatively liquid (publicly traded stock) | Relatively liquid (major exchanges) |

| Regulation | Subject to stock market regulations | Subject to evolving cryptocurrency regulations |

Which Investment Might Outperform in 2025? A Preliminary Assessment:

Based on the analysis, predicting which investment will definitively outperform is impossible. Bitcoin's potential for substantial price appreciation is undeniable, but it also carries significantly higher risk. MicroStrategy offers somewhat less volatility, but its success remains heavily reliant on Bitcoin's performance. This assessment assumes continued growth in the cryptocurrency market and positive regulatory developments for Bitcoin.

Conclusion: MicroStrategy or Bitcoin: Your Investment Decision

Both MicroStrategy and Bitcoin offer the potential for high returns but also carry significant risks. MicroStrategy provides a less volatile entry point into the Bitcoin market, but its success hinges on Bitcoin’s future. Bitcoin itself offers potentially higher returns, but with substantially increased risk. The optimal investment choice depends heavily on your individual risk tolerance, investment horizon, and financial goals. Remember to conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions. Make an informed decision on your MicroStrategy vs. Bitcoin investment strategy today.

Featured Posts

-

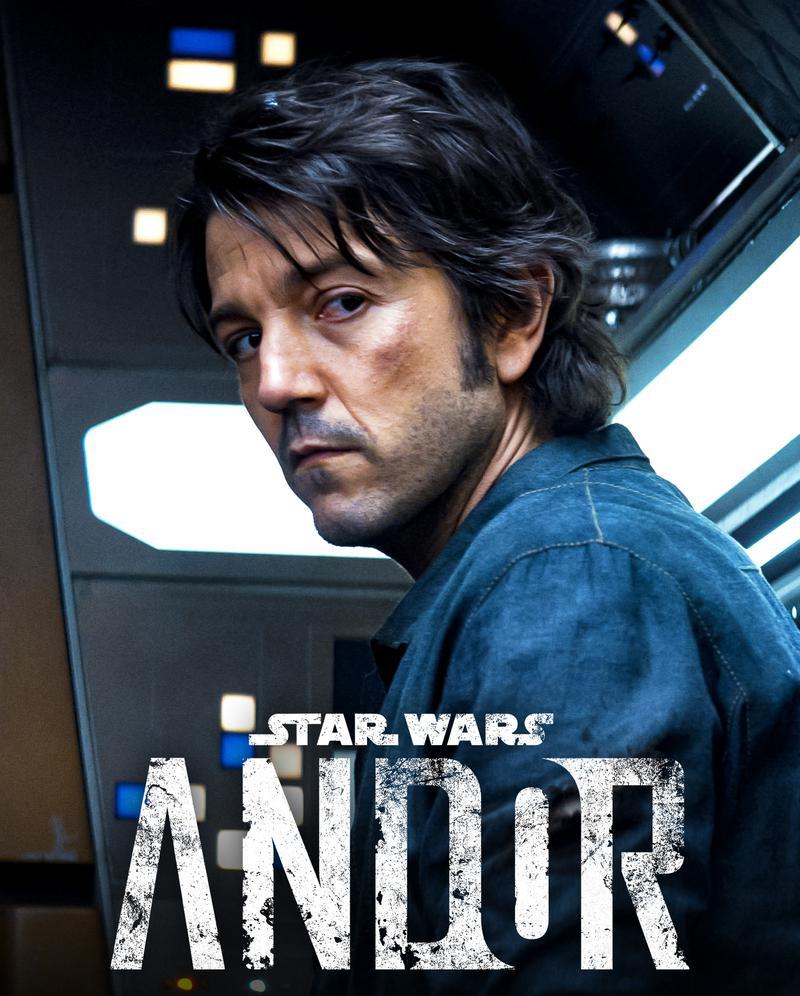

Andor Season 2 Significant Changes Promised By Diego Luna

May 08, 2025

Andor Season 2 Significant Changes Promised By Diego Luna

May 08, 2025 -

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025

John Fetterman Responds To Ny Magazine Article Questioning His Health

May 08, 2025 -

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025

Dwp Alert Verify Your Bank Details 12 Benefits May Be Affected

May 08, 2025 -

The Importance Of Trustworthy Crypto News Sources

May 08, 2025

The Importance Of Trustworthy Crypto News Sources

May 08, 2025 -

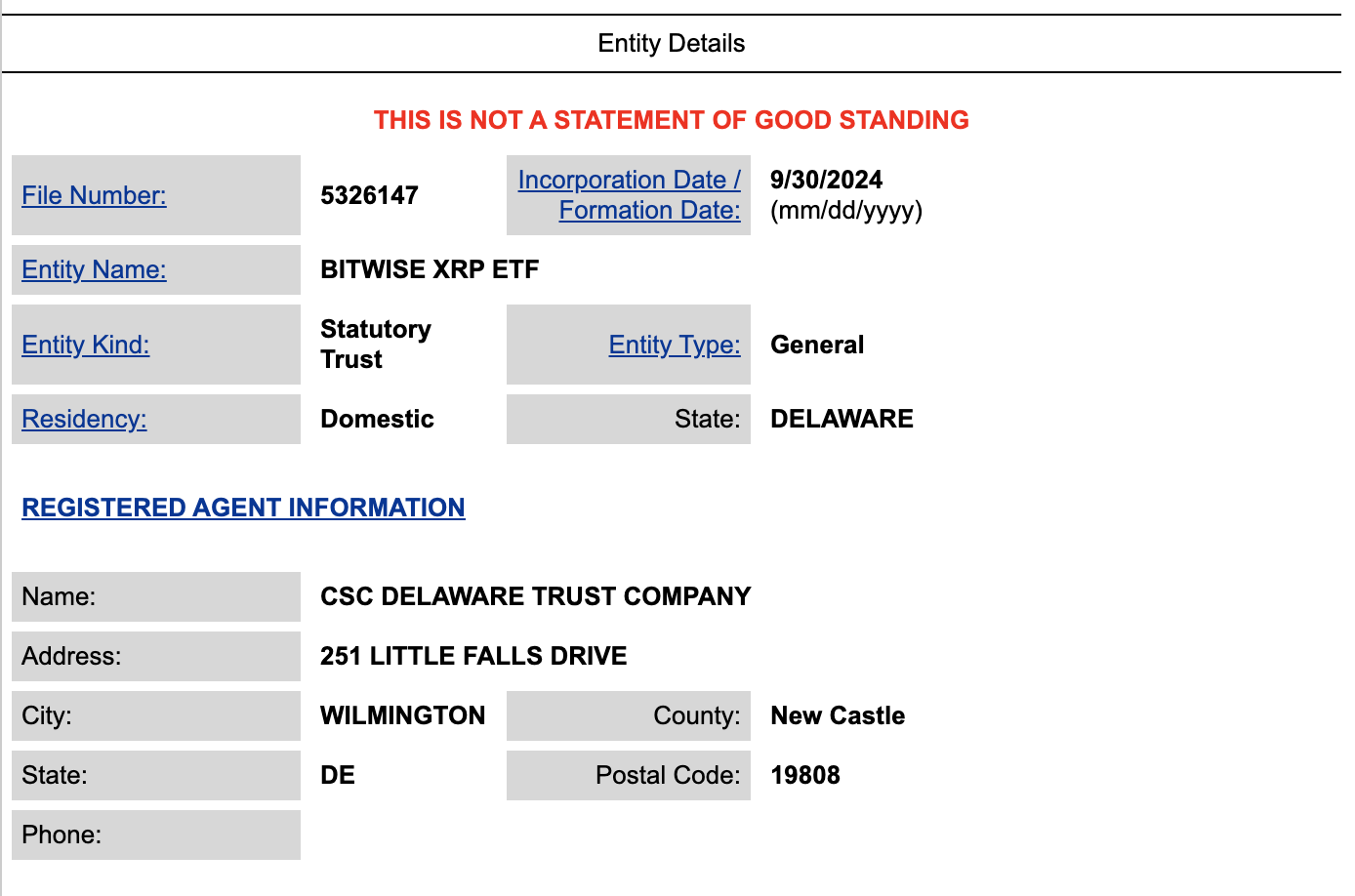

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025

Grayscales Xrp Etf Filing Xrp Price Performance Compared To Bitcoin

May 08, 2025

Latest Posts

-

George Lucas Protege On Yavin 4s Star Wars Return The Galaxys Diminished Scale

May 08, 2025

George Lucas Protege On Yavin 4s Star Wars Return The Galaxys Diminished Scale

May 08, 2025 -

3 Star Wars Andor Episodes Free On You Tube

May 08, 2025

3 Star Wars Andor Episodes Free On You Tube

May 08, 2025 -

Yavin 4s Return A Star Wars Galaxy Far Far Away

May 08, 2025

Yavin 4s Return A Star Wars Galaxy Far Far Away

May 08, 2025 -

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025

The Andor Season 2 Trailer Delay A Deep Dive Into Fan Reactions And Predictions

May 08, 2025 -

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025

Andor Season 2 Delayed Trailer Ignites Fan Speculation And Anxiety

May 08, 2025